The cost-of-living crisis is far from over

The figure brings inflation back much closer to the Bank of England’s target – but not quite as close as expected (the Bank themselves forecast 2.1 per cent). Rishi Sunak says inflation is back to ‘normal’.

In the real world the cost-of-living crisis is not over. Households have basically endured ten years’ worth of inflation in three years – with prices up 21.3 per cent on April 2021 (on RPI they are up 27.9 per cent). The cumulative impact of these price rises did not vanish in April 2024.

Food and non-alcoholic drink prices are still 31 per cent higher than they were in April 2021. Electricity is up 42 per cent and gas 66 per cent.

According to the RPI (the most relevant measure for those who own a home), mortgage interest payments are up 115 per cent – i.e mortgage payments have on average more than doubled between April 2021 and April 2024 (the latest available month).

TUC survey data

The public are all too alive to the ongoing pressures, as indicated by TUC polling. 60 per cent of people say their living standards have not improved this year, against only 14 per cent saying their living standards are up. Worse:

- 4 in 10 (42 per cent) say they’ve cut back on essentials like food and utility spending this year;

- around a fifth (19 per cent) of respondents say they have fallen behind on household bills this year; and

- Over one quarter (27 per cent) say they have taken out debt (loans, credit) to cover unexpected bills since the start of the year.

Outcomes against other countries.

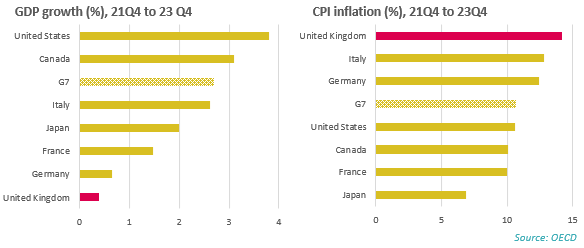

Rishi Sunak will say that he has made hard choices for our own good. But when he pledged to get growth up and inflation down, instead he delivered the opposite. Our analysis from last week showed the UK did worse than all G7 leading economies on both inflation and GDP.

- UK inflation increased by 14.2% while the economy grew by just 0.4%, between the end of 2021 (when interest rate rises began) and the end of 2023 (when data for all countries are available).

- In contrast across the G7 inflation increased by 10.7% on average, while economic growth increased by 2.7% on average.

The conservatives have nothing whatsoever to crow about. Inflation is closer to its target, but the impact of the past three years of high inflation are still being felt. Real wages are £15 per week below where they were three years ago. And this fits into a wider context of pay stagnation under the Tories: real wages are not just lower than three years ago, but also remain below their 2008 level. Fourteen years of repeated failure cannot be disguised by one month’s inflation figure and one quarter’s GDP.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox