Unbroken austerity economics cuts in half OECD wage growth for a decade

A decade after the global financial crisis, the British economy faces the risk of renewed recession due to weak growth and exposure to what the IMF has warned is a “precarious” global economic outlook.

As the UK and other countries begin to up government spending, political choices around austerity are changing.

But ‘austerity economics’ is far from dead and buried. And it’s still hardwired into policy thinking.

In a report issued today, the TUC calls for a review of the way the Bank of England and the Office for Budget Responsibility judge the impact of government spending on the economy.

‘Lessons from a decade of failed austerity’ calls for urgent changes to undo the disasters of the past decade and for a new approach to the challenging times ahead.

These changes include:

• An independent review of how the Office for Budget Responsibility and Bank of England judge the impact of government spending on the economy.

• Urgent fiscal support for aggregate demand through public sector pay increases and spending on services.

• Fast-track increases to UK public infrastructure spending to least the OECD average of 3.5% GDP.

• Increased expenditure should initially be financed by borrowing rather than increased taxation. This will strengthen the economy, leading to higher revenues that can support spending increases longer term.

• Fiscal policy should be part of a wider plan to deliver sustainable growth across the UK, including investment in the public services families rely on, the skills workers need for the future, a just transition to net zero carbon emissions, and giving workers a real voice at work.

Without this change, government action will fall far short of what is needed.

Political debate will be held hostage to the household budget fallacy and workers all over the world will continue to pay the price.

Unbroken austerity economics

Despite their warnings on the world economy, the IMF call for fiscal policy is as much a statement of austerity:

Where fiscal space exists and debt is sustainable, high‑quality fiscal policy should be used to support aggregate demand where needed.

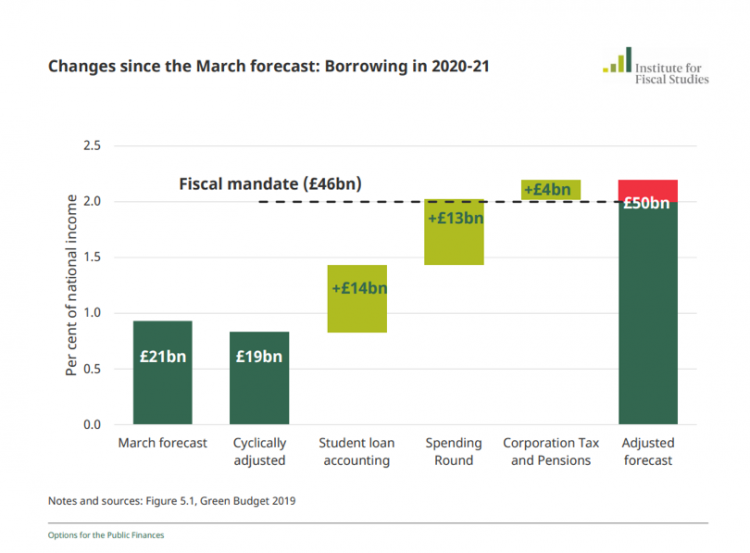

At home, public debate cannot get away from the question ‘how will it be paid for’? And this is still answered by austerity economics. Here for example is the Institute for Fiscal Studies’ treatment of the government’s newly announced spending increases.

Leaving aside the classification changes, spending increases are simply added to the old deficit (on the left) to get the new deficit (on the right).

On this thinking the government budget is like a household budget. But macroeconomics tells us that government spending strengthens the economy and can improve rather than damage the public finances. Our paper shows how the austerity decade has proved the macroeconomics in reverse.

Spending cuts across nearly all advanced economies severely damaged economic growth and had a disastrous impact on workers’ pay and didn’t fix the public finances.

Pay and jobs

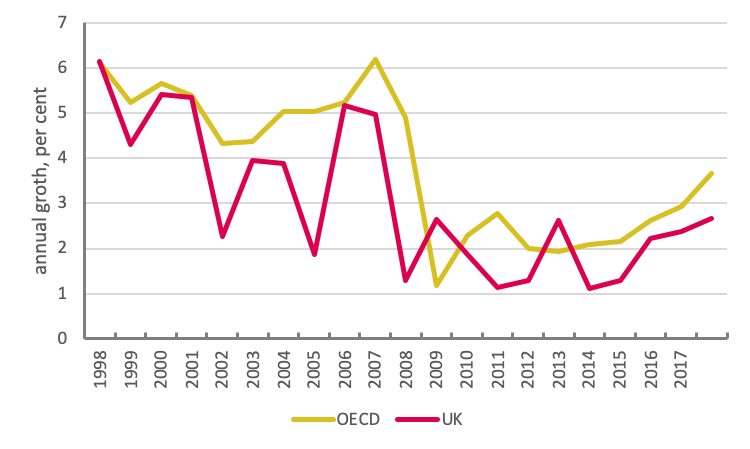

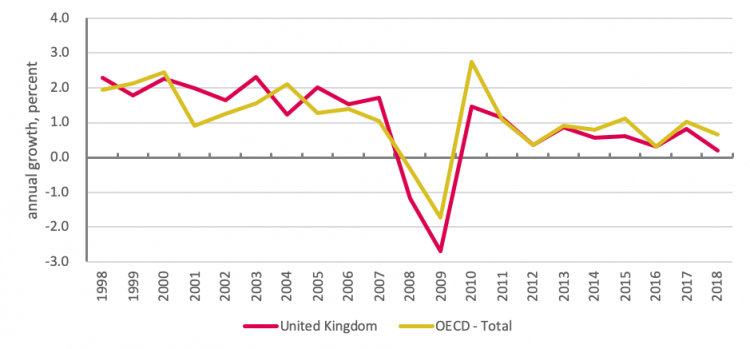

On average, pay growth has halved across OECD countries (comparing the nine post crisis years with the nine pre crisis years).

The chart below shows the OECD average slowing to 2½ per cent from 5 per cent and the UK slowing to 2 per cent from 4 per cent.

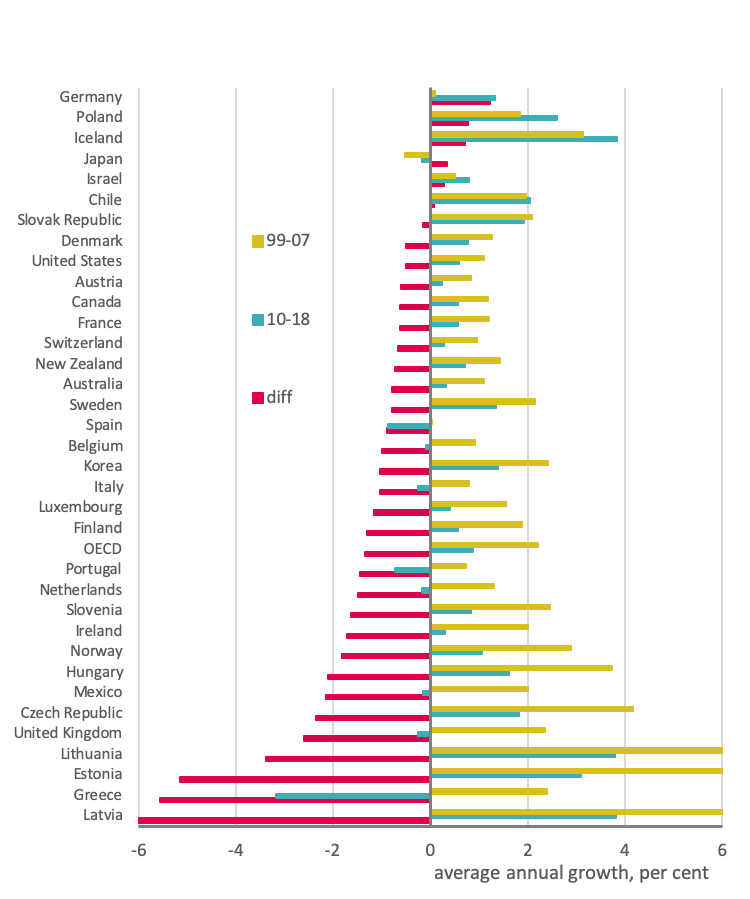

With inflation a little higher than many other countries, the UK does worse on real pay. The chart below shows for all OECD countries average pre- and post-crisis growth and the change. The UK reduction is the fifth largest, and the UK is one of nine countries with falling real wages in the post-crisis period.

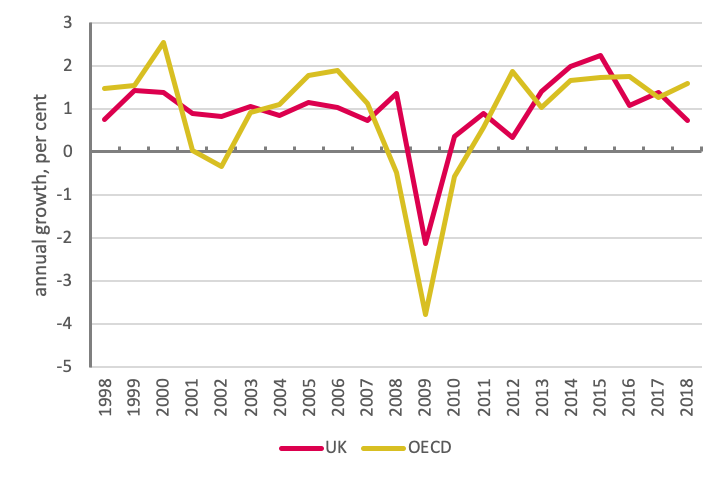

The jobs story is different. The government may like to claim a jobs miracle, but OECD jobs growth is also little different to pre-crisis rates. (Though some countries have had a very tough time.)

However, jobs growth across the OECD is accompanied by the rise of insecure and bad quality work. Renewed calls for flexibility have meant renewed attacks on trade unions. Fundamentally the sum of the parts is increased in-work poverty. For the UK, the UN rapporteur Philip Alston has explicitly rejected the government’s jobs narrative, warning “even full-time employment is no guarantee against in-work poverty”.

Austerity in practice

These labour market outcomes follow from greatly weakened economic growth that is the consequence of austerity.

The calls for austerity began exactly a decade ago in the autumn 2009 reports of the OECD and IMF. The OECD used threatening language:

Government budgets have suffered badly from the crisis and gross debt could exceed GDP on average in the OECD by 2011. Stopping the rot is clearly necessary and will call for fiscal consolidation that is substantial in most cases and drastic in some. Economic Update, November 2009

There is nothing new in economists calling for austerity. This time the argument was dressed up as the new sounding idea of ‘expansionary fiscal contraction’ (EFC). ‘Fiscal contraction’ – cutting government spending – would be ‘expansionary’ – so that it increased other types of spending. The past decade shows EFC was almost 100 per cent wrong.

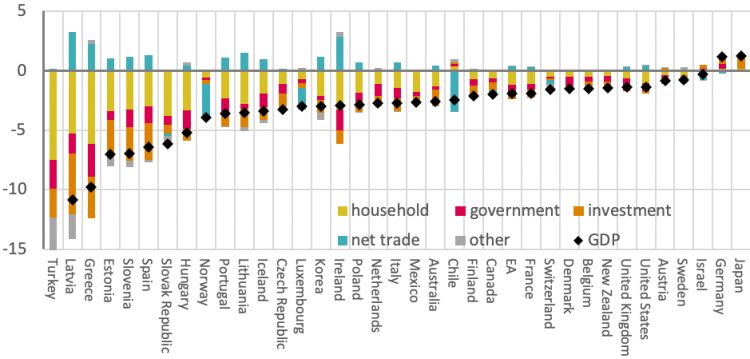

The chart below shows the change in GDP growth since the crisis (i.e. comparing pre crisis, 1999-2007, with post-crisis, 2010-2018).

If expansionary fiscal contraction was correct, the reductions to government spending (shown in crimson), would have been offset by increased spending across all other categories.

But very categorically this was not the case. In 32 of 32 countries where government spending was cut, pretty much every other category of spending in every country also fell (apart from net trade).

The exceptions were Germany and Japan, where government spending was not cut. At the other extreme, some countries took a very severe hit. (And this is why the IMF position is so profoundly toxic: the poorest countries who need most support end up having the biggest cuts.)

Macroeconomic analysis of government spending is based on the multipliers – so that spending has a multiplied effect on the size of the economy. To conform with austerity thinking, the OBR effectively switched off multipliers and set them below one. Such an approach was always highly contentious. Operating from first principles leads roughly to 1.5 for the UK, the figure used by the Obama administration. It is also consistent with the range (0.9-1.7) that the IMF devised in 2012, having U-turned on their earlier calls for austerity. But other policymakers have refused to rethink.

Contesting the productivity narrative

Given this refusal to reassess the (demand) impact of cuts on the economy, the failure of the economy is instead judged to be a failure of supply.

We contest this sleight of hand. In the UK a massive and inconclusive literature is testament to the failure to resolve the ‘productivity puzzle’, i.e. to find a supply side explanation for the deterioration of the economy. Nobody has even bothered to try and explain the same puzzle across pretty much all OECD countries.

We do not deny material structural defects with the UK economy, but the failure since the crisis has been a failure of demand not of supply. The reason there is a productivity puzzle for nearly all countries is because nearly all have austerity.

Though the full story is a little more subtle than this, and the report includes a discussion of the way the labour market has mainly adjusted to low growth through price (i.e. lower wage growth) rather than quantity (i.e. unchanged jobs growth). So, for the OECD as a whole (as well as the UK), low productivity is the result of comparing low GDP growth with relatively high jobs growth. Low productivity is a result of failed outcomes, not the cause. The bottom line is that the best way to avoid low productivity is to avoid cuts – so Germany and Japan are among those who do least badly; conversely Spain and Ireland in fact do best, but at the expense of sharply reduced employment growth.

Support for this argument has recently come from MPC member Gertjan Vlieghe, who observed of a recent book by ex-MPC member David Blanchflower:

I thought he would perhaps argue that, if only there was more demand stimulus, higher productivity growth might return … I would have some sympathy with that idea.

Inflation, debt and excess supply

Moreover, if supply was at fault the world should have been permanently wrestling with inflation. But inflation has been benign all decade and is now even more so:

core inflation has slid further below target across advanced economies and below historical averages in many emerging market and developing economies. (IMF, October 2019)

Rather than deficient supply, wider conditions point to excess supply. This becomes most obvious when central bank efforts to tighten monetary policy repeatedly backfire. Interest rates stay ultra-low, and we end up each time with more rather than less quantitative easing. Each time, panic in financial markets points at underlying and unresolved vulnerabilities from private debts and over inflated assets (Larry Elliott has discussed the latest IMF warnings and related dangers to pension funds – ‘Global economy faces $19tn corporate debt timebomb’.)

But debt inflation arises in a very different way to price inflation. Price Inflation follows when purchasing power becomes too great relative to production. Debt comes as purchasing power falls short of production, when firms and households have to borrow to stay afloat.

On this view, the problem of the world is too much production not too little production – excess rather than deficient supply. The knee jerk reaction to these conditions may be nationalism and protectionism, but this is a symptom of disarray not the cause (and certainly not the solution).

The paramount danger is that this cannot be sustained indefinitely, and global production will come crashing down.

But the better thing to do would be to raise incomes up. As trade unions have argued for more than a century and a half, production is only excessive as long as purchasing power is contained.

Ultimately this points at processes and arrangements with far deeper roots and that operate on much longer time horizons. The problems of the world doubtless go far beyond wrongheaded fiscal policy.

Conclusion

But for present purposes we can be sure that wrongheaded fiscal policy is making the situation greatly worst.

Given dismal outcomes and the world’s vulnerabilities, it is hardly surprising that austerity has fallen out of favour. But it is a travesty that such an extreme economic position was ever in favour. The Harvard historian Adam Tooze has gone as far as arguing the economics have simply been set to serve the politics. At best we are once again victim to groupthink.

It is for these reasons that the first recommendation in our report is for a serious review of how economists and policymakers think about policy, in the context of the failed outcomes of the past decade. Changed policy (the other recommendations) should then be based on changed thinking.

In the meantime, public economists should stop tearing strips from politicians for talking spending, when spending is desperately needed not only to repair broken public services but also to begin to repair a broken economy. Fundamentally it is no less extreme to suggest that properly resourced health, education, housing, welfare, culture, transport etc might be compatible with a working economy and decent labour market. After all, that is exactly what the Attlee government proved after the war.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox