On the side of working people

In the emergency fiscal statement expected next week, the latest Conservative Chancellor of the Exchequer has promised a new approach. Writing in the Financial Times, Kwasi Kwarteng argued that “the same old economic managerialism has left us with a stagnating economy and anaemic growth” and that “we need to be decisive and do things differently” to deliver stronger economic growth and living standards.[1]

But Kwasi Kwarteng is a continuity Conservative chancellor. From George Osborne onwards, Tory chancellors have promised to unleash growth and productivity by reducing supposed burdens on business in the form of protections for workers. And they have repeatedly promised tax cuts over investing in our public services, infrastructure, or collective security. These policies have failed comprehensively on the trade union movement’s goals for the UK of decent pay, jobs, rights, and services. But they have failed on their own terms as well, with growth, investment and productivity falling well behind our peers. The last twelve years of Conservative government have demonstrated decisively that cuts don’t work and that, in the middle of a cost-of-living crisis, the government is making the wrong people pay.

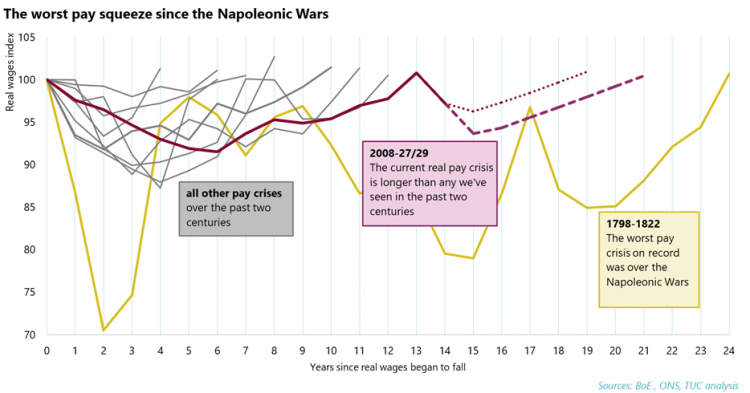

- Cuts in pay have led to the longest pay squeeze for 200 years and contributed to the current cost-of-living emergency: Conservative ministers repeatedly froze and cut public sector pay, meaning the average nurse is now £4,300 worse off than in 2010.[2] Rather than unleash pay growth in the private sector, workers across the economy have lost out on £20,000 worth in pay since 2008 (compared to a scenario in which pay had simply kept up with inflation). The latest pay data shows that real average monthly wages were £109 less in July 2022 than they were in the same month last year.[3]

- Cuts in rights have only led to an increase in insecure work: in the last decade, Conservative governments have restricted the right to strike through the Trade Union Act 2016, cut rights to unfair dismissal, and attempted to increase fees for employment tribunals. One in ten workers is now in insecure work – economic growth has flatlined, and workers are experiencing a pay crisis.

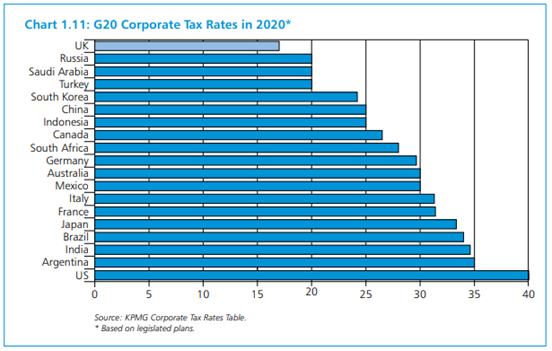

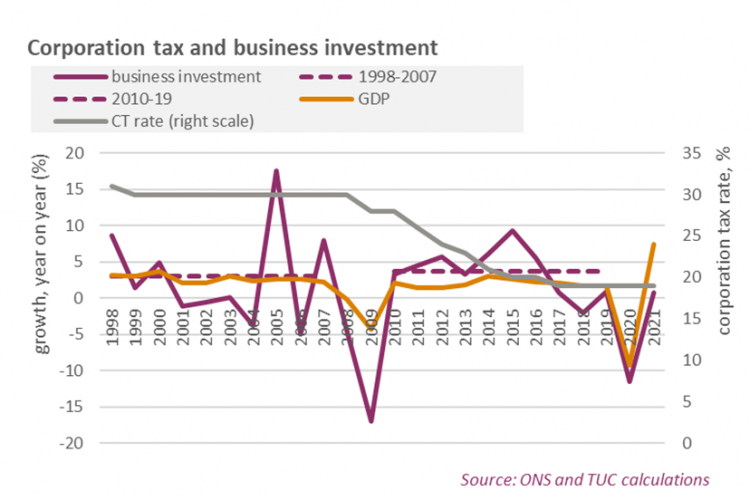

- Cuts in corporate taxes have failed to boost economic growth: Conservative governments in the last decade slashed corporation tax from 28 to 19 per cent. But as the chancellor outlined, growth is ‘anaemic’ and business investment has flatlined. Meanwhile, public services have been severely cut, and underinvestment in energy efficiency and infrastructure has left the UK especially vulnerable to gas price shocks.

- Cuts in skills funding have held back workers and businesses: government funding for adults attending college courses was halved in the last decade, and employment investment in training is just half the EU average. Businesses and government complaining of skills shortages and low productivity in the UK have comprehensively failed to address them.

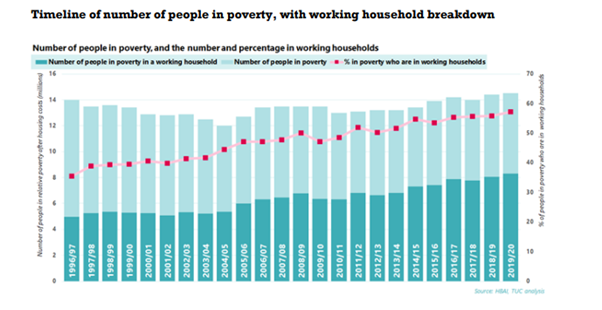

- Cuts in social security have left millions in poverty: Conservative governments cut around £14bn a year from the social security budget, and the standard benefit payment is now worth £52 less a month. Despite repeated claims that Universal Credit would ‘make work pay’ the numbers in working poverty have risen by two million.

- Cuts to public services have decimated services and created a recruitment and retention crisis: our public services went into the pandemic weakened by a decade of relentless cuts. Backlogs in our health and criminal justice system have reached record highs, while the crisis in social care has worsened. Plans for growth, set out in the 2021 spending review, failed to reverse the impact of these cuts and have been compounded by spiralling inflation which is inflicting austerity 2.0 on our services.

These persistent attacks on workers’ living standards have left working people in the UK particularly vulnerable to rising prices, and, even after action to partially cap energy prices, millions of families face a cost-of-living emergency this winter. An energy cap of £2,500 will mean energy costs have risen 18 times faster than wages in the year to October 2022. The latest figures for food prices show them rising at 13.4 per cent[4] and the Joseph Rowntree Foundation estimates that low-income families will face an £800 shortfall between their incomes and other costs over the winter.[5]

A fresh approach first needs to respond to this crisis – giving families more help to get through this winter.

- Government should bring forward inflation-proof increases in social security, pensions, and the national minimum wage to October, getting us on a path to a £15 minimum wage, and social security that provides a decent standard of living.

But the chancellor should also take this opportunity to set out a genuinely new approach that builds for fair growth and decent jobs – recognising that rewarding the workers who keep the country running is the best way to ensure that growth benefits everyone. That would include:

A plan to boost pay across the economy

Government should:

- follow the example of New Zealand and Australia by introducing fair pay agreements to allow unions and employers to negotiate minimum pay and conditions across whole sectors.

- get the UK on a path to a £15 minimum wage as soon as possible.

- fund decent pay rises so that all public service workers get a real terms pay rise that at least matches the cost of living and begins to restore earnings lost over the last decade.

- ensure all outsourced workers are paid at least the real Living Wage and receive pay parity with directly employed staff doing the same job.

- strengthen the gender pay gap reporting requirements, and introduce ethnic and disability pay gap reporting, requiring employers to publish actions plans on what they are doing to close the pay gaps they have reported.

A plan to ensure decent jobs and growth for everyone

Government should:

- should ensure that businesses prioritise sustainable growth and jobs, reforming corporate governance to promote long-term sustainable investment rather than a short-term focus on shareholder returns.

- invest in a just transition to the secure green energy future we need, slashing dependence on volatile imported gas, and introducing public ownership to the energy sector.

- help get productivity rising by rebooting our skills system through a new national lifelong learning and skills strategy.

- introduce industrial and trade policies that promote good jobs and ensure that businesses compete on a level playing field.

A plan for public services, funded by fair taxation

Government may use the autumn budget to set out a fuller plan to fund public services. But it must recognise the crisis they currently face.

Workers and businesses depend on strong and resilient public services but a decade of government-imposed pay restraint and under-funding is driving a recruitment and retention crisis in the sector. Vacancy rates in health and social care have reached record highs at 10.5 per cent[6] and 9.5 per cent[7] respectively. In education, retention rates have reached a historic low - just two-thirds of early-career teachers (67 per cent) remain in the profession after five years.[8]

Staff shortages put huge strain on those who remain as they try to plug the gaps, fuelling excessive workloads and long working hours. This undermines the quality of our public services, and leads to high rates of attrition and absenteeism.

Backlogs in hospital waiting times, rising ill health, and our stretched education system let down UK workers, and disrupt UK businesses. Investing to restore our public services, including childcare and social care, must be a part of the government’s economic plan.

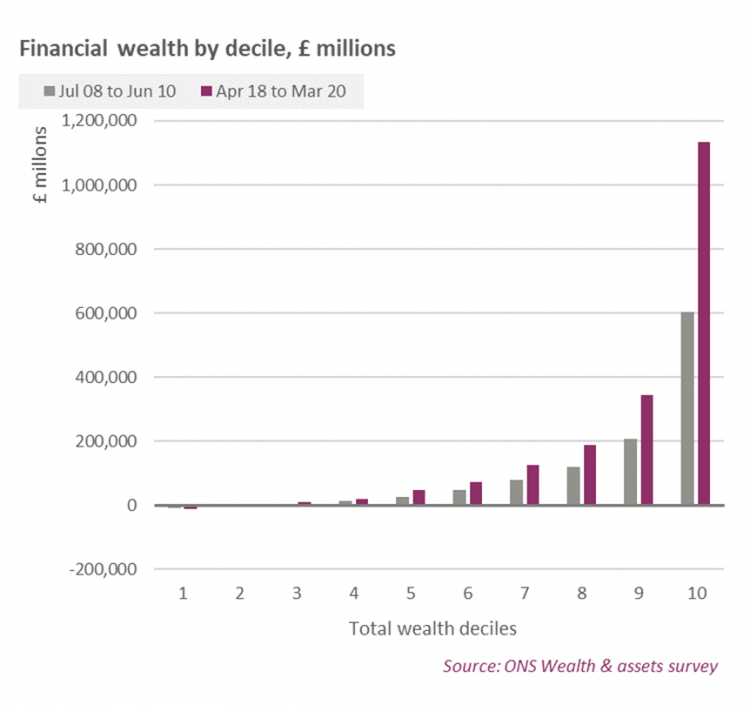

Public services depend on fair taxation. When considering tax changes, government must ensure that those with the broadest shoulders pay their fair share. Between 2008 and 2020, levels of financial wealth rose by 80 per cent, with 61 per cent of this going to the richest ten per cent. Government should equalise capital gains tax rates with income tax to start ensuring the fairer taxation of wealth. And the windfall gains experienced by oil and gas giants should be taxed at a higher rate.

The following sections outline the impact of policies over the past decade, and the current situation facing workers. The final section outlines the new approach workers need in more detail.

[1] Kwasi Kwarteng (September 4th 2022) ‘A Liz Truss government would be unashamedly pro-growth’ at https://www.ft.com/content/3c067e28-e33a-4bda-9f2e-81a109966b20

[2] TUC (2022) Unpublished analysis of 2022 pay award

[3] Source: TUC analysis of ONS data, based on regular average weekly earnings. Earnings are adjusted for inflation using CPI, June 2022=100.

[4] CPI figures for August 2022

[5] Joseph Rowntree Foundation (8th September 2022) Joseph Rowntree Foundation highlights the gap in support that remains for people on low incomes after Liz Truss energy announcement at https://www.jrf.org.uk/press/joseph-rowntree-foundation-highlights-gap-support-remains-people-low-incomes-after-liz-truss

[6] NHS digital (2021) https://digital.nhs.uk/data-and-information/publications/statistical/nhs-vacancies-survey/april-2015---september-2021-experimental-statistics

Cuts to pay have left us with the worst pay growth in 200 years

Since 2010, pay determination in the public sector has largely been dictated by pay policy set by government. Public sector workers have suffered some of the worst falls in pay, following government-imposed cuts, freezes and caps. This trend continued in 2022, with pay awards in the public sector well below the rate of inflation. Latest figures show that in the three months to August 2022, real wages fell by £103 per month compared to the same month last year for all workers, and by £190 for public sector workers. 1

Reduced pay meant reduced spending by public sector workers, which damaged the economy and contributed to reduced private sector pay.

Public sector pay cuts were part of a strategy of austerity that Conservative ministers promised would enable growth in the private sector, leading to increases in workers’ living standards. In his Mais lecture of 2015, George Osborne, then Chancellor of the Exchequer, held fast to his goals from 2010: “Monetary activism to support demand in the economy and repair our financial sector. Fiscal responsibility to underpin economic stability. And supply side reform to deliver sustainable increases in our standard of living.”2

This strategy has comprehensively failed, with workers experiencing the longest squeeze on pay – and their living standards – for 200 years. In cash terms workers lost £20,000 in the years to 2021, compared to a scenario in which pay had kept pace with inflation.3

The decade of brutal pay cuts and freezes have had a devastating impact on frontline workers and their families. Since the pandemic began, the number of children living in poverty in key worker households has grown to nearly 1 million.4

In some regions, such as the North East, North West and East of England, more than two-fifths of children living in key worker households are now living in poverty. Without immediate government action, this crisis will grow, with key worker child poverty expected to grow from 1 million in 2022 to 1.1 million in 2023.

- 1 Source: TUC analysis of ONS data, based on regular average weekly earnings. Earnings are adjusted for inflation using CPI, June 2022=100.

- 2 George Osborne (2015) Extracts from the Chancellor's lecture on economic policy at https://www.gov.uk/government/speeches/extracts-from-the-chancellors-lecture-on-economic-policy

- 3 Politics.co.uk (20 Jun 2022) UK workers have lost nearly £20,000 in real earnings since 2008 https://www.politics.co.uk/opinion-former/press-release/2022/06/20/uk-workers-have-lost-nearly-20000-in-real-earnings-since-2008/

- 4 TUC (2022) Key worker child poverty https://www.tuc.org.uk/news/1-5-key-worker-households-have-children-liv…

This pay squeeze looks set to continue. The latest pay statistics show real pay is down 4 per cent in the latest quarter (using CPI) - together with last month’s figures showing a decline of 4.1 per cent, these are record declines on recent figures that extend back to 2008.

While global pressures on prices are affecting many countries, the UK’s pay performance is particularly bad. In June this year the OECD issued pay and inflation forecasts showing UK real pay performance as the worst of all G7 countries over 2022 to 2023, and the fourth worst of all 35 OECD countries.

The economic strategy pursued by Conservative governments over the last decade has led to significant pay cuts for workers, but significant gains for the already wealthy. In aggregate terms, total financial wealth over 2008-10 to 2018-20 increased by around £0.9tn (80 per cent) from £1.1tn to £1.9tn. Some 61% of the increase went to the top decile, the (already almost insignificant) financial wealth of the lowest five deciles increased by only 3.7%.

This contrasts with losses to employees as a whole over 2008-2022 who saw their wages lose around £0.6tn compared to keeping pace with inflation (this is the total of the £20,000 loss in pay on average for each employee). This extreme inequality should be addressed when designing new tax policy.

Cuts to workers’ rights have left millions of workers facing insecurity at work

Kwasi Kwarteng’s ‘new’ approach to growth includes all too familiar “unshackling” business from “unsuitable regulations” 5

and there have been widespread reports that the new government plans to cut employment rights underpinned by EU legislation. 6

As a co-author of Britannia Unchained, Kwasi Kwarteng blamed Britain’s poor productivity on workers, claiming that too many “prefer a lie-in to hard work”.

But there is clear evidence that workers in the UK work some of the longest hours in Europe 7

and do not have sufficient protection at work. Government has failed to tackle new forms of insecurity, ignoring the rise in zero hours contracts, bogus self-employment, and aggressive new tactics by employers to drive down rights. More than one in ten workers, 3.7 million people, now face insecurity at work, over half a million more than in 2010 8

The lack of a strong framework of rights for workers was underlined by the widespread use of ‘fire and rehire’ tactics during the pandemic, where workers were asked to accept poorer terms and conditions or face the sack, and by the scandal at P&O Ferries, where 800 workers were fired without notice. 9

Despite these egregious breaches of current law and common decency, the Boris Johnson government dropped its much trumpeted commitment to an Employment Bill.

This failure has had a disproportionate impact on Black workers. The most recent analysis found that BME workers are far more likely than White workers to be in insecure work. Nearly one in six (15.7 per cent) BME men are in insecure work. Some 12.4 per cent of BME women are in the same position, and among employees (excluding the self-employed) BME women are the most likely group to be subjected to insecure work.

Structural and institutional racism also means BME workers face a lower employment rate and a higher unemployment rate than White workers. While the employment rate for BME workers has improved over the past decade, it remains significantly below the employment rate for White workers (68.3 per cent compared to 77.0 per cent). This is especially true for BME women. The employment rate for BME women has increased by almost 13 per cent over the past decade, yet it remains substantially below the employment rate for White men (61.7 per cent compared to 79.5 per cent).

Rather than acting to protect workers, Conservative governments over the last decade have repeatedly claimed that a strategy of slashing rights that protect workers would help boost growth and living standards. The Beecroft review, commissioned by the Coalition government and published in 2012, falsely argued that “much of employment law and regulation impedes the search for efficiency and competitiveness”. 10

Following the review the government increased the qualification period for unfair dismissal from one year to two, and introduced fees for workers wishing to challenge their employer at an Employment Tribunal (a decision that was later overturned in the High Court in a case brought by Unison).

In a further attempt to claim that workers’ rights were a barrier to UK success, the Conservative government then introduced the Trade Union Act in 2016, placing significant barriers on the right to strike for better pay and conditions. 11

These reforms have fuelled fear and insecurity at work. And they have had no positive impact on the UK’s poor rates of growth, productivity and investment. In fact, international advice now recommends that strengthening workers’ rights is key to an effective economic strategy. In the OECD’s latest employment outlook, published in September 2022, they argue that “strengthening collective bargaining is key to ensuring a fair distribution of the inflation shock between workers and employers. In the longer term, a stronger voice for workers and more robust competition between employers would ensure a re-balancing of bargaining power”. 12

Cuts in corporate taxes have done nothing to boost economic growth or living standards

There are widespread expectations that the current chancellor will drop the commitment to raise corporation tax rates for larger businesses from 19 to 25 per cent in April 2023. Kwasi Kwarteng argued for immediate action on “cutting taxes, putting money back into people’s pockets, and unshackling our businesses from burdensome taxes and unsuitable regulations”. 13

This also replicates Conservative strategy over the last decade, where corporation and personal tax cuts were prioritised over public expenditure, while public services and infrastructure investment, including in energy security, underwent deep cuts.

From 2010 to 2016 corporation tax was cut from 28% to 19%. The Social Market Foundation estimated there was a net cost to the Exchequer between 2010 and 2018 of £72.6bn. 14

In Budget 2016 the Treasury announced a new plan to decisively move the CT rate to the bottom of the G20 league: an announced 17% rate in 2020 (since abandoned) was aimed at moving the UK below Russia, Saudi Arabia and Turkey – as illustrated on the chart below. 15

- 5 Kwasi Kwarteng (September 4th 2022) A Liz Truss government would be unashamedly pro-growth at https://www.ft.com/content/3c067e28-e33a-4bda-9f2e-81a109966b20

- 6 Oliver Wright, The Times (3rd September 2022) Truss eyes bonfire of workers’ rights to boost economy at https://www.thetimes.co.uk/article/truss-eyes-bonfire-of-workers-rights-to-boost-economy-3dmpf0gfg

- 7 TUC (2019) British workers putting in longest hours in the EU at https://www.tuc.org.uk/news/british-workers-putting-longest-hours-eu-tuc-analysis-finds#:~:text=Workers%20in%20the%20UK%20are,a%20half%20weeks%20a%20year

- 8 TUC analysis based on the Labour Force Survey and Family Resources Survey. More on the impacts of insecure work can be found at https://www.tuc.org.uk/research-analysis/reports/insecure-work-why-employment-rights-need-overhaul

- 9 Trades Union Congress (25 January 2021). “’Fire and rehire’ tactics have become widespread during pandemic – warns TUC”, Trades Union Congress www.tuc.org.uk/news/fire-and-rehire-tactics-have-become-widespread-duri…; Nautilus International (18 March 2022). “Nautilus enters dispute over mass redundancies with P&O Ferries,” Nautilus International www.nautilusint.org/en/news-insight/news/nautilus-enters-dispute-with-p…

- 10 Adrian Beecroft (2011) Report on employment law at https://www.gov.uk/government/publications/employment-law-review-report-beecroft

- 11 See for example TUC (2017) Trade Union Act 2016 - A TUC guide for union reps https://www.tuc.org.uk/research-analysis/reports/trade-union-act-2016-tuc-guide-union-reps

- 12 OECD (September 2022) Employment Outlook 2022: Tackling the cost-of-living crisis: Why bold government action is needed in labour markets https://www.oecd.org/employment-outlook/2022/

- 13 Kwasi Kwarteng (September 4th 2022) A Liz Truss government would be unashamedly pro-growth at https://www.ft.com/content/3c067e28-e33a-4bda-9f2e-81a109966b20

- 14 Andrew O’Brien (2022) ‘Conservatives must tell the truth about tax cuts’ SMF at https://www.smf.co.uk/commentary_podcasts/the-truth-about-tax-cuts/

- 15 HM Treasury (2016) Budget 2016 at https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/508193/HMT_Budget_2016_Web_Accessible.pdf

The new plan to scrap the rise in corporation tax (from 19% to 25%) proposed in the March 2021 Budget, would cost £17bn a year, according to government estimates.16

Even were the rate raised to 25%, it would still the lowest CT rate of all G7 countries.17

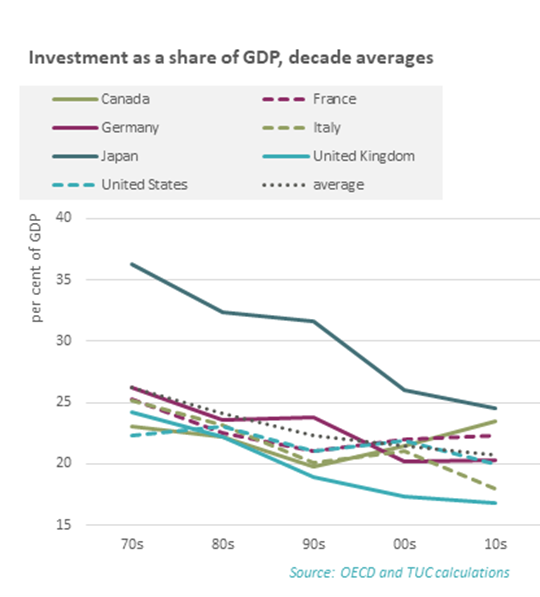

There is no evidence that cuts in corporation tax are an effective way to boost investment. On the contrary, international comparisons show that UK investment as a share of GDP has been among the lowest of all G7 countries since the 1990s. Over the 2010s the government’s drastic efforts on corporation tax saw no sustained increases in investment.

- 16 See the OBR’s database of policy costings here: https://obr.uk/forecasts-in-depth/policy-costings/

- 17 Goodier, Michael. “How the UK’s corporation tax rate will remain the lowest in the G7”. New Statesman, May 24, 2021.

The chart below shows figures for the UK only on business investment, GDP and the rate of corporation tax.

The average annual growth of business investment was only a little higher over the post financial crisis period (at 3.7 per cent) when rates were cut, than the 3.1 per cent per year ahead of the global financial crisis (though there is some distortion from a high figure in 2005, related partly to changed ownership of nuclear power). And while there was some expansion in the mid-2010s in particular, gains were brought to a decisive end after the EU referendum. Fundamentally this investment did nothing to boost wider GDP growth or living standards. GDP growth after the financial crisis has averaged just 2.0 per cent a year when ahead of the financial crisis growth was 2.7% a year.

Subsidising investment is a poor substitute for a virtuous circle of more sustainable economic growth. With pay higher and demand robust, firms will expect higher consumption and invest to expand the economy. So far since the global financial crisis, investment has had very limited impact on the strength of the economy as a whole.

Further proposed cuts to personal taxes look likely to disproportionately benefit richer households, doing nothing to tackle the current living standards emergency:

- Cutting VAT from 20 per cent to 15 per cent would cost £38bn a year,18

saving the average household around £1,300 per year. 19

But those on lower incomes for whom VAT-exempt essentials such as basic foods make up a larger proportion of spending, would see the smallest benefit from the cut. 20

- Raising the threshold for the higher rate of income tax from roughly £50,000 to £80,000, obviously advantages higher earners and does nothing to help the majority of workers.

- Reversing the increase in NICs rates at a cost of £13bn per year 21

will save the UK’s poorest households just 76p a month, compared to £93 for the richest. 22

In addition, this increase to NICs has been earmarked to be spent on Health and Social Care, a sector which is still in desperate need of more funding to meet increasing demand.

The TUC has set out plans for fair taxes to help tackle the crisis in social care. Equalising capital gains tax rates with income tax rates and removing exemptions could raise, on average, up to £17bn a year, and would be a recognition of the fact that while workers face a cost-of-living emergency, levels of wealth have soared. The typical family in the richest 10 per cent of households had £1.3m more in wealth per adult than the typical family in the fifth decile of the wealth distribution – an increase of 50 per cent in the wealth gap between 2006-8 and 2016-18. 23

Cuts in skills have held back workers and business productivity

Skill shortages have often been cited as a cause of the UK’s poor economic performance. But in the last decade, both government and business have slashed their investment in skills.

Spending on adult education and apprenticeships fell by 38 per cent in real terms between 2010-2011 and 2020-21, according to analysis by the Nuffield Foundation. 24

The 2021 Spending Review failed to reverse the impact of these cuts, with spending on apprenticeships and adult education 25 per cent lower in 2024-25 compared with 2010-2011.25

This analysis did not take account of the impact of soaring inflation on budgets.

TUC research 26

has highlighted that job-related training provided by employers has been in decline since the mid-1990s and this trend intensified during the pandemic. UK employers invest just half the EU average in training. If investment per employee equalled the EU average, there would be an additional £6.5bn spent each year.27

Despite repeated complaints from both government and business about skills shortages and productivity levels, there has been no action to ensure that workers can get the skills they need.

Cuts in social security have left millions of families in poverty

Deep cuts to social security for those both in and out of work have been a key plank of the Conservative economic agenda over the past decade.

Conservative governments have cut around £14bn a year from the social security budget..28

TUC analysis shows that the real value of the standard benefits payment is now worth £52 less a month.29

Government stated that social security reform, including the introduction of Universal Credit, would ensure work pays and reduce in-work poverty. Yet the majority of people in poverty (57 per cent, or 8.3 million people) live in a working household. 29

This is a record high.

- 18 Diver, Tony. “Liz Truss Considers ‘Nuclear’ Option of Five per Cent VAT Cut.” The Telegraph, August 27, 2022.

- 19 Ibid.

- 20 Stacey, Tim. “VAT vs Income Tax.” Web log. The Equality Trust (blog), January 13, 2014. https://equalitytrust.org.uk/blog/vat-vs-income-tax.

- 21 Office of Budget Responsibility. “Economic and Fiscal Outlook”. March 23, 2022.

- 22 Corlett, Adam. “Happy new tax year? National Insurance and Income Tax changes in 2022”. Resolution Foundation. April 3, 2022.

- 23 See TUC (2021) A new deal for Social Care: A new deal for the workforce at https://www.tuc.org.uk/research-analysis/reports/new-deal-social-care-new-deal-workforce

- 24 Nuffield Foundation (2022) https://www.nuffieldfoundation.org/news/plans-will-leave-spending-on-ad…

- 25 ibid

- 26 F. Green & G. Henseke (2019) Training Trends in Britain, TUC unionlearn

- 27 Learning & Work Institute (2021) Learning at Work: employer investment in skills

- 28 New Economics Foundation (2021) ‘How our benefits system was hollowed out over 10 years’ at https://neweconomics.org/2021/02/social-security-2010-comparison

- 29 a b This is based on TUC analysis of standard benefit payments. Figures are adjusted for inflation using CPI, financial year 2022/23 = 100. Inflation rate for financial year 2022/23 is taken from latest Bank of England forecast.

These cuts lie behind the dramatic rise in the need for emergency food aid. The Trussell Trust says the need for emergency food parcels dramatically increased following the £20 a week cut to Universal Credit and rapid increases in living costs. 30

The failed strategy of the last decade has left households in the UK particularly vulnerable to the cost-of-living crisis

The Conservative government’s strategy of cutting pay, rights, taxes, skills and social security over the last decade has left working people in the UK facing a crisis of real pay, soaring poverty, weakened public services, and an epidemic of insecure work. And it has left households in the UK particularly vulnerable to the sharp rises in prices following global supply chain pressures and the war in Ukraine.

The UK government has now provided a partial cap on energy bills, restricting the standard energy cap to £2,500 a year (though actual prices will vary depending on how much energy households use), and promising support to business. But this will be insufficient to address the cost-of-living emergency facing families and, by failing to impose a fair and ambitious windfall tax on energy company excess profits, it is making the wrong people pay.

- Capping energy bills at £2,500 a year means that energy bills will have risen 18 times faster than wages in the year from October 2021 to October 2022.31

- Rising food, transport and other bills mean that much of the existing support 32

– delivered through the emergency budget in May – is already being used up: the Trussell Trust is reporting almost two-thirds (64%) of Universal Credit claimants had to spend July’s first Cost of Living Payment from the government on food. 33

Inflation data for August 2022 showed that prices for food and non-alcoholic beverages rose by 13.1% in the 12 months to August 2022, up from 12.7% in July. The annual rate for this category was minus 0.6% in July 2021 but it has since risen for 13 consecutive months. The current rate is the highest since August 2008.

- The Joseph Rowntree Foundation has estimated that taking all of the announced measures into account, including the energy bill cap, families claiming means tested benefits will still face a gap of around £800 between the support provided and the costs they face. As they set out: “This means millions of families still face a winter going without essentials like food or hygiene, or borrow money at increasing interest rates, just to meet the rising cost-of-living.” 34

- Disabled workers often face particularly high costs. In 2021, TUC research found that Disabled workers were twice as likely to have had to visit a food bank than non-disabled workers (with six per cent of Disabled workers having visited a food bank, versus three per cent of non-disabled workers),35

and increasing costs are likely to have pushed these figures still higher.

A fresh start: building for fair growth

The government appears set on attempting to cut its way to growth. But the evidence of the last decade shows that this is a disastrous strategy.

Government’s first priority in this emergency intervention must be to help families suffering the consequences of this failure, and a cost-of-living emergency:

- Government must bring forward inflation-proof increases in social security, pensions and the minimum wage to October, and get the UK on a path to decent social security and benefits.

Government should protect families facing a cost-of-living emergency now by bringing forward inflation-proof increases to social security, pensions and benefits and the national minimum wage to October, rather than waiting to April.

This should be a first step towards putting the UK on a path to decent minimum wages, social security and pensions. The TUC is calling for:

- A £15 minimum wage as soon as possible

- The basic level of social security to be increased to 80 per cent of the real living wage.

- The triple lock for pensions to be maintained.

But government must also make it clear that there is a better way to build for growth, investing in the working people across the UK who deliver it. That should include the following aims and policies.

A plan to boost pay across the economy

The real wage crisis facing the UK lies at the heart of the cost of-living crisis. Government must set out a plan to address it that includes:

- A plan to strengthen and extend collective bargaining across the economy, including introducing fair pay agreements to set minimum pay and conditions across whole sectors

- A plan to increase the minimum wage to £15 an hour as soon as possible; and

- Fund decent pay rises so that all public service workers get a real-terms pay rise that at least matches the cost of living and begins to restore earnings lost over the last decade, through fully independent pay review bodies or collective bargaining.

- Ensure all outsourced workers are paid at least the real Living Wage and receive pay parity with directly-employed staff doing the same job.

- The government should strengthen the gender pay gap reporting requirements, and introduce ethnic and disability pay gap reporting, requiring employers to publish actions plans on what they are doing to close the pay gaps they have reported.

- Stronger rights for workers enable them to have more confidence when negotiating pay. Alongside stronger collective bargaining rights, government should ban zero hours contracts, tackle fire and rehire protect and enhance employment rights that derive from the EU, including strengthening workers’ rights to join and be represented by a union..

A plan to ensure decent jobs and growth for everyone

Efforts to induce business to invest in the economy through ever greater tax cuts have comprehensively failed. Instead we need to change the rules to encourage a long-term approach to delivering decent jobs and growth. That should include:

- Corporate governance reform to promote long-term sustainable investment and organic growth, rather than short-term focus on shareholder returns. Directors’ duties should be reformed so that directors are required to promote the long-term success of the company as their primary aim, taking account of the interests of stakeholders including the workforce, shareholders, local communities and suppliers and the impact of the company’s operations on human rights and on the environment. And company law should require that elected worker directors comprise one third of the board at all companies with 250 or more staff.

- Investment in the secure green energy future we need, ending our dependence on volatile imported fossil fuels. Energy is expensive in the UK because of our broken energy system and dependence on volatile imported fossil fuels. The TUC has set out a plan to take our retail energy companies into public ownership, and we need to rapidly scale up investment into a secure net zero carbon energy mix.36

- The UK’s buildings are the worst insulated in Europe. That’s why we need a rapid programme of public-sector led home improvements to reduce the cost of heating our homes. Making our homes warm in the winter will slash the UK’s imports of fossil gas, helping both the national economy and millions of families,37

and defusing future supply crises.

- Rebooting our skills system through a new national lifelong learning and skills strategy. The TUC is calling for a new national lifelong learning and skills strategy based on a vision of a high-skill economy, where workers can quickly gain both transferable and specialist skills to build their job prospects. Delivering this would require:

- A significant boost to investment in learning and skills by both the state and employers. People should have access to fully-funded learning and skills entitlements and new workplace training rights throughout their lives, expanding opportunities for upskilling and retraining.

- These entitlements should be incorporated into lifelong learning accounts and accompanied by new workplace rights, including a new right to paid time off for learning and training for all workers.

- Create a new national social partnership on skills – led by employers and unions – to provide clear strategic direction, as in the case of most other countries. This should include renewed support for union learning.

- And the government should reverse the counter-productive decision to cut the funding for UnionLearn.

Industrial and trade policies to promote good jobs and ensure that businesses compete on a level playing field

To boost domestic manufacturing, services and technology development, and reap the full benefit of developments in infrastructure and renewable energy, the government should adopt strong trade and procurement policies to strengthen local supply chains and raise employment standards.

- The UK government should use local content requirements where they are legal and needed.

- Trade deals and WTO rules should be used as a lever to lock in the highest standards by enforcing respect for International Labour Organisation standards. Too often, rights have been defined disparagingly in trade deals as ‘non-tariff barriers’ that should be removed.

- The UK government must uphold the Level Playing Field (and Paris Agreement compliance) commitments in the UK-EU Trade and Cooperation agreement to high standards of workers’ and trade union rights

- The government must avoid a trade war with the EU and ensure the Good Friday Agreement is protected by respecting the Northern Ireland Protocol.

Invest in decent public services, funded by fair taxation

This emergency event will, we assume, be followed by a more comprehensive spending review in the autumn, where government must set out its plans to reboot public services following a decade of cuts, and to invest in social care and childcare. This should include:

- Fixing the public sector’s recruitment and retention crisis. Government should immediately halt any planned job losses in the civil service, deliver a real terms pay rise for public sector workers and engage in a public sector jobs drive. TUC previously calculated we need an additional 600,000 staff to get back to strong and resilient public services that families depend on.

- A new deal for social care workers, introducing a new sectoral minimum wage of £15 per hour. This should be backed up by a funding settlement that fully offsets the cuts of the past decade and establishes future rises at a level that allows local authorities to meet rising demand for services. A new tripartite Social Care Forum should be established, involving government, unions and employers, to coordinate the delivery and development of services, oversee negotiation of a new workforce strategy, set minimum standards of employment and reform of the fragmented private provider market towards insourcing of care services.

- Introduction of universal, flexible, high-quality childcare that is available to all from the point at which paid maternity or parental leave ends. This would ensure every family has access to affordable, flexible, high-quality childcare and that no one is worse off because they work and need to use childcare.

Tax changes must ensure that those with the broadest shoulders pay their fair share in this national effort. This should include:

- A higher windfall tax on excess oil and gas and energy company profits, in order to fund the Energy Price Guarantee and measures to future-proof homes

- Equalising capital gains tax rates with income tax rates, as a first step in ensuring that wealth is taxed fairly.

- 30 Trussell Trust (April 2022) ‘Food banks provide more than 2.1 million food parcels to people across the UK in past year, according to new figures released by the Trussell Trust at https://www.trusselltrust.org/2022/04/27/food-banks-provide-more-than-2…

- 31 Energy bill cap data taken from Ofgem and government announcements. Wage data taken from the Office for National Statistics and Office for Budget Responsibility (OBR) forecasts.

- 32 Government support announced so far includes 1) a £150 Council Tax rebate for households in England in Council Tax bands A-D (2) A universal £400 of support towards energy bills. (3) a £650 Cost of Living Payment, to those on means tested benefits ( excluding housing benefit). (4) £150 Disability Cost of Living Payment. (5) £300 Pensioner Cost of Living Payment.( 6) The package also includes additional funding to extend the Household Support Fund, of £421 million for the period covering October 2022 to March 2023.

- 33 Trussell Trust (April 2022) ‘Forty per cent of people claiming universal credit skipping meals to survive new research from the Trussell Trust reveals’ at https://www.trusselltrust.org/2022/09/07/forty-percent-of-people-claiming-universal-credit-skipping-meals-to-survive-new-research-from-the-trussell-trust-reveals/

- 34 Joseph Rowntree Foundation (8th September 2022) Joseph Rowntree Foundation highlights the gap in support that remains for people on low incomes after Liz Truss energy announcement at https://www.jrf.org.uk/press/joseph-rowntree-foundation-highlights-gap-support-remains-people-low-incomes-after-liz-truss

- 35 TUC (2021) TUC poll: Two in five disabled workers pushed into hardship during pandemic at https://www.tuc.org.uk/news/tuc-poll-two-five-disabled-workers-pushed-hardship-during-pandemic

- 36 See TUC (2022) ‘A fairer energy system for families and the climate’ https://www.tuc.org.uk/research-analysis/reports/fairer-energy-system-families-and-climate

- 37 See TUC (2022) ‘A fairer energy system for families and the climate’ https://www.tuc.org.uk/research-analysis/reports/fairer-energy-system-families-and-climate

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox