Doubling down on the 'plan' that has failed growth

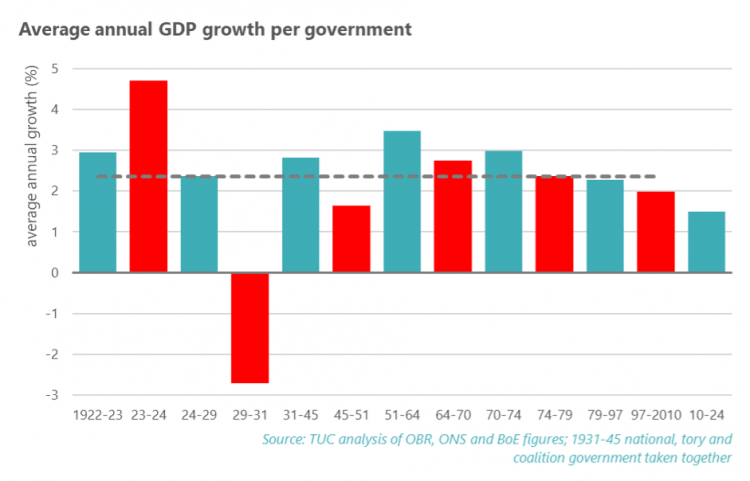

From 2010 to 2024 UK economic growth has averaged 1.5 per cent a year, the worse outcome for a government since the great depression, and a third below the long-term average of 2.4 per cent.

He ignored the fact that the UK economy in the second half of 2024 was in technical recession, and the Office for Budget Responsibility permitted him the hope that it might be short lived, though with feeble growth of 0.8 per cent in the current year. (Looking forward, the OBR are optimistic – reckoning annual growth 0.5 percentage points higher over 2024 and 2025 than other forecasters.) Unemployment is expected to rise by another 100,000 over the coming year, having risen 150,000 since the middle of 2022.

His unsurprising tax and national insurance giveaways are scant consolation when the Tory governments have presided over the worse failure in real pay for two hundred years. The pay crisis continues this year with real pay in 2024 still below the 2008 level. Had real pay continued to grow at its pre-2008 rates, it would now be £14,900 per year higher than it is.

The long-standing failure on real pay has intensified under the inflation of the past two years. Households are dealing with steep interest rate rises, and the OBR show debt servicing costs sharply rising – more than doubling (or up £67bn) between 2022 and 2028 (detailed economy table 1.18). Food prices are up 25 per cent since January 2022, and energy is up 55 per cent.

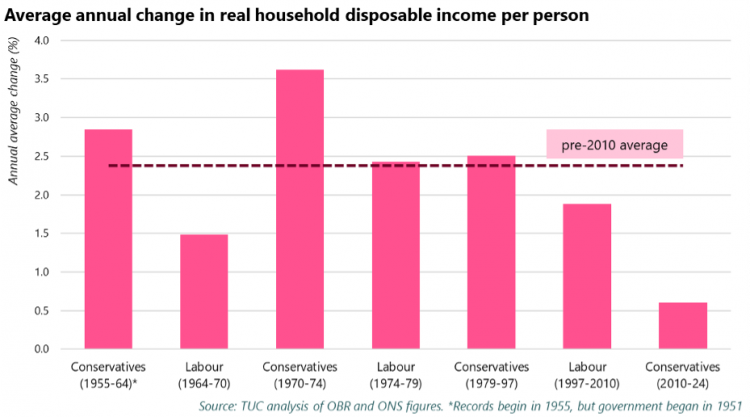

On the broadest measure of living standards, real household disposable income per person, the chart below shows since 2010 the government presiding over the worst performance since records began (in the 1950s).

On top of this the OBR forecast suggests unsecured debt (credit cards and loans) per household will rise by £1,600 this year – and in 2028 will reach the highest level since the global financial crisis.

With no change in course there is severe hardship to come, and any claimed reduction from tax cuts is put into perspective. And there are already 14.5 million people in poverty in the UK. The extension of the household support fund for six months is welcome, but a permanent mechanism is needed to support those on the lowest incomes. And the action cannot disguise the severe undermining of social security support since 2010.

A re-run of public sector austerity is baked into the Chancellor’s plans, with ongoing savage spending cuts for public services and infrastructure spending. The latter is reduced by a further 0.1 percentage points of GDP every year through to 2028-29. Ahead of the pandemic the Tory plan was to increases public sector net investment to 3 per cent of GDP; instead in 2028-29 it will now be down to 1.7 per cent – Hunt is hitting hard a vital factor for future growth.

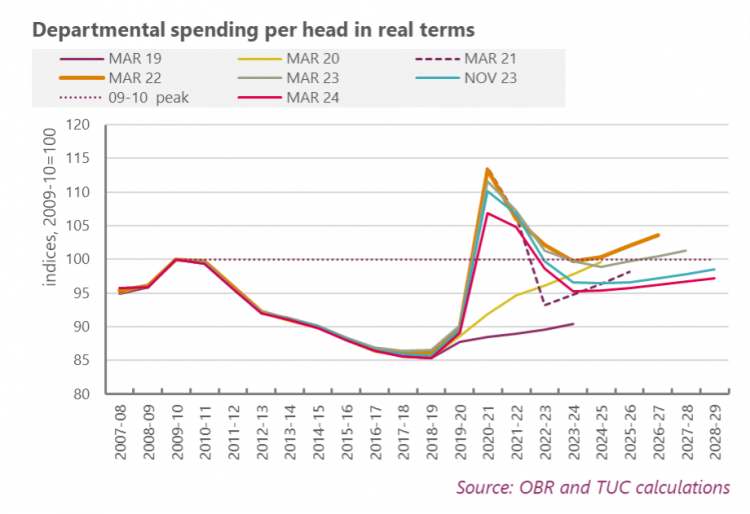

Following his self-imposed fiscal rules, in the autumn public service spending was cut back to match the tax cuts. And nothing today improved the desperate outlook for public services. The OBR report there will be “no real growth in departmental spending per person over the next five years” and a real cut in many departments’ budgets of 2.3 per cent a year from 2025-26. On departmental spending per person the position has got worse in every ‘fiscal event’ since 2022 – see the orange line on the chart below repeatedly falling to the latest position in red.

Investing, not cutting, is the key to boosting public sector productivity. Underfunded public services and their exhausted workforce cannot be expected to do more with less.

After fourteen years of failed productivity drives, the chancellor today announced another one. The bulk of the funding for which will be spent on implementing an NHS productivity plan, with a further £800m to various initiatives in other public services. Government claims it will deliver £1.8 billion worth of productivity benefits by 2029 based on increasing public sector productivity by 5 per cent. Between 1997 and 2019, productivity in the public sector grew by 0.2% on average.1 Given the current strain on public services, a 25-fold increase in productivity seems highly improbable.

The chancellor is using technology to justify budget cuts. Technology can be a valuable tool, but it's no substitute for skilled and experienced workers. With record vacancies in education, health and social care, crumbling school buildings and unusable hospital spaces, services desperately needed a significant boost in capital and day-to-day spending.

Increasing numbers of economists are finally coming forwards and recognising the government’s approach as self-defeating. For example the Cambridge economist Diane Coyle wrote yesterday: “The short-term perspective ignores the basic dynamics of growth, and therefore of fiscal arithmetic”. We made the same point in our submission to the Treasury ahead of today’s Budget:

The government is now in danger of repeating the mistakes of 2010, when huge public spending cuts decimated services and undermined economic growth. The result was the worst economic recovery for more than a century. Such poor economic outcomes also mean the debt ratio has barely stopped rising, a disastrous outcome and unprecedented for at least a century.

It is not possible to repair the growth failure with the same policies that caused the growth failure.

It remains unclear whether full expensing of business investment, made permanent in the Autumn Statement in November 2023, is a cost-effective way of boosting business investment. Today’s budget documents say this measure ‘represents a tax cut for companies of over £10 billion a year and is forecast to generate £3 billion of additional investment each year’. Nonetheless, the Chancellor has announced that this will be extended to leased assets ‘when fiscal conditions allow’.

In reality, business investment will only get properly off the ground when there are grounds for optimism, when good salaries permit a serious and sustained expansion in spending.

Another recurring theme here is aiming people’s retirement savings at boosting investment. While reasonable, the proposals are confused and potentially conflicting. The threat of heavy-handed action against pension schemes that don’t get the best long-term returns and increase holdings of UK equities is a potential concern, particularly as the flight from UK equities was driven by earlier regulation focused on de-risking and diversifying. And on pensions more generally it was also disappointing that the Chancellor committed to further explore the lifetime provider model of pensions. The idea was roundly rejected after the last Autumn statement – including by the TUC. There is little chance the government will get far with this, but it will eat up resources that would be better spent improving the pension system we have – starting with implementing 2017 proposals to extend auto-enrolment.

As always blame for Tory economic failures is placed elsewhere. And his claimed plan for long-term growth also points the finger at workers. Fundamentally workers are victims of a lack of growth not the cause of the lack of growth.

Paul Nowak slammed “a deeply cynical budget” with “wishful thinking on productivity and pre- election gimmicks”. Tax reductions are a “political con trick” - “no one wants tax cuts at the expense of their local services”. “Action on non-doms is too little too late” - and unsurprising from a government that has always “put the very wealthiest first”.

We need a government that will take responsibility for growth, with stronger public services and strengthened public infrastructure not least to meet the climate crisis. For working people up and down the country a change of government cannot come to soon.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox