Budget 2023 – was that it?

Today’s budget saw the Chancellor speak about a high-wage and high-skills economy but do nothing to deliver it. The UK is still in the longest pay squeeze for more than 200 years. And our public services are still run-down and understaffed.

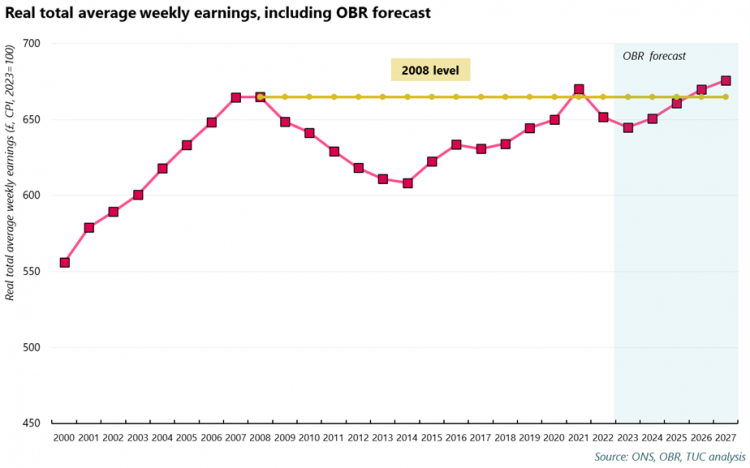

There was no plan to get wages rising across the economy. Real wages will not return to 2008 levels until 2026. And the elephant in the room was the lack of funding for our public services and the pay rises needed to recruit and retain nurses, carers and teachers.

The Chancellor should have announced measures to boost secure jobs, pay and skills. He should have provided a fully-funded workforce plan across our public services to recruit and retain key workers. And he should have set out an investment plan to rebuild our services – from fixing school buildings that are falling apart to restoring public health services. Apart from some long overdue steps forward on childcare, workers across the economy will have looked at this Budget and thought ‘was that it?’

Pay crisis

Appealing to a “high wage high skills economy”, the Conservatives continue to preside over the longest pay crisis in modern history. On current forecasts real pay will fall by 1.0 per cent in 2023, before beginning to grow again in 2024. But even with this growth, real pay will not return to its 2008 level until 2026 – an 18-year pay squeeze that could outlast the government that has spent the past thirteen years taking no action to address it.

This pay squeeze has hit workers’ pockets hard. If real pay had grown by the pre-2008 rate since 2008, workers would’ve been £233 per week better off in 2022 than they were. This gap is set to widen to £304 per week by 2027.

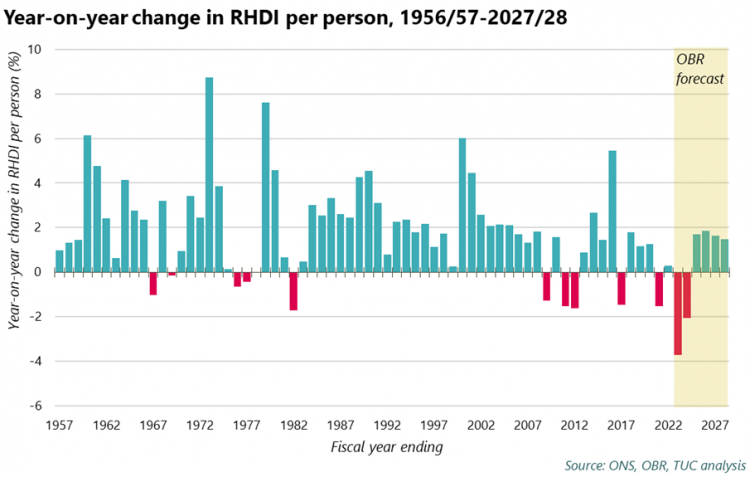

Beyond pay, the OBR forecasts real household disposable income (RHDI) per person, a measure of living standards, to fall by six per cent between 2021/22 and 2023/24. This is the steepest two-year decline since records began in the 1950s.

Before 2010, RHDI per person had only fallen in five of the 54 years since records began. Between 2010 and 2025, it’s set to fall six times.

Unending growth failure

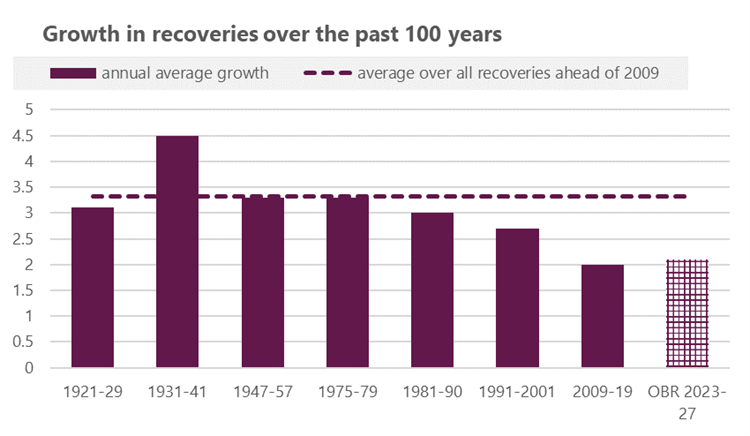

According to today’s OBR forecast, the Chancellor’s ‘plan for growth’ will deliver growth over the next five years that is only only 0.1 percentage point higher than growth between 2009 and 2019 – widely acknowledged as a decade of stagnation. Even if the forecast is delivered, the conservatives will have presided over the two worst recoveries in a century.

The forecast benefits from reduced concerns about recession. But it’s early days on this – the backdrop to his speech is a steep 3.8% decline in the stock exchange today – reacting to newly exposed dysfunction in the financial sector.

And this poor performance will have real consequences for workers. Unemployment will rise from 1.3 million this year to 1.5 million throughout the rest of the forecast.

Failing to deliver

In our Budget statement we asked the Chancellor to invest in public services and the workers that deliver them, and to put workers before wealth.

We asked the chancellor to boost pay across the economy, but astonishingly he did nothing to address the public sector pay crisis.

There was nothing to boost get us on a path to a a £15 minimum wage as soon as possible, or to set up the fair pay agreements we know we need to drive up fair pay across the economy.

We wanted a plan for strong public services and fair taxation:

Battered by inflation and recruitment crises, the chancellor did not mention public services. He offered none of the new funding desperately needed to recruit the nurses, carers and teachers that our public services rely on.

The Chancellor declined to extend the windfall tax on firms profiting from the gas price crisis, even though Big Oil firms fully doubled their profits last year. At the same time, many employers – from small business to big paper mills – have already faced closure due to spiking energy prices. But the Government has declined to extend its energy bills support package for employers.

Long overdue announcements on childcare follow years of union campaigning. But without improved conditions for childcare workers, recruitments and retention challenges could make delivery impossible.

We wanted workers (not the wealthy) protected from hardship

Pressure from unions and broader civil society has worked – the Government agreed to keep the Energy Bills Guarantee at £2,500 for the average household for a further three months, after which energy prices are expected to fall below this level. The Government also finally ended the unfair premium paid on energy by households on pre-payment meters.

But there is nothing in this budget – and in the Government’s existing commitments – to restrict bills sky-rocketing again. No new funding for upgrades to our leaky, draughty homes. And despite announcements to support nuclear energy and carbon capture and storage, there is nothing to expand the supply of clean energy in the next few years.

In spite of the severity of the cost-of-living crisis and the dramatic weakening of provisions over a decade of austerity, the chancellor did nothing on social security protections (beyond the childcare support in universal credit). Instead he further ramped up the already harsh sanction regime for those looking for work and on low earnings.

The work capability assessment will not be missed. But given the government’s track record, we cannot be sure that the new proposals for disabled people will be any better.

Remarkably, however, to fix a quirk in our system of tax relief on pension contributions that pushes some senior doctors into early retirement, the Chancellor scrapped limits on how much individuals can save for retirement tax free over a lifetime.

This indiscriminate measure, together with increases to annual limits, is projected to hand around £4 billion to the wealthiest savers over the next five years. These tax breaks will make it easier for the rich to use pensions as a vehicle for passing on wealth without paying inheritance tax, but do nothing to help most workers save for retirement. With a quarter of over-50s unlikely to achieve even a minimum retirement income, extra incentives should have targeted low earners.

We wanted a plan for sustainable growth that creates decent jobs

The most expensive line in the budget is the announcement of 100% expensing of qualifying capital investment for the next three years. This is predicted by the OBR to cost an average of £9.1 billion per year – over £27 billion in total. The measure means that companies will be able to deduct 100% of qualifying capital investment against their tax bill in the year of investment.

Measure to encourage UK businesses to raise their stubbornly low rates of investment are certainly needed. However, the question with this proposal is whether it will encourage additionality in business investment - or will simply hand public money to companies for investment that would have taken place anyway. Given the huge predicted costs to the scheme, this question is critical to whether it can be judged a success.

The OBR notes that the super-deduction, which this new measure replaces, raised business investment by less than originally expected, saying: “we overestimated its dynamic benefits”. Given the temporary nature of the new measure, the OBR expects it to bring forward investment that is currently planned and to have a smaller peak impact on investment than its predecessor super-deduction.

The measure must be judged by the additionality it creates in terms of levels of business investment and whether this is a sustainable, rather than temporary, effect.

Rather than simply splurging money, the government should reform how business is regulated to encourage long-term, sustainable growth. We need corporate governance reform to encourage companies to prioritise sustainable, long-term investment and decent jobs over short-term shareholder returns. This means reforming directors’ duties to remove the priority given to shareholder interests and requiring that worker directors comprise one third of the board at large UK companies. These reforms would encourage sustainable business models based on long-term investment and decent work, and would help to ensure that government investment incentives are well used by businesses, with the benefits shared with those who work for them.

And the UK’s manufacturing and process industries were sorely lacking any mention in the Budget. Indeed, when the Chancellor outlined his ambition for the use if Levelling Up investments, the example given as a success was Canary Wharf: hardly hopeful for people who work in real economy jobs in held-back regions now. The headline commitment to increase defence spending lacked any reference to jobs this spending could generate – meaning any industrial benefit is likely to be offshored once again. And while the Government did confirm its intention to invest into Carbon Capture, Use, and Storage, this does little to secure the future of the rest of the UK’s heavy industries. Industrial strategy – and a proper strategy to navigate the climate transition, protecting jobs and livelihoods along the way – is still lacking.

‘Was that it?‘ - a Budget with no ambition, more of the same at best, and basically ignoring the most pressing problems facing the UK.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox