Working people take the hit for Tory economic failure

In his Autumn Statement today, Jeremy Hunt, the fourth Conservative Chancellor this year, announced that the UK economy is in recession. The documents that accompanied his statement warned of half a million job losses. Staggeringly workers face in 2022 and 2023 the worse years of a pay crisis that is now reckoned to be lasting basically for two decades.

Rightly protections were announced against further energy price rises, and social security protection was uprated in line with inflation. The government took the advice of the low pay commission to increase the minimum wage to £10.42 an hour.

But this support is paid for by steep cuts to departmental budgets from 2024-25 onwards. And immediately there was no extra money to support public servants in the face of double-digit inflation.

As Frances O’Grady said,

“This is a recession made in 10 Downing Street, which will put jobs at risk and hit workers’ wages. We are all paying the price for the last decade of Tory governments, which decimated growth and living standards. Today’s statement shows it will be two decades until real wages recover. Millions of key workers across the public sector – who got us through the pandemic – face years of pay misery as departmental budgets are brutally squeezed."

Real pay and jobs

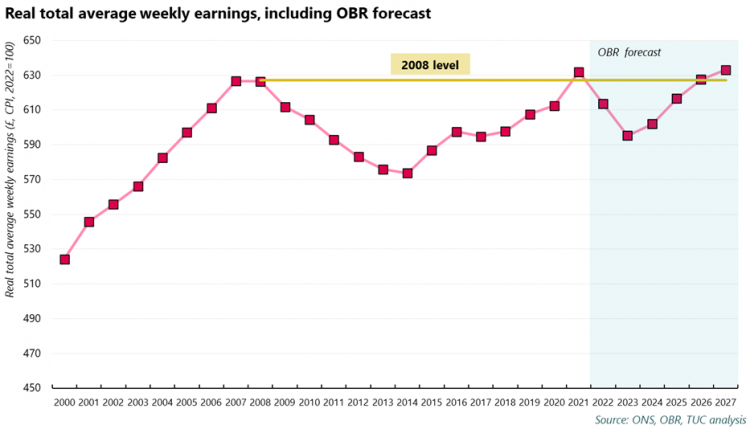

The OBR forecast expects that the real pay squeeze that’s already in its fourteenth year is set to last another five. Real average weekly earnings aren’t expected to go back above 2008 levels until 2027 – a 19-year pay squeeze that’s hit workers hard and is longer than any other since the Napoleonic times. The statement itself did little to help. The minimum wage has increased, but by less than inflation and still below the level of a real living wage. There was nothing to suggest public sector workers will get pay rises to help face the rising cost of living, after a decade in which their pay has been squeezed time and time again.

In terms of the labour market, the OBR has forecast a sustained fall in employment, still flatlining economic participation, and a rise in unemployment, which is not expected to return to the pre-crisis level until beyond the end of the forecast period in 2027. In terms of headcount the rise in unemployment is half a million – though the Bank of England is forecasting that it will rise by double this.

Policies to support working people and households

Ahead of the disastrous mini budget we called for protection against rising bills, with any costs shared fairly. And we called for a plan to grow the economy. The most prominent feature of the Chancellor’s plan was also the most worrying – to celebrate Nigel Lawson’s big bang that scrapped regulation on the city and set the trajectory to the global financial crisis.

Protection against inflation

A universal protection against rising energy bills was replaced with a more targeted approach, with bills now allowed to rise to an average of £3,000 p.a. (up from £2,500), but extra support for those on means tested benefits, pensioners, and disabled people. But energy are not the only bills that are soaring – CPI inflation is now at a forty year high of 11.1 per cent. Food inflation is at a record level, fuel prices are very high and prices are up across the board. The ONS reported this week that inflation rates hitting the lowest earners are three percentage points higher than those for the highest earners.

Benefits

Chancellor said, ‘I am proud to live in a country with one of the most comprehensive safety nets anywhere in the world.’ This comment is beyond belief, as since 2010 this Government have implemented cuts which have decimated the social security system.

The benefit uprating by the Chancellor today has been the bare minimum. The standard out of work benefit is now worth just 13% of average weekly earnings. And the basic amount of universal credit will be worth £43 a month less than in 2010 even after this uprating is in place.

The state pension has fared better than working age benefits thanks to the triple lock, but ours remains one of the least generous in Europe. So the decision to return to the triple lock formula and increase pensions by CPI inflation after this year’s real terms cut, and to increase pension credit in line with prices too, was the bare minimum.

The autumn statement also contained a strong hint that the government was preparing to axe its formula linking state pension age rises to improvements in life expectancy and bring forward its planned increase. The savings to government – and cost to the public people – of this move would dwarf the impact of pension increases resulting from the triple lock in any given year.

The minimum wage will be raised to £10.42 in 2022/23. Significant increases are needed especially after real terms declines over the last couple of years. But the announced increase will still leave the real value of the minimum wage 1.1 per cent below where it was two years before. The government must, instead, put the minimum wage on a growth path to £15 as soon as possible.

Infrastructure investment

The Chancellor warned that capital investment was too soft a soft target for austerity (like under George Osborne), then proceeded to cut planned spending by £5bn in 25-26, £9bn in 26-27 and £15bn in 27-28.

This will have major impacts on delivering the infrastructure needed to keep people moving, the UK economy competitive, and to hit climate targets.

Taxing wealth and windfalls

The Chancellor was duty bound to hit the better off. But these were not big changes in the great scheme of things. The biggest hits came on the energy profits levy and the electricity generator levy, raising £14bn in 23-24 and £11bn in 24-25. The wider hit from the 20% income tax thresholds will earn the Treasury a cool £6bn a year, compared to less than £1bn raised from lowering the threshold for paying the top rate of tax. All these changes are however dwarfed by the reversal of Rishi Sunak’s health and social care levy which costs £16-£17bn a year.

And then - staggeringly- news quickly leaked out that the surcharge on bank profits (i.e. the extra they pay in corporation tax) was being reduced from 8 to 3 per cent.

More pay misery for millions of public sector workers and the services they deliver

A strong economy relies on strong public services. Welcome words from the Chancellor as he set out his fiscal statement. Yet, warm words failed to match spending plans.

The Chancellor confirmed government would stick to cash spending plans set out in the Comprehensive Spending Review 2021. Meaning departmental budgets would not be adjusted to account for soaring inflation, placing unsustainable pressure on public services and creating more years of pay misery for the millions of key workers across the public sector who got us through the pandemic.

Analysis carried out by NEF for the TUC ahead of the budget showed, departmental budgets needed an additional £43 billion just to remain at the level set out in the Comprehensive Spending Review 2021 and keep public sector pay in line with the cost-of-living. This did not materialise.

Some relief was provided for key government departments such as the NHS, social care and schools. Nothing for public sector pay rises or cash starved areas like the court system, prisons, HMRC and local government.

Schools will receive an additional £2.3 billion in funding for 2023-24 and 2024-25, representing an overall spending increase of 4 per cent, returning per pupil spending to 2010 levels. But no additional funding was provided for adult education, where spending fell by 49 per cent between 2009 and 2019 - surprising given the Chancellor’s emphasis on the importance of skills to economic stability and growth. Nor for the cash-strapped early years sector, where the number of providers fell by 4,000 between 1 April 2021 and 31 March 2022, in large part due to a toxic combination of unsustainable funding levels and soaring costs for essential expenditure such as energy and food.

Health and social care will receive additional funding of around £7.5 billion. An estimated £1.6 billion of the money identified for social care requires local authorities generating additional revenue through rises to council tax. At a time when millions of households are struggling with the cost-of-living, it is hard to see how councils will do this without putting even more financial strain on families. Councils in areas of high socio-economic deprivation, often the most cash strapped when it comes to social care, will have the hardest time raising additional revenue.

The additional £3.3 billion for the NHS represents around 2% of it’s overall budget. A drop in the ocean. Only a fraction of what our NHS and its workforce needs this winter. With NHS vacancies at a record-high, one in ten posts unfilled, what the health system desperately needed was investment in its workforce.

Indeed, across the public sector, what was needed and missing from today’s fiscal statement was a recognition that after twelve years of government imposed pay restraint and real terms pay cuts, our public sector workforce are on their knees. To deliver world class, high-quality public services, we need to treat the people that deliver them, with respect and dignity. That starts with spending plans that deliver cost-of-living proof pay rises in 2022 and beyond.

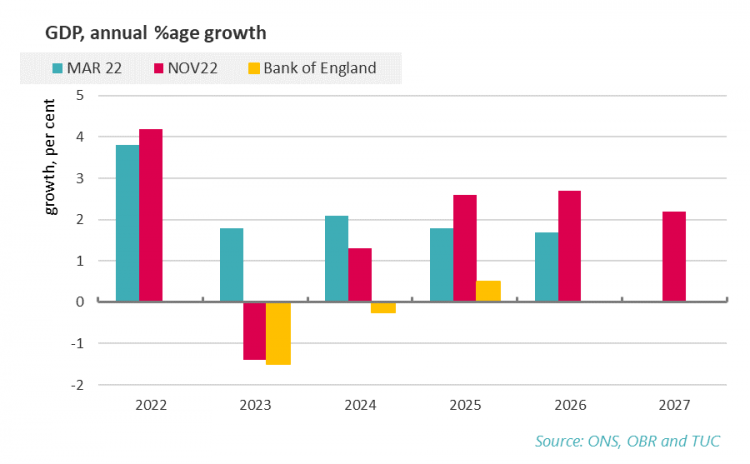

Public spending, GDP and the government finances

In spite of all this pain, the biggest risk is still the economy. Here the OBR have let the government off lightly. While the recession means a decline in GDP next year of 1.4 per cent, activity recovers quickly into 2024 and then continues at rates that would be exceptional given the experience since 2008. The OBR maintain they are closer to the wider consensus, with the Bank of England the outlier.

This vigour comes in spite of much higher than anticipated central bank interest rates, virtually unchanged government support on the immediate horizon, and heavy austerity into the future (the OBR argues this is not as severe as under George Osborne).

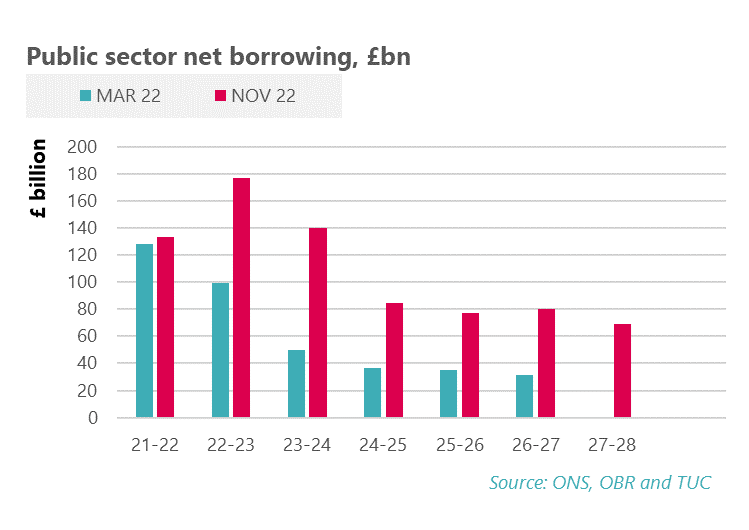

In a way we are lucky. Better projected GDP outcomes protect against the need for even tougher austerity, given the vogue for fiscal rules. Nonetheless the government have also accepted a fairly substantial increase in borrowing over coming years, with public sector debt is expected to peak at 97.6 per cent of GDP in 2025-26.

There are no game changers here, and there is very little protection against a steeper deterioration. In the meantime workers face yet another severe reduction in the standard of life. But sadly nothing here is new. Until we have a government that has a serious plan to put work before wealth, we look set to remain trapped in the doom loop of austerity politics.

We know that today’s choices weren’t inevitable. There is a better plan to grow the economy, protect our public services, and get wages rising. Now we need a government prepared to deliver it.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox