Protecting jobs and investing in our future - the best way to give people hope

The UK officially entered recession last week, with a record fall in GDP (Gross Domestic Product – a measure of economic activity) of 20 per cent – the steepest decline on record. The number of employees registered on business payrolls has also fallen by 730,000 since the crisis began.

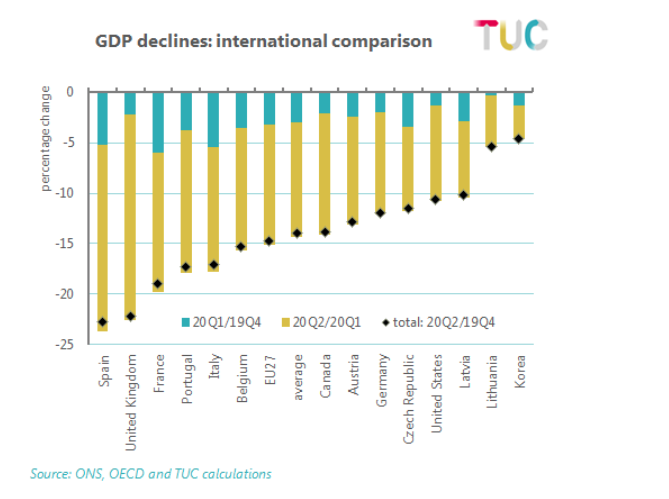

Right now the UK is on course for a deep recession, possibly one of the worst among international counterparts, with the UK’s GDP decline double that of the United States.

GDP International comparisons

The chancellor, commenting on the figures, said more people will lose their jobs and hard times and tough decisions are ahead. But if the government acts now and makes the right choices, our economy can recover from this crisis more quickly. The cost of not doing enough now will be far greater in the long run than the cost of doing everything we can to kick start our economy with investment and protecting jobs and incomes.

The furlough scheme needs to be extended

With daily job loss announcements hitting the headlines right across the economy from high street familiars like Debenhams and Pizza Express to institutions like British Airways and the National Trust, this is a worrying time for workers and their families.

Right now, many will be supported by the Job Retention Scheme, but with the scheme due to end at the end of October, many more businesses and their staff face a cliff edge. At its peak, the job retention scheme was helping to protect the incomes of over 9 million employees.

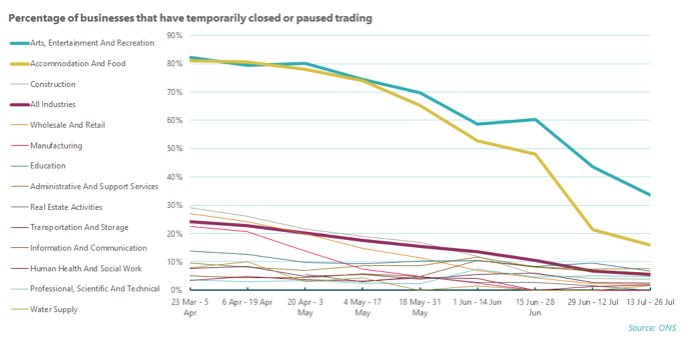

At the height of lockdown, around a quarter of businesses (24 per cent) across all industries temporarily closed or paused trading. The latest figures, covering the two-week period up to 26 July, show that this has now dropped to 6 per cent.

Two industries (accommodation and food, and arts, entertainment and recreation) have consistently had a much higher proportion of businesses pausing trading or temporarily closing. While the easing of lockdown has seen more businesses open up, a significant proportion in these industries remain closed.

This is especially true in the arts, entertainment and recreation sector, where a third of businesses (34 per cent) remain temporarily closed. This reflects the type of activities that have been allowed to reopen as lockdown has been eased. While pubs and restaurants have been given the go ahead, many theatres and other venues are unable to reopen.

Changes to trading status during the pandemic by industry

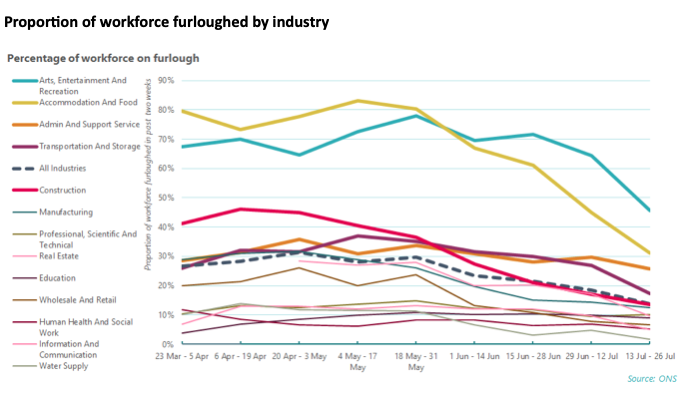

The accommodation and food and arts and entertainment industries have also had the highest proportion of the workforce on furlough during the pandemic.

In the latest figures, around half of the arts and entertainment workforce remain furloughed, while the rate has dropped to around 3-in-10 in accommodation and food. The rate across all industries was at 31 per cent at its peak in late April, but dropped to 14 per cent in late July.

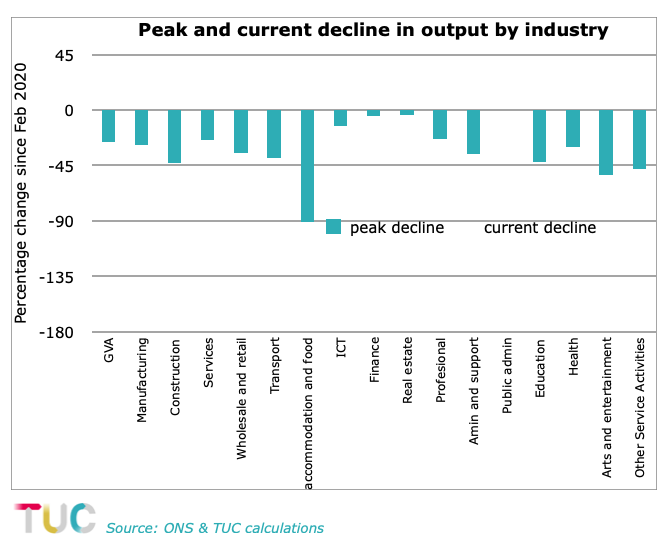

The necessary measures to protect public health have hit many industries hard and lots of businesses do not know when they will be able to operate at a normal capacity again. But this week’s figures show accommodation and food and the arts and entertainment have suffered some of the steepest declines in output during this crisis and are struggling to ‘bounce back’.

Output declines by industry

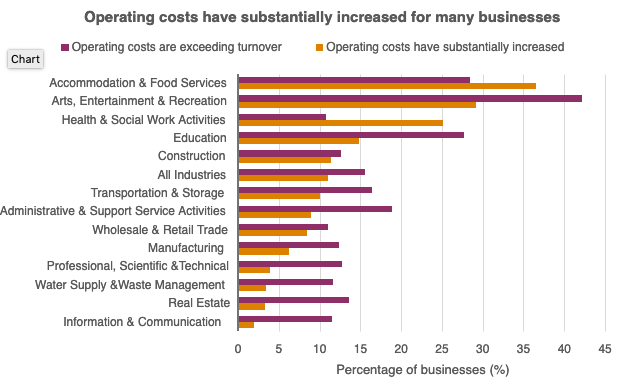

Just over 1 in 10 businesses are experiencing a substantial increase in their operating costs in July and in many cases operating costs are often exceeding turnover.

Operating costs are exceeding turnover for many businesses

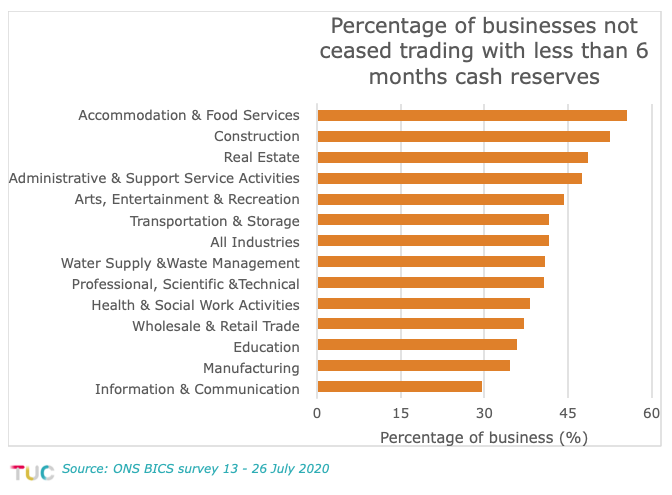

Across all industries, just over 40 per cent of businesses have less than six months cash reserves, with over 50 per cent of construction and accommodation and food businesses having less than six months cash reserves.

Businesses with less than 6 months cash reserves by industry

It is clear that many businesses are doing everything they can to keep afloat during these difficult times and are taking steps to protect public health. The government must help support viable businesses by extending furlough where it is needed to ensure that hundreds of businesses don’t go under, leaving millions of employees facing redundancy through no fault of their own.

Household finances have taken a hit.

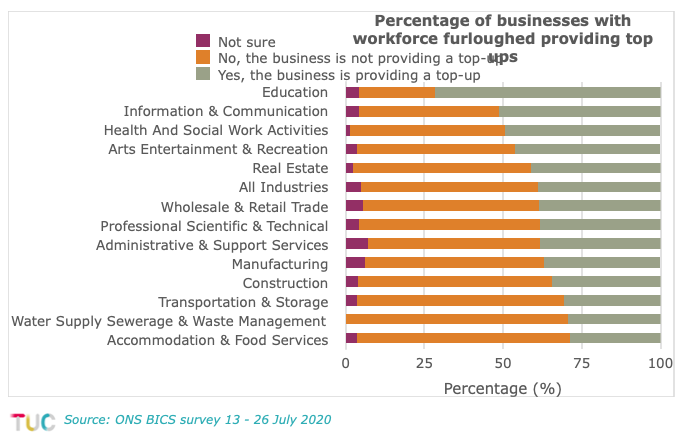

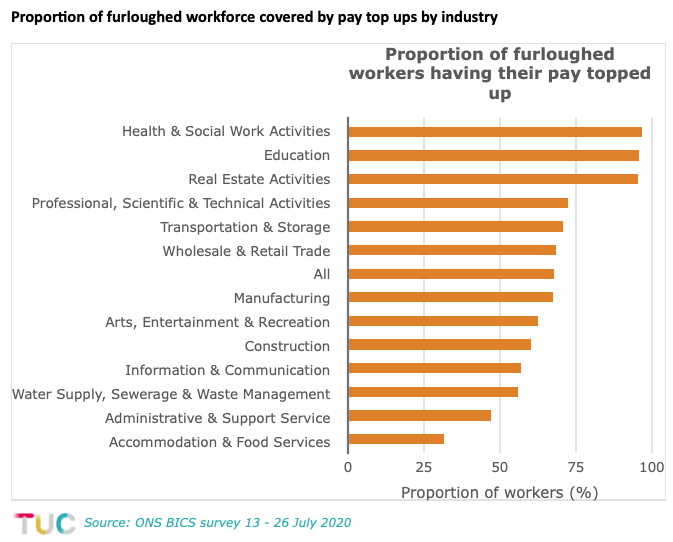

The job retention scheme has protected millions of household incomes and it is difficult to imagine where we would be without it. Nearly 2 in 5 businesses who are using the CJRS are providing top ups to employees’ pay, covering around 68 per cent of the furloughed workforce, meaning nearly a third of the workforce are only receiving 80 per cent of their usual salary.

However, this varies by industry, and in hard hit industries, the proportion of the furloughed workforce having their pay topped up is much lower. In accommodation and food, less than a third of the furloughed workforce are having their pay topped up by their employer.

Proportion of businesses topping up pay by industry

According to the Coronavirus and impacts on Great Britain survey released by the ONS, around a fifth of people report their finances being affected by the crisis. In the latest survey 16 percent said they have found it difficult or very difficult to pay bills since the crisis began, this has increased from just over 1 in 10 at the end of June.

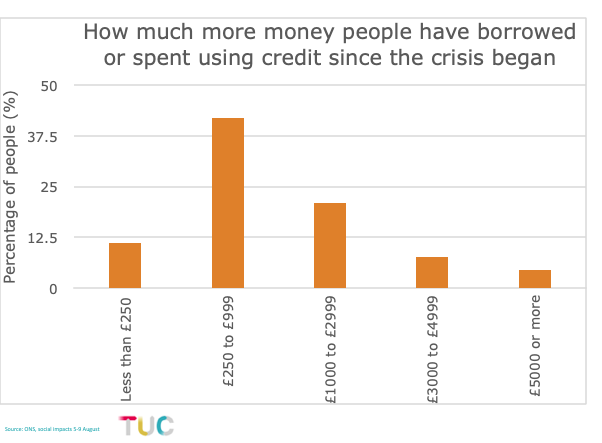

Of those who had seen their finances impacted, a fifth also said they borrowed money or used credit to cope. Over 40 per cent said they had borrowed between £250 and £999, and 1 in 5 said they had borrowed between £1000 and £2999.

People are having to borrow money to cope with the financial impact of the crisis

Rising financial hardship and debt pressure is reflected in data from the DWP that shows there were 2.4 million starts to universal credit during the first two months of lockdown. The inbuilt 5 week wait for first payment means many will have been forced to take on debt or go without essentials while they waited for support.

Statutory Sick Pay is too low

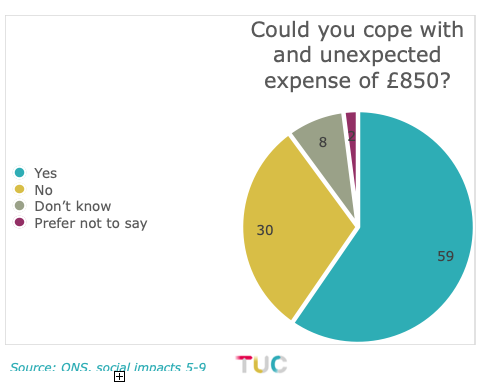

Thirty percent of those responding to the latest ONS Social Impacts Survey said they would not be able to cope with an unexpected but necessary expense of £850. The Statutory Sick Pay (SSP) rate is £95.95 per week and for the average worker, two weeks on statutory sick pay would see them lose £830 in income. 2 million workers don’t earn enough to even qualify for SSP.

Telling people to self-isolate for two weeks without decent sick pay won’t work. Many people will be forced to choose between financial hardship and going into work ill.

The best way to recover from this crisis is to keep people in work and invest

Waiting to see how this crisis continues to unfold and allowing businesses and workers to fall off a cliff edge come the end of October will not help us recover from this crisis. In fact, not taking action now will only make things worse.

The Job Retention Scheme showed how effective decisive and active government intervention can be. Unions stand ready to work with the government again to deliver more action that will protect jobs and help us recover faster.

We must:

- Extend the furlough scheme for viable businesses that need continued help in the coming months.

- Raise Statutory Sick Pay to £320 per week so people aren’t forced into going to work when they may be sick.

- End the 5 week wait for Universal Credit that sees so many people fall into debt and hardship.

- Kick start our recovery by investing in our overstretched public services and the green infrastructure we need to tackle the climate crisis.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox