Working families aren't 'just about managing' - they're in danger of going under

When Theresa May first took office in July 2016, she promised to stand up for those who were ‘just about managing’ – people from working families who worry about paying their mortgage, the cost of living and getting their kids into a good school.

But just over two years later, the so-called ‘JAMs’ are significantly worse off today than they were the day she took office.

According to new TUC analysis, households have spent on average £1250 more than they earned in the period since May became Prime Minister – that’s £34 billion in total.

There has been a shortfall in every quarter since she took office. Plus, the shortfalls are concentrated over the poorest fifth of households, where debt levels have soared.

The first shortfall in 30 years has not been driven by excessive spending, but by a collapse in incomes.

So rather than just about managing, it’s clear that many working families simply aren’t managing at all.

The facts

Let’s put the performance of household budgets since Theresa May became Prime Minister in July 2016 into context.

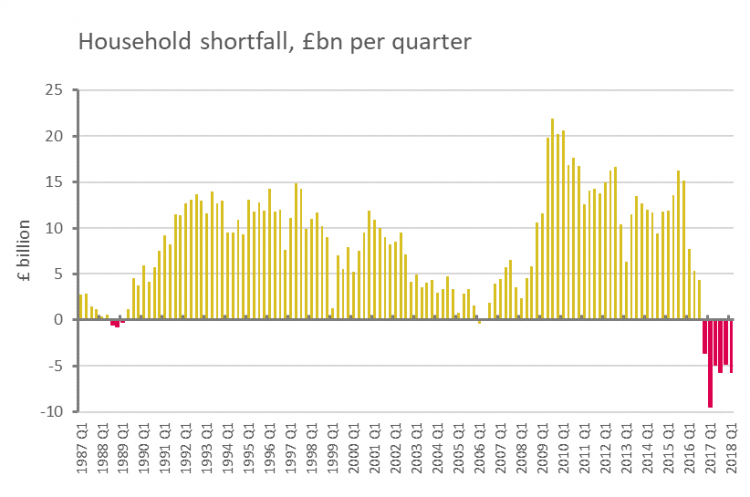

We can see from the following chart that in every quarter since July 2016, household outgoings have outstripped income (2016Q4 to 2017Q1):

The total shortfall is £34bn across all households – an average of £1250 per household.

And the annual shortfall for 2017 of £900 per household was also the first for 30 years. As the ONS has pointed out, even in the run-up to the 2008 financial crisis – an era of 100% (or more) mortgages – we never reached a point when the average household was a net borrower.

Bust not boom

The only other recorded shortfall came in the late 1980s during the so-called ‘Lawson boom’, when the Tories lost all control of the economy. Yet even then outgoings lagged behind incomes for only half as long (1988Q3-1989Q1.

During the three negative quarters of the ‘Lawson boom’, real terms spending grew by an annual rate of 6½ per cent while income increased by 5½ per cent. But over the six quarters since Theresa May took office, household spending has grown by an average annual rate of only 2 per cent, while real disposable incomes have declined at an annual rate of -½ per cent.

This time many households are borrowing to maintain a basic standard of living this time round, in contrast to the heady (though deluded) period in the 1980s.

Poorest hit hardest

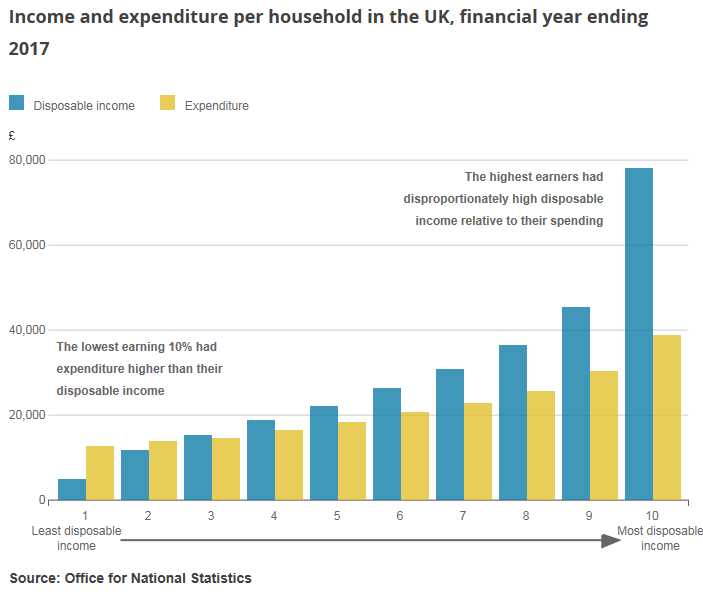

Now let’s take a closer look at how this shortfall is impacting most on lower-income households:

The annual shortfall in 2017 is concentrated among those households that earn the least – particularly the poorest decile.

While it’s important to recognise that household incomes are difficult to measure, it’s clear that the shortfalls are concentrated at the bottom of the income distribution. (And these results have been replicated this week by interesting research from by Nottingham Civic Exchange.)

Meanwhile, those higher up are managing a little better on average, and top earners are having a field day.

Rising debt

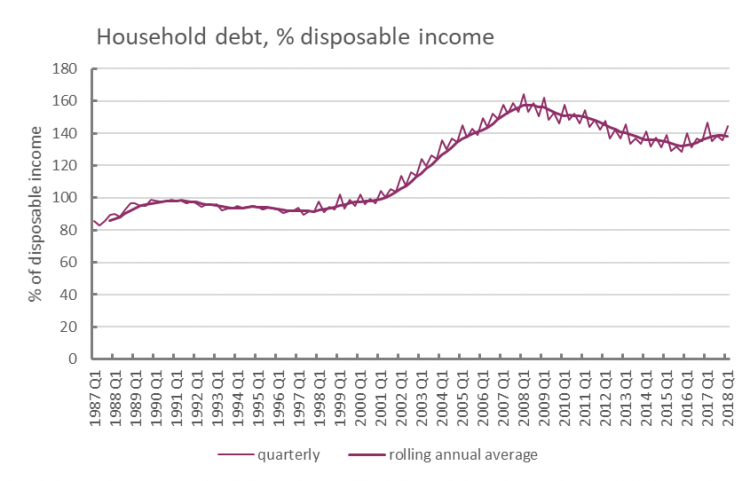

Inevitably, these shortfalls mean households are turning to borrowing. Overall the debt level (including mortgages) is rising again. On a rolling annual average, debt has risen by 4 percentage points of household disposable income since Theresa May’s pledge in 2016Q3.

And while household debt as a percentage of disposable income may be down around 20 percentage points (to 138%) since the peak of the global financial and economic crisis, it is still up 40 percentage points since the ‘Lawson boom’:

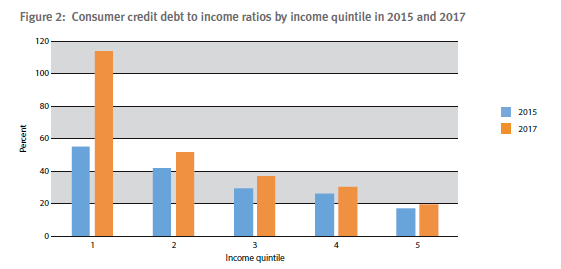

Needless to say, debt levels among the poorest households are of greatest concern.

The Centre for Responsible Credit and Jubilee Debt Campaign show (consumer credit) debt to income for the poorest households rose by a staggering extent from around 55% to 110% from 2015 to 2017:

Not managing at all

Two years since Teresa May took office, working families can’t make ends meet without being forced into the red. And May has done nothing to get wages rising or to crack down on the epidemic of insecure work.

It’s time to get serious about domestic issues. Families on the edge need more than empty words.

For a start, she should do something to tackle insecure work. More than a year after the Taylor report on modern work was published, it’s still gathering dust. But fundamentally we need an economy that generates rising income, so that people can pay their bills.

Methodology notes The analysis is based on commentary produced by the ONS but extending to look at quarterly figures. https://www.ons.gov.uk/economy/nationalaccounts/uksectoraccounts/articles/makingendsmeetarehouseholdslivingbeyondtheirmeans/2018-07-26 The household shortfall is measured by the national accounts net/lending borrowing measure, which compares all household revenues with current and investment expenditures. The June Quarterly National Accounts dataset is used, with figures extending to 2018Q1: https://www.ons.gov.uk/economy/nationalaccounts/uksectoraccounts/datasets/unitedkingdomeconomicaccountssectorhouseholdsandnonprofitinstitutionsservinghouseholds For number of households the 2017 figure of 27,228,000 is used.Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox