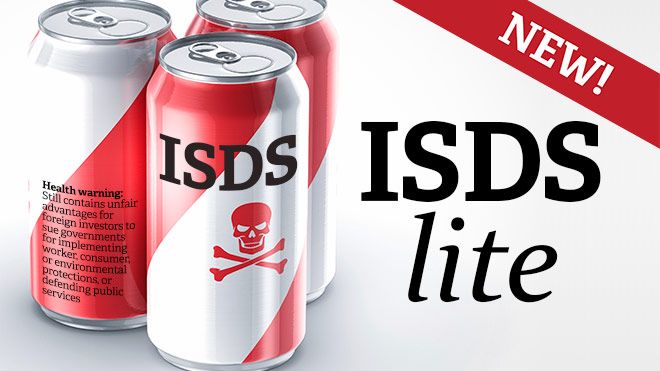

Commission’s proposals for reforms to ISDS: new name, same danger

Last week EU Trade Commissioner Malmström announced proposals for a reformed version of the notorious Investor-State Dispute Settlement (ISDS) provisions in TTIP.

The new system of investment protection she described is called the ‘Investment Court System’, or ICS. Sounds similar to ISDS, doesn’t it? That’s because it is.

Under the new ICS proposals, there is still a special court system for foreign investors to claim their rights, or threaten countries with litigation if they feel their rights have been infringed. This would stay the hand of any government about to do something like introduce environmental regulations or renationalise public services.

No other group gets the kind of rights the Commission still wants to give foreign investors through these courts –not workers, civil society groups or domestic investors.

Meanwhile Malmström’s claim that the ‘right to regulate’ would be protected is undermined by the fact the ISD proposals don’t change the definitions of ‘fair and equitable treatment ‘and ‘indirect expropriation’ in TTIP which give lawyers broad scope to sue governments for regulations, or actions, that are seen as bad for business.

Nor do the ICS proposals address the fundamental point that international courts for foreign investors are not necessary given strong protections provided against expropriation in both the EU and USA.

This is why we’ve managed to do business with each other for hundreds of years without ISDS. In fact, Malmström herself last week admitted that there was no direct relationship between ISDS and increased investment. This is borne out by the fact that Brazil has experienced significant investment without having a single investment treaty with ISDS.

Such concerns with ISDS were the reason civil society groups and unions – including the TUC – overwhelmingly opposed the proposals when the Commission held a consultation on the issue last year.

Detailed summaries of the ICS proposals and why they don’t fix the problems with ISDS can be found here and here.

There is likely to be concern about these proposals in the European Parliament too. UK Labour MEPs, it should be remembered, voted against the recent resolution on TTIP because it didn’t make clear no form of ISDS should be in TTIP.

Last week, Labour MEP Judith Kirton-Darling said of the new ICS proposals:

There is little appetite amongst Labour MEPs to accept a mere rebranding of ISDS.

The Commission also faces an uphill struggle getting these proposals agreed with the USA, as the US Chamber of commerce quickly condemned ICS as ‘deeply flawed’, suggesting that the ‘model Bilateral Investment Treaty’ developed by the US government is better. This model is no better for workers or society though, still giving foreign investors special courts to sue for their rights, and has been condemned by trade unions in the USA.

Looming in the background of all of this is the fact the EU-Canada agreement (CETA) contains ISDS and is due to come to parliaments for ratification next year. US companies with bases in the Canada would be able to use ISDS in CETA to sue UK governments. 80% of US companies have such bases – which means the potential threats of ISDS in TTIP might be a reality through CETA very soon.

Rather than rebranding, the Commission must heed the overwhelming opposition to corporate courts and scrap ISDS in all its forms from TTIP, CETA and all trade agreements.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox