GDP and the pandemic in 2020

We now know that GDP for 2020 fell by 10 per cent, at face value the worst annual decline for 300 years.

But unlike any other, this recession was the result of necessary decisions in the face of a global health crisis.

GDP trends

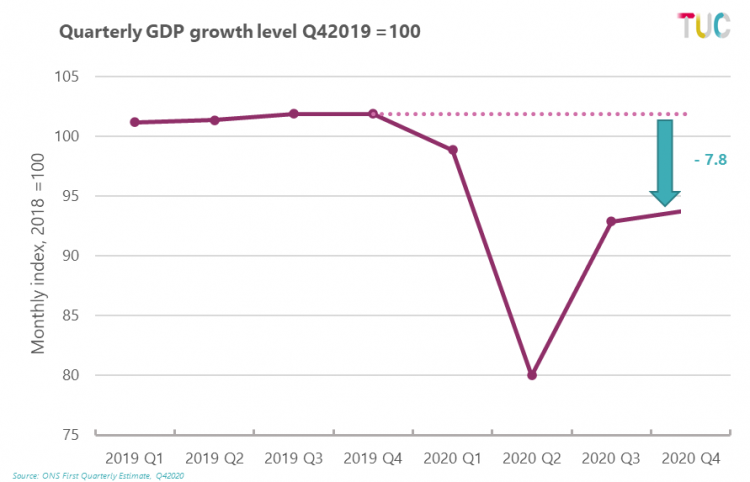

The path of GDP through the year reflects the changing intensity of lockdown.

The decline began in 2020Q1 (January to March), with the most severe contraction in the second quarter (April to June).

After a vigorous revival in the third quarter (July to September), the recovery faltered into quarter four (October to December) – as stricter national lockdown measures were introduced in November, then briefly eased in December before the introduction of tier 4 measures (the closure of all non-essential retail, leisure and personal care services) for London, the South East and East of England over the Christmas period, as well as stricter measures in the devolved nations.

Monthly figures show decline (2.3%) into November but slight revival into December (1.2%) - likely as the restrictions on non-essential retail and services were lifted in the early part of December.

But overall, the economy is still 8 per cent below the starting point a year ago in 2019 Q4.

This is still a largely unprecedented reduction in quarterly terms – although there were broadly corresponding but more sustained declines in the aftermath of the first world war, with GDP declining by around 8 per cent a year for the three years over 1919-21.

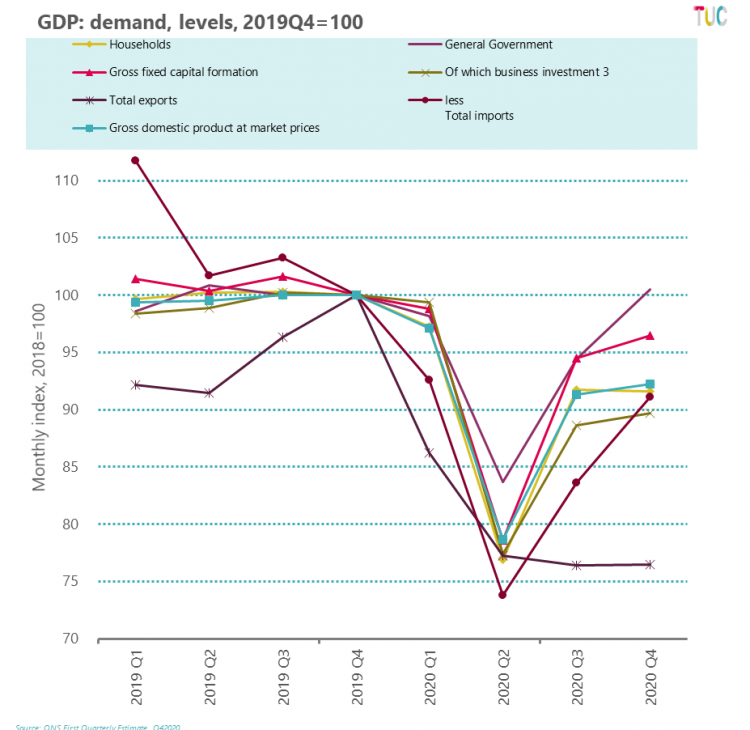

Looking in more detail at demand and industry output figures highlights the factors holding the economy back.

On the demand side, it is perhaps surprising that government (purple line) is not supporting the economy more – with output standing only 0.5% above pre-crisis levels. Household consumption (-8.4%, yellow) and business investment (-10.3%, brown) are still greatly down.

The one area that has not recovered at all is exports.

While imports came back to 8.9 per cent relative to pre-crisis levels, exports remain well below at -23.5 per cent.

Both figures may be impacted by Brexit, with stockpiling before the end of the transition period providing a boost to imports, but uncertainty over the terms of trade is causing a drag on exports.

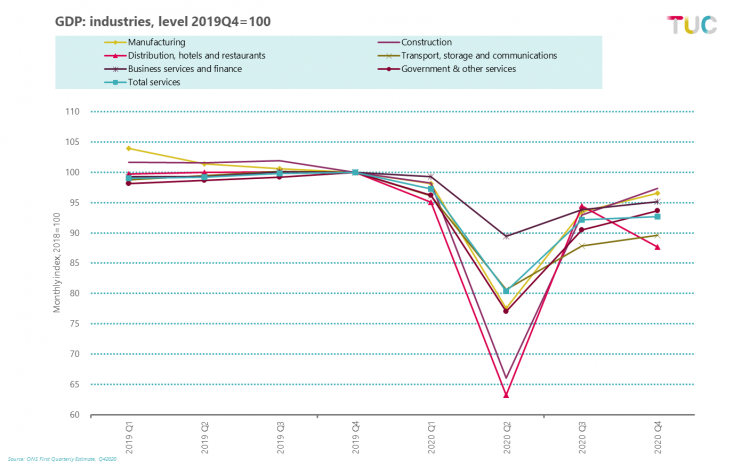

From an industry view, the most severe ongoing impact is on services which continue to struggle at -7.3 per cent versus a year ago.

This is driven by distribution hotels & restaurants (-12.3%) and transport, storage and communications (-10.4%) in particular.

Business services and finance have performed least badly (-4.8%), though finance (-2.9%) and real estate (-1.5%) have offset a more severe decline in ‘professional scientific administrative and support’ (-9.2%).

Although online sales reduced the impact of restrictions in November, wholesale and retail still declined 1.9 per cent in quarter four.

Aside from food stores and online, all other types of retailing recorded large annual falls in sales, with clothing stores recording a decline of 25 per cent versus 2019, the largest on record for that sector.

While manufacturing did less badly, ending the year 3.5 per cent down on a year ago, declining output had already set in during 2019.

Some industries remain significantly below their pre-pandemic levels, not least the manufacture of transport equipment (-11 per cent). Construction increased 4.6 per cent into the fourth quarter and is now just 2.8 per cent below pre-pandemic levels but did see a monthly fall in December of 2.9 per cent.

The ONS suggests construction has been less affected by various restrictions in the latter part of the year, with 80 per cent of construction businesses continuing to trade.

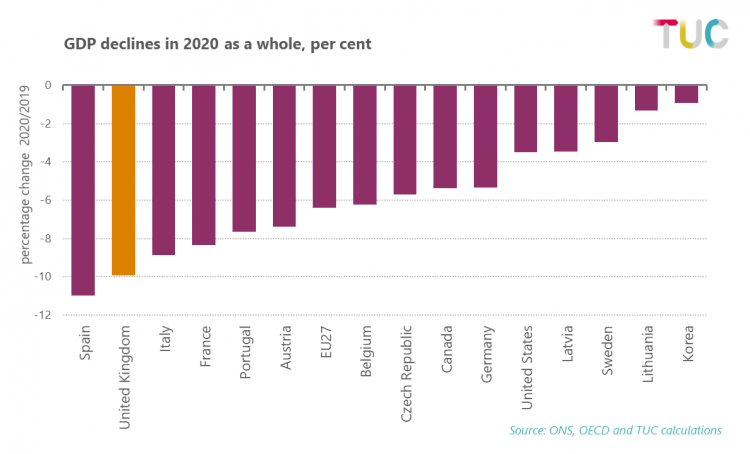

Finally, an alarming figure that has been emerging over the year is the position relative to other countries.

For 2020 as a whole, only a limited number of countries are available, but these show Britain with the steepest decline relative to other G7 economies (Japan is not available but expected to be more around minus 5%), and the second largest decline relative to all OECD countries so far.

There are all sorts of factors potentially influencing this performance. The ONS draw attention to differences in the treatment of certain government expenditures.

But one factor in this may be the less certain footing of UK support to businesses and workers.

Throughout the year the government has always playing catch up, the terrible uncertainties business and workers confront is exacerbated by the extension of measures repeatedly happening only at the last minute.

Today TUC GS Frances O’Grady reiterated the arguments in our budget statement:

“The more people we keep in work, the faster we can recover. But with the job retention scheme set to end in April, millions of people’s jobs hang in the balance.

“It’s time to end the uncertainty and anxiety. The Chancellor must urgently extend full furlough support to the end of the year to keep jobs safe.

“And he must cancel the pay freeze that is due to hit millions of key workers in April. The last thing our businesses and high streets need is to have consumer spending held down when they are trying to recover.”

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox