Government fails to get real about pay

Real pay

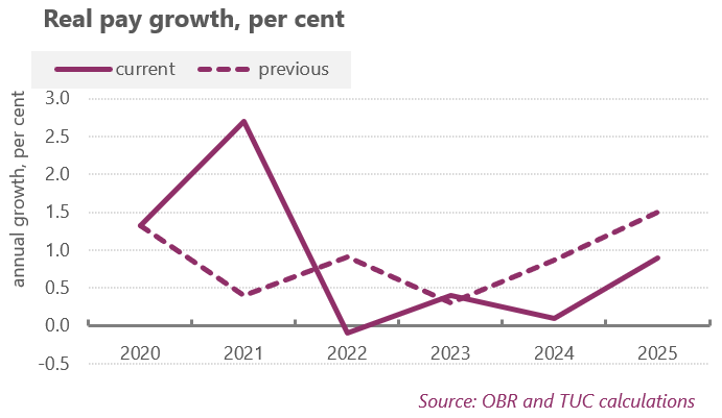

The chancellor admitted that real pay growth across the economy next year would fall by 0.1% - inflation of 4% for the year will outstrip average earnings growth of 3.9%. And over the coming four years, from 2022-2025, average real pay growth is predicted to be just 0.3%.

After a twelve year pay freeze, most workers won’t see their standard of living improve. Without a plan to boost pay across the economy, including by giving trade unions more power to drive up pay and conditions across sectors, we won’t see the pay rise workers deserve.

Public sector pay

Public sector workers’ real pay is already in decline, with growth of only 2.6 per cent in the year to August against the latest CPI September inflation figure of 3.1 per cent. It is good that the Chancellor has accepted Trade Unions’ arguments that the pay freeze was wrong.

And it is good that he is offering three years’ of real terms pay increases for all workers in all government departments, but the fine print needs to be checked on whether this really comes with no strings attached. We have sat by and watched for too long as protected departments leave the rest further behind.

The cost of living crisis wasn’t addressed

Amid a cost-of living crisis, boosting the minimum wage is vital. But the government must set its sights higher. An increase to £9.50 in April just about steers the minimum wage towards its pre-existing target of two thirds of median earnings by 2024. But we need a £10 minimum wage now. The announced increase won't come into effect until next spring by which time many household budgets will have been hammered by rising bills.

The chancellor has not done enough to protect the poorest in society. Workers on universal credit should always have been able to keep more of their wages. The cut in the taper rate does not make up for the £1,000 per year cut to universal credit and does not help those on universal credit who cannot work. The Chancellor has only given back £2 in every £6 he’s taken away from families; that’s not an adequate answer to the pressures they face this winter.

Changes to minimum wage, taper rates and work allowances won’t help people who are out of work. The OBR forecast that unemployment will rise again to a peak of 5.2 per cent over the coming winter. For all the talk of a ‘plan for jobs’ there was no plan to tackle that rise.

Strengthening the economy?

The OBR upgraded its forecasts for growth this year. We hope this optimism about the recovery is not misplaced. There were reasons for concern in the latest official figures with monthly GDP growth falling by -0.1 per cent in July and only recovering only to +0.4 per cent in August. Retail sales have fallen in each of the past five months, by a total of nearly 7 per cent.

And while the forecasts for employment have improved, the OBR are still forecasting an unemployment rise this winter - just as the cost of living crunch really kicks in. With the end of the furlough scheme in September, we should still be worried about jobs.

The government could have announced a public sector jobs drive to help deliver better services, alongside real investment in the social care system.

Beyond the NHS and social care package announced at the start of September, government spending increases have simply reset the position to where it was a year and a half ago. As the Office for Budget Responsibility put it:

Of the roughly £30 billion on average added to departmental budgets in each year of the Spending Review, around half goes directly from the new levy to health and social care with the other half undoing the £18 billion of unspecified cuts to pre-pandemic spending totals made in the last two fiscal events. (Economic and fiscal outlook, p. 8)

So in the case of most departments we are still way back from the position in 2010 before the Conservative led government started its deep programme of cuts.

The government could have met the vital challenge of net zero ahead of COP26, and provided a boost to the economy too. It is embarrassing that a week before hosting the COP26 UN climate summit, the budget and spending review makes very little reference to the public investment needed to get the UK on track to Net Zero. The TUC has called on government to invest £85 billion over two years in green infrastructure and decarbonising industry. The official Climate Change Committee identified a £50 billion annual investment gap by 2030 to get us on track, of which a significant proportion must be public investment if we are to see the benefits to UK jobs and industry. Instead, the headline measure of public sector net investment averaged over the coming three years is down by 0.05 percentage points of GDP, now 2.77% compared to 2.83% GDP.

The increase to public R&D investment includes funding EU programmes after Brexit. The Chancellor spoke of optimism for a new economy. But this is no decisive change. The overall position on government spending is not greatly changed, and while some protections have been put in place many will approach the cost of living squeeze with trepidation. The promised higher pay economy remains out of reach.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox