Pay up, chancellor – or the doom loop will never end

It couldn’t be a more fitting backdrop to the Chancellor’s statement. For 13 years the Conservative party have hammered public sector workers and public services under the pretence of setting conditions right for an improved economy.

But the improvement never happened: instead the economy is locked into a doom loop of low growth, terrible living standards, and repeated doses of austerity.

With real pay falling by 3.4 per cent, 2022 was the worst year of a crisis that began in 2008 and is now expected to last 20 years. Nothing like this has ever been endured by workers in modern history.

Last year prices rose steeply as fragmented and too-long global supply chains couldn’t cope after lockdowns ended, and then energy and commodity shocks were intensified following Putin’s illegal war. While workers are fighting hard for higher pay, nominal wage growth of 5.4 per cent was outstripped by CPI inflation of 9.1 per cent and RPI inflation of 11.6 per cent. In cash terms average real pay is still £110 a month below the 2008 position.

The experience of austerity since 2010 shows the pain transmitted in lockstep from public sector to private sector workers, but public sector workers were battered in 2022 with a real pay decline of 5.9 per cent.

In the meantime, the scale of the challenges facing our public services are immense, from record backlogs in health and justice, soaring levels of unmet care needs to crumbling school buildings. Acute staffing shortages across public services are made immensely worse by the government’s intransigent approach to public sector pay. We have over 300,000 vacancies across the NHS and social care, and one third of teachers who started in 2010 have since quit. And a TUC poll shows one in three public sector workers have taken steps to quit or are actively considering doing so, citing a toxic mix of low pay, excessive workloads and low morale.

The doom loop in the economy

The Chancellor’s statement comes as the economy once more teeters on the brink of recession, and workers are faced with years of stagnant economic growth and negligible real pay gains.

The latest ONS figures show zero growth into the three months to January 2023, with the Bank of England predicting negative GDP in both 2023 (-1/2%) and 2024 (-1/4%). The Bank have also downgraded the ability of the economy to growth into the future seemingly to only 0.7 per cent a year.

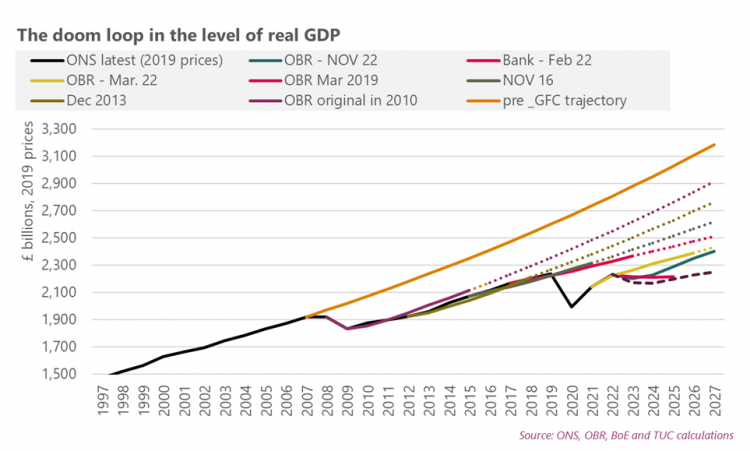

TUC analysis shows how the ‘doom loop’ of slow growth and austerity has got us here. The top line on the chart below is a projection of the economy at the pace ahead of the global financial crisis. The next line is a projection of how the Office for Budget Responsibility (OBR) first saw it in June 2010 (extended beyond the five-year horizon they forecast at each fiscal event), and so on through to their latest forecast in November 2022 and the Bank of England’s deathly scenario last month. For 2023 the latest forecast is £400 billion or one sixth below the projection of the OBR’s original assessment in 2010.

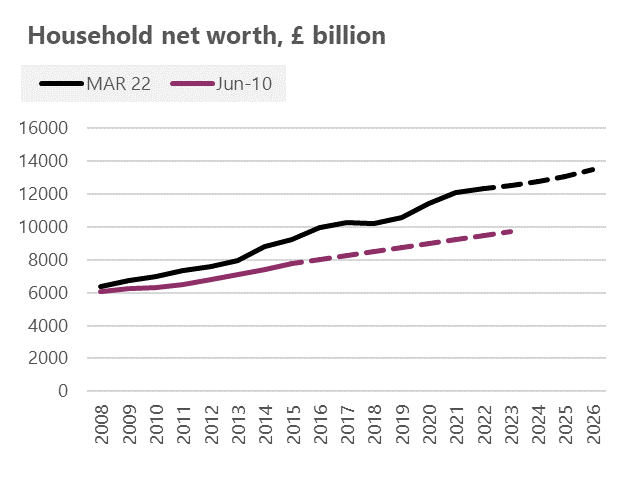

Our report also looks at how outcomes for wealth had greatly outperformed expectations, and the ‘all in it together’ deceit. The simplified chart below looks at the original OBR forecast for household net worth (in purple) and the latest view (in black). For 2023 wealth is now expected to be £12.5 trillion, nearly £3 trillion above a projection of the original OBR view from June 2010.

Drawing on TUC figures the Labour Party are right that the latest recovery is the worst in two centuries. The cash figures give a sense not only of what has been lost but what the government should be seeking to recover.

The government has to learn that cuts are opposed to economic growth, and the economy will only recover when workers have money and spend it.

So pay up, Chancellor

The TUC will be looking next Wednesday for policies that put workers ahead of wealth, as we outlined in our Budget statement:

Boost pay across the economy, including:

- Fund decent pay rises so that all public service workers get a real-terms pay rise that protects them from the soaring cost of living and begins to restore earnings lost over the 12 years.

- Get the UK on a path to a £15 minimum wage as soon as possible.

- Follow the example of New Zealand and Australia by introducing fair pay agreements to allow unions and employers to negotiate minimum pay and conditions across sectors.

Deliver a plan for strong public services and fair taxation, including:

- A new funding settlement for public services, with adjusted spending plans that mitigate the impact of high inflation on departmental budgets and provide for fully-funded pay rises that keep pace with the cost-of-living.

- Ensure those with the broadest shoulders pay their fair share in tax, including higher windfall tax on excess oil and gas and energy company profits, with less exemptions and loopholes, in order to fund the Energy Price Guarantee and measures to future-proof homes

- Introduce universal, flexible, high-quality childcare that is available to all from the point at which paid maternity or parental leave end.

Protect workers from hardship, including:

- Cancel the imminent hike in energy bills. The Energy Price Guarantee (EPG) must not be raised beyond the current £2,500.

- Set a path to significant and permanent improvements in the levels of social security.

Ensure decent jobs and growth for everyone, including:

- Ensure that businesses prioritise sustainable growth and jobs, reforming corporate governance to promote long-term sustainable investment rather than a short-term focus on shareholder returns.

- Invest in a just transition to the secure green energy future we need.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox