Labour internationalism begins at home

As part of our discussions on labour internationalism, Matthew Klein will be outlining his (2020) book written with Michael Pettis 'Trade Wars are Class Wars'. The work points to an alternative economics, one that is rooted not only in past thinking but also past actions of the left.

This economics operates across three fundamental domains.

- power relations between wealth and labour

- a theory of the economic cycle as resulting from glut not scarcity

- and the interplay between domestic and international economies

We are led to conclusions wholly at odds with orthodoxy, offering opportunity but also danger.

Given disaster has been caused by operating the system wrongly, error can be corrected.

But without correction, past errors will be exacerbated and outcomes go from bad to worst.

In the context of our discussion on labour internationalism, this danger is exemplified by the politics that takes us from the failure of globalisation to nationalism. The opportunity follows from a better understanding power relations, and seeing the problem not as internationalism but as internationalism on the terms of capital.

We need instead an internationalism done on the terms of labour.

The commentary below includes brief remarks on each of the identified fundamental domains.

Similar thinking influenced the recovery from the great depression and for three decades after the Second World War.

In the final section, historic outcomes across the G7 are compared to show internationalism done on the terms of labour is greatly preferable to the present model.

1. Class interests

Matthew and Michael bring class interests back into play as a “conflict mainly between bankers and owners of financial wealth on one side and ordinary households on the other – between the very rich and everyone else” (p. 221).

In political economy terms: between finance capital and labour. In enduring popular language: between the few and the many.

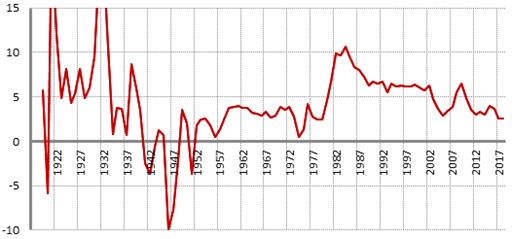

My sense is that this conflict is fundamental to the dynamics of a monetary economy. And this dynamic can be captured empirically. The return to wealth is estimated by the rate of interest. This goes beyond Bank rate or the rate on government bonds, and is proxied here by the inflation-adjusted rate of interest on long-term corporate borrowing in the US.

US real interest rate

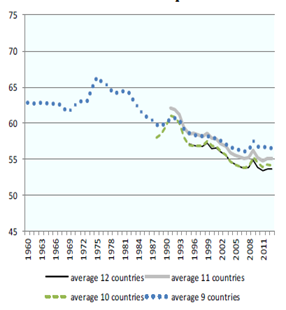

The labour share then indicates the return to labour (note the timespans differ).

G20 Labour share from 1960

For both we see abrupt shifts in power relations.

Most obviously the balance was towards labour between the 1930s and 1970s, and it was towards wealth ahead of and after this episode.

There is then a choice of economics to explain these shifts.

According to the orthodox view these returns are preordained according to economic conditions. We hear this today: central bankers repeatedly insist alleged low interest rates are a consequence of a dismal outlook for growth.

The rival view is that these returns simply result from power relations.

From the 1980s the ‘Volker shock’ to global interest rates and so called financial liberalisation marked the restoration of power relations that existed before the great depression. And in parallel wages were attacked, in the UK most potently over the miners’ strike. But a deregulation agenda emerged from international institutions for example the OECD jobs study and EU Lisbon agenda.

And this is still the world we live in. For the many, austerity policies enforced increased competitiveness and cut public sector jobs and salaries, while the few were rewarded by immense subsidies not least QE.

2. The cycle as a glut (‘excessively abundant supply’) of production not scarcity

On this rival view, economic outcomes are also determined by power relations.

And this is where Matthew’s theory of the cycle comes in. The fundamental point is that aiming the system at few is not only unfair it is also profoundly dysfunctional.

The factor of greatest importance is the relation between production and purchasing power. With the balance towards the few, production becomes excessive relative to deficient purchasing power.

On one hand low wages put production out of reach of workers. On the other hand excess wealth is constantly seeking new outlets for capital gain, fostering excesses in property, production in cutting edge technologies, and in ripe-for-exploiting overseas economies. Today, think high end residential property, the FAANG – Facebook, Amazon, Apple, Netflix and Google (now Alphabet) – companies, and the notions (courtesy of Baron O’Neill, then of Goldman Sachs) of BRIC – Brazil, Russia, India and China – and MINT – Malaysia, Indonesia, Nigeria and Turkey – economies.

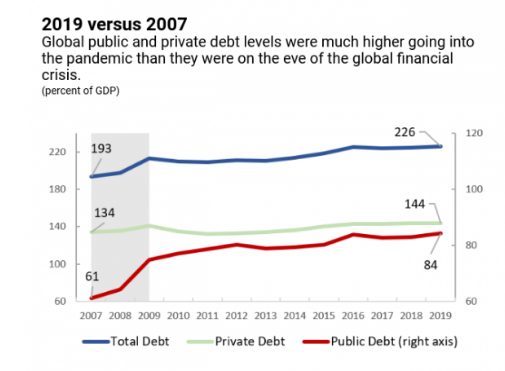

Private debt is inherent to the process across all economies, as firms are unable to meet desired sales and households unable to afford a basic standard of living.

Eventually the system caves in. This was first localised, e.g. toward the end of the last century in Japan, Scandinavia and SE Asia. It culminated in the global financial crisis of 2007-09.

It is vital to recognise that this diagnosis is the reverse of orthodox analysis.

Under convention we are blamed for living beyond our means. We want to consume in excess of our ability to produce - we are both greedy and inept.

This is further reinforced by the productivity narrative. But while higher productivity is obviously needed, it cannot be a solution to overproduction.

And on this view austerity is obviously wrong. Overproduction cannot be resolved by further reducing incomes (as we have spent the last decade discovering). So debt remains unresolved – far from it – as this recent IMF analysis vividly illustrates.

And with debt unresolved, the global crisis remains unresolved.

3. Relation between domestic and international economies

Not for the first time, the backlash is nationalism. We see this in the Brexit process, and in trade wars against China.

This follows a profoundly wrong reading of global economic relations.

The problem is not with internationalism, it is with orienting the international system to the interests of wealth.

Labour is internationalist because it has understood for 200 years that capitalism exerts economic power by setting workers in each country against each other.

And this has been obvious to progressive economists all along.

Klein and Pettis acknowledge the British Liberal economist John Hobson (1858-1940), as also did Keynes. But we can go back as far as the 1820s to find Jean Charles Léonard de Sismondi (1773-1842) rejecting Ricardian economics as protecting the interests of wealth, and offering an early theory of gluts.

Inevitably this thinking has been persuasive to the trade union movement.

From the 1930s various factors came together to mean real change.

After the First World War the interest of the few was imposed in an extreme and high-handed way. But when the system imploded, socialist and progressive forces had finally made up the necessary political ground to be able to offer a lead.

They offered an internationalism on the terms of labour. Fundamentally, and perhaps paradoxically, this meant reorienting the economy to internal rather than external factors, to domestic demand rather than overseas trade.

The change was captured most neatly by future UK Labour Party leader Hugh Gaitskell:

It is recognised at last that the expansion of international trade depends on the maintenance of Full Employment – and not the other way round

The same thinking was shared by progressive forces globally, most importantly by President Franklin Delano Roosevelt in the US and Prime Minister Léon Blum in France. These changes endured after the Second World War, albeit in greatly compromised form.

Private investment was strengthened by the consequent lower interest rates (above). Consumption was strengthened by greater labour protection at home and reduced competition overseas. On top of this was increased government spending and social protection.

Domestic initiative was facilitated by changed global arrangements: by a monetary architecture to support production not speculation, and by rules that supported labour.

Results

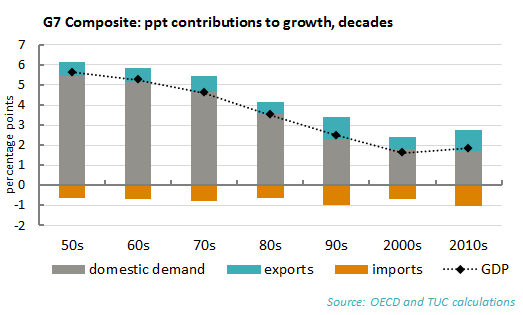

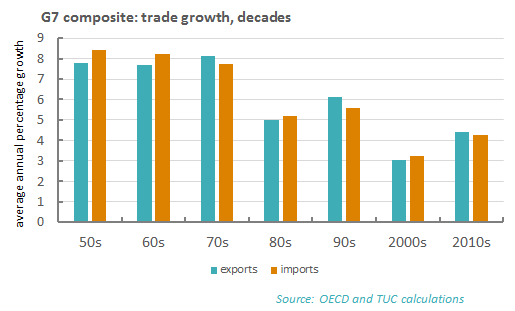

Analysis of post-war outcomes for G7 countries vindicates labour internationalism.

The chart below is a composite measure of annual average GDP growth by decade, showing the contribution of domestic demand in grey and exports in blue and imports in orange

Plainly overall growth was higher when the economy was oriented towards domestic demand; conversely from the 1980s with the domestic orientation undone, growth has been greatly weaker.

Furthermore just as Gaitskell predicted, trade growth was also stronger under the domestic orientation. On the composite measure, export growth over the 1950s-1970s averaged 7.8% a year. This was nearly twice as fast as the 4.6% annual growth over the 1980s-2010s. The domestic orientation was a greater internationalism.

I want to conclude with two points.

First, the post war arrangement was profoundly compromised, and far from that sought by Roosevelt, Blum and Keynes. Above all the compromise preserved the hierarchy between North and South, between the G7 and the rest of the world.

Second, I may here be justifying labour internationalism on the basis of growth, but growth is not inherent to labour internationalism. Chasing growth or ‘growthmanship’ was a feature of the compromise; labour and trade unions sought full employment.

The fundamental conclusion is that under labour internationalism there are no economic constraints to prevent us from shaping the world in the way that we want. The Attlee government chose to build social infrastructure; today’s priorities would obviously put climate change in front place.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox