Why an interest rate rise is still the wrong decision for workers

In May the Bank of England sensibly defied expectations and chose not to increase interest rates.

The consensus that rates will rise this week has strengthened amongst commentators. But the actual case for a rate rise has got weaker.

The Bank’s mandate is to target inflation. Their case for an interest rate rise is that the economy is near capacity – the point at which further expansion will lead to inflation.

But when we look at wages and prices, the data says the opposite.

That's why we're clear that a rate rise would be another nail in the coffin for any hope of a sustained increase in wage growth.

Because if wages are to rise the economy needs support, not restraint – and the government’s refusal to do what’s necessary shouldn’t mean the Bank simply gives up too.

There are three reasons why now isn't the best time to raise inflation rates.

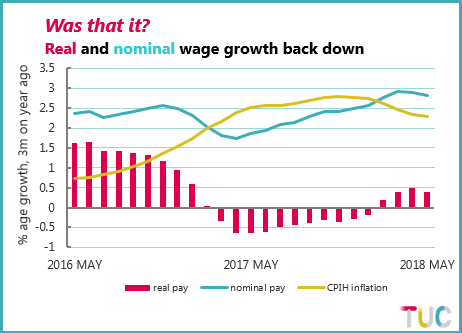

1. Wage inflation has slowed

Regular pay growth has slowed over two months to 2.7% in May from the recent peak of 2.9% in March. Real pay growth (after CPIH inflation) also slowed, after only the briefest revival:

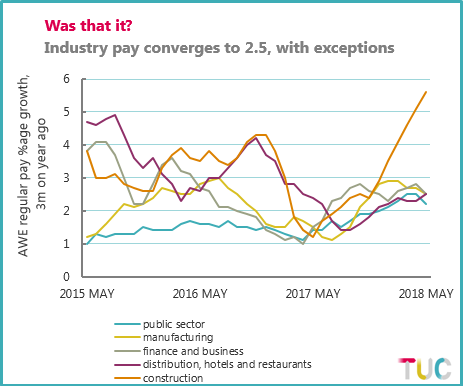

Looking at the industry earnings breakdown, it seems that 2.5% has become the norm:

The exceptions are the volatile construction industry (5.6%) and the hard-pressed public sector (down to 2.2%).

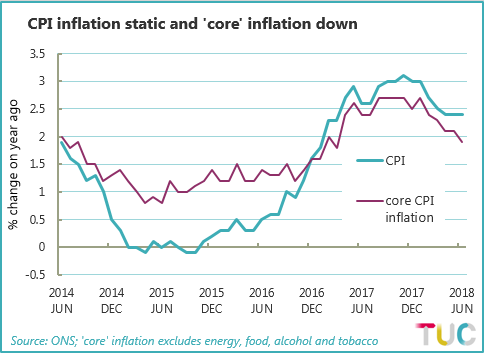

2. CPI inflation has also slowed

CPI inflation slowed to 2.4% in June – marginally lower than the 2.5% expected by the Bank.

Lower inflation across the board is offsetting higher energy prices, with core inflation falling steadily to 1.9% on the latest reading – that’s below the 2% target (though of course the target is for headline inflation):

3. Everything else

Looking more widely, some commentators point to GDP bouncing back from the very weak Q1 figure.

When the last interest rate decision was taken in May, GDP quarterly growth was just 0.1% (it was later revised afterwards to 0.2% following improvements to how construction is measured).

Apart from construction, some bounce-back was always likely given the erratically weak retail sales in the first quarter. Whatever happens in Q2, economic growth is likely to remain subdued.

Others point as to the consistently low unemployment figures, but the link between unemployment and inflation has been broken for years.

In fact, we’re now facing the opposite situation: the price of lower unemployment has been lower wage growth.

Economic growth is also looking fragile elsewhere in world, notwithstanding the stronger (and likely erratic) US figure.

Eurozone GDP came in at 0.3 per cent yesterday, and several emerging market economies are suffering a loss of confidence in financial markets, such as Turkey and Argentina.

Better to hold off

We were never convinced of the case for a rate rise in the first place, as there’s still so much that can be done to build a much better economy.

But commentators seem to think the Bank should simply act according to previous judgements rather than by impartially assessing the data.

That’s why the Bank faced such a storm of criticism for not raising rates back in May, even though this was the right thing to do in the face of a clearly weakening economy.

We hope the Bank is willing to confront that criticism again, given the growing evidence that judgments around capacity are rash.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox