From the doom loop to an economy for work not wealth

Keynes’s deconstruction of the classical theory of interest – shown in greatly simplified form below – is both the appropriate point of departure to the General Theory and arguably constitutes the substance of his scheme in practice.

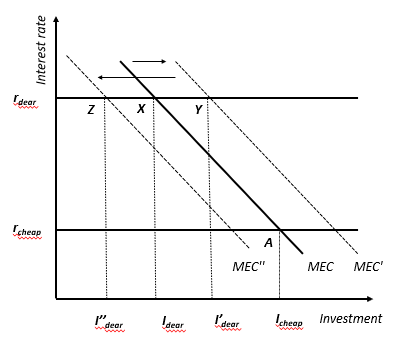

Taken as given here is the ability of policymakers to bring the long-term rate of interest (or more broadly the return to wealth) under control (Tily 2010[2006]). So the diagram focuses only on consequent investment outcomes – via the marginal efficiency of capital (MEC) – and is simplified according to two interest scenarios (on the vertical axis).

Warning dear money should be avoided “as we would hell-fire”, (CW XXI:389), Keynes argued dysfunction was a consequence of the authorities allowing high interest rates to prevail. Specifically, the scheme illustrates why capitalism operates both to restrict activity and to make conditions dangerously volatile. At the basic level, higher interest rdear means lower investment Idear on a given MEC that captures the ‘animal spirits’ of the business community. Activity and then employment follow according to the multiplier and so marginal propensity to consume (MPC; inflation is briefly touched on in section six).

Moreover the system is prone to more optimistic animal spirits: the MEC shifts right to MEC’ and means higher investment Idear. But it is likely that these conditions can only be temporary. Dear money may not prevent borrowing, but it reduces the likelihood of repayment. Keynes saw conditions reversing through a sharp leftwards shift in the MEC from MEC’ to MEC’’, leading to collapsed investment I’’dear and so recession. Following Fisher (1933) and Minsky (1985), Tily (2010) argues that the collapse in the MEC is better understood as the consequence of associated inflations in private debt (and balance sheet inflation more generally).

In contrast to this (potentially severely) negative trajectory, the positive conclusion follow the consequences of instead setting cheap money. In his chapter on his theory of the trade cycle, Keynes wrote of “enable[ing] the so-called boom to last”, (CW VII:322). But this was too throwaway – his reading of contemporaneous conditions was that the US boom of the 1920s still fell short of potential (e.g. CW XIII:349). So Figure 1 suggests that setting cheap money will permit greater investment outcomes than even at the peak of the ‘so-called boom’ (position A vs. Y).

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox