From the doom loop to an economy for work not wealth

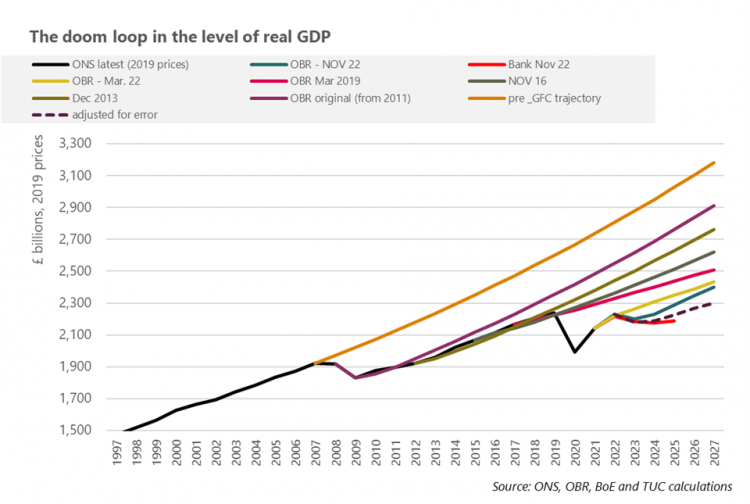

The starting point to better understand the IFS projection of real incomes should be similar projections of real GDP. Figure 2 shows various iterations over time of the Office for Budget Responsibility (OBR) forecast (and the Nov. 22 forecast by the Bank of England). The IFS real household disposable income per capita projection is broadly in line with the latest OBR projection for real GDP that shows the economy in 2027 expected to be nearly one third smaller than the pre-global financial crisis trajectory.5

The size of the UK economy is expected to be £2.3 trillion rather than £3.2 trillion, in real terms and 2019 prices.

This dysfunction has been progressively intensifying since Chancellor Osborne began austerity policies in 2010. With only a handful of exceptions, each OBR forecast for the level of real GDP is worse than the previous one. The chart therefore captures the consequences of the ‘doom loop’ (though for only a subset of forecasts to keep it readable).

Figure 2: The doom loop in the level of real GDP

- 5 In this instance pre-financial crisis trajectory is 1981-2007 rather than 1948 to 2007.

The OBR recognise uncertainty in their forecasts (as emphasised in discussion around ‘black holes’– sections 8 and 10), but there is very little uncertainty here: over time forecasts are revised down. According to the ‘doom loop hypothesis’, this is because the mechanisms at play – inadvertently perhaps – contain the expansion of the economy.

Very roughly (and conservatively) these downgrades (since 2010) amount to around £20bn a year (measured on the five-year horizon, and in 2019 prices); so likely by 2027 outcomes may have fallen shorter still by £100bn.6

So rather than hit £3.2tn as on the pre-crisis trajectory, GDP will be £900bn lower at £2.3tn.

Beyond the abstraction of GDP the consequences are the worst pay squeeze for two hundred years,7

a vast increase in insecure and low-quality work,8

and public services in crisis. Of a devastating 15 million people in poverty, more than half are in work.9

The Resolution Foundation show unprotected departmental current spending per head reduced by 20 per cent from the position under the Labour government.10

Conversely, as TUC analysis ahead of Congress 2022 showed, since the global financial crisis, ‘financial wealth’ was up by more than £800 billion to £1.9 trillion, and annual growth in dividend payments has been three times the annual growth in nominal pay (up from double ahead of the crisis).11

Total wealth for the top decile was up 70 per cent, from £3.9 trillion to £6.6 trillion.12

- 6 The downgrade is assessed at the end of each actual OBR forecast (so eg. at 2015 for the June 2010 forecast) rather than the implied position in 2027.

- 7 https://www.tuc.org.uk/research-analysis/reports/insecure-work-why-employment-rights-need-overhaul

- 8 Text for footnote

- 9 https://www.tuc.org.uk/blogs/only-good-well-paid-work-route-out-poverty

- 10 ‘Help today, squeeze tomorrow: Putting the 2022 Autumn Statement in context’, 18 November 2022, Figure 30.

- 11 https://www.tuc.org.uk/news/ministers-should-boost-wages-not-slash-taxes-emergency-budget; and https://www.tuc.org.uk/news/shareholder-pay-outs-growing-three-times-faster-wages-under-tories-tuc-analysis;

- 12 Source: ONS wealth and assets survey.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox