From the doom loop to an economy for work not wealth

Since the global financial crisis the performance of the UK economy has been unprecedentedly bad: stagnant GDP per head, collapsed real pay, greatly increased poverty and public services at breaking point. On the other hand wealth has expansed to a massive extent. Moreover the same broad pattern is apparent on a longer view back to 1979. There is a sense of great precarity, not least in the face of highly risky central bank monetary policies.

Confining debate to the public finances avoids the broader issues confronting society. But even on these terms debate falls short: in spite of all this attention, the public finances have got worse not better.

There should surely be a great deal of scrutiny whether the assumptions behind the policy followed by both central banks and the Treasury might be culpable. Policy is both controversial (even extreme) on theoretical grounds, and the wider evidence base has collapsed. While a number of economists periodically protest,55

the great part of the profession is silent. Too many commentators and institutions seek only to police the orthodox mechanisms, and so potentially the same wrongheaded restraint. The most vocal support for the present regime appears to come from economists based in the City of London.56

The parallel trajectory of wealth suggests these are not wholly disinterested parties.

But there is resistance also against expansionary policies from parts of the left. As above, many urge moving forwards instead with wealth taxes.57

The preceding commentary has made the empirical and theoretical case that not only austerity but also – and more sustantially – the orientation of the economy since 1979 means that economic potential exists but is denied.

Likely there is (and has always been) scepticism on parts of the left towards UCOP/Keynes given the association with Liberal politics.58

And on theoretical grounds the (supply-side) idea of a falling rate of profit may still be persuasive, and regarded as vindicated by productivity outcomes on a long horizon. Yet viewed beyond the narrow grounds of fiscal policy, the solution outlined here involves a major re-orienation of power towards working people and away from wealth When it was published, key left figures celebrated the General Theory as follows:

- “the supreme challenge to the practice of capitalism”, G. D. H. Cole (1999 [1936]:102)

- “… at every point, without a single exception … in full agreement with Labour policy in this country, and, what is even more significant, expresses in proper economic form what has been implicit in the Labour Movement’s attitude all along”, A. L. Rowse (1999 [1936]:110-11).

Rowse (1936, p. 119) however dismissed Keynes’s faith in the power of his ideas: “It is much more uncommon for people to think of ideas as for the most part being effective in so far as there are interests behind them which make them effective”. And he urged that the only possibility of delivering his policy goals was through making common cause with the left.59

The Keynes approach does not mean disregarding the considerations emphasised by some left economists. But it means approaching wealth taxes and the climate crisis from a different theoretical standpoint. The positive implication is that there are fewer constraints on necessary action, and so the political case for that action might be more easily made. But above all the approach operates on the international terrain that has been inherent to the labour movement for more than two centuries, but is too much sidelined in debate today.

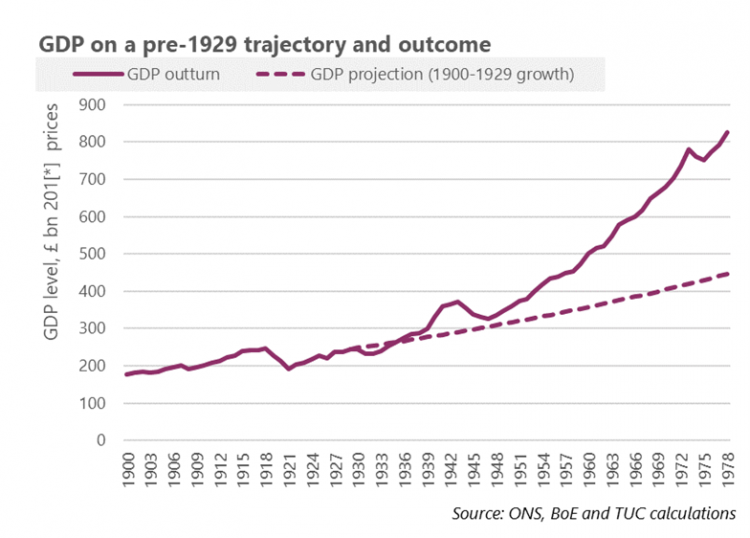

The evidence of the Attlee government in instructive. As widely understood public debt of 250% of GDP did not stand in the way of the biggest step change in social infrastructure likely in history. And while thinking around growth and supply constraint was emerging in the US, the mechanisms were not in play in the UK. Were these restraints in place, it seems highly unlikely that the expansionary approach would have been permitted, above all after the war but equally over the 1930s. In a striking parallel, proceeding on the basis of the pre-great depression trajectory would have meant GDP in 1978 at roughly £400bn rather than £800bn: half the level secured in practice.

Figure 12: GDP on a pre-1929 trajectory and outcome

- 55 https://www.stopthesqueeze.uk/resources/open-letter-to-jeremy-hunt

- 56 Those reported commending the Chancellor’s Autumn Statement in the Financial Times were the IMF and the chief economist of Citi: https://www.ft.com/content/efeba04f-2f9f-43ca-b2ec-fc25a63217b1

- 57 n. 29

- 58 And Keynes was on the record making stupid remarks, for example in his (1925) ‘A short view of Russia’: “How can I adopt a creed which, preferring the mud to the fish, exalts the boorish proletariat above the bourgeois and intelligentsia who, with whatever faults, are the quality in life and surely carry the seeds of all human advancement?” (CW IX, p. 258)

- 59 The Trade union view: “The theories of John Maynard Keynes provide the sound intellectual framework for the views which trade unionists had always instinctively held and known to be right” (TUC, 1968, p. 85)

This episode above all suggests commentators should be very cautious before writing off or denying prosperity. The scale of the crisis on a global view is too severe to be left only to taxes becoming politically feasible and the hope of unlocking supply-side gains that have eluded the world for more than 40 years.

In various commentaries since 2019 the TUC have called for “a review of policymaking institutions and processes that appear to have given too much priority to the interests of the city, finance and the powerful, and too little to those who work too hard for too little”.60

At the very least there may be mechanisms operating here that are be undermining the actual performance of the economy, doing serious harm to households and businesses, and standing in the way of action to set things right. Given the widely accepted view that theory and models failed before the global financial crisis, it would seem sensible to question whether they are standing in the way of resolving that crisis.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox