Beyond the GDP headlines, alarms ring as households cut back

Beyond the usual headlines about the position of the economy compared to pre-pandemic or other countries (see chart at end), alarm bells should be ringing.

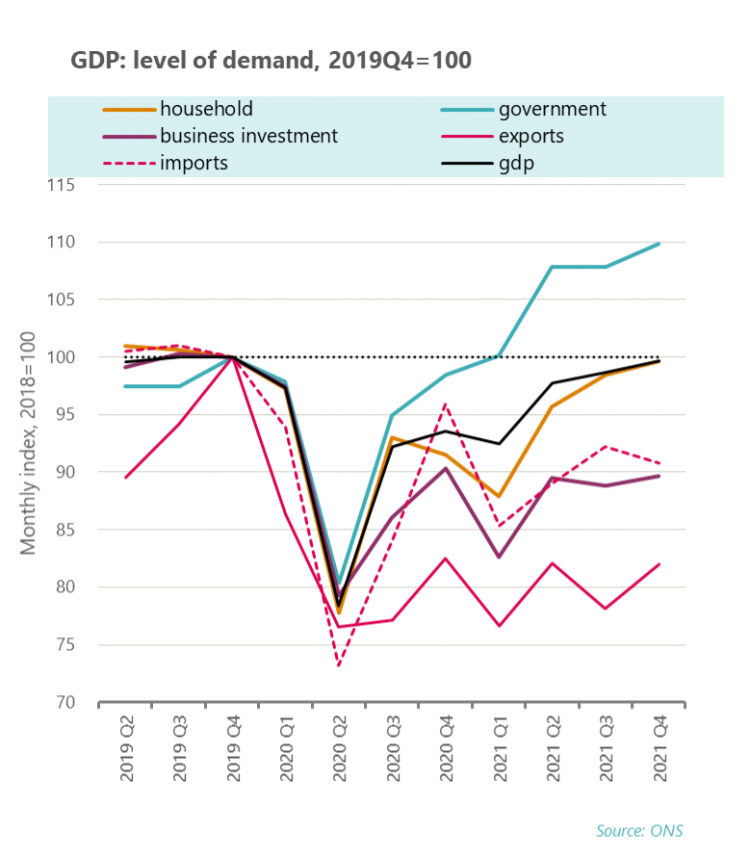

Since coming back from the most severe phase of lockdown, the economy has been sustained by a combination of government spending and a revival in household spending.

As the chart below shows, over the past year exports (red), imports (dotted red) and investment (purple) have basically flatlined (in fact exports have barely recovered any lost ground since the peak of lockdown and Britain’s withdrawal from the EU). Compared with 2020Q4 exports are down -0.6%, imports down -5.3% and business investment down -0.8%. Supporting the economy were government expenditure up 11.6% (blue) and household demand up 8.9% (orange).

But the contribution from household spending is slowing. Up vigorously by 8.9% into the second quarter, it slowed to 2.9% in Q3 and then 1.2% in Q4. Some of this slowdown may be related to omicron at the end of the year, but on top of this comes the increased hit to real incomes and intensifying loss of confidence. Monthly retail sales data for example has fallen in six out of the last eight months, and YouGov polling shows consumer confidence falling “a full point into January”.

And this is what forecasters are expecting. The Bank of England show hard-pressed households cutting back on spending, with growth slowing to a snail’s pace in 2023 and 2024. Why they wrongly want to make it worse with the ongoing increases in interest rates is covered here.

And worse of course is that the government is planning to cut its own support: the Bank reckon on support in the “near term”, but “fiscal policy gradually tightens over the forecast period”.

As Frances continued:

"With millions facing a cost-of-living storm the last thing hard-pressed families need right now is more pay restraint.

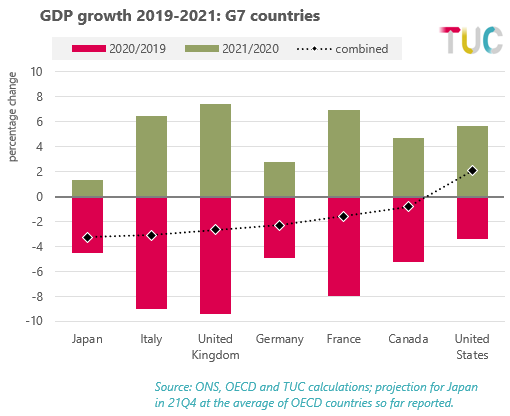

NB For the record, inevitably, the Treasury boasted this morning “the fastest growth in the G7”. Most have been at pains to point out that UK GDP growth of 7.5% in 2021 must be set in context of the 9.4% decline in 2000, which was the steepest decline of all G7 economies. Over both years UK still in the lower half of the league (the ONS more generously suggests the middle).

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox