Sick pay that works

The TUC believes that, while inadequate on its own, rapid introduction of such a scheme could help tackle coronavirus and save many workers from hardship. However, the government has not taken this idea forward as yet.

And it is clear that further action is needed to help those who would still miss out on payments and to reform SSP for the future.

The government should:

- abolish the earnings threshold for statutory sick pay, extending coverage to almost two million workers

- for all absences, remove the waiting period for sick pay

- increase sick pay to £330 a week, the equivalent of a week’s pay at the real living wage

- provide additional funds to ensure employers can afford to pay sick pay.

Introduction

A robust sick pay system is essential.

It safeguards the incomes of those who become sick. And it ensures that those who are potentially infectious stay away from their workplaces.

However, the Covid-19 pandemic has shown in stark terms that our sick pay system is broken.

It needs to be urgently overhauled to help workers through the coronavirus outbreak and beyond.

Analysis by the TUC shows that:

- two million employees are not eligible for sick pay[1]

- and already-paltry minimum levels of sick pay have fallen over the past decade.

On top of this, new research by the TUC contained in this report reveals that self-isolation payments introduced six months ago for workers without sick pay have failed to reach them.

What level of sick pay a worker receives depends on their contract. Sick pay is highly valued and, as workers at retailer Wilko are currently showing, they will even consider taking industrial action to protect their rights.[2]

But many rely on the minimum statutory sick pay (SSP). At £95.85 a week, it is one of the lowest rates of sick pay in Europe. To make matters worse no payments are made for the first three days.

Although this waiting period has currently been suspended, it is still the case that the UK’s low level of sick pay means that during this pandemic many affected workers have been forced to choose between paying the bills and isolating at home.

Many have fallen into debt and the government’s own testing tsar Dido Harding has blamed the lack of decent financial support for deterring people with Covid-19 symptoms from self-isolating.[3]

In partial recognition of the problem, the Department of Health and Social Care has been arguing for universal payments of £500 for those testing positive for coronavirus.[4]

The TUC believes that, while inadequate on its own, rapid introduction of such a scheme could help tackle coronavirus and save many workers from hardship. However, the government has not taken this idea forward as yet.

And it is clear that further action is needed to help those who would still miss out on payments and to reform SSP for the future.

The government should:

- abolish the earnings threshold for statutory sick pay, extending coverage to almost two million workers

- for all absences, remove the waiting period for sick pay

- increase sick pay to £330 a week, the equivalent of a week’s pay at the real living wage

- provide additional funds to ensure employers can afford to pay sick pay.

How sick pay works

Who gets it?

Many people will receive sick pay as set out in their contracts.

Others will rely on statutory sick pay (SSP) which is the minimum that employers have to pay out by law.

The weekly rate for SSP is £95.85. It can be paid for up to 28 weeks.

It kicks in if someone is sick for at least four days in a row, so someone on SSP will normally receive no payment for the first three days.

To qualify, your average weekly earnings over the previous eight weeks must be at least £120 a week.

If you have more than one employer, you can claim SSP from both if you earn more than £120 from each.

You are not eligible for SSP if you're receiving statutory maternity, paternity, adoption or additional paternity pay. The self-employed are also excluded.

Research for the TUC shows that those who are better off are much more likely to receive contractual sick pay.

A BritainThinks survey, carried out on behalf of the TUC, found that almost a quarter (of workers receive only basic SSP if they are off work sick. This equates to around 6.4 million employees.

Some 57 per cent receive their usual pay in full, with 9 per cent telling us they receive nothing. A small percentage of workers receive more than SSP, but less than full pay.[1]

These broad figures mask disparities. For example:

- Some 26 per cent of women receive only SSP, compared to 21 per cent of men. Male employees are also more likely than female employees to receive their full pay (62 per cent compared to 52 per cent), and less likely to receive nothing (8 per cent compared to 11 per cent).

- The less someone earns, the less likely they are to receive full sick pay. While 35 per cent of those earning less than £15,000 per year receive full pay when sick, compared to 87 per cent of those earning over £50,000 per year.

- While black and minority ethnic (BME) employees are as likely as white employees to receive only SSP, BME employees are more likely to receive no sick pay at all (12 per cent compared to 9 per cent) and less likely to receive full sick pay (53 per cent compared to 58 per cent).

- Young workers are more likely to receive only SSP, and young workers and older workers are most likely to receive no sick pay at all.

- Those working from home are much more likely to receive full sick pay than those who are working outside the home (77 per cent compared to 50 per cent).

Who pays it?

Employers pay their employees’ sick pay.

When SSP was introduced in 1983 employers were reimbursed for payments.

This was later reduced to the Percentage Threshold Scheme where employers could reclaim up to 13 per cent of their National Insurance liability.

This was abolished in 2014.

Changes made for coronavirus

Since the coronavirus pandemic began the government has made some small but welcome changes.

No waiting period for Covid-19

As of 13 March 2020, employees and workers must receive any Statutory Sick Pay (SSP) due to them from their first day of self-isolation if it's because they have coronavirus, coronavirus symptoms, someone in their household has coronavirus, they have been told to shield by the NHS or they have been told to self-isolate by a doctor, NHS 111 or the government’s test-and-trace service.

Despite this change, SSP is only payable if the employee has self-isolated for at least four days.

If the employee or the person in their household who had symptoms receives a negative Covid-19 test result within the first three days of self-isolation and the self-isolation ends, they do not receive sick pay.

Payments for some employers

Another change is that employers with fewer than 250 employees can reclaim any Covid-19-related SSP they pay to employees for the first two weeks of sickness.

Self-isolation payments

Since 28 September 2020, some people in England on low incomes who have had to isolate due to Covid-19 have been entitled to a £500 Test and Trace Support Payment.

The payments are available to those who are employed or self-employed, are unable to work from home and receive or are the partner of someone receiving benefits including Universal Credit and Working Tax Credit.

For others who are not receiving benefits but are on a low income there is the possibility of a £500 discretionary payment from their local authority.

However, we show below that there are significant problems with both elements of the scheme.

Many don’t qualify

Currently you must be in employed work earning more than the lower earnings limit (LEL) of £120 to qualify for SSP or any financial support from your employer.

- The self-employed, of whom there are around 4.5 million in the UK, do not qualify, although can apply for Employment and Support Allowance which can be lower or more complex to apply for.[1]

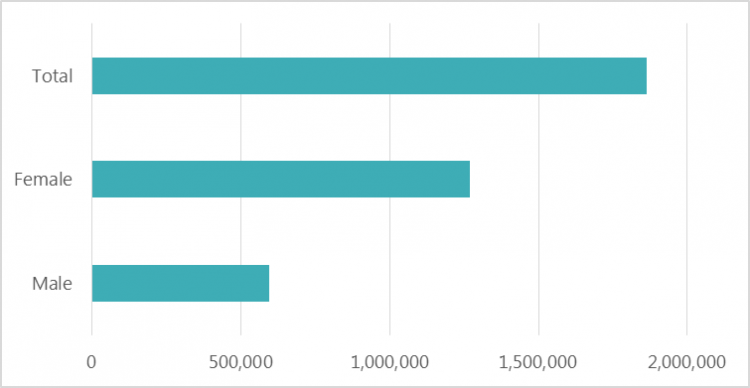

But many of those in work, some 1.9 million of those in employment according to analysis done last year by the TUC, are also not able to claim sick pay when ill.

Women, those in insecure work, and younger and older workers are most likely to miss out.

Indeed, TUC analysis shows around one in ten women employees are not entitled to SSP due to the LEL threshold.

And around 70 per cent of those who would benefit from the removal of the threshold are female.

Numbers earning below the sick pay earnings threshold

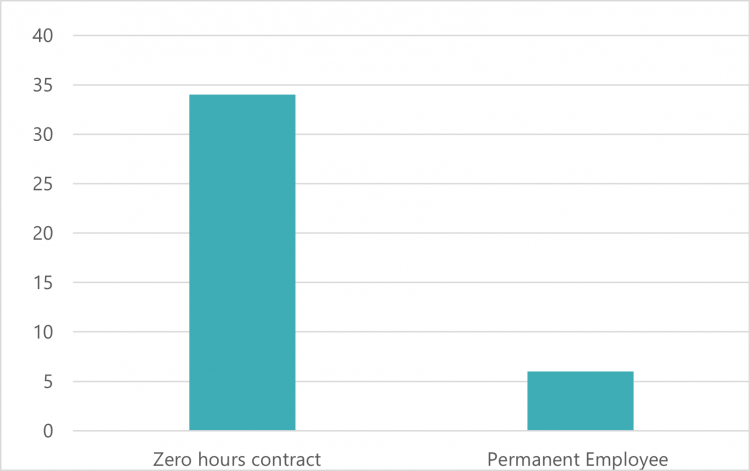

Around a third of those on zero-hours contracts also do not qualify for sick pay, compared to 6 per cent of permanent employees.

This is because their irregular hours may not result in them earning enough to meet the income threshold. Those in insecure jobs may force themselves in to work even if they are unwell – putting their clients’ or fellow workers’ health at risk.[1]

Percentage of zero hours contract workers v permanent employees who do not meet earnings threshold

Polling by the TUC shows that a fifth of workers who have been forced to self-isolate, but unable to work at home, have received no sick pay (or wages) at all.

Low-income workers (one in seven) were more likely than middle and higher earners (one in 12) to have to self-isolate without being able to work from home.[1]

Separate research has shown that those with household incomes below £20,000 were three times less likely to be able to self-isolate compared with those on household incomes of £50,000 and above, despite there being no difference in their willingness to isolate.[2]

The problems caused by the qualifying threshold were recognised long before the pandemic hit.

In 2019 the government had stated that there is a case for extending SSP to all employees, regardless of earnings, after it was proposed in The Taylor Review of Modern Working Practices.[3] And while government consulted on this change in 2019, it has yet to respond to the consultation.

Sick pay is low and falling

The rate of statutory sick pay is just £95.85 a week compared to average earnings of £503.

This means that the average worker would lose 80 per cent of their income if they had to stop work due to coronavirus.

If they were sick for any other reason, the fall would be even greater because SSP doesn’t kick in until the fourth day of absence.

Sick pay has failed to keep pace with inflation in the decade since the Conservatives came to power.

TUC analysis shows that statutory sick pay of £79.15 in 2009/10 would be worth £99.86 today once adjusted for inflation[4].

But the rate workers receive has dwindled in real terms to just £95.85 under first a Tory-led Coalition and then lone Tory governments.

Forcing people into hardship

Such low rates of sick can have a devastating impact on a household’s finances.

Polling for the TUC found that two-fifths of workers say they would have to go into debt, or go into arrears on their bills, if their income dropped to– the current level of statutory sick pay (SSP).

This number rises to nearly half (48 per cent) for disabled workers.

The polling found that, for workers who had been forced to self-isolate and were unable to work from home, one in 10 struggled to cover bills or had to go into debt.[5]

Low compared to other countries

The UK’s sick pay regime is notably less generous than those of other comparable countries.

In the majority of EU countries, the proportion of an individual’s wages that are covered by sickness benefits varies between 70 per cent and 100 per cent.

The UK, alongside Malta, stands out for its rock-bottom replacement rate of just 20 per cent for the average worker.[6]

Many countries have also taken significant steps to improve sick pay provision during the coronavirus pandemic.

In Germany employees who are unable to work at home receive full pay for up to six weeks. This is paid by the employer, who is then reimbursed by the state. After that, workers may be eligible for sick pay. Freelancers and self-employed people are generally also entitled to full pay for six weeks paid by their regional government.

Meanwhile, in Sweden employees receive about 80 per cent of their salary while they isolate, subject to a cap equivalent to just over £60 a day. The self-employed are entitled to payments capped at just over £70.

In Portugal, those employers who have been in direct contact with a confirmed coronavirus case are entitled to 100 per cent of their basic salary, for 14 days. For those who show symptoms, or have tested positive, the same is available for up to 28 days.[7]

It is notable that in several countries particular effort has been made to ensure that the self-employed receive sickness benefits during the coronavirus pandemic.

In Cyprus sickness benefit are paid to the self-employed under the same conditions as for employees. And in Finland a sickness benefit for those affected by Covid-19 (or told by a doctor to go into in self-isolation) will be paid to both employees and the self-employed, accounting for the full loss of income and with no waiting period.[8]

Self-isolation payments

In September, more than six months into the pandemic, the government introduced a £500 payment for those on low incomes who have been told to self-isolate by NHS Test and Trace.

But TUC research has shown that it has failed to meet demand for support.

How the scheme works

The scheme is run by local authorities and offers two payments: the main payment and the discretionary payment.

The main payment, is aimed at the four million people in work and on benefits. The government-set eligibility criteria means only one in eight workers is eligible.[1]

The discretionary payment is aimed at those who miss out on the main payment as they don’t receive the qualifying benefits. Councils can set their own eligibility criteria for this payment.

The government provided £50m funding for the scheme, with £10m for councils’ administrative costs, £25m initial funding for the main scheme, and £15m for the discretionary scheme.

This was intended to cover four months up until 31 January 2021, when the scheme would end.

Councils were told that funding for the main scheme would be topped up if it ran out, but funding for the discretionary scheme was fixed for the four-month period.[2]

This meant that while councils had more control over the discretionary scheme, if they ran out of funding, no more would be available.

70 per cent of applications rejected

New research by the TUC has found that the scheme has failed to address the demand for financial support to self-isolate.

We sent freedom of information (FOI) requests to every English council operating the scheme to find out more about how it was being run.

We asked councils, as of 6 January 2020, how many applications they’d received, how many payments had been made, and how much funding had been used. We asked, where possible, that this be split by main and discretionary applications and payments.

What we found, based on responses from 175 councils, was that the scheme is not meeting the demand and that the funding provided to councils is clearly not sufficient.

Just three in 10 applications to the scheme are accepted, leaving 70 per cent of those that apply for support with no help.

Some 116 councils provided a breakdown of main and discretionary applications. This showed that only 37 per cent of main scheme applications were accepted.

The limited and fixed funding for discretionary funding has led councils to be extremely conservative with their eligibility criteria.

Only one in five applications to the discretionary scheme has been accepted. In a quarter of councils, 10 per cent or less of the applications to the scheme were successful. In some councils, only 1 or 2 per cent of applications were accepted.

Councils are running out of funding

For some councils, the funding provided for the discretionary scheme has not been sufficient.

Of the 169 councils that provided us with information about funding, a quarter had either run out of money for the discretionary scheme or were close to doing so. This left them to either fund the difference themselves of close the scheme.

Some 35 per cent of councils told us that they had run out of funding for the main scheme. While the government has promised to cover this, it does show the extent to which government underestimated demand for the scheme.

A failing scheme

Our findings shows that the scheme is failing to financially support workers who have been required to self-isolate.

This is for two reasons: the eligibility criteria for the main payment means that many workers miss out; and the lack of funding for the discretionary scheme means most applicants are rejected.

Since we surveyed councils, the scheme has been extended with more funding announced. The scheme will now last until 31 March, with an extra £20 million of funding to cover the extra two months.[3]

However, neither the two-month extension nor the extra funding will fix the major flaws of this scheme.

The scheme has been one of the key failures of the pandemic response. It was a late, insufficient substitute for increasing SSP that has left many workers without the financial support needed to self-isolate.

Conclusion

The UK government has lagged behind those of other countries in ensuring that our sick pay system can function through the pandemic and beyond.

Despite acknowledging in 2019 that the current system works poorly for the millions of excluded low-paid workers, it failed to act then or even when the pandemic struck.

Instead, it has relied on a series of half-hearted measures: ending the waiting time for reasons of Covid and introducing additional self-isolation payments for low-paid workers, only a small number of whom have actually been able to claim them.

It is of the utmost urgency that ministers turn their attention to overhauling a sick pay system that does little for many workers and fails to safeguard public health.

[1] TUC (2020). Sick pay for all, TUC www.tuc.org.uk/research-analysis/reports/sick-pay-all

[2] Castle, R. (26 January 2021). “Wilko workers could go on strike over controversial cuts to sick pay”, Burton Mail www.staffordshire-live.co.uk/news/wilko-workers-could-go-strike-4930931

[4] Halliday, J. (22 January 2021). “Ministers consider paying £500 to everyone with Covid in England”, The Guardian www.theguardian.com/world/2021/jan/21/ministers-ponder-paying-500-to-all-with-covid-in-england

[5] BritainThinks conducted an online survey of 2,133 workers in England and Wales between 31st July - 5th August 2020. All respondents were either in work, on furlough, or recently made redundant. Survey data has been weighted to be representative of the working population in England and Wales by age, gender, socioeconomic grade, working hours and security of work in line with ONS Labour Force survey data.

[6] ONS (10 November 2020). EMP14: Employees and self-employed by industry

[7] Full details of our analysis are in TUC (2020), Sick pay for all, TUC www.tuc.org.uk/research-analysis/reports/sick-pay-all

[8] BritainThinks conducted an online survey of 2,231 in England and Wales between 19th November – 29thNovember 2020. All respondents were either in work, on furlough, or recently made redundant. Survey data has been weighted to be representative of the working population in England and Wales by age, gender, socioeconomic grade, working hours and security of work in line with ONS Labour Force survey data. Full details at TUC (6 January 2021) “Government must boost self-isolation support to get control of “spiralling” Covid-19 cases https://www.tuc.org.uk/news/government-must-boost-self-isolation-suppor…

[9] Atchison CJ, Bowman L, Vrinten C, Redd R, Pristera P, Eaton JW, Ward H. (3 April 2020) “Perceptions and behavioural responses of the general public during the COVID-19 pandemic: A cross-sectional survey of UK Adults”. medRxivhttps://www.medrxiv.org/content/10.1101/2020.04.01.20050039v1.full-text

[10] HM Government (July 2019). Health is everyone’s business: proposals to reduce ill health-related

job loss p. 33

[11] Real sick pay is calculated using Consumer Price Index inflation (Apr 2020=100).

[12] TUC (6 January 2021). “Government must boost self-isolation support to get control of “spiralling” Covid-19 cases”, TUC www.tuc.org.uk/news/government-must-boost-self-isolation-support-get-control-spiralling-covid-19-cases

[13] Spasova, S., Bouget, D., Belletti C., and Vanhercke B. (2020). Sickness benefits in the EU: making sense of diversity, ETUI

[14] BBC (23 January 2020), “Covid hand-outs: How other countries pay if you are sick”, BBC website www.bbc.co.uk/news/world-55773591; ETUC (31 March 2020). Sick pay and social protection-related interventions: extraordinary measures to protect workers in times of Covid19, ETUC

[15] Spasova et al

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox