The Chancellor must use the spring statement to help workers facing falling wages and soaring bills

The spring statement comes in the context of the illegal Russian invasion of Ukraine, posing a terrible toll on the Ukrainian people. The TUC has called on the government to support all efforts towards a diplomatic resolution of the conflict, and written to the Chancellor to ensure that sanctions are backed by effective enforcement, and that we provide the funding to secure support both for humanitarian aid and for refugees to come to the UK.

The conflict is also leading to significant price rises, leading to further pressures on working people in the UK. Without action from the Chancellor, workers are being walked into a cost-of-living crisis, while energy companies see their profits soar.

This week’s figures (using the CPI measure of inflation) meant that real pay for workers is falling by 1.5% on the year, the worst for eight years. If you use RPI, it's the worst in over a decade: falling by 3.5%. But this year’s pay squeeze hasn’t come from nowhere. Even ahead of the crisis in Ukraine, energy price rises were expected to mean even higher inflation to come. In February, the Bank of England were expecting a 2% real pay decline in 2022 and only marginal increases of ½ per cent in both 2023 and 2024. The UK economy will be characterised by low real pay, low spending and low growth (dismally: 1¼ % in 2023 and 1% 2024).

The Chancellor needs to learn the lessons of the pandemic, and act now to support workers from threats beyond their control. That’s the best way to protect working families and the economy.

Longest pay crisis since the Napoleonic wars

Workers’ real pay is still below where it was before the global financial crisis – this means that workers’ purchasing power has fallen short of the position in 2008 in every year, and the Bank of England expect this to continue until at least 2024. This is wholly unprecedented, with only the experience through the Napoleonic Wars (1798-1822) worse.

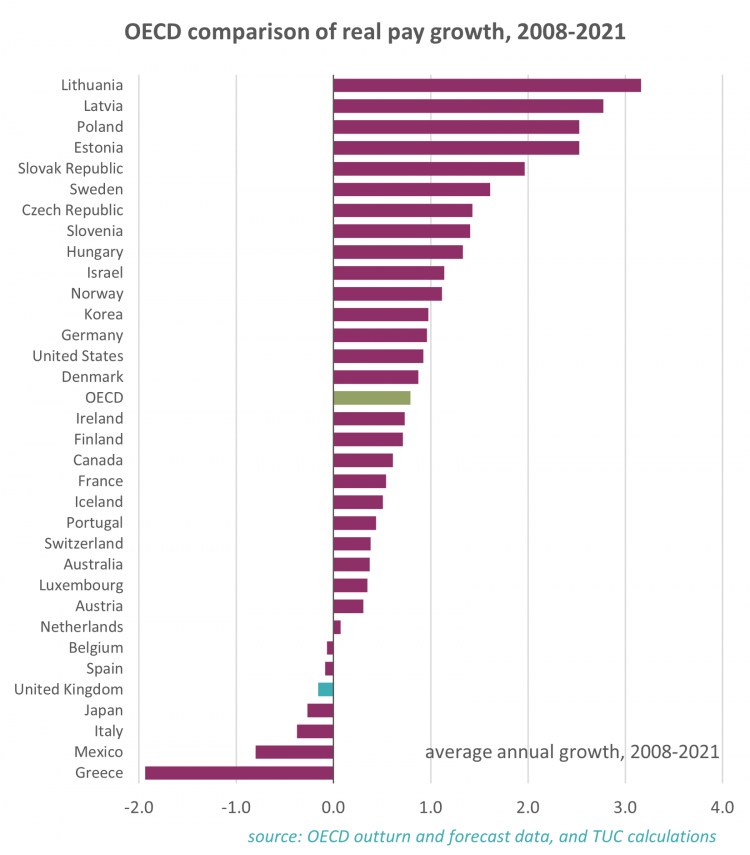

And UK workers have had it tougher than workers across other rich economies. Our new analysis of comparable real pay figures across OECD economies shows the UK fifth from bottom of 33 OECD countries. This looks at the annual average real pay growth since the global financial crisis in 2008 through to 2021, with OECD forecasts used for 2021 as outturn data are not yet available. The UK decline averaged 0.2 per cent a year, when the average across all OECD countries was an increase of 0.8 per cent a year.

Public sector workers have suffered some of the worst pay cuts, following government imposed pay restraint throughout the 2010s. And this is again intensifying, with real pay falling over the year to the fourth quarter of 2021 by 1.6% in health, 4.6% in education and 4.2% in public administration. And we know from the Treasury’s evidence to the pay review bodies that the government is already backing down on its phoney pledge to give all public sector workers a real terms pay rise.

The failed economics of inaction

But it’s not just about public sector workers, the Governor of the Bank of England’s call for wage restraint across the economy was met with astonishment and anger by workers and trade unions.

After a decade of austerity when both public and private sector pay went nowhere, workers’ are asked again to suck up more falls in the standard of living. When will they take on board that cutting pay hits spending and damages the economy? The bigger the damage, the bigger the impact on public finances.

On the other hand policymakers seem determined to fill the pockets of the wealthy, when we know they spend far too little of their massive gains (“the rich can only throw so many million dollar birthday parties”, as economist and FT commentator Matthew Klein put it at a TUC event last year). TUC and High Pay Centre analysis showed how over 2014 to 2018, dividends to FTSE 100 shareholders rose by 58.3 per cent while average UK worker wages increased by just 8.8 per cent (in nominal terms). Right now, the government are letting energy companies rake in profits – while workers struggle to pay their bills.

A spring statement that is fit for purpose

Deliver an immediate boost to pay

Government should:

- Boost the minimum wage immediately to at least £10 an hour, for all workers irrespective of age.

- Fund decent pay rises so that all public service workers get a pay rise that at least matches the cost of living and begins to restore earnings lost over the last decade, through fully independent pay review bodies or collective bargaining.

- Ensure all outsourced workers are paid at least the real Living Wage and receive pay parity with directly-employed staff doing the same job.

- Recognise that collective bargaining is the most sustainable way to boost pay, and use the long-promised employment bill to give trade unions new powers to negotiate fair pay agreements across sectors.

- Take measures to support equal pay including strengthening gender pay gap reporting requirements, and introducing ethnicity and disability pay gap reporting.

- Ensure that fiscal policy is supporting growth and pay.

Fund efforts towards a peaceful solution to the conflict in Ukraine

- We welcome the proposed register of wealthy overseas owners of UK property through the Economic Crime (Transparency and Enforcement) Bill, but this needs to be backed up by sufficient powers and funding for Companies House to enforce.

- Government must fund additional humanitarian assistance for displaced people, and welcome refugees to the UK.

- Government should consider implementing a new 100 per cent tax on additional profits made by UK based companies from their shareholdings in Russian state backed enterprises that have profited from the gas price crisis.

Take additional measures to support families in the UK with rising energy prices

- Government must improve its support for families facing rising energy costs by:

- providing support for households in the form of a grant, not a loan (replacing the energy price rebate)

- an increase in the warm homes discount

- rapid implementation of an accelerated and expanded domestic home retrofit programme, delivered by local councils who are best placed to deliver fast.

- Provide funding for these measures by the implementation of a windfall tax on North Sea oil and gas companies’ profits

- Government must also fix the holes in the safety net which have made families less resilient to rising costs. This should start with an immediate boost to Universal Credit and other related benefits to the value of 80 per cent of the real living wage.

- As the final parts of Covid-related support are removed, families are also facing a rising cost of being sick, Now is the time to fix sick pay by

- removing the lower earnings limit

- paying sick pay from day one

- raising the value of sick pay to the level of the real living wage.

- Childcare costs are also posing a rising burden on families. Government must provide an urgent funding boost to the childcare sector.

- Measures must also be taken to boost the value of both public and private pensions, including restoring the triple lock for 2022/23 and extending auto-enrolment to include more low-paid workers.

Deliver the long-term changes needed for a high-wage, high skill, high productivity economy

The Chancellor should also set out how the government will deliver the changes needed to achieve the Prime Minister’s ambition of a high wage, high skill, high productivity economy. These include:

- New funding for the skills system to deliver access to fully-funded learning and skills entitlements and new workplace training rights throughout the life course.

- Reforms to corporate governance to embed long-termism and sustainable business models in corporate decision making, including reform of directors’ duties and including elected worker directors on company boards.

- Delivering an industrial strategy that delivers good jobs as we transition to net zero, including funding for industrial decarbonisation, and new commitments to deliver supply chain jobs in the UK.

- An expansion in the public sector workforce, delivering the decent public services we need to level up.

There is still the chance to fulfil the promise to build back better after Covid. The Chancellor must commit to that at the spring statement.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox