Introducing fees in the Employment Tribunals and the Employment Appeal Tribunal

The TUC is the voice of Britain at work. We represent more than 5.5 million working people in 48 unions across the economy. We campaign for more and better jobs and a better working life for everyone, and we support trade unions to grow and thrive.

Trade unions, their officials and union workplace representatives have extensive experience of representing members and helping them to resolve workplace disputes. The TUC believes that it is in the interests of all parties to resolve workplace disputes as swiftly as possible before they escalate. Where it is not possible to do this by using workplace procedures, unions will seek to defend their members’ interests by supporting meritorious claims to an employment tribunal. Trade unions have considerable experience of representing members at employment tribunals in both individual and multiple cases. The latter may involve small groups of employees or many thousands of workers.

This experience means we understand just how important it is for workers to have unimpeded access to the justice system.

We believe that in order for the rights conferred on employees to be effective, and to achieve the social benefits which Parliament intended, they must be enforceable in practice.

Headline response

Introducing fees in the Employment Tribunals and the Employment Appeal Tribunal will price workers out of accessing justice. The government is repeating the mistakes it made in 2013, when it unlawfully introduced employment tribunal fees. Following UNISON’s legal challenge, the Supreme Court, in 2017, ruled that employment tribunal fees were unlawful because they priced workers out of accessing justice and discriminated against women. The government has failed to learn lessons from past mistakes and is ignoring clear legal principles set out in the Supreme Court judgment.

Question 1: Do you agree with the modest level of the proposed claimant issue fee of £55, including where there may be multiple claimants, to ensure a simple fee structure? Please give reasons for your answer.

No. The TUC firmly opposes the introduction of fees in the Employment Tribunals and the Employment Appeal Tribunal. We believe the introduction of fees is unlawful. Workers should have unimpeded access to the justice system.

Any level of employment tribunal fee, particularly given the current economic climate and prevalence of insecure work, would create a barrier to some workers accessing justice via the tribunal system. The Supreme Court judgment was clear about this and established some legal principles that the government is choosing to ignore:

- “The Fees Order will be ultra vires if there is a real risk that persons will effectively be prevented from having access to justice. That will be so because section 42 of the 2007 Act contains no words authorising the prevention of access to the relevant tribunals.”

- “In order for the fees to be lawful, they have to be set at a level that everyone can afford, taking into account the availability of full or partial remission.”

- “The question whether fees effectively prevent access to justice must be decided according to the likely impact of the fees on behaviour in the real world. Fees must therefore be affordable not in a theoretical sense, but in the sense that they can reasonably be afforded. Where households on low to middle incomes can only afford fees by sacrificing the ordinary and reasonable expenditure required to maintain what would generally be regarded as an acceptable standard of living, the fees cannot be regarded as affordable.”

The current economic climate means that household finances are extremely stretched and that there for many there is no slack in household budgets to pay for employment tribunal fees. Workers are in the middle of the longest pay squeeze in living memory - with average weekly earnings still £12 lower than they were in 2008, and not expected to get back to that level until 2028. Citizens Advice analysis shows that more than 2.1 million households are in a negative budget. That’s 5 million people - including 1.5 million children - who are in households that can’t afford basic essentials and are at risk of being pushed into debt. The latest data shows 14.4 million are in poverty, with 7.8 million (54 per cent) of these living in a working household. The number of people in poverty living in a working household has increased by 1.5 million since 2010.

The government acknowledges that the introduction of fees could lead to a reduction in claim volumes. The consultation document states that predicting the impact of fees on claim volumes is uncertain – “Although our intention is not to impact demand through these proposals, income estimates are sensitive to volumes and it is difficult to know how the introduction of a fee, along with other factors, could affect the volume of applications to the ET. Therefore, a reduction of 20% to the volumes has been applied to calculate the lower income estimate.”

Instead of repeating its unlawful behaviour the government should address the systemic flaws in our labour market enforcement system:

- We have a chronically under resourced labour market enforcement system. There are not enough labour market inspectors to proactively enforce employment rights.

- There are lengthy delays in the employment tribunal system, with some claimants having to wait years to have their case heard. This is particularly problematic for migrant workers who are only in the country on six-month visas. This puts pressure on claimants to abandon claims.

- The Legal Aid, Sentencing and Punishment of Offenders Act 2012 (LASPO) devastated the legal aid system when it came into force on 1 April 2013. People could no longer get help with many employment problems.

- Lack of enforcement of employment tribunal awards. A study carried out by the Department of Business, Innovation and Skills, shortly before the introduction of fees in 2013, found that only 53 per cent of claimants who were successful before the ET were paid even part of the award prior to taking enforcement action.[1] Even after enforcement action, only 49 per cent of claimants were paid in full, with a further 16 per cent being paid in part, and 35 per cent receiving no money at all.

- Employment tribunals should make greater use of the aggravated breach financial penalties at their disposal. Instead of introducing fees that will restrict access to the tribunal system, the Minister and the department should be ensure that tribunals use the full powers at their disposal to adequately sanction exploitative employers.

Question 2: Do you agree with the modest level of the proposed EAT appeal fee? Please give reasons for your answer.

No. Please see above.

In addition to the above, we also have concerns that workers may be charged considerably more than £55, in some circumstances, when they bring a claim to the EAT.

Paragraph 37 is unclear and contradictory. We are concerned that the £55 fee could apply for each ground of appeal. Or that each putative error of law is a relevant "decision" that incurs a separate fee. Most appeals contain multiple grounds and multiple alleged errors of law, so appellants might incur a much higher fee than the headline £55, or face being dissuaded from running all arguments due to barrier of costs.

Question 3: Do you believe this proposal meets the three principles set out below? Please give reasons for your answer.

The three principles underpinning this proposal are affordability, proportionality and simplicity. These ensure that the cost of the fee can broadly be met by users; that the value of the fee generally does not exceed the value of the remedy being sought; and that there is clarity around what fees are payable and when.

No.

The fees are not affordable for many workers/families. The Minister and department are detached from reality and the cost-of-living crisis afflicting working people.

The current economic climate means that household finances are extremely stretched and that there is no slack in many household budgets to pay for employment tribunal fees. Workers are still in the middle of the longest pay squeeze in living memory - with average weekly earnings still £12 lower than they were in 2008, and not expected to get back to that level until 2028. Citizens Advice analysis shows that more than 2.1 million households are in a negative budget. That’s 5 million people - including 1.5 million children - who are in households that can’t afford basic essentials and are at risk of being pushed into debt. The latest data shows 14.4 million are in poverty, with 7.8 million (54 per cent) of these living in a working household. The number of people in poverty living in a working household has increased by 1.5 million since 2010.

The fees are not proportionate. The equalities statement states that:

‘Some claimants seek non-monetary outcomes such as a change in policy or reinstatement to a job position. According to the 2018 SETA survey, in 90% of cases that went to a tribunal and a decision was made in favour of the claimant, the award involved a monetary element, demonstrating that approximately 10% of cases involved a non-monetary award;’

This clearly shows that in 10 per cent of cases, where a worker is pursuing a non-monetary award, any level of fee will not be proportionate.

Furthermore, the equalities statement shows that:

‘Of the 51 claims analysed in the file review exercise we found that 20% of the awards made under claims such as breach of contract, unauthorised deductions from wages, redundancy pay, maternity and pregnancy related discrimination and Agency Worker Regulations were for less than £500, the lowest award being £84.70, meaning a £55 claimant fee is proportionate to the range of possible awards (both monetary and non-monetary);’.

This example included in the equalities statement demonstrates that it is not proportionate for a person to pay a £55 fee if they are hoping to recover a small amount, such as £84.70. It is not reasonable or proportionate to expect a worker to go through the stress and effort of bringing a claim to tribunal for an award of £29.70 (once the fee is taken into account).

Tribunals are in place to deal with claims that are often of modest financial value, or of no financial value at all, but are nonetheless of social importance. Fees will dissuade workers from bringing claims where there is little or no financial compensation/reward:

- Many significant employment tribunal claims are brought to establish legal principles that will benefit workers across the entire labour market. These claims may have little financial value. This can be seen with the cases brought to establish legal principles around the payment of holiday pay. There is a risk that these types of strategic litigation cases will be reduced by the introduction of fees.

- Many employment cases involve non-pecuniary loss and are brought to establish important legal principles. This can be seen in the ongoing case of Mercer v Alternative Future Group, which was recently heard at the Supreme Court. Ms Mercer brought a claim under s. 146 Trade Union and Labour Relations (Consolidation) Act 1992 (TULRCA) on the basis that her suspension was a detriment imposed on her for the sole or main purpose of preventing or deterring her from taking part in the industrial action. When Ms. Mercer’s employer, Alternative Future Group Limited (AFG), announced plans to cut payments to care staff working sleep-in shifts, Ms Mercer, who was a UNISON rep, organised and participated in strike action. As a result, she was suspended by the charity and prevented from attending work or contacting her colleagues. This was in the middle of the strike. The employer sought to undermine the effectiveness of the strike. The subsequent claim by Ms Mercer was important as it sought to establish additional protection for all trade union members.

- The outcome of some employment tribunal claims can involve a declaration from the tribunal. These can be critical for individuals, to establish, for example, the terms of a written statement.

- In redundancy cases, including those involving fire and rehire, employers may seek to avoid their collective consultation obligations by splitting the numbers of employees being made redundant into groups of less than 20 employees. Claimants may seek a declaration from the employment tribunal that collective consultation obligations should apply.

- ET fees will be particularly restrictive for pregnant women who want to uphold their right to paid time off for antenatal appointments. The financial compensation where an employer refuses to pay for ante natal leave or refuses to allow an employee to attend ante natal leave, is likely to be less than £55 in a lot of cases. Where the fee is greater than the financial award, many pregnant workers could be put off from bringing claims.

- When fees were last introduced a review commissioned by the Ministry of Justice (MoJ) highlighted evidence from the Council of Employment judges, and the Presidents of the ETs in England and Wales and Scotland. They raised concerns that there had been a greater fall in lower value claims (such as unpaid wages, or unpaid annual leave) and claims which did not seek a financial remedy. They argued that this suggested that, at least for some types of case, the fees were disproportionate to what was at stake in the proceedings, and people were deciding that they were not economically worthwhile.

- This was confirmed by the Supreme Court in the UNISON case – “Furthermore, it is not only where fees are unaffordable that they can prevent access to justice. They can equally have that effect if they render it futile or irrational to bring a claim.”

The TUC doesn’t agree with the premise that users of the employment tribunal should make an additional contribution to alleviate some of the financial burden on taxpayers. The consultation document makes a distinction between the ‘taxpayer’ and ‘users of the service’. They are the same thing. Working people are taxpayers and have already made a significant contribution to the upkeep of the tribunal system by paying tax. Secondly, as the Supreme Court judgment pointed out, the ET system and the cases it hears, don’t just benefit the direct users of those cases. Wider society benefits from the decisions and upholding of workplace justice.

Question 4: Do you consider that a higher level of fees could be charged in the ET and/or the EAT? Please give reasons for your answer.

No. See above.

Question 5: Are there any other types of proceedings where similar considerations apply, and where there may be a case for fee exemptions? Please give reasons for your answer.

No, we believe that fees should not be introduced in any circumstances.

Question 6: Are you able to share your feedback on the different factors that affect the decision to make an ET claim, and if so, to what extent? For instance, these could be a tribunal fee, other associated costs, the probability of success, the likelihood of recovering a financial award, any other non-financial motivations such as any prior experience of court or tribunal processes etc. Please give reasons for your answer.

N/A

Question 7: Do you agree that we have correctly identified the range and extent of the equalities impacts for the proposed fee introductions set out in this consultation? Please give reasons and supply evidence of further equalities impacts as appropriate.

No. The TUC believes the ‘Equalities Statement’ published alongside the consultation document is wholly inadequate and fails to acknowledge the different groups of workers that will be disproportionately affected by the introduction of fees. Given that the last fees regime was quashed for unlawfully discriminating against certain groups of workers, it is staggering that the detrimental impact of fees on certain groups of workers has not been properly considered.

The TUC believes that the Minister and his department are breaching their duties under Section 149 of the Equality Act 2010 (“the Act”) which requires them, when exercising their functions, to have ‘due regard’ to the need to:

- Eliminate unlawful discrimination, harassment, victimisation and any other conduct prohibited by the Act;

- Advance equality of opportunity between different groups (those who share a relevant protected characteristic and those who do not);

- Foster good relations between different groups (those who share a relevant protected characteristic and those who do not).

The TUC believes that the equalities statement has failed to take into account that workers with protected characteristics are more likely to be in situations with a reduced income, or forms of employment that are low paid. Therefore, the equalities statement fails to address the link between low income households and workers with protected characteristics. Because of this, the statement has failed to consider that some groups of workers with protected characteristics groups will be disproportionately harmed by the introduction of a fee.

Paragraph 5.9 of the equalities statement is an example of this:

“Sex: ET claimants are more likely to be male than female, compared to the wider working population. This would suggest that men would therefore be disproportionately adversely impacted by the introduction of a fee. However, analysis of the 2013 SETA report responses finds that male claimants were disproportionately more likely than females to report higher salaries. 49% of male claimants said that their salary was £30,000 or more, compared with 43% of females. This suggests that salaries may mitigate some of the potential adversely disproportionate impacts on men.”

The equalities statement suggests that men might be disproportionately affected because more men bring claims to tribunal. The statement then goes on to say that men’s higher income will counter this disproportionate impact. But the statement fails to recognise that many women receive less pay because they are in part time employment, on maternity leave, in lower paying occupations/sectors, not receiving equal pay, and because of other factors contributing to the gender pay gap. This means that any level of fee would create an additional barrier for many women.

The TUC believes that certain groups of workers will be disproportionately adversely affected by the introduction of fees, meaning the new fees could be discriminatory:

- Single parents (mainly women)

- Insecure workers, who on average are paid less than permanent workers. BME workers and young people are overrepresented in insecure employment.[2]

- Pregnant women and new mothers who will struggle even more during a cost-of-living crisis. Charging fees for employment tribunal claims puts the justice system out of reach for women at a time when they are most in need of protection.

- Migrant workers, many of whom already face huge hurdles including short term visas (meaning they don't have time to have their claim heard in tribunal), limited finances due to wage theft, lack of familiarity with employment laws and language barriers. Many migrant workers are also affected by significant rises in immigration fees. For instance, in July 2023, the Government announced that the immigration health surcharge would rise by 66 per cent (from £624 a year to £1,035); work and visit visa fees by 15 per cent; and other visas, extensions, settlement and citizenship by 20 per cent.

The equalities statement is silent on these groups.

Evidence from a report[3] jointly commissioned by and undertaken on behalf of The Legal Services Board and The Law Society, demonstrates that certain groups already experience greater difficulty accessing the justice system. There is a risk that introducing a fee will further entrench these disadvantages. The report shows that when handling a contentious legal issue younger people are less likely to obtain professional help. A £55 fee to access the tribunal system is going to further compound this accessibility issue. The report confirmed that ‘there is also a declining trend of unmet legal need across income, with those on lower household incomes more likely to have an unmet legal need than those on higher household incomes’. Again, this shows that a fee will further compound existing accessibility issues.

Additional points

Early conciliation

The consultation document claims that “modest fees might also help encourage parties to consider early conciliation as a means of resolving their dispute before taking their case to the ET.” This claim was made prior to the introduction of fees in 2013 and was disproved by an MoJ-commissioned review and highlighted in the Supreme Court judgment:

‘According to the tribunal statistics, in 2011/12 33% of claims were settled through Acas. The following year, the proportion was again 33%. In 2014/15, following the introduction of fees, 8% of claims settled through Acas. In 2015/16, the figure rose again to 31%. Even ignoring the exceptional figure for 2014/15, it appears that the proportion of cases settled through Acas has slightly decreased since fees were introduced. That is consistent with the view of commentators, noted in the Review Report, that some employers were delaying negotiations to see whether the claimant would be prepared to pay the fee.” This shows that employers might be less likely to seek resolution of disputes.’

The government has provided no evidence to show that fees would lead to more settlements via early conciliation. It is disingenuous to suggest that fees might lead to greater early conciliation when it has already been disproved by statistics and highlighted by the Supreme Court.

Lord Chancellor’s Exceptional Power to remit fees

The TUC strongly disputes that the Lord Chancellor’s Exceptional Power to remit fees will offer an additional safeguard that will protect access to justice for those with no disposable means to pay a fee. We know that this is a rarely used power. The Supreme Court highlighted that this power was only used 31 times during the period between 1 July 2015 and 30 June 2016: a period during which 86,130 individual claims were presented. It was exercised 20 times during the period between 14 July and 22 December 2016.

Revenue forecast of the new fee regime

The new fee regime is forecast to generate £1.3m-£1.7m a year from 2025/26 onwards, with an estimated income of £0.6m-£0.7m from implementation in November 2024 to March 2025. The consultation does not indicate if these are net or gross sums. Assuming they are net, then this new scheme will only cover only about 1 per cent to 2 per cent of the total costs of running the tribunals. As UNISON pointed out recently, in the Law Society Gazette, “What is the point of the scheme, then, other than to be (once more) an impediment to access to justice?”[4]

Longstanding impact of previous fees regime

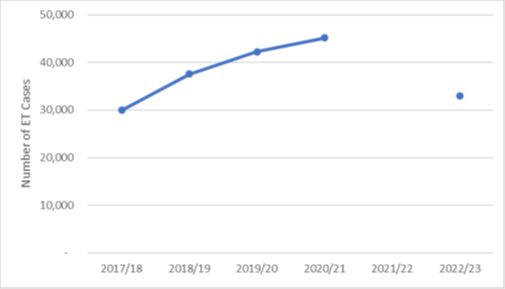

Case levels have still not been restored to pre-fee levels. The introduction of fees led to a substantial fall in the number of claims brought to ETs. ET case volumes fell by 54 per cent in the 12 months after the fee change, from 60,000 cases between July 2012 and June 2013 to 28,000 cases between July 2013 and June 2014. The table below, from the impact assessment shows that in 2022/23 there were just over 30,000 cases. This clearly shows that fees not only reduce case levels in the short term – they also have long term, devastating impacts on the justice system.

Source: Tribunal Statistics Quarterly, Table ET_1, total cases.

Note: Case volumes for 2021/22 unavailable (see paragraph 52). Also, ‘total’ refers to sum of single claim and multiple claim cases.

The government hasn’t provided full compensation following its previous unlawful behaviour

Before the Minister and department implement a new fee regime, they should ensure that workers who suffered a loss because of the previous unlawful fees regime are compensated.

A letter from the Minister to Sir Robert Neill MP, Chair, Justice Select Committee, dated 13 July 2023, highlights that only £18.6m has been recovered in fees and interest for workers who previously paid fees to the ET & EAT. 43,000 claimants were contacted and told they were eligible for a refund. But only 22,871 claimants have received a refund.

Further ratcheting up of fees

The TUC is concerned that the introduction of fees could lead to a ratcheting up of fees going forward. There is no commitment in the consultation document that fees will remain at the £55 level. The TUC is concerned that the government is seeking to make the tribunal system increasingly funded by ‘users’ of the service, even to the point where it is entirely self-funded, which could mean fees rising to exorbitant levels.

Help with Fees scheme

The TUC does not believe that the revised Help with Fees scheme will prevent workers from being priced out of accessing justice.

Claimants with a certain level of savings will not have access to the HwF scheme. This was flagged as a problem by the Supreme Court. “Some potential claimants may have temporarily inflated capital balances, due for example to payments received on the termination of their employment or to savings made in anticipation of childbirth. So, for example, if a woman has been selected for redundancy on a discriminatory basis, she will be disqualified from receiving any remission in proceedings to challenge the discrimination if the redundancy payment amounts to £3,000 or more.”

This problem remains with the revised Help with Fees scheme and the modestly raised disposable capital thresholds.

The TUC is concerned about the factors that are taken into consideration when assessing a worker’s income under the HwF scheme. We remind the government what the Supreme Court said in relation to affordability and ordinary and reasonable expenditure:

“The question whether fees effectively prevent access to justice must be decided according to the likely impact of the fees on behaviour in the real world. Fees must therefore be affordable not in a theoretical sense, but in the sense that they can reasonably be afforded. Where households on low to middle incomes can only afford fees by sacrificing the ordinary and reasonable expenditure required to maintain what would generally be regarded as an acceptable standard of living, the fees cannot be regarded as affordable.”

However the methodology[5] for determining income thresholds takes into account what the government determines to be non-essential expenditure.

The government states that: “To establish what should be included in the income threshold as ordinary and reasonable expenditure, we assessed all expenditure categories within the ONS LCF and made decisions to exclude certain categories of spend that we consider to be non-essential – such as alcohol, tobacco, narcotics, and gambling payments. Annex B contains a detailed explanation with a full list of categories that have been included and excluded for the purposes of the income test.’

Annex B goes on to state that “Holiday related expenditure (£145): package holidays, spending on holidays, travel and medical insurance. We do not consider such expenditure to be necessary and therefore, could be dispensed with or replaced with an alternative form of recreation.”

The TUC believes that it is totally unacceptable for the government to take into account the amount of money that a family spends on its holidays when determining whether someone should be granted fee remission. Families should have unimpeded access to the tribunal system and should not have to sacrifice holidays. In line with what the Supreme Court says, expenditure on a family holiday should generally be regarded as expenditure which is required to maintain an acceptable standard of living.

For the reasons above, related to both income and capital thresholds, we do not believe that the Help with Fees scheme is fit for purpose.

We can also learn from the previous unlawful introduction of fees for employment tribunal and employment appeal tribunals. The government of the day, in their impact assessment published in May 2012 estimated that at least 24 per cent of the pre-fees population of claimants would receive full remission, and that a further 53 per cent would receive partial remission on fees up to £950. In the event, the Review Report found that the proportion of the post-fees population of claimants receiving full or partial remission was initially very low, but had increased by 2016 to about 29 per cent. The proportion of claimants who received remission was far lower than had been anticipated. There is every reason to expect that this low take up would be repeated.

[1] Department for Business, Innovation and Skills (1 November 2013), Payment of employment tribunal awards, DBIS. www.gov.uk/government/publications/payment-of-employment-tribunal-awards

[2] TUC (August 2023). Insecure work in 2023, TUC.

[3] Legal Services Board and Law Society (2019). Legal needs of Individuals in England and Wales, Technical Report 2019/20. Legal Services Board and Law Society.

[4] David, S. (16 February 2024). “What is the point of another ET fees scheme?” Law Society Gazette www.lawgazette.co.uk/practice-points/what-is-the-point-of-another-et-fe…

[5] Ministry of Justice (October 2023. Revising the ‘Help with Fees’ remission scheme – protecting and enhancing access to justice paragraph 64, www.gov.uk/government/consultations/revising-the-help-with-fees-remission-scheme/revising-the-help-with-fees-remission-scheme-protecting-and-enhancing-access-to-justice

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox