Universal credit cut will hit millions of working families and key workers

By removing this lifeline, poverty will increase among the 6 million claimants of Universal Credit. 40 percent of these claimants – over two million people - are in work.

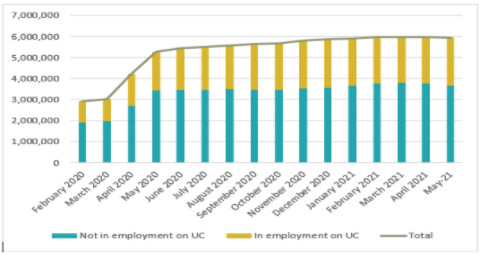

Number of people on Universal Credit 2020/21 (including in work and out of work breakdown):

Source - TUC analysis of stat explore data using May 2021 data

Our new analysis reveals the regional and local impact cutting Universal Credit will have on low-paid workers.

Numbers on Universal Credit in work by region/nation (May 2021):

|

Region/nation |

Number in work receiving UC |

Total number receiving UC |

% Of UC recipients in work |

|

North East |

100,437 |

281,759 |

35.6% |

|

North West |

282,131 |

755,400 |

37.3% |

|

Yorkshire & Humber |

194,344 |

518,269 |

37.5% |

|

East Midlands |

166,265 |

403,272 |

41.2% |

|

West Midlands |

214,730 |

585,069 |

36.7% |

|

East of England |

199,459 |

494,271 |

40.4% |

|

London |

375,426 |

1,015,321 |

37.0% |

|

South East |

274,235 |

677,609 |

40.5% |

|

South West |

184,983 |

439,612 |

42.1% |

|

Wales |

103,609 |

279,068 |

37.1% |

|

Scotland |

176,935 |

481,263 |

36.8% |

|

Total |

2,274,976 |

5,938,914 |

38.3% |

Source - TUC analysis of stat explore data using May 2021 data – for constituency level data see press release

The impact on poverty

The government justifies the £20 cut by saying its focus is to move people into jobs, but this misses the point. Many of those on Universal Credit (40 percent of claimants) are already in work.

2.3 million workers, many of which are key worker households, will be worse off as a result of the government’s plans to cut universal credit.

The working tax credit is also being cut, having also been raised by £20 per week in early 2020. This cut to crucial in-work support will push more families below the breadline.

Analysis by the Joseph Rowntree Foundation shows the majority of families that lose out will be working families.

These cuts are likely to worsen already record-high levels of poverty.

Just before the pandemic hit, poverty was at a record high, with 14.5 million people in poverty. The majority of these (57 per cent, or 8.3 million people) were in working households. The idea that work is a guaranteed route out of poverty is now simply not true.

Low standard rate

Even with the increase in the rate by £20 a week – the basic rate of universal credit is worth around a sixth of average weekly pay.

The UK system is strikingly less generous than in most other European countries, where unemployment benefits are related (at least in the initial period of unemployment) to previous wages to cushion income shocks, ranging from 60 per cent of previous wages in Germany to 90 per cent in Denmark.

The TUC believes that rather than being cut, Universal Credit should be increased to at least 80 per cent of the level of the living wage, around £260.

And the temporary £20 top-up excluded those on legacy benefits all together, many of whom are disabled or carers, and cannot work. This should be extended to these claimants too.

Change is needed

The UK safety net is failing as a result of years of deliberate attacks on the social security system, with around £34 billion of cuts made to social security since 2010.

The reason for increasing Universal Credit and Working tax credits was that previous rates were too low. Removing this increase makes no sense. The pandemic might – hopefully – be going away, but the need for social security isn’t.

The £20 increase in universal credit has been a “vital lifeline” for low-paid workers: having £20 a week less to spend will mean going without the essentials in life.

An ambitious agenda to tackle in-work poverty would include decent pay, secure work, progression opportunities for those on low incomes, and affordable childcare and housing costs. It would not include a cut to the lifeline support that working families across the country are relying on.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox