From the doom loop to an economy for work not wealth

Until the pandemic the existence of underutilised potential was indicated by permanently low inflation outcomes. Moreover proceeding on the basis of the usual assumptions around natural rates of unemployment setting limits to expansion, policymakers tried and failed on several ocassions to tighten monetary policy.23

The processes operating were wholly at odds with any such assumptions. Rather than low unemployment causing higher wage inflation, lower unemployment was caused by lower wage inflation. There was debate and confusion about how worse than expected output was at odds with better than expected unemployment.

Policymakers (and commentators who urged them on) ended up with egg on their faces more than once. On each occasion retreat was forced as financial markets nosedived and inflation never materialised. This was in fact the situation at the start of 2020, confirming the economy entered the pandemic with significant underutilised potential.

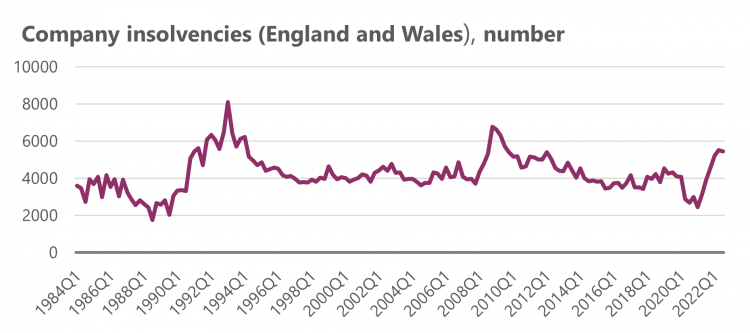

Plainly the pandemic and lockdown measures across the globe meant a violent disruption. But this does not allow policymakers to reset any misreadings of the economy. There is not much evidence that the pandemic meant the writing off of significant amounts of underutilised capacity. In the UK corporate banktruptcies fell to a 30 year low, having risen modestly ahead of the pandemic.

Figure 5: Company insolvencies (England and Wales), number

- 23 Phillip Turner (2021) warns “Central banks have seen successive plans (in 2009, in 2013 and in 2018) to ‘normalise’ monetary policy frustrated by weak growth and low inflation”.

In parallel, deficient demand was greatly exacerbated as furlough and some extension of social security payments did not support fully support wages and incomes.

This means that policymakers over 2022 and into 2023 are intensifying contractionary policy in the face of deficient aggregate demand, let alone widespread and severe hardship. Above all Bank of England interest rates hikes will be crushing already hard-pressed households and businesses.

Acting against their own initial advice that little could be done against a global cost inflation, central banks have made an extreme change of course to impose the most severe tightening of policy since the Volcker shock forty years ago.25

The consequent recession now forecast by central banks themselves is the price workers are paying for their treating a cost inflation as a demand inflation.

There are of course appeals to labour supply shortages. But this is still a pressure on the cost side, and will soon come up against the buffers of intensified collapsing demand. Moreover too many firms may have previously been over-reliant on a low wage model, in part because of the progressive undermining of trade unions but also (and relatedly) because of the wider deficiency of aggregate demand. Nonetheless while nominal pay growth has picked up to around 6 per cent real pay is still collapsing at a near unprecedented pace – there is only limited of firms using higher pay to overcome shortages.26

Again any labour shortage is hardly aided by higher borrowing costs and even further reduced consumer spending in the economy.

Certainly many companies are making excessive profits,27

but some are going backrupt at a pace not seen since the great recession of 2008-9 (Figure 5 again) as collapsing demand meets rising interest rate payments. Likely power is also at play within the corporate sector.

In parallel there are reverberations through financial markets, most obviously in the UK pensions’ disruption, asset price declines, dysfunction and job losses in tech and platform companies, and the (surely inevitable) collapse of cryptocurrencies. Central banks have been warned by their own side that higher interest rates pose a particular problem in conditions of high leverage and an increasingly opaque financial landscape (section 9).

The point remains that the economy needs more not less aggregate demand, otherwise the doom loop is in danger of giving way to a death spiral.

- 25 As discussed by Martin Wolf in the Financial Times: https://www.ft.com/content/889fec5a-cb62-463f-af8c-22c841bddb65

- 26 In particular (i) there is not a strong relation across industries between vacancies and pay growth, as TUC first reported here: https://www.tuc.org.uk/research-analysis/reports/jobs-and-recovery-monitor-pay-and-recovery; (ii) across countries there is almost no relation between measures of tightness and real pay growth: [TUC forthcoming]

- 27 Unite the Union, ‘Corporate profiteering and the cost of living crisis’, 17 Jun. 2022: https://www.unitetheunion.org/news-events/news/2022/june/new-unite-investigation-exposes-how-corporate-profiteering-is-driving-inflation-not-workers-wages/; Institute for Public Policy Research, ‘Prices and profits after the pandemic’, Chris Hayes and Carsten Jung, Jun. 2022: https://www.ippr.org/files/2022-06/prices-and-profits-after-the-pandemic-june-22.pdf

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox