Global (G4) QE topping $10 trillion shows policy stance is self-defeating

Recent Bank of England calculations show how massive this support has become, and policymaker reservations are understandable. Bank figures also show the very close link between QE and fiscal policy. The tragic irony is that the restriction of government spending is likely to have exacerbated the reliance on QE. Stronger growth and great jobs depend on a reversal of policy.

Terminology

QE is the process by which central banks create money/expand their balance sheets in order to buy up specified financial instruments (assets) from financial institutions – usually, but not exclusively, government bonds. These policies have become very important in the wake of the global financial crisis as an additional means of supporting economic activity, with central bank policy rates all near zero.

Size of QE

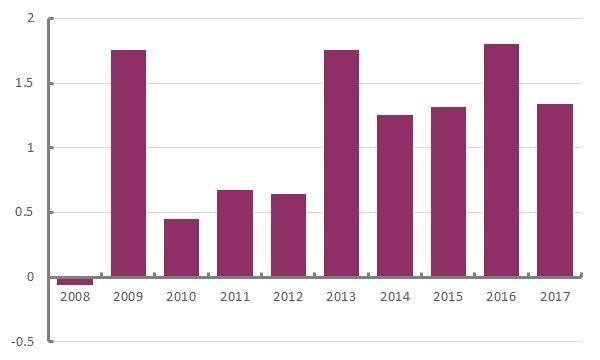

In 2016 the central banks of the major G4 countries (Eurozone, Japan, US and UK) purchased assets worth $1.7 trillion. Figure 1 below shows that this intervention in 2016 was the largest so far of the whole of the financial crisis – surprising perhaps given we are led to understand that the world economy is in goodish shape.

Figure 1: G4 central bank asset purchases, $ trillion

Source: Mark Carney, [De]Globalisation and inflation, speech, 18 September 2017

That said, it was on exactly the same scale as the other larger intervention years: 2009 and 2013. Each of these was followed by smaller-scale purchases in the subsequent years, though the small-scale years seem to be getting larger – purchases over 2017 as a whole are expected to fall back, but will still be the fourth highest since the start of the crisis.

These figures are accessible from individual country central bank websites and other commentary, but were set out in readily accessible form by Mark Carney in the course of his speech at the IMF earlier this week.

Overall, G4 central banks will have pumped $11 trillion ($10,917,000,000,000) into their economies by the end of 2017.

This is an eye-wateringly big number, more than four times the present size of the UK economy.

Policy considerations

Carney’s comments about Europe attracted the most attention, but his speech was wide ranging and included discussion of the global context for monetary policy and in particular the relation with fiscal policy.

We have become accustomed to the idea of ‘fiscal restraint [i.e. government spending cuts] and monetary ease’, with the sense of two policies that operate separately. But Carney’s figures make it obvious that QE is integral to the present fiscal policy setting.

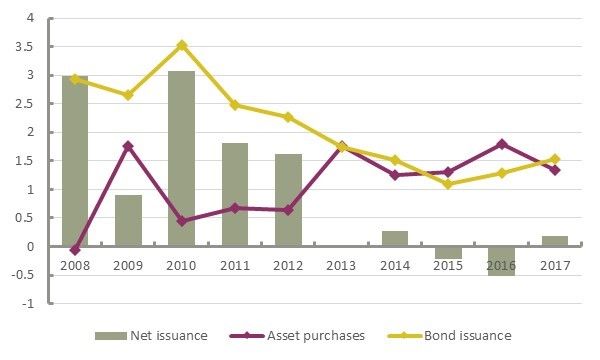

He also provides figures for new government bond issuance in G4 countries, corresponding roughly to annual government borrowing (i.e. the public deficit). These figures for ‘bond issuance’ are shown on Figure 2 (the citrine line) alongside the earlier figures for asset purchases (the aubergine line). Carney calls the difference between the two lines ‘net issuance’ (the sage column). This is basically the difference between annual government borrowing and the scale of QE.

In 2015 and 2016 net issuance was negative, indicating central banks were buying more government debt than governments were issuing. Carney observes “all net issuance within the G4 was effectively absorbed”. The net position is then marginally positive in 2017, with debt/bond issuance continuing to rise, but asset purchases falling back a little. But this is really to split hairs. The point is a fascinating and fundamental one: for G4 countries, the scale of government borrowing has been pretty much equal to the scale of QE since 2013.

Figure 2: G4 QE and asset issuance, $ trillion

Source: as above

Various civil society groups have called for this ability of central banks to create money to be aimed more directly at good causes, most obviously ‘green quantitative easing’. Carney’s figures show just how important this mechanism already is.

The analysis is relevant to the interest rare debate because up to now the willingness of the central bank to buy up government debt has been reflected in a low interest rate on government debt. Holders of government debt have been safe in the knowledge that central banks will be willing to take it off their hands, and so arguably the assets are close to risk-free.

Carney argues that Federal Reserve plans to start reducing their holdings of government debt will start to put upwards pressure on interest rates. (These intentions were confirmed yesterday by the Federal Reserve.) And so this is a part of the broader (international) context for the domestic interest rate debate.

Some reality

But Carney gives the usual caveat around the unwinding of QE: “… the precise degree and timing of this effect are subject to considerable uncertainty”. And rightly so: we have been here before.

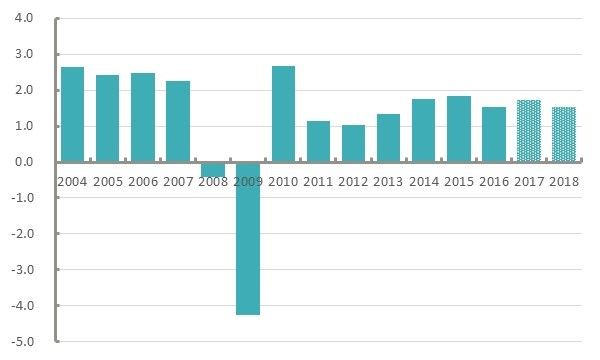

As the chart below shows, policymakers have been repeatedly required to re-expand QE as global economic outcomes have disappointed as a matter of routine. Since the global financial crisis, any spells of growth have been weak and have quickly run out of steam. Figure 3 shows average GDP growth across G4 countries (unweighted) resolutely below 2% since 2010, and even expected to fall back in 2017 (on the basis of this week’s OECD forecast: with Japan and the UK weaker, EU the same and US stronger). Astonishing given the present scale of QE.

Figure 3: G4 GDP growth, %

Source: OECD, average across of G4 countries

Talk of withdrawing QE has repeatedly proved premature. Though central banks have taken turns with the heavy lifting – Carney doesn’t give the detail, but the first two interventions were dominated by the US and the most recent by the EZ and Japan. The Bank of England has operated on a smaller scale (given its smaller economy) throughout, not least in the wake of the EU referendum.

What will make this time different? The problems of the aftermath of the financial crisis are not resolved. Private debt remains high and is rising again in many countries. The rising figures for bond issuance exemplify how the public finances have not been resolved.

Moreover, the action is circular. The failure of the combination of QE and government spending cuts to provide decisive momentum to the global economy lies behind the inability to reduce the public debt (as weak growth translates to weak government revenues and higher welfare spend). So QE is doubly necessary, as the means to provide any forward momentum (no matter how inadequate) but also to mop up relentless increases in public debt. It is understandable for policymakers to have reservations about the scale of QE (and there are many additional concerns, e.g. the distributional effects of supporting asset prices). And it is understandable that they might want a tightening of ultra-loose monetary policy. Conversely it is understandable that civil society might want to deploy this fantastic power at worthy causes.

But the real need is for a policy that works. For the umpteenth time: higher public sending is the means to a stronger economy, stronger public finances and reduced reliance on QE. A debate about monetary policy and inflation will be appropriate only when such an expansionary strategy is in place. Let’s close with the OECD chief economist Catherine Mann’s remarks at yesterday’s launch of their latest Economic Outlook:

"Policymakers should recognise the interconnected nature of their efforts. Better choices on fiscal, monetary, structural, and international policies will improve the well-being of a country’s own citizens, but also spill over to improve the outcome for others, raising the probability that the current cyclical upturn will endure and become the foundation for sustained and broad-based improvements in living standards around the world."

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox