Bank taxation

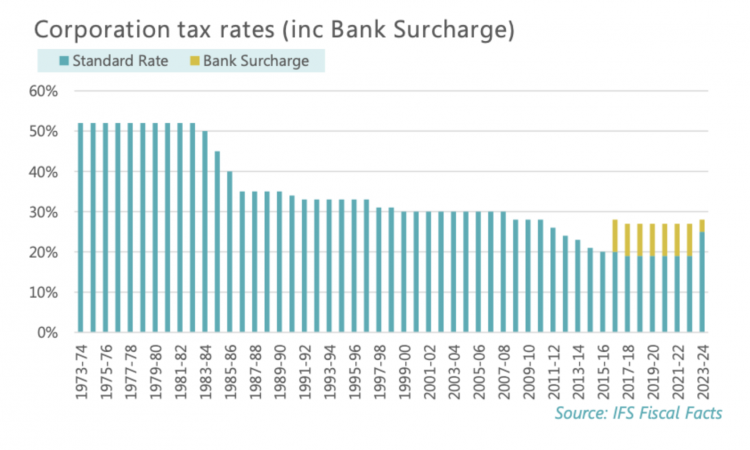

Since 2015 the two taxes targeted specifically at banks have been slashed, although there have been wider increases in corporation tax across the economy.

The two targeted bank taxes are the bank levy and bank surcharge. Since cuts were announced to both taxes, banks significantly increased their profits. This is because of increases in inflation followed by interest rates, which were not forecast when these tax cuts were planned. Despite higher profits, banks paid £0.2 billion less tax in real terms in 2022/23 than in 2017/18 when the tax take peaked.

The main taxes paid by banks are currently corporation tax, the bank surcharge and the bank levy.

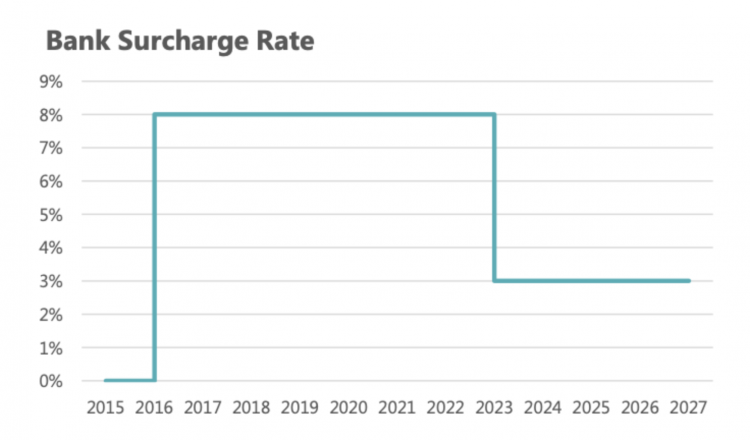

- The government cut the bank surcharge (tax on profits) from 8% to 3% in April 2023.

- The government introduced this cut to partially offset the increase in corporation tax from 19% to 25% that took effect in April 2023.

- As a result, the total corporation tax rate on bank profits increased from 27% to 28%. This is still below historic levels which existed before the financial crisis. It is also worth noting that banks only received a 1 percentage point increase to their tax rates, while other businesses had a much bigger 6 percentage point increase to their total corporation tax rates.

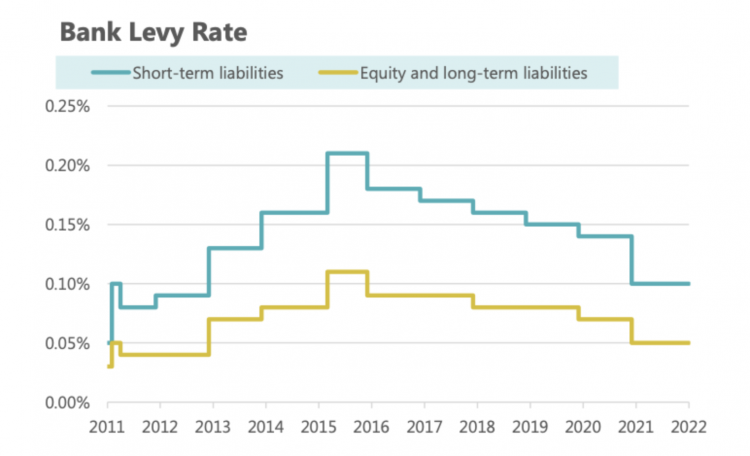

- The government has also steadily cut the bank levy (tax on balance sheets) since 2015.

- In 2015 the short-term rate was 0.21% and the long-term rate was 0.11%. These have been more than halved to 0.10% and 0.05% respectively, between 2015 and 2021.

Recent history of bank taxation

The House of Commons Library summarises the recent history of bank taxation:

“While banks and financial institutions are liable to pay corporation tax on their profits, as other companies, three new taxes have been introduced on the banking sector following the financial crisis in 2008:

- In December 2009 the Labour Government introduced a new bank payroll tax: a special one-off levy of 50% on any individual discretionary bonus above £25,000 to be paid by the bank, not the bank employee.

- In January 2011 the Coalition Government introduced a new bank levy to the balance sheets of UK banks and building societies, and to the UK operations of banks from abroad. Over the 2010-15 Parliament the Coalition Government amended the rates of the levy several times, with a view to maintaining the yield that it had initially anticipated.

- In July 2015 the Conservative Government announced a new bank surcharge – a supplementary 8% charge payable on banking sector profits in addition to corporation tax – alongside a gradual reduction in the rate of the bank levy over the period 2016-21.

In the Spring 2021 Budget on 3 March the Chancellor, Rishi Sunak, announced an increase in the rate of corporation tax from 19% to 25% from April 2023, as part of a series of reforms to corporate taxation. On 27 October [2021] the Chancellor presented the Autumn Budget and Spending Review, and in his statement announced the bank surcharge would be set at 3%, so that the overall rate for corporation tax on banks will, in 2023, increase from 27% to 28%.”

Source: Taxation of Banking, House of Commons Research Briefing, January 2022

In response to recent windfalls, this paper presents some options for increasing taxes to raise additional revenue from banks – and to renew a policy of fairer shares that has been abandoned by Sunak. Our estimates for the revenue these options will raise are all very conservative. This is because they are based on OBR forecasts from March 2023 which have not been adjusted for the larger than expected bank profits that have come in over the course of this year. Options include:

-

Reversing the cuts to the bank surcharge. This would set the surcharge at 8% and the overall corporation tax rate at 33%. This would raise £6-6.5bn over 4 years.

-

Raising the bank surcharge to 10% to create an overall tax rate on bank profits of 35%. This would raise £7.5bn-£8.1bn over 4 years.

-

A windfall tax bank surcharge of 35% to match the ** levy on energy companies. This would create a total corporation tax rate of 60%. This would raise £26bn-£28bn over 4 years.

-

Reversing cuts to the Bank Surcharge and Bank Levy so that they collect the same total revenue in real terms as they did in 2016/17. This would raise £15bn over 4 years.

Overall taxation

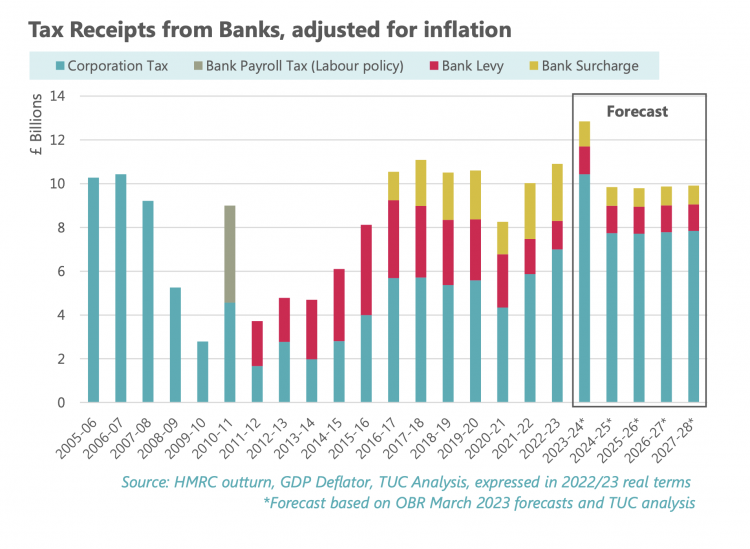

Following the financial crisis, tax revenues from banks fell (chart below). The exception to this was 2010-11 when Labour implemented a one-off tax which collected £4.4 billion [1] in real terms from bankers’ bonuses. In the first tax year after the 2010 election, bank taxation totalled less than £3.7 billion in real terms. Tax receipts then rose steadily to a peak of £11.1 billion in 2017/18. The three main taxes on banks collected £10.9 billion in 2022/23. This is below the 2017/18 peak.

[1] £3.5 billion in nominal terms

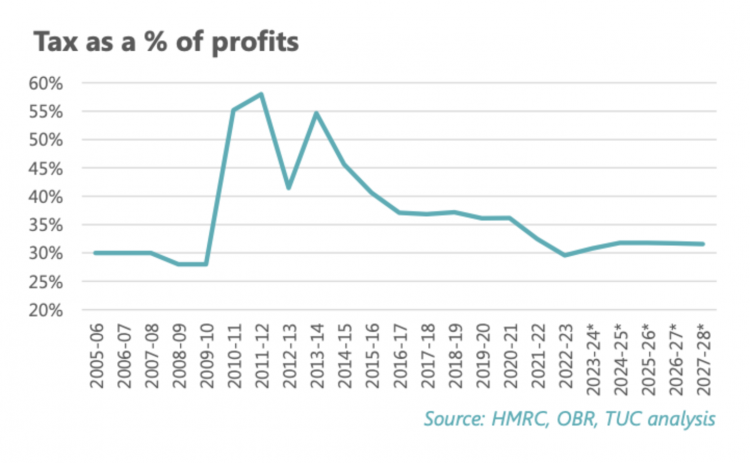

From 2023/24 the changes in corporation tax and the bank surcharge will come into effect. Our forecasts based on the OBR March 2023 economic outlook suggests tax receipts will be higher than usual this year. Our forecasts also suggest tax on banks will fall to around £10 billion a year for the four financial years from 2024/25 to 2027/28. The costings for the policy proposals in this paper are based on collecting more tax over this four year period.

Bank Levy

The bank levy was written into the Coalition agreement and set out in George Osborne’s first budget. Osborne announced, “the failures of the banks imposed a huge cost on the rest of society, so I believe that it is fair and right that in future banks should make a more appropriate contribution, reflecting the many risks that they generate.”

The bank levy came into force in 2011. It applies a charge to certain balance sheet liabilities. The levy took in tax receipts from banks even when corporation tax receipts were down due to reduced profitability after the financial crash.

The bank levy rates were gradually increased over the course of the coalition government from 2010 to 2015. The various reasons given for these increases include: to maintain the overall £2 billion yield from this tax, to offset cuts to corporation tax rates across the wider economy, and “as our banking sector becomes more profitable again … it can make a bigger contribution to the repair of our public finances.”[2]

After the 2015 election Osborne announced that the levy would be reduced in scope and the rates would be reduced gradually from 2016 to 2021. This would be done alongside the introduction of a bank surcharge which would more than offset the cost to the exchequer of the reductions in the levy.

As a result the bank levy rates are now less than half of what they were at their peak. In 2015 the short-term rate was 0.21% and the long-term rate was 0.11%. The rates have been more than halved to 0.10% and 0.05% respectively.

The bank levy is now forecast to stay at these rates. The OBR forecasts receipts of £1.3 billion a year from the levy over the next five years.

|

Tax receipts |

Outturn |

Forecast |

|||||

|

Bank Levy |

2021/22 |

2022/23 |

2023/24 |

2024/25 |

2025/26 |

2026/27 |

2027/28 |

|

£ billions |

1.3 |

1.4 |

1.3 |

1.3 |

1.3 |

1.3 |

1.3 |

|

Source: OBR March 2023 |

|||||||

Bank Surcharge

Introduction by Osborne, 2015

The bank surcharge was announced in the first budget after the 2015 election. Osborne introduced the surcharge at the same time as plans to reduce the bank levy in scope and level over six years. The bank surcharge was set as an additional 8% tax on bank profits paid on top of corporation tax.

In his Budget speech in July 2015 Osborne said, “I will, over the next six years, gradually reduce the bank levy rate, and after that make sure it no longer applies to worldwide balance sheets. But to maintain a fair contribution from the banks, I will introduce a new 8% surcharge on bank profits from 1 January next year.”

The shift away from the bank levy to the new bank surcharge was intended to bring in comparable revenue but shifted the balance of contributions from different banks. The bank levy took a lot of its receipts from large and international banks such as HSBC but the bank surcharge spread the contributions more evenly across UK banks.

[2] George Osborne, House of Commons debate, 18 March 2015

Cut by Sunak, 2021

In 2021 Chancellor Rishi Sunak announced a reduction of the surcharge to 3%. This tax cut came into force from April 2023. Sunak’s cut to the bank surcharge were accompanied with an increase to the headline corporation tax rate across the economy but no reversal to the cuts in the bank levy.

Sunak initially announced that the headline corporation tax rate would increase from 19% to 25% in his Spring 2021 Budget. The Budget announced that there would also be a review of the bank surcharge as the increased corporation tax rate would combine with the 8% surcharge rate to create an overall 33% tax rate on profits. The Budget report argued this would “make UK taxation of banks uncompetitive”.

In the October 2021 Autumn Budget, Sunak announced that the bank surcharge would be cut to 3%. The overall rate of tax on bank profits would therefore only increase from 27% to 28%.

However, the new overall tax 28% rate on bank profits is just a return to 2010 levels. The headline corporation tax rate has been cut significantly by the Conservative government and the bank surcharge has just maintained rather than increased overall tax rates for bank profits.

Non-banking businesses have seen their corporation tax rate increase by 6 percentage points, while banks have only had a rise of 1 percentage point.

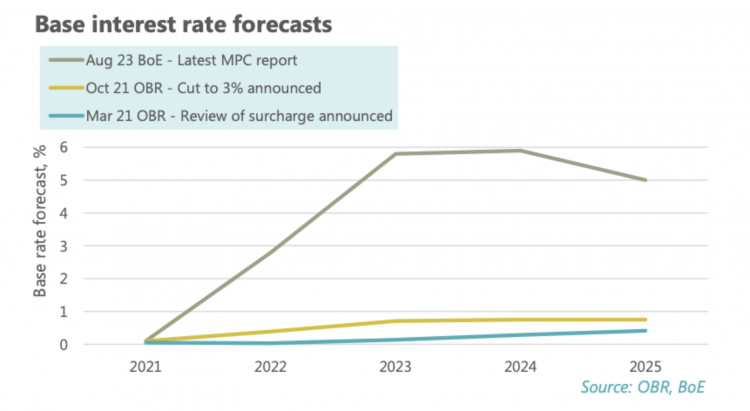

Bank Windfalls

At the time decisions were made about cuts in the bank surcharge, there was no indication in the OBR forecasts that inflation would rise so dramatically, nor that interest rates would rise in response, and that banks would make huge windfall profits as a result.

Below are the OBR forecasts for interest rates published in March 2021 and October 2021 alongside the latest Bank of England base rate forecast.

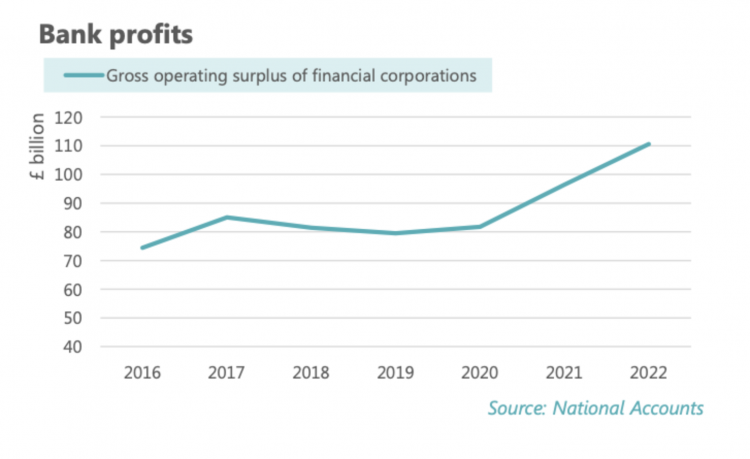

Banks have made significant unexpected profits because of increased interest rates. This happens because of increases in net interest incomes – higher interest rates allow a bigger difference to emerge between interest charged to borrowers and the interest paid to savers. The national accounts[3] show bank profits increasing by 15% in 2022 following an increase of 18% in 2021. This growth in bank profitability far outstrips increases in average wages.

[3] Note the National Accounts definition of gross operating surplus for banks is different to corporate accounting, so that net interest receipts are likely to be understated.

Unite has recently published analysis[4] looking at the profits of the big four banks across Q1-Q3 of 2023. The union found that HSBC, Barclays, Lloyds and Natwest made combined profits of £41 billion in the first nine months of 2023, up 79% on last year. This is equivalent to £1000 profit per person in England. Unite has also criticised the Bank of England for its role in enriching banks while squeezing living standards by raising interest rates.[5]

Positive Money has also undertaken some up-to-date analysis[6] looking at profits from the first nine months of 2023 for the big four banks. This finds that that HSBC, Barclays, Lloyds and Natwest made pre-tax profits of £41 billion in 2023 Q1-Q3. Positive Money estimates that this is 400% higher than the banks reported for the same period in 2020, when interest rates had not begun rising yet.

Rising bank profits have attracted widespread criticism of profiteering. In June 2023 Martin Lewis told the Today Programme, "The fact that the banks, who remember we bailed out in 2007 when they were in trouble, the banks are now profiteering by increasing their margins when we - the state, the taxpayer - is in trouble - [it] seems a bit beyond the pale to me.” He continued “this is a margin growth - the difference between what they're charging borrowers and what they're charging savers has gone up pretty substantially over the past year as we've been seeing interest rate rises."[7]

Bank tax has fallen as a proportion of bank profits over recent years and our forecasts suggest they will sit at around 32% from 2024/25 onwards, down from around 37% between 2016/17 and 2020/21.

[4] Unite the Union, Profits of the big four banks equivalent to £1,000 for everyone in England, November 2023, https://www.unitetheunion.org/news-events/news/2023/november/profits-of-the-big-four-banks-equivalent-to-1-000-for-everyone-in-englandveryone in England (unitetheunion.org)

[5] Unite the Union, Unite calls on BofE to stop squeezing workers while enriching the banks, November 2023, https://www.unitetheunion.org/news-events/news/2023/november/unite-calls-on-bofe-to-stop-squeezing-workers-while-enriching-the-banks

[6] Positive Money, Campaigners trick or treat the banks, October 2023 https://positivemoney.org/2023/10/campaigners-trick-or-treat-the-banks/

[7] Manchester Evening News, Martin Lewis says banks are 'profiteering' after being bailed out in 2007, June 2023, https://www.manchestereveningnews.co.uk/news/cost-of-living/martin-lewis-says-banks-profiteering-27197942

Policy options

Our estimates for the revenue these options will raise are all very conservative. This is because they are based on OBR forecasts from March 2023 which have not been adjusted for the larger than expected bank profits that have come in over the course of this year. In practice these policy options are likely to raise more than our estimates.

Put the Bank Surcharge back to 8% reversing the recent cut in full

Raises: £6bn - £6.5bn over 4 years

The Chancellor could reverse the bank surcharge cut. This would increase the rate from 3% back to 8%. Below is the March 2023 OBR forecast for receipts from the bank surcharge.

|

Tax receipts |

Outturn |

Forecast |

|||||

|

Bank Surcharge |

2021/22 |

2022/23 |

2023/24 |

2024/25 |

2025/26 |

2026/27 |

2027/28 |

|

£ billions |

2.3 |

2.4 |

1.2 |

0.9 |

0.9 |

0.9 |

0.9 |

|

Source: OBR March 2023 |

|||||||

In 2022/23 the bank surcharge was forecast to collect £2.4 billion at a rate of 8%. After transitioning to the 3% rate in full, the bank surcharge is forecast to collect £0.9 billion a year. This is a reduction in revenue of £1.5 billion per year. Reversing this tax cut would raise £6 billion a year over four years.

This is a conservative estimate because bank surcharge receipts[9] turned out to be higher than the OBR forecast in March. The OBR based its March forecasts on underestimates of the severity of interest rate rises. They forecast that interest rates would peak at 4.3 in 2023Q3 and then fall but instead interest rates went from 5% to 5.25% over the course of 2023Q3. The latest HMRC statistics show the outturn for Bank Surcharge receipts to be £2.6 billion in 2022/23, roughly 8% higher than forecast. If this continues, a reversal in the tax cut would raise a further £0.5 billion over four years.

And finally, it is worth noting the analyses done by Positive Money and Unite looking at bank profits from the first half of 2023. This suggests that profits have risen even higher and that even more could be raised by reversing the surcharge cut.

Raise the Bank Surcharge to 10%

Raises: £7.5bn - £8.1bn over 4 years

A second option would be to raise the bank surcharge to 10%. By grossing up the above costings we can forecast a benefit to the exchequer of £7.5 billion to £8.1 billion over four years.

Alongside the corporation tax rate of 25% this would create a total tax rate of 35% on bank profits. This is attractive because it mirrors the rate of the Energy Profits Levy which has been set at 35% from January 2023 and is set to run until March 2028.

This proposal would still be well below the overall tax rate on oil and gas production profits. The Energy Profits Levy of 35% is paid on top of a 40% rate of corporation tax for these companies. The total tax rate on profits from oil and gas production is currently 75%.

A 35% headline corporation tax rate was last in place from 1986 to 1990.

Windfall tax surcharge of 35%

Raises: £26bn - £28bn over 4 years

This is the primary proposal put forward by Positive Money.[10] It would raise the bank surcharge to 35% in line with the Energy Profits Levy. Like the windfall tax on energy profits, this would be paid on top of corporation tax. The total tax rate would be 60%, so still lower than the 75% currently levied on oil and gas production.

By grossing up the costings made above for an 8% bank surcharge, we can predict that this would raise approximately £25 billion to £28 billion over four years. This is a conservative estimate based on forecasts from March 2023 and the outturn for tax receipts in 2022/23.

Positive Money get a much larger figure based on profits in the first half of 2023. They claim this policy could raise £20.3 billion in one year from the 2023 profits of the big 4 banks alone.

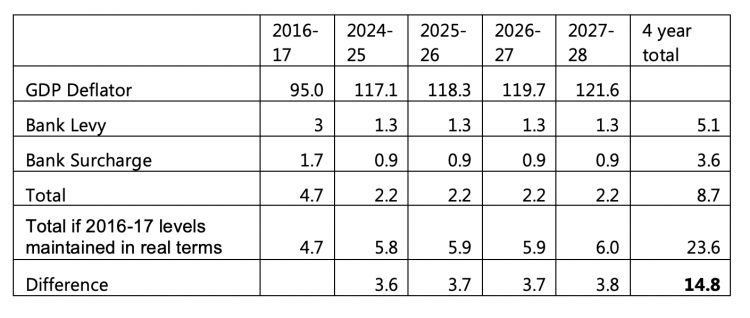

Reverse cuts to the Bank Surcharge and the Bank Levy

Raises: £15bn over 4 years

The Lib Dems published analysis[11] in November 2022 showing that cuts to the bank surcharge and bank levy would cost £18 billion over the following five years. This is based on maintaining revenues from these two taxes in real terms at 2016-17 levels.

By replicating this analysis using OBR March 2023 forecasts we find that this policy could raise £15 billion over the next four years.

It is worth noting that this methodology implies setting taxes at the rates needed to raise the same real revenue as in 2016/17. If banks are more profitable now, that would mean lower rates of tax now than in 2016/17.

[9] HMRC Corporation Tax Statistics 2023, Published 21 September 2023

[10] Positive Money, August 2023, Options for a windfall tax http://positivemoney.org/wp-content/uploads/Options-for-a-windfall-tax-…

[11] Liberal Democrats, Nov 2022, Conservative giveaway to big banks set to cost taxpayers £18 billion https://www.libdems.org.uk/press/release/conservative-giveaway-to-big-b…

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox