Challenging Amazon report- What is Amazon up to?

Amazon’s growing presence in the UK

Here in the UK, Amazon continues to increase its presence. In 2019 its UK sales revenue increased by 23 per cent to £13.4 billion (outpacing global sales revenue growth of 20 per cent). As sales increase so does Amazon’s growing network of distribution centres and number of employees which stands at 21 distribution centres, 3 Development Centres, over 30,000 direct employees, as well as multiple Amazon delivery stations and indirect employment through their supply chains, which Amazon themselves estimate to have created 122,000 additional jobs in 2018[1]. They have also recently announced the creation of 7000 new jobs, nearly half of which will come from three new distribution sites across the UK[2].

Reports also suggest Amazon will expand its presence in the UK through the launch of ‘Amazon Go’ convenience stores – where Amazon technology is used to create a checkout-less experience for customers. Ten sites are reportedly planned with a further 20 potentially opening down the line[3]. As is the case globally, their presence in the UK through the cloud computing arm of their business, Amazon Web Services (AWS) is also growing. Amazon Web Services UK turnover hit £850 million in 2018, doubling its market footprint[4]. A substantial part of AWS growth is in the private sector, particularly in banking[5], where concerns have been raised about the increasing concentration of cloud services into the hands of the big three (AWS, Google and Microsoft), including by the Treasury Select Committee[6].

However, equally concerning (and particularly given the Treasury Select Committees concerns) is their increasing presence in the public cloud, where Amazon Web Services now account for over a third of the services that store government held information and are one of the main providers of Infrastructure as a Service (IaaS) and Platforms as a Service (Paas)[7].

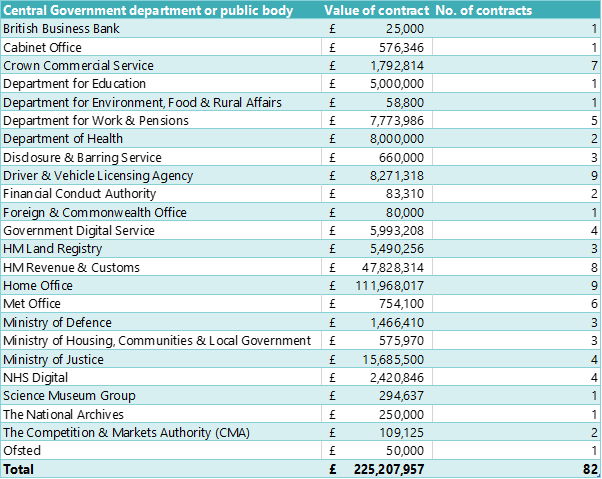

Joint research commissioned by the TUC and GMB shows the extent to which Amazon is benefitting from public contracts. HMRC, the Department for Work and Pensions (DWP), the Cabinet Office, the Drivers, Vehicles and Licensing Agency (DVLA), NHS digital, and the National Crime Agency have all awarded contracts in recent years to Amazon Web Services with a lifetime value of over £225 million as the table below sets out.

In 2020 alone, Amazon has been awarded contracts with a lifetime value of over £23 million, including contracts related to testing and tracing valued at £8.3 million[1]. While local government thus far has spent less on Amazon Web Services, they do spend through the Amazon Marketplace. Amazon have also been named on a procurement contract with a potential lifetime value of up to £400 million to create a centralised digital marketplace for the Yorkshire Purchasing Organisation (YPO) – a procurement organisation publicly owned by 13 local authorities.

Amazon’s growth seems set to continue. Against the backdrop of the coronavirus and the changing nature of retail particularly, warehouse and logistic based jobs are increasing, as demonstrated by the recent announcement from Amazon that they will create new jobs in the UK to meet increased demand[2].

Both central and local government should be holding Amazon to account, ensuring their business model doesn’t hurt workers and communities. But at present, instead of demanding Amazon do better, government in the UK is failing to challenge their numerous damaging business practices, either because they lack the tools to do so or the willingness to act.

All the while as we set out in the rest of the report, Amazon continues to operate a business model that functions on driving down workers’ rights while benefitting from the public purse through the millions of pounds spent on data services and the procurement of goods, as well as the enabling infrastructure that government provides.