Failed Trussonomics out. Failed austerity and City bankers back in.

Yesterday the government replaced one catastrophic plan with another.

A new course to placate financial markets is traded off against likely massive hits to household budgets and fears about the future.

Support for energy bills was cut, public services already stretched beyond breaking point will be hit again, little was offered on soaring borrowing and mortgage costs, and nothing about already deeply inadequate benefits and universal credit falling further behind inflation.

There is another way to deliver an economy that works for working people, but the government couldn’t be further from it,

Dealing with failure

The Truss government were right about one thing, the economic policies of the past decade and more have been a disastrous failure. As Kwasi Kwarteng admitted, growth has been ‘anaemic’. In the ONS words: the UK is the only G7 economy yet to recover above its pre-coronavirus pandemic level in Quarter 4 2019. The UK has the lowest investment as a share of GDP (see our ‘companies for the people report’, Figure 7) In Spring OECD figures showed UK real wages would fall furthest of all G7 economies.

Mini budget catastrophe

But the mini budget was catastrophically wrongheaded. Truss and Kwarteng took the fundamental problem of an economy serving wealth not work and turned it into the solution. The flip side of support for energy bills, was lavish tax breaks for those least in need – under the spurious and long discredited fallacy of ‘trickle down’.

On top of this their intention was to borrow to fund this extreme project. They did so the day after the Bank of England had confirmed that they would be reducing support for government borrowing, and implementing a £80billon programme of ‘quantitative tightening’ [i.e. selling back government bonds to financial markets] from the start of October. (Regardless of anything else this revealed staggering lack of coordination on the part of both institutions – the excellent Daniella Gabor called this ‘uncoordinated class war on the British public’.)

Financial markets took fright and instead of buying started to dump government debt, but this was also intimately connected to a third factor. The complex financial strategies – so-called liability driven investments (LDI) – that pension funds have been deploying (unnoticed by most) for the past 20 years began to unravel in the face of these rate rises.

The Bank of England was obliged to step in to halt a vicious cycle – or doom loop – of bond sales leading to higher interest rates and so more bond sales. The spike in the chart below of interest rates on UK 30-year bonds shows how the episode was at least momentarily brought under control.

Yield on 30-year UK government bond

And in the meantime the government came under sustained assault for ‘fiscal irresponsibility’.

U-turn to a worse economy

After two U-turns (on the 45p top rate and corporation tax reductions), yesterday they U- turned on pretty much the whole thing.

But reversing a wrong doesn’t make a right, far from it.

We are now on the brink of a deep and damaging recession that threatens millions of jobs. But the latest Conservative chancellor has now announced the same basic approach that got us into this mess.

He warned of “more difficult decisions” on tax and spending to come. And immediately that “Some areas of spending will need to be cut”.

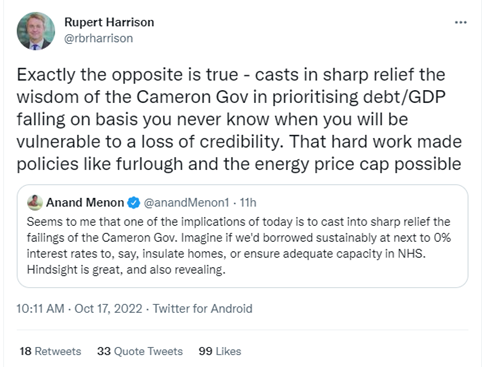

The Chancellor not only announced austerity. He not only sought once more – as did his George Osborne – to make a political virtue about imposing misery. He even invited George Osborne’s favourite adviser Rupert Harrison (now at Blackrock, one of three key institutions in LDI strategies) back to the Treasury to head a new panel of ‘economic advisers’ to deliver this reborn monstrosity.

Yesterday morning Rupert gave his City-oriented perspective on austerity

But this is a seriously misleading statement. The Osborne government did not repair the public finances. Over 2010-2019 the public debt ratio increased by 22 percentage point of GDP – the worse performance over a decade of economic recovery for a century (here).

For workers, this meant the worst pay crisis for 200 years. As Frances O’Grady spells out today, now expected (and this was before yesterday) to last at least two decades.

In the meantime shareholder payouts have grown three times faster than pay.

An even more dangerous context

But the context for policy today is even more worrying than in 2010. Central banks, led by the Federal Reserve in the United States, are engaged in a forceful (their word) tightening of monetary policy. This amounts to ending a strategy that has been in place since the start of the global financial crisis. In the wake of the last increase to 3.0 to 3.25 per cent, a Fed committee member has pointed to rates at up to 4.5 to 5 per cent. Fear of the impact of these rate rises on mortgage rates is likely common to all countries – for example in the US rates on a 30-year mortgage are up from 2.7 per cent at the start of 2021 to 6.9 per cent now.

And while in the UK the spike was brought under control, government interest rates are still seriously elevated and will carry on feeding through to mortgages.

In the UK money expert Martin Lewis has offered a grim rule of thumb: "For each 1 percentage point your mortgage rate increases, expect to pay roughly £50 more a month (£600/year) per £100,000 of mortgage debt.” The Resolution Foundation reckoned five million families would see annual payments rising by an average of £5,000 between now and the end of 2024.

Standing further back, the Financial Stability Board (Dietrich Domanski on the Today programme, 6 Oct.) have warned of the challenges of raising interest rates to deal with inflation under the conditions of the high global indebtedness that prevail today.

Likewise the IMF last week warned of “hidden leverage”, “waves of deleveraging”, and in particular the risk to ‘non-bank financial institutions’ – the latter including pension funds.

(press conference for the Global Financial Stability Report). In terms of countries, first in the firing line are emerging market economies – with 20 countries “in default or trading at distressed levels”.

While the immediate trigger for central bank policies is the inflation set in motion by the end of lockdowns and Putin’s brutal invasion of Ukraine, the scale of the dislocation reflects a wider failure to set the economy right since the global financial crisis of 2008-09 exposed deep underlying failings. Summing up, the IMF offered the chilling: “the level of risk we are flagging at the moment is the highest outside acute crisis”

As the Biden administration has argued, for 40 years the interests of wealth have been prioritised over those of workers. The economy crashed in the first place because these financial interests proved wildly at odds with the interests of the population as a whole. An economy of speculation and debt crowded out production and decent pay and work.

The chancellor’s new advisory panel puts these interests back front and centre of policymaking at the Treasury. The other members so far announced are also from the City of London, not least securing J.P. Morgan a seat at the table.

This morning the Financial Times reported that the Bank of England’s programme of quantitative tighten has been put on hold, likely to protect the casino capitalism around pension funds.

Ahead of the mini budget the TUC issued a plan for a budget ‘on the side of for working people’. We desperately need a government that will put first our interests not those of wealth. But instead once more the interests of the city of London are put ahead of those of workers and the country.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox