GDP recovery takes a set back

Eat out to Help out in August has exaggerated growth into August, with recovery in several industries stalling or taking a set-back.

Headline GDP

Monthly GDP grew 2.1 per cent into August. This is the fourth consecutive month of growth since the low point in April, at the height of lockdown measures.

But GDP is still 9.2 per cent lower than pre-pandemic February levels and is showing signs of a slowing recovery - growth is much weaker in comparison to the growth in June (9.1 per cent) and July (6.4 per cent).

The picture by industry is very mixed

Headline figures disguise a very mixed picture by industry.

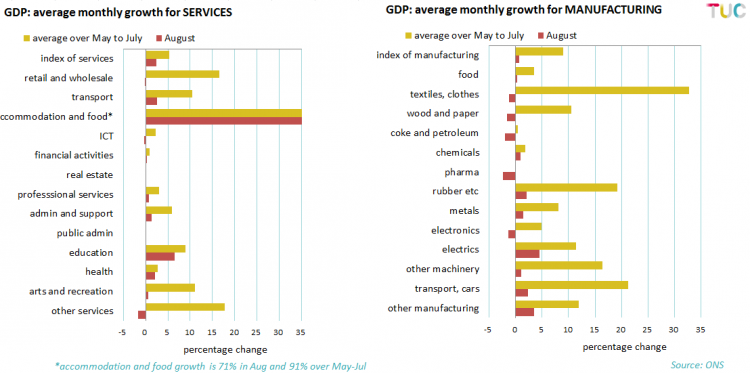

The two ONS charts below illustrate the differences within the services (left) and manufacturing (right) industries and while the labels are not shown, the broad picture is clear.

After some rebound between May and July - as restrictions began to ease and more industries were able to open up - August has seen the pace come to a near standstill for most industries and even decline for others.

Many remain well below February levels.

The charts below look more closely at monthly growth rates into August (red), compared with the average over May to July (yellow):

The index of services, which grew 2.4 per cent into August, was down 5.3% on average across May-July.

But the August growth was largely driven by accommodation and food, which saw growth of 71 per cent, propelled by the ‘Eat out to Help out’ scheme.

Education and transport also saw some growth of 6 per cent and 2.5 per cent respectively, but most other services industries saw little to no growth, with ICT and other services showing a decline.

Service output as a whole is still 9.6 per cent below February levels.

In manufacturing, the headline growth figure was much more sluggish at 0.7 per cent (and 8.5 per cent below February levels), but we again see a mixed bag when we look at performance by type of manufacture.

Six sub-sectors saw stronger growth than the manufacturing average, most notably manufacture of electrics (4.6 per cent) and other manufacturing (3.5 per cent). But five sub sectors saw declines (pharmaceuticals, textiles and clothing, wood and paper, coke and petroleum and electronics).

Across all manufacturing and service industries, growth was significantly slower in August than in the previous three months.

We need a national recovery council

With so much uncertainty ahead, it is vital that there is a full national recovery plan.

We need support for the hardest hit sectors through the winter months and investment in both a green recovery and the public sector to create decent, secure work.

TUC research has found that over a million jobs can be created in the next two years by fast-tracking investment in green transport and infrastructure.

Investment in a public sector jobs drive could also create 600,000 jobs across health, adult social care, education, local government, public administration and the civil service.

The government must convene a national recovery council bringing unions, business and government together to create a plan to build a stronger, greener economy.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox