From the doom loop to an economy for work not wealth

Winston Churchill vividly captured the underlying nature of the great depression:

“The whole wealth so swiftly gathered in the paper values of previous years vanished. The prosperity of millions of American homes had grown upon a gigantic superstructure of inflated credit, now suddenly proved phantom” (1948, p. 34).

The post-Second World War policies outlined above were the culmination of efforts to find a way forwards. In the background was progressive initiative beginning in the UK (as in 1931 the first country to come off the gold standard) and the US under Roosevelt, but also the violent reaction of nationalism, Nazism and ultimately war. It is possible that no consensus on cause of the depression has survived into the literature. At the time there was no doubt;43

,44

Robert Reich cites Marriner Eccles, President Roosevelt’s appointee to the Federal Reserve:45

A giant suction pump had by 1929-1930 drawn into a few hands an increasing portion of currently produced wealth. As in a poker game where the chips were concentrated in fewer and fewer hands, the other fellows could stay in the game only by borrowing. When their credit ran out, the game stopped.

The relevance of this line of thinking today seems undeniable. The flip side of the bad performance of real GDP, wages and work has been the vast expansion of asset prices (Figures 6). With the latter now so far ahead of the former, the question of unsustainability is surely unavoidable.

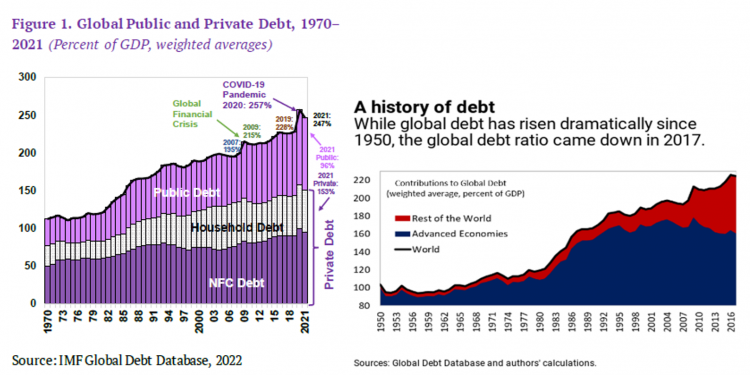

As Eccles indicates the counterpart to asset gains is a parallel expansion in private and public debts, likely best viewed at global terms. The charts below are from the IMF, with a steep increase from the pandemic, but before that debt still greatly elevated relative to the global financial crisis (left chart – Annex 2 looks at the position by country) and history on a longer view (better shown on the right chart). On the global view, assets are highly concentrated: North America and Europe account for around 10 per cent of the world population but 57 per cent of household assets.46

Note also the benign trajectory for global indebtedness mirroring the UK asset trajectory ahead of 1979.

Figures 8: IMF on global debt

- 43 Keynes saw matters through the rate of interest: “The leading characteristic was an extraordinary willingness to borrow money for the purposes of new real investment at very high rates of interest” (CW XIII, p. 345); ultimately high rates are not a deterrent to borrowing, but make repayment greatly more difficult and so lead to increased indebtedness

- 44 George Orwell is helpful – while not following at all closely any contemporaneous economic debate, he concluded: “However, most observers are satisfied that the cause of our present ills lies in an outworn economic system which makes it impossible to consume all the goods that are produced and leads inevitably to struggles for markets and hence to Imperialist wars”, George Orwell, Complete Works, Volume XVII, p. 27.

- 45 See n. 30.

- 46Global Wealth Report 2022, Credit Suisse: Table 1.

Unlike the orthodox theory, inflation of assets and liabilities – or balance sheet inflation – is a critical feature of underconsumption/overproduction and related theories, like Hyman Minsky’s financial instability hypothesis.47

The intuition and logic are very straightforward:

- Overproducing firms are unable to meet desired sales, and have increasingly to rely on borrowing to repay costs of investment and stay afloat; and

- Under-compensated households are unable to afford a basic standard of living, and have to borrow to do so.

Eventually the system caves in as a debt deflation, so labelled by Irving Fisher (1933) (tellingly) at the depths of the great depression. At this point excessive debts cannot be rolled over, and balance sheet repair is necessary. Companies must therefore seek cost savings (investment, intermediate consumption, pay and job cuts) and/or go bust; households must cut back on spending and maybe also face bankruptcy.

Caught unaware of the dangers from balance sheet inflation in the face of the global financial crisis, policymakers are now at least alive to the dangers of tightening policy under these conditions. “Higher policy interest rates could also slow growth by more than projected, with policy decisions difficult to calibrate given high debt levels and strong cross-border trade and investment links that raise the spillovers from weaker demand in other countries” (OECD, 2022, p. 13).

And moreover wider dislocations related to high debt are recognised: “Increased stress on households and companies, and the possibility of loan defaults, also raises risks of large potential losses at bank and non-bank financial institutions” (ibid., p. 38). The OECD (and IMF before them) point in particular to the scale of crisis outside advanced economies: “We are particularly concerned about low-income countries, over half of which are already in (or at high risk of) debt distress and now face tightening financial conditions” (Economic Outlook, p. 10).

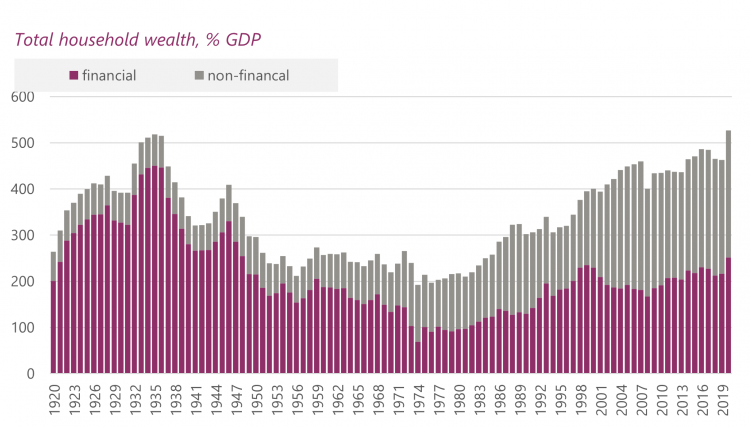

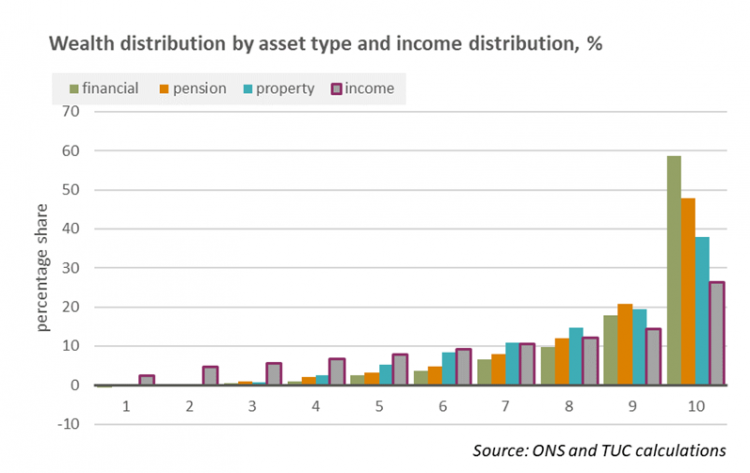

For advanced economies the housing market is a particular focal point, not only in the immediate context of rising rates, but more widely as a dominant factor in the inflation of assets. On the latter view, Figure 9 shows over the past 100 years the evolution of UK financial and non-financial assets as a share of GDP. Net worth as a share of GDP in 2020 matches the peak in the 1930s, though today non-financial assets make up a far greater part. Wealth and asset survey data shows how wealth is greatly more unequally distributed than income (Figure 10).

Figure 9: household net worth, % GDP

- 47 Minsky, Hyman P. (1985) ‘The Financial Instability Hypothesis, A Restatement’, in Philip Arestis (Ed.), Essays in Post Keynesian Economics, Aldershot: Edward Elgar.

Figure 10: Wealth and income distribution, per cent by decile

On a longer view, while real GDP and so wage gains have disappointed, for some housing wealth is plainly an important compensation. In the immediate context, the OECD give particular emphasis to countries where variable mortgage rates are most common – four of the top eight are Nordic countries (and likewise they are amongst the highest indebted countries overall – see Annex 2).

Nonetheless, having raised these considerations, policy recommendations are unchanged. As noted above, on a global view central bank tightening is the most forceful since the ‘Volcker shock’ of 40 years ago, and government fiscal policy is marshalled within the same context.48

In his ‘financial instability hypothesis: a restatement’ (n. 45), Hyman Minsky was concerned with exactly this situation: when rate rises to deal with inflation triggered a financial collapse because of high indebtedness.

Most striking, in terms of the overall stability of the system, is that the balance sheet inflation has proceeded largely uninterrupted even in spite of the the global financial crisis (as on figures 6 and 8). There is a sense that monetary policies in the wake of that crisis may have intensified not resolved the underlying dislocation. The emerging financial distress must be symptomatic of a serious risk to the global outlook.

Finally a distinction should be made between Keynes’s low interest rate polices and the manner of monetary policy over the past decade. Keynes sought low interest rates above all to strengthen fixed capital investment, and he envisaged domestic action in the context of capital control on the international domain.49

Low interest rate policies today are in the context of an utterly deregulated global regime. Rather than foster domestic production, low rates have been recycled to earn high reward on more speculative terrain. To follow the above, the obvious example is housing, with buy-to-let recycling low mortgage interest rates for high rents. Churchill and Bonizzi (2017) give particular emphasis to the interplay between pension funds’ liability driven investment strategies to earn high yields and investment in emerging market economies. Other activities that have a strongly speculative sense include sub-prime auto loans, private equity, commercial property, tech and platform companies.

The specific mechanics of these processes are beyond the scope of this commentary, but likely involve shadow banking, central bank QE policies, and pension and other wealth funds. Though any such analysis must be speculative in its own right, given central banks and regulators are under challenge from their own side for inadequate understanding and insufficient action.50

One substantive point can however be made. These activities appear symptomatic of a rentier economy seeking to sidestep production and earn vast rewards for speculators, with a consequent increase in leverage and greatly higher risk. There is evidence that some associated ventures are beginning to unravel, e.g. job losses at tech companies, the failure of crypto currencies, threats to sub-prime car loans, and the outflow of money from emerging market countries and associated and severe crises. And from the asset side, there are large falls in fund values and evidence of some distress in the pension industry. The sum of the parts was captured by the IMF, warning “the level of risk we are flagging at the moment is the highest outside acute crisis”.51

- 48 “Monetary policy should stay the course to restore price stability, and fiscal policy should aim to alleviate the cost-of-living pressures while maintaining a sufficiently tight stance aligned with monetary policy”, IMF, World Economic Outlook, Dec. 2022: https://www.imf.org/en/Publications/WEO

- 49 “In my view the whole management of the domestic economy depends upon being free to have the appropriate rate of interest without reference to the rates prevailing elsewhere in the world. Capital control is a corollary to this. Both for this reason and for the political reasons given above, my own belief is that the Americans will be wise in their own interest to accept this conception, even though its immediate applicability in their case is not so clear” (Keynes to R. F. Harrod, 19 April 1942, CW XXV, p. 149, my emphasis) As he suspected, his proposals were too Utopian

- 50 ‘Bank of England accused of failures on shadow banking’, Financial Times, Aug. 7 2022: https://www.ft.com/content/284c2817-f888-4e56-9cb3-e74d8e18ec9c

- 51 Press conference for the October 2022 global financial stability review: https://www.youtube.com/watch?v=vSqSsMNv4Z8

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox