UK third bottom of the global investment league

Today we publish new analysis showing that the UK is one of the worst countries in the OECD for economic investment.

Our figures show that the UK ranks below the OECD average in every single investment category.

After years of government underinvestment, these figures come as no surprise.

Most parts of Britain are crying out for faster transport links, affordable homes and clean energy. And our public services have suffered a devastating decade of cuts.

But the government’s failed austerity agenda means we have failed to invest in the vital infrastructure necessary to boost economic growth and create good quality, skilled jobs.

Britain can be so much better than this.

The government must match the level of public investment in other nations to help rebuild Britain for the 21st century.

And the TUC is calling for the creation of a new National Investment Bank with a remit to target the towns and communities that most need new industry and better jobs.

Relegation zone

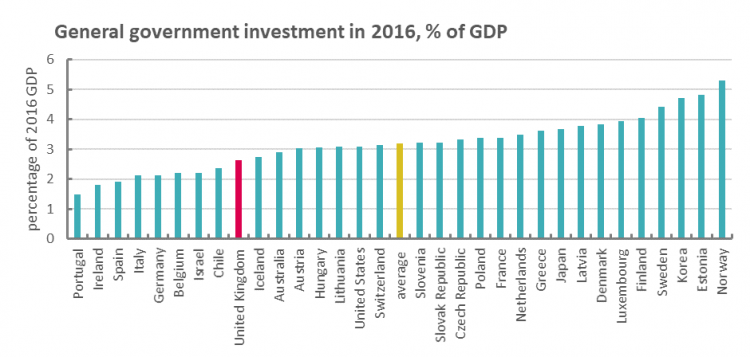

Today’s figures show that the UK is in the relegation zone when it comes to capital investment across the OECD.

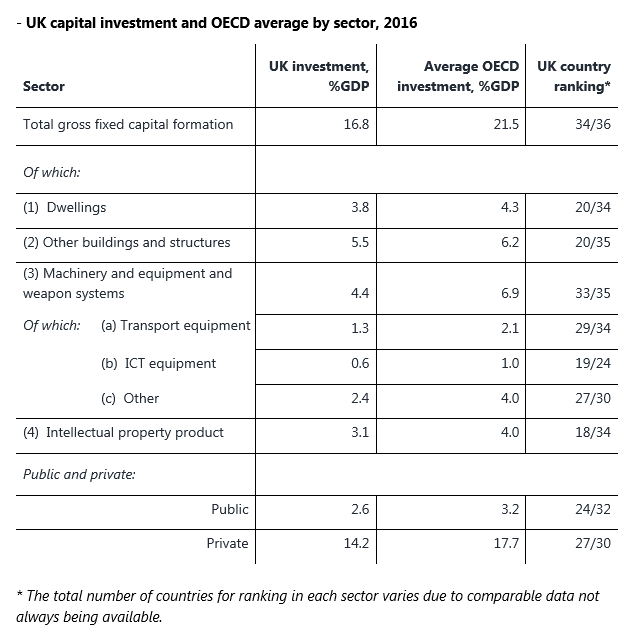

In total, UK capital investment was 16.8% of GDP in 2016, while the OECD average was 21.5%.

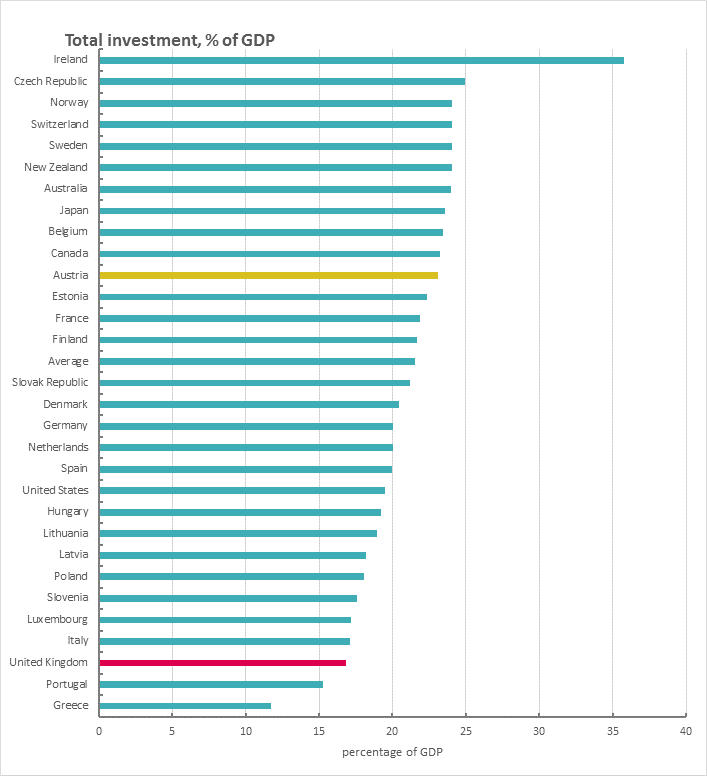

As the following chart shows, that leaves the UK languishing 34th out of 36 countries, trailed only by Portugal and Greece:

And as the table below shows, the UK also ranks below the OECD average in every investment category:

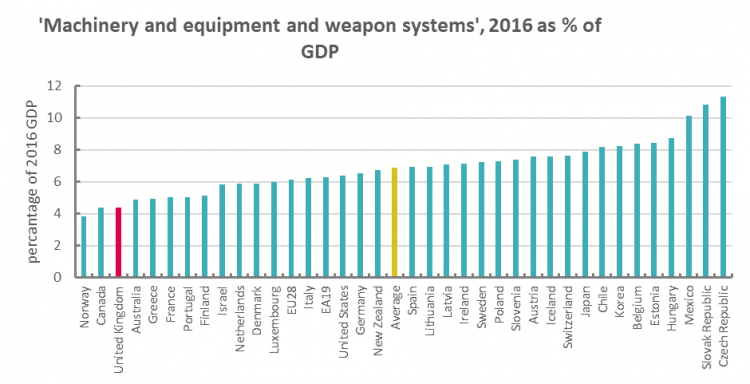

The UK compares worst for investment in the important ‘machinery and equipment’ category thanks to the small size of the our manufacturing industry.

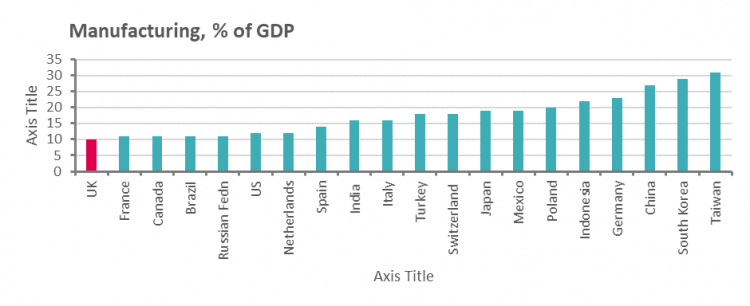

As an aside, the House of Commons Library shows the UK ranking bottom across a cross- section of the largest economies when it comes to the size of the manufacturing industry as a share of the economy:

Finally, despite Britain’s shortage of housing supply, the UK is also still below average for investment in this sector.

Instead of subsidising home loans, the best way to boost UK investment in dwellings would be for the government to increase funding for public house building programmes.

Not enough support

The problem of low investment affects both the private and the public sector.

For private sector investment, the UK ranks 27th out of 30 countries. And for public sector investment, the UK ranks 24th out of 32 countries:

At 2.6 % of GDP, UK public investment is well below the 2016 OECD average of 3.2%.

And while future government spending plans will increase this to just 2.8%, as things currently stand now this would only improve the UK ranking by one position.

A better way

The link between investment and economic prosperity is widely understood.

The OECD itself repeatedly reminds us that “investment spending has a high-multiplier, while quality infrastructure projects would help to support future growth, making up for the shortfall in investment following the cuts imposed across advanced countries in recent years.” (Economic Outlook, 2016)

That’s why the TUC is calling for a £20 billion annual increase in public infrastructure investment that would help us catch up with the OECD average.

Investing to build world-class transport and public services will also help communities thrive and attract new business investment across the country.

So we also need a National Investment Bank that will focus on rebuilding the country, not building bigger profits.

Without greater capital investment Britain will be at greater risk from the challenges of life outside the EU – especially if the Prime Minister fails to negotiate a deal that protect jobs and trade by retaining the benefits of the single market and customs union.

Methodological note

The analysis is based on OECD figures for capital investment as a share of GDP, available on their Annual National Accounts database (http://stats.oecd.org/). Investment by asset and GDP are taken from Table 1: Gross domestic product. ‘Investment’ corresponds to ‘gross fixed capital formation’ (System of National Accounts code ‘P5’). The ratios are derived from cash estimates in national currencies for 2016, which is the most recent year that has figures available for all countries, though a number of countries do not produce figures for some asset classes.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox