Lets get real about pay

The labour market figures issued earlier this week reveal that real wages are plummeting at speeds not seen for nearly a decade. But you would struggle to find this story in much of the coverage. Instead, narratives about spiralling nominal pay growth have been increasingly prominent. These claims are often based on contentious experimental statistics.

The likely reality is that nominal pay growth is too weak and has been slowing. This has combined with inflation to create a serious real pay crisis. This ratchets up the pressure as we continue to feel the effects of the longest pay squeeze in 200 years.

And this is before the energy price cap is increased and national insurance increases come in. Workers can ill afford any further pay loss. After a decade of failure, the government needs a plan to get wages rising, boost spending and strengthen the economy.

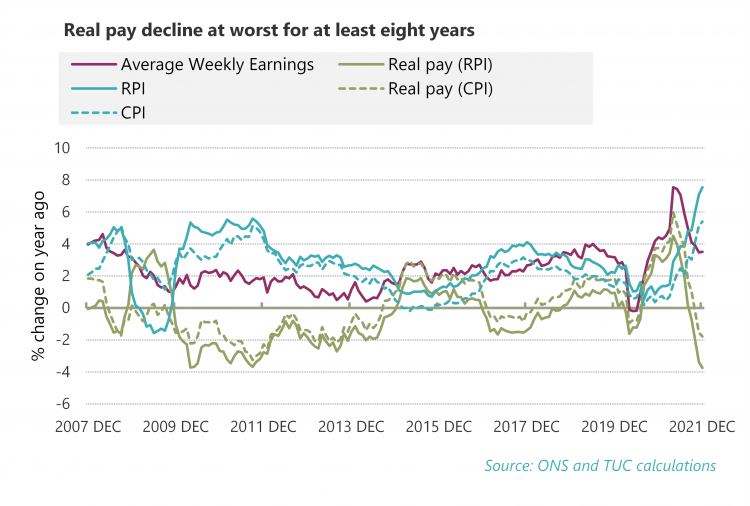

Real pay decline at worst for at least eight years

Real earnings have fallen by 3.8 per cent against retail price index (RPI), the worst decline in eleven years. On consumer price index (CPI) the fall was 1.8 per cent, the worst decline for eight years. Even on the CPIH measure real pay declined by 1.2 per cent. CPIH is a controversial new inflation measure which is currently lower than CPI and RPI. All of these figures are based on single month pay growth on a year ago.

It is wrong to draw too many conclusions from HMRC's nominal pay data

Real pay is what matters as workers find it harder to make ends meet, and the official statistics are sobering. Despite this, we’re seeing more and more attention on experimental estimates of nominal pay growth. These figures, derived from HMRC’s payroll real time information (RTI), should be treated with more caution.

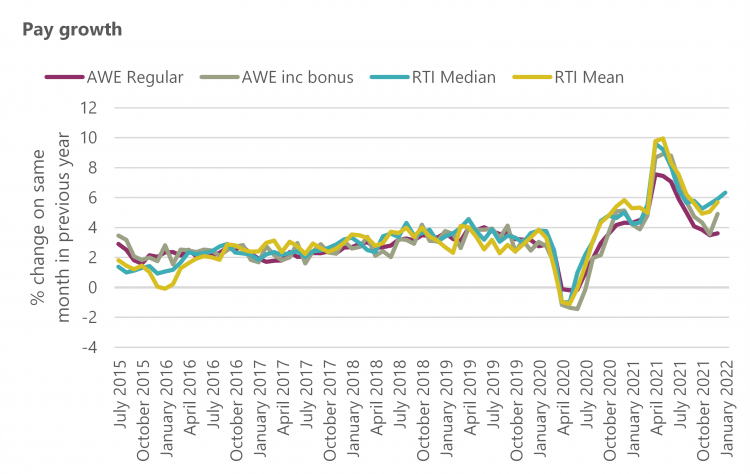

Early estimates on the RTI median measure put nominal pay growth in January at 6.3 per cent, up from a low point of 5.2 in October and 5.6 and 5.9 in November and December respectively. It would be better for workers if nominal pay is growing this fast, but it is worth being cautious with these figures. Even on the RTI flash estimates, pay growth is wiped out by RPI inflation of 7.8 per cent.

These figures are different from what, as far as we are aware, is the best measure of nominal pay growth, the regular average weekly earnings (AWE) data from the ONS. These are official statistics, and we tend to use the ‘regular pay’ figures which strip out the distorting impacts of bonus payments. Nominal pay growth has been declining on this measure, contributing to falls in real pay. Pay grew by just 3.6 per cent on the year in December. This compares to 4.25 per cent average year on year growth in the decade before the 2008 financial crisis.

We are using single month figures which express pay growth as the percentage change on the same month in the previous year. This is most alike to the single month flash estimates from RTI. The headline AWE figures published by the ONS however, are often based on the most recent three months compared to the same three months a year ago.

How well do payroll real time information and average weekly earnings match up?

Monthly estimates from experimental RTI data have outstripped regular AWE pay growth by roughly 1 per cent throughout the pandemic – before the pandemic they matched broadly. This is a worrying discrepancy which requires some explanation, especially if it is contributing to policy judgements about what pay growth is doing.

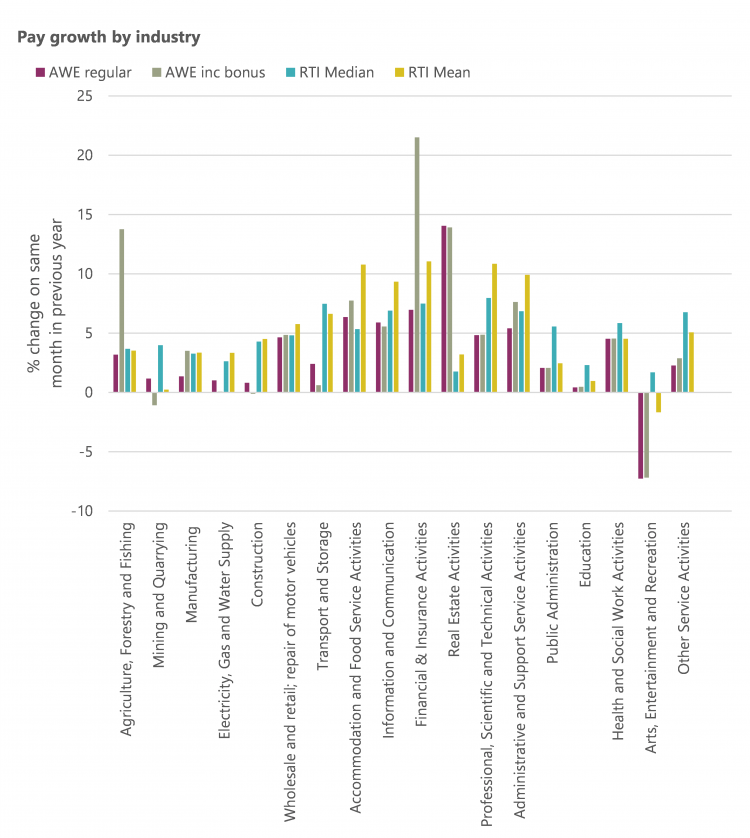

The available RTI data does not allow us to strip out the distorting impact of bonus payments. The AWE data does allow us to do this, and it shows huge bonus payments in the banking sector. AWE including bonuses grew by 4.9 per cent in December on the year, but by 21.5 per cent in financial and insurance activities. These bonuses contribute to higher total nominal pay growth despite not creating any consolidated pay growth and ending up in the hands of few workers. Bonuses typically peak between December and April so currently emerging data is particularly affected by this.

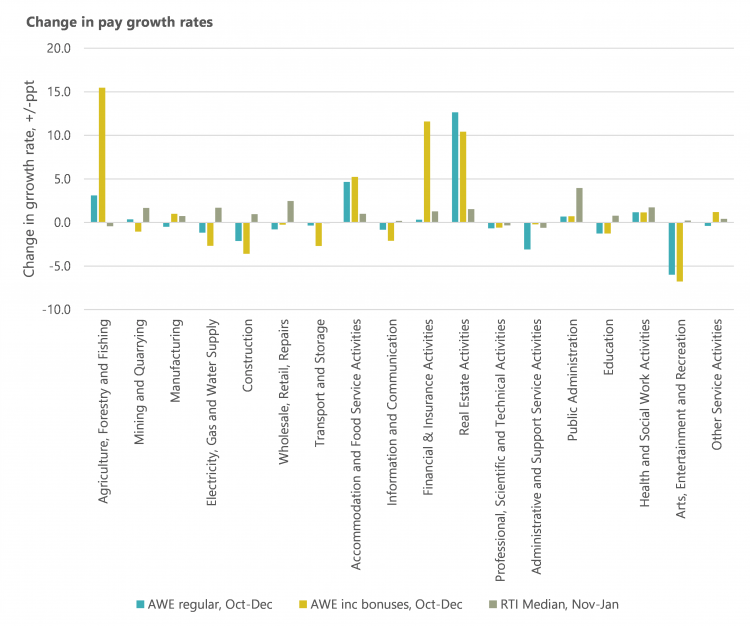

This could explain the recent uptick in RTI pay growth but, curiously, the RTI industry breakdowns show very little change in pay growth for bankers during the most recent quarter. The chart below shows the industry breakdown of the acceleration in pay growth on the RTI median measure, so the change in the growth rate during November to January. We have matched it with the most recent three month period on the AWE, though only to December as this is the latest figure available.

The latest RTI median data (in grey) show the uptick driven by accelerating pay growth in public administration, and wholesale trade, retail and repairs. But the match with AWE is not good: for in most industries RTI is higher, except for four that stand out on the chart.

Digging down to industry level also throws up some more general questions about the discrepancies between these measures. There appears to be limited consistency between the December industry breakdowns of RTI median and regular AWE pay growth. To name a few industries, there are large discrepancies between the data for the financial sector, real estate, farming, construction and professional, scientific and technical activities. If these measures are both accurate you would expect to spot more similarity than this.

Workers desperately need to see some pay growth. Trade Unions are fighting for pay rises and we have reported some of the success workers are seeing. It is not clear, however, that all the available figures are giving the right overall signal. We would welcome a better understanding of how useful the flash estimates are as they feature more prominently. We would be doubly concerned if misleading pay information was increasing the likelihood of further interest rate rises.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox