Beyond furlough: why the UK needs a permanent short-time work scheme

The Coronavirus Job Retention Scheme (JRS), and accompanying Self Employment Income Support Scheme (SEISS), were introduced at speed in March 2020, following discussions with unions and business. While far from perfect, the schemes have been recognised as one of the successes of the government’s response to the pandemic, with the CJRS – or furlough scheme - supporting 11.6 million people and playing a clear role in limiting job losses.

This report makes the case that the UK should build on the success of these schemes, putting in place a permanent furlough scheme to deal with future periods of economic turbulence. The UK is rare in not having such a permanent scheme in place; twenty-three OECD countries had short-time working schemes in place before the pandemic.

Both the success of the furlough schemes in the UK and prior evidence from Europe, including in the financial crisis, shows that short-time working schemes can play a valuable role in protecting both workers and business. They save jobs, protect workers incomes, limit the impact of crises on inequalities, reduce recruitment and hiring costs for business, and help protect communities from the devastation of long-term unemployment.

And while we hope that the impact of the coronavirus pandemic is reducing, we know that the UK will face other periods of economic change in the future. The government has not ruled out future lockdowns to deal with new variants of the coronavirus. Climate change requires substantial changes in the way we do business, and technological change could also lead to significant economic disruption. Global financial instabilities could also lead to new recessions- even as the world seeks to recover from the pandemic. The aim of a new short-time work scheme is not to prevent change. Rather, it is to ensure that change happens in a way that protects workers, and avoids the company failures and redundancies that a temporary period of support could prevent.

A new scheme should build on the success of the furlough scheme in working with unions and business and be designed and governed by a tri-partite panel. It should draw on best practice from schemes around the world in ensuring that consultation with workers is a pre-condition for businesses wishing to access the new scheme; flexibility in how the scheme is used; protection for workers’ income, and that use of the scheme is a trigger for businesses to improve their working practices.

A new scheme must also put a significant emphasis in ensuring that furloughed workers receive access to training, as part of wider government efforts to invest in skills fit for a changing economy.

Furlough has been a lifeline for millions of working people during the pandemic. Now is the time for the government to build on the success of furlough with a short-time working scheme – not throw away its good work.

Download full report (pdf)

1. Introduction

The Coronavirus Job Retention Scheme (JRS), and accompanying Self Employment Income Support Scheme (SEISS), were introduced at speed in March 2020, following discussions with the TUC and our affiliate unions. The schemes, while far from perfect, have been widely judged to be one of the major successes of government policy during the pandemic, protecting millions of jobs and livelihoods.

At present, both schemes – popularly known as ‘furlough’ - are due to end at the end of September, with government judging that the lifting of corona-related restrictions means they will no longer be needed. But the UK is rare among developed nations in having no permanent short time working scheme to deal with periods of industrial disruption and weak demand. This report makes the case for a permanent short-time working scheme to be put in place as a post-pandemic legacy, helping the UK to protect working people through future periods of economic change.

The report:

- Sets out the evidence of the success of the furlough scheme in the UK, and shows the sectors currently using the scheme.

- Shows that similar schemes are normal in most developed countries, and have proved to be an effective and affordable way of preventing job losses in recessions.

- Gives examples of future challenges where working people, businesses and the economy could be better protected if a similar scheme was in place; and

- Sets out a proposal for a permanent short time working scheme.

2. The role of job retention schemes in protecting jobs throughout the pandemic

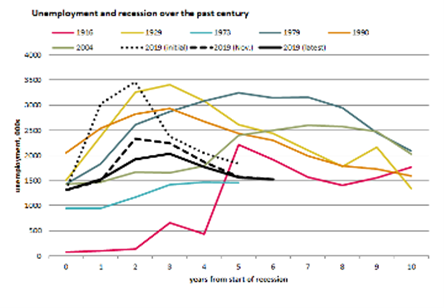

It is clear that the furlough scheme has played a major role in protecting jobs throughout the pandemic, with unemployment rising far more slowly than in previous recessions.

At the start of the pandemic the Office for Budget Responsibility (OBR) produced a ‘central scenario’ showing unemployment peaking at 3.4 million in 2021, higher than any other recession over the past century (see comparisons on chart below). By the end of last year, they had reduced the annual peak to 2.4 million. In their most recent forecast in March this year, the peak was further reduced to 2 million a year later in 2022 - equivalent to an unemployment rate of 5.9%.

The Bank of England have now gone further, and judge the biggest impact on unemployment to be in the past. Originally, in May 2020, they suggested unemployment could rise to 9 per cent in the second quarter of 2020.1

Unemployment and recession over the past century

- 1 Bank of England (May 2020) Monetary Policy Report May 2020 available at https://www.bankofengland.co.uk/-/media/boe/files/monetary-policy-report/2020/may/monetary-policy-report-may-2020 [/fn In their latest August 2021 forecast, the Bank reported that unemployment had peaked at 5.2 per cent in December 2020, and had now fallen to 4.8 per cent – still far too high, but significantly lower than first forecast.

Bank of England (August 2020) Monetary Policy Report August 2020 available at https://www.bankofengland.co.uk/-/media/boe/files/monetary-policy-report/2021/august/monetary-policy-report-august-2021.pdf?la=en&hash=BBCA21B8254B381928385A615F0DEC51E111FE43

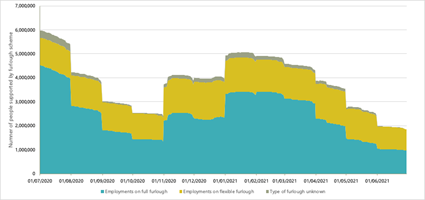

By July 2021 some 11.6 million people and 1.3 million employers had used the CJRS scheme, with around 8.8 million people being supported by the scheme at its peak in April 2020. 3

. By the end of June 2021, it’s estimated that around 1.9 million people were supported by the scheme, with 970,000 of these on partial furlough and working for some of the time.

Full and part time furlough use over time

- 3 HMRC Coronavirus Job Retention Scheme Statistics 29 July 2021, published 2nd August 2021 available at https://www.gov.uk/government/statistics/coronavirus-job-retention-scheme-statistics-29-july-2021/coronavirus-job-retention-scheme-statistics-29-july-2021

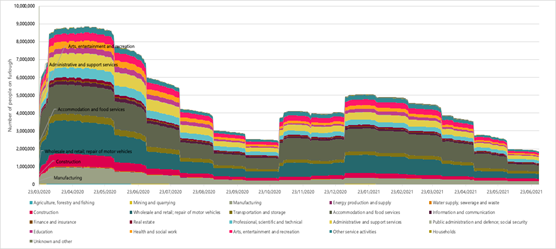

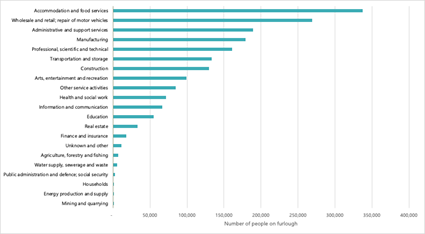

The chart below breaks furlough use down by sector. It shows that throughout, accommodation and food and wholesale and retail have been the largest users of the scheme, reflecting both the fact that they have been exposed to shutdowns, and their status as sectors employing large numbers of people. Manufacturing, administrative and support services, and arts entertainment and recreation have also used the scheme extensively.

Furlough use over time by sector

As of the end of June 2021, use of the scheme had fallen significantly, but there were still over 330,000 people on furlough in the accommodation and food sector, almost 270,000 people in wholesale and retail, around 190,000 in administrative and support services, almost 180,00 in manufacturing, just over 130,000 in transport and just under 130,000 in construction, and just under 100,000 in the arts entertainment and recreation sector.

People on the furlough scheme by sector at the end of June 2021

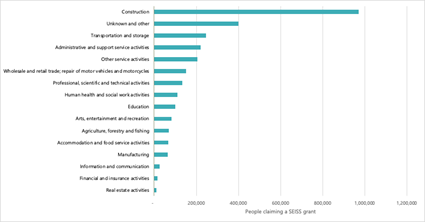

Statistics on use of the Self-Employed Income Support Scheme (SEISS) show that a total of just under 2.9 million people made a claim to the scheme. 4

Across the four grants, around one in three claims came from workers in the construction industry.

Use of the SEISS grant by sector up to 6th June 2021 (number of individuals claiming)

- 4 HMRC (12th July 2021) Self-Employment Income Support Scheme statistics: July 2021 available at https://www.gov.uk/government/statistics/self-employment-income-support-scheme-statistics-july-2021

It’s clear that the CJRS and SEISS schemes have represented a valuable investment in protecting jobs. As the next section sets out, the value of short-time work schemes was recognised by most developed countries long before the pandemic took hold.

3. The success of the UK furlough scheme reflects widespread evidence from long-standing schemes in other developed countries

The UK had to start its furlough scheme from scratch when the pandemic hit. But schemes supporting temporary lay-offs or short-time work are common in most developed economies. Twenty-three countries in the OECD had short-time working schemes in place before the coronavirus pandemic, including most famously Germany, but also Japan and many US states.

The OECD highlights the vital role that these schemes have played in limiting the fall-out of the pandemic: “J[ob]R[etention] schemes played a significant role in reducing labour costs and hence the number of jobs at risk of being terminated as a result of acute liquidity problems in firms. By preserving jobs, they helped to protect valuable firm-specific human capital that is contained in the job matches between employers and employees. By supporting the incomes of workers whose hours were temporarily reduced, they also prevented financial hardship and supported aggregate demand.”5

Their simulations, based on economic data from 14 countries, suggest that short-time work schemes could reduce the risk of job loss during the pandemic by ten percentage points. 6

There is also widespread evidence that countries that have short-time work schemes in place have been able to protect workers in other, less dramatic, periods of economic change, including the financial crisis. For example, a study looking at the use of short-time work schemes in Europe between 2010 and 2013 found that they were used by 7 per cent of firms in the region, and that “Workers in these firms, while facing a subsidised reduction in their hours, were far less likely to lose their jobs during the Great Recession.”

The researchers found that workers in sectors with a higher take up of short time work schemes were likely to be much better protected from the impact of a recession, with employment falling by just 0.12 per cent in response to a one per cent fall in output, compared to 0.4 per cent for workers in sectors with a low take up of the scheme. 7

The evidence also shows that these schemes are affordable, particularly compared to the cost of other responses to economic downturns. Research for the European Commission concluded that: “Expenditure for STW schemes has not been a significant financial burden in the past, except in crisis years in countries where short-time work is heavily used. Moreover, expenditure for these measures is not additional but an alternative to payments for unemployment benefits that would have otherwise been incurred.” 8

Expenditure on the furlough schemes during the coronavirus pandemic has been exceptional, with the majority of the economy impacted. By July 2021, around £67bn had been spent on the CJRS 9

and £25bn on the SEISS.10

This reflects the exceptional scale of the disruption caused by the pandemic, which evidence from across Europe shows has necessitated expenditure on short-time work schemes far beyond that in normal times.

Eurofound has shown that:

- In Germany, take up of the short time work scheme in May 2020 was around 30 per cent, compared to 3 per cent at the peak of the 2008-2010 financial crisis.

- In France, Austria and Italy, take-up at the peak of the economic crisis was around 1%, whereas in May 2020 take-up was 33%, 35% and 44%, respectively.

- Expenditure on these schemes across Europe between March and September 2020 was more than ten times higher than at the height of the financial crisis in 2009 – which reached just €12.3billion across Europe.11

The significantly higher costs involved in these schemes in 2020 reflect the exceptional nature of the coronavirus crisis which involved shutting down large parts of the economy, with impacts across sectors.

Moreover, the evidence is clear that short time work or furlough schemes have significant benefits for workers, firms and government. They

- reduce the risk of workers’ losing their jobs in times of crisis, acting as a form of collective insurance to protect both workers’ and employers’ investment in job specific skills.

- protect workers’ incomes – particularly as short-time work benefits are usually more generous than unemployment benefits.

Because short time work schemes, including the coronavirus job retention scheme are based on a proportion of workers’ normal income (up to a cap) they protect against the sudden income losses which are key trigger points for debt. The debt advice Charity StepChange reported in 2019 that seven in ten people who came to them for advice said that the main reason they had got into problem debt was because of a life event or shock – including unemployment or redundancy. 12

The income shock from unemployment reflects the UK’s particularly meagre system of unemployment support – set to fall to around 14 per cent of average wages if the government goes ahead with a £20 a week cut to Universal Credit at the end of September. 13 But the furlough scheme has shown that more generous payments to those temporarily away from work are possible – and this could be seen as one of many needed steps towards a more generous social security system.

- protect against long-term unemployment, and the devastating impacts on communities.

Long term unemployment has devastating impacts on individuals and communities. It leads to permanent labour market ‘scars’, including increased incidence of future unemployment, a greater likelihood of being in poorer quality work and lower subsequent earnings.[14 . Unemployment also has significant consequences for health and wellbeing, even when other factors are taken into account.15 .

Research by the Industrial Communities Alliance showed that these effects can be long-lasting, Before the pandemic, hourly earnings in older industrial towns and the former coalfields – areas previously devastated by badly managed industrial change - were on average eight per cent below the national average and only around three-quarters of the level in London. 12 .

The experience of being on furlough has for most people been a short-term one. The Resolution Foundation has shown that while 24 per cent of 18-64 year olds experienced a spell of being furloughed or unemployed for at least a month, only four per cent had been furloughed or unemployed for 12 months or more.13 . Due to the income protection within the furlough scheme, it is also likely to have less significant impacts on health and wellbeing than unemployment – and may, though we do not yet know, have less impact on long term job prospects.

- help prevent widening inequalities. Even with the furlough scheme in place, the coronavirus crisis has served to widen existing inequalities, with unemployment rising faster for BME groups than for white people, 14

. and evidence suggesting that insecure workers have been particularly likely to lose work. 15

. However given that job losses are likely to hit groups who already face structural discrimination in the labour market hardest, measures which protect against job losses – as short-time work schemes clearly do – could have a disproportionate benefit for these groups.

The fact that the CJRS was available to disabled workers who needed to shield and to parents whose children were undertaking remote learning after schools had closed is highly likely to have protected these workers’ jobs, as well as alleviating the considerable stress faced by these groups.

- save employers redundancy and hiring costs. By maintaining workers in jobs for which they have been recruited and trained, short-time work schemes can save employers significant redundancy and hiring costs.

CIPD estimated in 2020 that the average costs of redundancy in the private sector are around £10,600.16 . Oxford Economics looked in 2014 at the impact of losing key employees in five sectors - IT and tech, accounting, legal, media and advertising and retail, and found the financial impact on the business of losing an employee earning £25,000 was around £30,000 a year.16 . By maintaining workers’ attachment to their firms, short-time work schemes represent a significant saving for business.

- help stabilise the economy and encourage a faster economic bounce-back as workers continue to spend their wages.

By subsidising workers’ wages, short-time work schemes enable workers’ to keep spending, preventing shocks to the economy being multiplied through a sharp reduction in consumption and demand.

The OECD show that they have protected spending during the coronavirus crisis, finding that “by supporting household incomes and reducing income volatility, JR schemes are likely to have played an important role in supporting aggregate consumption and alleviating the risk of the supply shock transforming itself in a demand crisis.”18

And by making it easier for businesses and other organisations to survive a period of short-term difficulty, these schemes enable the wider economy to bounce back more quickly from the impact of an economic shock.

It’s clear that short-term work schemes have considerable benefits for workers, business, and society. The next section looks at the circumstances where they could be used in the future.

4. The UK economy is likely to face significant risks in the future where workers will need stronger job protection

There are some signs that the economy is recovering from the impact of the pandemic – though the jobs market is still fragile, with 900,000 fewer people in work than in January 2020.19

But the UK economy still faces significant threats, both from coronavirus and wider industrial change.

- The impact of the coronavirus pandemic is still significant for many industries, and there remains a risk that new variants could require further lockdowns

While the economy has opened up significantly over the past few months, many industries are still operating with significant restrictions. The New Economics Foundation estimated at the end of July that between 450,000 and 1.1m furloughed jobs could still need the furlough scheme at its current end date of September, and without an extension these workers could face redundancy or a reduction in hours and pay. 20

The UK’s travel booking are currently at only 16 per cent of their 2019 level at this time of year, but data from other countries suggests that the industry is sustainable with the right support: in Germany flight bookings have returned to 60 per cent of their 2019 level, and in France they have returned to 48 per cent. The impact of job losses in aviation following the end of the furlough scheme would be significant; one in four constituencies has over 1,000 people employed directly by aviation companies, and 60% have over 500.

And as we have seen in the pandemic before, new variants with greater transmissibility and unknown health effects can change the situation rapidly, and the government’s latest guidance (as of July 5th) is clear that lockdowns will remain an option for virus control – albeit as a last resort. 22 Previous attempts to wind down the furlough scheme have been met with handbrake turns as a change in the evidence required new lockdowns – in November, and once again in January. Late decisions to ensure support was in place for these periods are likely to have cost jobs. 23

Rather than scrapping the scheme entirely, the government should maintain the scheme architecture in place, with access for those industries still facing significant restrictions, and the ability to widen access in the face of new lockdowns.

- The transition to a net zero economy could involve reduced periods of demand for high carbon industries, who will need support to re-orient their business towards new forms of production

According to research from the University of Leeds, approximately 6.3 million jobs in the UK, about one in five, are likely to be affected either positively or negatively by the transition to a green economy.24

The TUC is calling on government to put in place a comprehensive Just Transition plan, to allow workers and businesses to plan for the future. 25

Access to a short-time working scheme to support businesses as they transition to new forms of production, and workers to have time to gain new skills, could be a vital tool for preventing unemployment during the transition. For example, in the construction sector, where gaps in skills and certification have impeded firms' ability to take on energy efficiency retrofit opportunities, such support could enable workers and employers to address urgent skills gaps, (we suggest below that a short-time work scheme must include better access to training than the current furlough scheme) and take on new types of work as a result. The German ‘Kurzarbeit’ scheme, perhaps the best known short-time working scheme, includes restructuring as one of the situations in which short-time working support can be paid.

Unions representing steel workers in the UK say that the availability of such schemes for European competitors, to help them cope with the cyclical nature of the business, is one of the reasons that the UK struggles to compete for investment – and we know that investment in low-carbon steel will be key to securing the transition to net zero.

Failed attempts to manage industrial change in the past left working-class communities abandoned, and have resulted in the widespread regional inequality we see today. A scheme that protects workers and jobs through periods of change should be one part of a strategy that can help prevent further levelling down.

- Technology driven industrial change may also mean that companies and workers need to access support

The OECD estimates 14 per cent of jobs face a high likelihood of automation and another 32 per cent are estimated to experience significant change over the next 10-20 years. 26

We have already seen the impacts of a significant change to business models in retail from in store to online on jobs in the sector. Access to a temporary short-time working scheme could also help businesses and workers to navigate change more successfully, providing a period of support to retrain which could support workers’ transition to another sector, as well as give a business time to restructure and adapt to new business models.

- There may be another recession at some point

Short-time work schemes have proved to be a valuable tool automatic stabiliser in recessions, ensuring that workers and firms are given time to recover from a temporary hit to demand, and protecting workers’ livelihoods and spending.

Even if the government is able to successfully steer the economy out of the pandemic, there are still long-standing risks to the global economy. Ahead of the pandemic there was growing recognition of the scale of global indebtedness, especially corporate debts – including those in emerging market economies. The 'Systemic Risk Council' (comprised of ex-central bankers and academics) warned: “Covid-19 strikes the world at a time when too many corporations around the world are overindebted, and after a period during which persistently favourable market conditions caused traders to take aggressive positions, exposing them and the system to spikes in volatility, let alone a collapse in asset values” 27 .

While a bold approach to building back better is the best preventative medicine, a furlough scheme could provide an additional and valuable new form of collective insurance policy.

As this section sets out, the UK is likely to face significant periods of economic disruption in the future, during which a short-time work scheme could help workers and business navigate change within a company, returning with new skills, rather than facing redundancy. There may also be some limited situations where a scheme could help a worker gain the skills to transition to a new and expanding sector while maintaining their connection to an existing place of work and avoiding periods of unemployment. The next section sets out considerations for the design of a new scheme to achieve these goals.

5. The UK should establish a permanent short-time working scheme as a post pandemic legacy

It’s time for the UK to catch up with other developed countries and put in place a permanent short-time work scheme. This section sets out design considerations for the scheme – with the idea that these would be consulted on widely.

The scheme should be governed by a tripartite panel bringing together unions, business and government, which should be tasked with designing the criteria for the new scheme.

The value of social partnership in designing the original furlough scheme has been widely recognised, with the Chancellor thanking both the TUC and CBI in his speech announcing the introduction of the scheme in March 2020. 28

This approach should be utilised in the design and governance of a more permanent scheme, with a panel bringing together unions, business and government set up to both finalise the scheme criteria and govern the scheme on an ongoing basis.

In designing the scheme, the panel should take into account best practice from European schemes, taking the following factors into consideration.

· There are various ways of demonstrating a reduction in demand, but the scheme should be clear that the reasons for this can include restructuring

Most European schemes require companies to demonstrate a temporary reduction in demand, with some schemes setting a numerical threshold. The table below, reproduced from Eurofound, summarises criteria across European schemes.

In order to demonstrate that reductions in demand are temporary, some schemes (in Austria, the Czech republic, Hungary, Latvia, Lithuania, Slovakia, Slovenia and Sweden) required employers to demonstrate that they were not in a situation of insolvency or bankruptcy or that they had met all their social insurance and tax obligations or both.29

One way of assessing viability could be to require employers to make a continuing contribution towards the cost of employment, but we recommend that this is capped at the level of national insurance and pension contributions to maximise the flexibility of the scheme.

The German Kurzarbeit scheme is clear that the reasons for a temporary reduction in demand can include restructuring, with a ‘transfer short-time work allowance’ available in the context of a restructuring process that entails a reduction of staff in order to avoid redundancies and to improve the employees’ placement prospects. A UK scheme should include this provision, which would be particularly useful for workers in companies restructuring in the context of climate or technological related developments.

Eligibility for short-time work and wage subsidy schemes in September 2020 – adapted from Eurofound

|

Eligibility criteria |

None stipulated |

10% |

20% |

25% |

30% |

Other |

|

Requirements regarding percentage reduction in turnover |

Austria, Bulgaria, Czech republic, Finland, France, Greece, Italy, Lithuania, Portugal, Romania, Slovenia, Spain, Sweden |

Belgium, Romania, Slovenia |

Croatia, Estonia, Latvia, Netherlands, Slovakia |

Cyprus, Ireland, Malta |

Latvia, Portugal |

Germany (at least 10 per cent reduction in working hours) Estonia (50% after 1st June) Hungary (75% reduction in working hours) Poland (15% over two months as a result of the pandemic, 25% month on month for any reason) |

|

Requirements regarding share of workforce affected |

Czech republic, Finland, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Malta, Poland, Romania, Slovakia, Slovenia, Spain, Sweden |

Croatia, Germany, Romania, Slovenia |

Belgium, Croatia |

|

Denmark, Estonia |

France (short time working must usually apply to the whole workforce, but during the pandemic it could apply to any part of the workforce) |

For further details see Table 11 in Eurofound (2021) Covid-19: implications for employment and working life available at https://www.eurofound.europa.eu/sites/default/files/ef_publication/field_ef_document/ef20050en.pdf

· Firms seeking to access a short-time working scheme should show that they have come to an agreement with their workers, either through a recognised union or through consultation mechanisms.

Most short time work schemes across Europe have a requirement to negotiate the scheme with employees, with, for example, firms in Germany required to show that they have agreed the use and duration of the scheme with Works Councils. Firms should be required to do the same thing in the UK – coming to agreement with a recognised trade union, or through formal collective consultation with their staff, using similar processes to those required when firms are making multiple redundancies. 30

This requirement provides a valuable safeguard against misuse of the scheme by employers. As use of the scheme will normally involve some loss of income by workers, they are unlikely to agree to it unless there is no other alternative.

· The scheme should ensure full flexibility in working hours

The flexibility embedded in the furlough scheme has enabled companies to bring workers back gradually, to adapt their working conditions, and enable work sharing. This flexibility should be embedded in the design of any new scheme, allowing workers to work any proportion of their normal working hours, including zero.

· Workers should continue to receive at least 80 per cent of their wages for any time on the scheme, with a guarantee that no-one will fall below the minimum wage for their normal working hours

Workers should continue to receive at least 80 per cent of their wages for hours during which they are accessing the scheme, with a cap on the maximum amount that can be paid to limit the support to high earners.

However, the flaw in the current scheme that allows workers to fall below the minimum wage for their normal working hours should be fixed, with all workers guaranteed that their wages will not fall below the minimum wage for the hours they normally work.

· Any worker working less than a specified proportion of their normal working hours must be offered funded training.

A missed opportunity within the current furlough scheme is that workers have not had the chance to use non-working time to improve their skills. A permanent scheme, particularly one designed to help deal with periods of industrial change, should invest significantly more in training.

Skills shortages have been identified as a major problem for UK businesses. In June 2021, KPMG suggested that reskilling furloughed workers should be a priority, arguing that: “We need action from businesses and government to reskill and upskill furloughed and prospective workers now more than ever, as the increasing skills gap in the workforce has the potential to slow the UK’s economic recovery” 31

. In 2020, the CBI suggested that nine in ten employees will need to reskill by 2030, at an additional cost of £13 billion a year. Skills in particular demand include basic digital skills (needed by 21 million people), critical thinking and information processing skills (16 million people), and leadership and management skills (14 million people).32

A revised furlough scheme cannot solve this problem alone, but it could play a significant role in helping address the skills gap.

One option would be for employers who have furloughed workers who are working less than a proportion of their normal working hours to be required to offer workers independent advice on the training and development that will futureproof their skills, and to help facilitate participation in identified training. We suggest that this criteria is drawn widely to enable as many workers to participate in training as possible.

In the Netherlands, since June 2020, employers applying for job retention support have to declare that they actively encourage training and the government has taken additional measures to make on‑line training and development courses freely available. In France and Germany, employers are offered additional financial incentives if they offer training to staff on short-time working schemes, 33

with in Germany, the government funding employers’ social insurance contributions provided that at least 150 hours of training is provided to the worker.34

A similar provision could be applied in the UK, with the government meeting the national insurance and pensions costs of firms that provide appropriate training to furloughed staff. The government has given a commitment to review the apprenticeship levy and this also offers an opportunity to examine the potential for unspent levy funds being utilised to give furloughed workers the opportunity to retrain through an apprenticeship programme.

The government is currently rolling out a number of new skills entitlements which could be flexed for workers on furlough. One of these is the Lifetime Skills Guarantee which offers free courses for adults without a level 3 qualification (equivalent to A levels) to achieve a qualification at this level. However, many furloughed workers will not be able to take up these courses because they already have a qualification at level 3. It makes no sense to bar people on this basis and the government should immediately widen this guarantee of free level 3 courses to all furloughed workers and other groups in desperate need of access to retraining. Many furloughed workers will have level 3 qualifications tied to industries where job opportunities may be falling. So it makes sense to support them to get qualifications for jobs in sectors that will expand, such as the green economy.

Access to other free retraining courses that will support progression and job prospects - such as level 2 qualifications and ICT/digital courses – should also be available at no cost for furloughed workers. And the government should consider how workers on furlough could be supported to take up higher level qualifications in sectors identified as expanding.

· There should be time limits on the use of the scheme, with extension possible in limited circumstances

While there is strong evidence that short-time work schemes protect jobs, some economists fear that if used over long periods, they might prop up unsustainable firms or stop workers moving to jobs with better prospects. There is little evidence that the UK furlough scheme has been used in this way; the rapid falls in the numbers of people accessing the scheme show that when businesses can open, workers have returned to work.

However, to encourage businesses to only use the scheme in exceptional circumstances, it might be sensible to place a time limit on any single use of the scheme. We suggest that this could be set at an initial six-month period with extension possible in exceptional circumstances – such as the covid crisis itself. This should allow firms facing a shortfall in demand, or needing a period to transition to new ways of doing business, to hold onto valuable staff.

· Firms accessing the scheme should be required to set out a plan for fair pay and decent jobs

Access to a short-time working scheme should be used as an opportunity for firms to get back on their feet – and to rethink how they operate. This should include a plan to offer fair pay and decent jobs to their staff – agreed with unions, and respecting the terms of any collective agreement already in place.

At a minimum, firms wishing to access the scheme could be asked to set out within three months a plan agreed with unions or staff to:

- Ensure that no staff within the company are paid less than the living wage

- Reduce pay ratios within the company to a maximum of 20:1

- Eliminate the use of zero hours and insecure contracts within their business; and

- Allow trade unions access to their workplace where there is no collective agreement in place.

These conditions should cover all workers directly or indirectly employed by the business, including any outsourced, agency, or contracted workers.

· Firms accessing the scheme should commit to paying their corporation tax in the UK, and not pay out dividends while using the scheme.

A short-time work scheme should be designed to protect jobs when businesses have no other option, not to protect company profits. Firms using the scheme should not pay dividends while doing so, and must pay their fair share when they can, by committing to pay their corporation tax in the UK.

· The scheme should be designed to promote equality, and monitored on its success in doing so

The ability to access the furlough scheme for working parents and workers who need to ‘shield’ from the coronavirus because of a pre-existing health condition has been an important step to considering how short-time work schemes can help prevent structural inequalities from widening during times of crisis. Government should ensure that, in line with their public sector equality duty, they take account of equality as an integral part of drawing up a future scheme. This is best done through an equality impact assessment. Regular monitoring should also be carried out on the outcomes of the scheme for different groups.

Selected features of some short time work schemes before the crisis

|

Country |

Main circumstances covered |

Eligibility conditions |

Duration of benefit/subsidy |

|

Austria |

Economic reasons due to decline in demand or disruption of deliveries, force majeure |

Employers who provide short-time working support or qualification support for employees during 10-90 per cent reduction in working time. Agreement with social partners on condition, duration |

Initially six months, can be extended by a further six months if eligibility conditions unchanged. Maximum duration 24 months. |

|

Germany |

Economic downturn, seasonal short-time work in construction, displaced workers in firms undergoing restructuring |

All employees covered by social security, with few exceptions Wage losses of at least 10 per cent affect at least one third of employees |

Business cycle scheme up to 12 months with possibility of extension to 24 months, transfer short-time work maximum 12 months, seasonal scheme only in winter. |

|

Denmark |

Reduced volume of work shared by the same number of employees |

All employees eligible for unemployment insurance. Options to reduce working time by days per week or alternating weeks of work. |

Maximum 13 weeks with possibility of extension up to 26 weeks. |

|

Netherlands |

Downturn |

Firms – temporary reduction in working time; employer expects at least 20 per cent less work for period of 2-24 weeks. Employees – loss of at least 5 weekly working hours, and must have worked at least 26 out of previous 36 weeks. |

Maximum 24 weeks after waiting period of two weeks. |

Source: adapted from Annex 2 in European Commission, European Network of Public Employment Services, (2020) Short time work schemes in the EU Study report European Commission – short time work schemes in the EU see https://ec.europa.eu/social/BlobServlet?docId=22758&langId=en

The furlough scheme has been vital throughout the pandemic. But rather than throwing away this good work, government should build on it, catching up with other developed countries to introduce a new permanent short-time working scheme.

This should sit alongside wider plans to deliver a better recovery, including

· Investment in job creation in the new green industries of the future, restoring public services and investing in social care.[1]

· A new deal for workers, with the upgrade in employment rights they deserve, including a ban on zero hours contracts, decent sick pay, a stronger safety net, and action on equality;[2] and

· A fair pay rise for all key workers, raising the minimum wage to £10 per hour and ending the public sector pay.

[1] See Geoff Tily (September 2020) A public sector jobs drive can stop mass unemployment and power an economic recovery at https://www.tuc.org.uk/blogs/public-sector-jobs-drive-can-stop-mass-unemployment-and-power-economic-recovery

[2] See TUC (2021) Jobs and recovery monitor: insecure work at https://www.tuc.org.uk/research-analysis/reports/jobs-and-recovery-monitor-insecure-work

6. Conclusion

The furlough scheme has been vital throughout the pandemic. But rather than throwing away this good work, government should build on it, catching up with other developed countries to introduce a new permanent short-time working scheme.

This should sit alongside wider plans to deliver a better recovery, including

- Investment in job creation in the new green industries of the future, restoring public services and investing in social care.35

- A new deal for workers, with the upgrade in employment rights they deserve, including a ban on zero hours contracts, decent sick pay, a stronger safety net, and action on equality;36 and

- A fair pay rise for all key workers, raising the minimum wage to £10 per hour and ending the public sector pay.

- 5 OECD (2020) Job retention schemes during the COVID-19 lockdown and beyond available at https://www.oecd.org/coronavirus/policy-responses/job-retention-schemes-during-the-covid-19-lockdown-and-beyond-0853ba1d/

- 6 The simulations are “based the results from a micro-simulation analysis conducted by the OECD to assess the potential effectiveness of STW and WS schemes on the number of jobs at risk of termination in liquidity constrained firms. The micro-simulations are based on stylised examples of STW and WS schemes, with the parameters of the schemes set so as to ensure fiscal neutrality. The simulations are based on comprehensive firm-level data (Orbis), covering approximately 1 million firms across 14 European countries with rich information on their financial situation at the onset of the COVID‑19 crisis. The assumed decline in sales for firms is identical to the economic shocks in the single-hit and double-hit scenarios that were used to develop the OECD projections of June 2020 – Box 2 in OECD (2020) Job retention schemes during the COVID-19 lockdown and beyond available at https://www.oecd.org/coronavirus/policy-responses/job-retention-schemes-during-the-covid-19-lockdown-and-beyond-0853ba1d/

- 7 See Reamonn Lydon, Thomas Y. Mathä, Stephen Millard (2019) The whys and wherefores of short-time work: Evidence from 20 countries at https://voxeu.org/article/whys-and-wherefores-short-time-work

- 8 European Commission, European Network of Public Employment Services, (2020) Short time work schemes in the EU Study report European Commission – short time work schemes in the EU see https://ec.europa.eu/social/BlobServlet?docId=22758&langId=en

- 9 HMRC Coronavirus Job Retention Scheme Statistics 29 July 2021, published 2nd August 2021 available at https://www.gov.uk/government/statistics/coronavirus-job-retention-scheme-statistics-29-july-2021/coronavirus-job-retention-scheme-statistics-29-july-2021

- 10 HMRC (12th July 2021) Self-Employment Income Support Scheme statistics: July 2021 available at https://www.gov.uk/government/statistics/self-employment-income-support-scheme-statistics-july-2021

- 11 Eurofound (2021) Covid-19: implications for employment and working life available at https://www.eurofound.europa.eu/sites/default/files/ef_publication/field_ef_document/ef20050en.pdf

- 12 a b The Debt Advice Charity StepChange reported in 2019 that seven in ten people who came to them for advice said that the main reason they had got into problem debt was because of a life event or shock – including unemployment or redundancy – see StepChange (2019) Life happens- understanding financial resilience in a world of uncertainty available at https://www.stepchange.org/Portals/0/assets/pdf/life-happens-safety-nets-stepchange-debt-charity.pdf

- 13 a b See TUC (2020) Fixing the safety net: Next steps in the economic response to coronavirus available at https://www.tuc.org.uk/research-analysis/reports/fixing-safety-net-next-steps-economic-response-coronavirus

- 14 a b Wiji Arulampalam, Paul Gregg, Mary Gregory (2008) ‘Unemployment scarring’ The Economic Journal Issue 475, November 2001, Pages F577–F584, https://doi.org/10.1111/1468-0297.00663

- 15 a b Michael Marmot, Jessica Allen, Peter Goldblatt, Eleanor Herd, Joana Morrison (2020). Build Back Fairer: The COVID-19 Marmot Review. The Pandemic, Socioeconomic and Health Inequalities in England available at https://www.instituteofhealthequity.org/resources-reports/build-back-fairer-the-covid-19-marmot-review/build-back-fairer-the-covid-19-marmot-review-full-report.pdf

- 16 a b CIPD (2020) Labour market outlook; views from employers, summer 2020 available at https://www.cipd.co.uk/Images/8040-lmo-summer-report-web-2_tcm18-82560.pdf

- 18 OECD (2020) Job retention schemes during the COVID-19 lockdown and beyond available at https://www.oecd.org/coronavirus/policy-responses/job-retention-schemes-during-the-covid-19-lockdown-and-beyond-0853ba1d/

- 19 See ONS (15 July 2021) A01: Summary of labour market statistics at https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/datasets/summaryoflabourmarketstatistics

- 20 Alex Chapman (2nd August 2021) Not out of the woods yet: why its too soon for the furlough end game at https://neweconomics.org/2021/08/still-too-soon-for-the-furlough-end-game /fn]

To take one example, the aviation sector still faces considerable challenges. The sector employs around one million workers directly, with the latest CJRS statistics showing that 58 per cent of the remaining employees in air transport companies are currently furloughed.

HMRC (2nd August 2021) Coronavirus Job Retention Scheme statistics: 29 July 2021 at https://www.gov.uk/government/statistics/coronavirus-job-retention-scheme-statistics-29-july-2021/coronavirus-job-retention-scheme-statistics-29-july-2021 - 22 The government’s Covid-19 Response; Summer 2021 states that “The Government will maintain contingency plans for reimposing economic and social restrictions at a local, regional or national level if evidence suggests they are necessary to suppress or manage a dangerous variant.” See https://www.gov.uk/government/publications/covid-19-response-summer-2021-roadmap/covid-19-response-summer-2021#enable-the-public-to-make-informed-decisions

- 23 TUC analysis suggests that the two peak months for unemployment increases happened around previously scheduled endings of the furlough scheme, see https://www.tuc.org.uk/blogs/time-certainty-worker-protection-unemployment-rises-fast

- 24 Nick Robins, Andy Gouldson, William Irwin and Andrew Sudmant (2019) Investing in a just transition in the UK at https://www.lse.ac.uk/granthaminstitute/wp-content/uploads/2019/02/Investing-in-a-just-transition-in-the-UK_Full-policy-report_40pp-2.pdf

- 25 See, for example, Mika Minio Paulello (14 July 2021) ‘A greener economy can be positive for workers too’ at https://www.tuc.org.uk/blogs/greener-economy-can-be-positive-workers-too

- 26 OECD (2018) Putting faces to the jobs at risk of automation at https://www.oecd.org/employment/Automation-policy-brief-2018.pdf

- 27 See Systemic Risk Council (March 2020) SRC Statement on Financial System Actions for Covid-19 at https://www.systemicriskcouncil.org/2020/03/src-statement-on-financial-system-actions-for-covid-19/

- 28 HM Treasury and the Rt Hon Rishi Sunak MP The Chancellor Rishi Sunak provides an updated statement on coronavirus

- 29 Eurofound (2021) Covid-19: implications for employment and working life available at https://www.eurofound.europa.eu/sites/default/files/ef_publication/field_ef_document/ef20050en.pdf

- 30 The ACAS guidance here sets out the process for holding collective consultation, including the election of employee representatives https://www.acas.org.uk/collective-consultation-redundancy/how-to-hold-…

- 31 KPMG and REC (8 July 2021) Report on jobs available at https://home.kpmg/uk/en/home/media/press-releases/2021/07/kpmg-and-rec-uk-report-on-jobs.html?utm_source=Economic+Change+Unit&utm_campaign=0d539c431f-Biden_COPY_02&utm_medium=email&utm_term=0_6101fe9ecd-0d539c431f-180116993&mc_cid=0d539c431f&mc_eid=6668204961

- 32 CBI (2020) ‘A radical strategy for lifetime reskilling must be the bedrock of UK economic recovery’ https://www.cbi.org.uk/media-centre/articles/a-radical-new-strategy-for…

- 33 OECD (2020) Job retention schemes during the COVID-19 lockdown and beyond available at https://www.oecd.org/coronavirus/policy-responses/job-retention-schemes-during-the-covid-19-lockdown-and-beyond-0853ba1d/

- 34 Eurofound (2021) Covid-19: implications for employment and working life available at https://www.eurofound.europa.eu/sites/default/files/ef_publication/field_ef_document/ef20050en.pdf

- 35 See Geoff Tily (September 2020) A public sector jobs drive can stop mass unemployment and power an economic recovery at https://www.tuc.org.uk/blogs/public-sector-jobs-drive-can-stop-mass-unemployment-and-power-economic-recovery

- 36 See TUC (2021) Jobs and recovery monitor: insecure work at https://www.tuc.org.uk/research-analysis/reports/jobs-and-recovery-monitor-insecure-work

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox