Universal credit - emergency boost needed to help people through coronavirus

The last few weeks have seen an unprecedented change in the economic situation of the UK.

Since the Prime Minister announced a full ‘lockdown’ on the 23rd March, economic activity in the UK has been rightly restricted in the service of protecting public health.

The TUC has clear priorities throughout this crisis. First, to ensure that public health is protected. Second, to protect workers’ jobs and livelihoods.

Following calls from the TUC and unions the government has announced welcome schemes to try to keep people in work.

Protecting jobs must be the first step to protecting incomes and ensuring the country can get back on its feet when the crisis subsides.

But there is still more to do to ensure everyone who is sick gets the income support they need and support the livelihoods of those who do lose their jobs.

Our safety net has been dramatically undermined after years of underinvestment.

The UK has avoided mass unemployment since the recession of the early 1990s, and the devastating unemployment of the early 1980s.

Those experiences left deep scars, which we are still seeing the legacy of today. It is vital the government does everything it can to keep people in work now.

But even in the 1990s, our safety net was stronger.

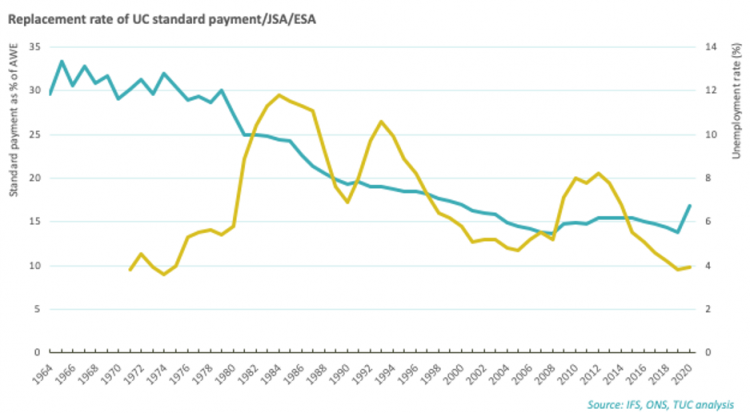

In 1993, the last time the unemployment rate went over 10 per cent, the basic rate of unemployment benefit was worth around a fifth of average wages.

In 1984, when unemployment was over 11 per cent, the benefit was worth a quarter of the average wage. And in 1979, it was worth 30 per cent of the average wage.

Today – even after the welcome recent increase by £20 a week – the basic rate of universal credit is worth around a sixth of average weekly pay (17 per cent).

The UK system also compares poorly to the support provided internationally.

In most European countries, unemployment benefits are related (at least in the initial period of unemployment) to previous wages to cushion income shocks, ranging from 60 per cent of previous wages in Germany to 90 per cent in Denmark.

In a new report we call for a new plan to fix the social safety net, building on our previous reports on sick pay, a job retention scheme, and support for the self-employed.

We call on the government to urgently raise the basic level of universal credit.

Restoring ‘replacement rates’ to the level seen before the long dismantling of the safety net began in the 1980s, would mean increasing the payment of universal credit to £165 a week – around 30 per cent of average wages.

But we think the government should be more ambitious to protect against this income drop. We recommend raising the basic rate of universal credit for this period to the value of 80 per cent of weekly earnings at the national living wage – or £260 a week.

In addition the government should:

- Suspend any conditionality requirements with universal credit, as well as parts of the application process.

Applications for universal credit are being delayed by the need to carry out a telephone appointment with a work coach. The requirement to hold a phone interview should be suspended, in addition to any work-related conditionality within the universal credit system. - Remove the savings rules in universal credit to allow more people to access it.

- End the five week wait by converting emergency payment loans to grants.

- Significantly increase child benefit payments.

Child benefit is the simplest, quickest and most effective way to get money to households with children. The level has long been too low. This payment would also recognise the additional costs many parents will face with having children at home because schools are closed. - Ensure nobody loses out as a result of these changes.

The benefits cap should be lifted so that these increases do not just mean a change in the composition of the benefits someone receives. As well as this, no one on legacy benefits should lose the protection of the managed transition to UC as part of this change. - Remove the minimum hours requirements in working tax credits. Families still claiming tax credits must work a minimum number of hours to be eligible. This rule should be removed with immediate effect.

The government has acted swiftly to protect jobs. But for those who do lose work, it’s vital the safety net is strengthened fast.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox