Labour market on red alert

On the surface, the data appears to suggest that the Covid-19 pandemic and lockdown have had only a limited impact on jobs.

But the red lights are the detail. In fact, pay is down most for those who can least afford it.

The plan for recovery has to prioritise protecting and creating jobs, because getting people back into work is the only way out of recession.

That’s why the TUC is calling for a new job guarantee scheme to help those who lose work, especially young workers.

New figures show employment falling

New experimental HMRC data on the number of employees in the UK on payrolls shows this fell by 600,000 between March and May 2020.

This seems to be the best guide to underlying movements in the labour market, based on PAYE tax records. The Office for National Statistics headlined these figures rather than their usual assessment of the employment rate – which is a lagged indicator. Figures for January to March showed that at 74.6% it had only fallen 0.1 percentage points on the previous quarter, and unemployment rate which at 3.9% in unchanged on the previous quarter.

The most striking figure is the claimant count measure of unemployment, which has surged to 2.8 million. This can’t be taken at face value as it will include some workers still with jobs but who have become newly eligible for benefits under the government’s emergency measures.

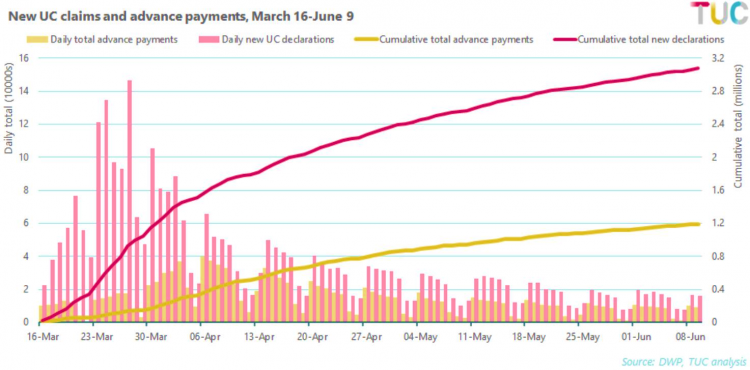

These claimant count figures overlap with direct measures on universal credit which show over three million applications between March 16th and June 9th, and around 1.2 million advance payment loans.

Outside the headline numbers there are big falls in the numbers of hours worked and available vacancies. The total number of weekly hours worked in the three months to April 2020 was 959.9 million, down a record 94.2 million (8.9%) hours on the previous year. This is the largest fall on record (extending to the 1970s) – and is roughly twice as steep.

This fall is perhaps the most comparable with the GDP effect seen last week, though the hours’ impact is some way below output which is basically down 25% over the same period.

Vacancies are down to 476,000 (over March-May) from 841,000 a year ago. This fall of 43 per cent is comparable to the 2008-09 recession, when vacancies fell 35%.

Unsurprisingly pay is down as well. The headline figures (including bonuses) fell by 0.9% in the year to April, down from (+) 1.2% in March and 3.1% in January. The story is more telling by industry, where there are some very large falls in the activities most affected by the crisis – accommodation and food, arts and recreation, construction and retail.

As is now widely recognised, these are also the industries where low pay is most prevalent. The unfair impact of falling pay is seen most clearly in the PAYE statistics. Here over the quarter (three months to April compared to the three months to January) median pay is down 0.6%, but by far the biggest impact is at the low end, with pay down 1.6% on the quarter. At the top end pay is not reduced, except a small reduction at the very top.

It’s clear from these figures that the labour market is on red alert.

We need strong action now to stop lasting economic damage.

The government must work closely with unions and business at national and industry level to get the next steps right.

That means a plan for protecting and creating jobs.

And those who lose work need help, especially young workers, which is why we’re calling for the government to introduce a job guarantee scheme.

This would provide a minimum six months job with accredited training, paid at least the real living wage, or the union negotiated rate for the job.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox