Universal Credit and the impact of the five week wait for payment

The TUC has been campaigning against the unreasonable five wait since its introduction.

We recently set up a survey on our website to hear more about the experiences of those on universal credit and also to gain views on the five week wait from those who were not claiming the benefit.

The survey ran from 19th May to 12th June 2020. We had a total of 386 responses in this short time. The responses were split evenly by those who had claimed and not claimed universal credit. While these responses are not representative, they indicate the problems caused by the five week wait.

- Our survey found over two thirds of those claiming universal credit (71 percent) reported the five week wait to be a problematic feature of universal credit.

- One in five said they could just about cope, and only one in ten responded they could cope.

- The survey also asked those who obtained an advance payment if this had put pressure on their household budget, 86 percent responded this had

- Of those who had not claimed universal credit, roughly the same proportion said they would find the five week wait a problematic feature if they had to claim.

The survey claimant responses were harrowing, with many being forced into debt, relying on food banks or going without food. Many said it had impacted their mental health through stress and anxiety and feeling degraded by the process.

The five week wait in payment is causing immense misery to claimants.

The TUC argue the five week wait for the first payment of universal credit must be replaced immediately with non- repayable grants.

This change must sit alongside a wider set of reforms to the social security system to provide decent support for all who need it.

Download full report (pdf)

Introduction

Under the design of universal credit, new claimants must wait five weeks for their first payment. This means at the point when people are most vulnerable, the system fails to support them and adds to the turbulence of their finances.

The five-week wait has fundamental consequences. Claimants are falling into poverty and debt, and rising numbers are being referred to foodbanks.

Advance loans are available, but these must be paid back out of future meagre benefit payments. Claimants, who have been reluctant to claim cite the fear of falling into debt.

Many more people are now reliant on universal credit than when Covid -19 began. Latest official figures from the Department of Work and Pensions (DWP) show the number of people on universal credit as of 8th of October is 5.7 million. There has been a 90% (2.7 million) increase in numbers from 3 million on 12 March 2020.[1]

The National Audit office estimate that 57 percent of households making a new claim received a repayable universal credit advance in the six months to February 2020.[2]

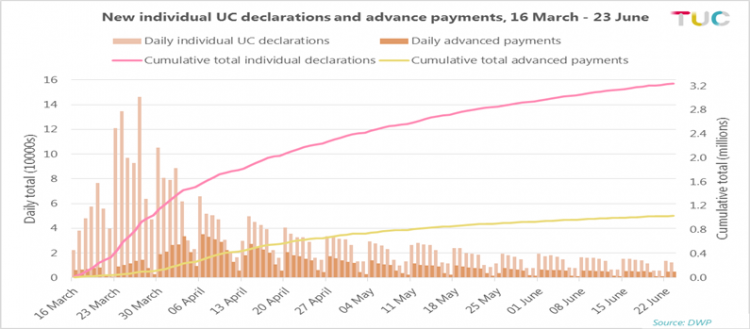

Data on advances are not published in official statistics; however experimental data on advances during the initial period of the coronavirus pandemic was published. Between the start of lockdown and 23rd June over a million advance payment loans were made to new claimants. [3]

There is no justification for the five-week wait for the first payment of universal credit

The government says that the five-week wait for the first payment of universal credit is key to its design. But there is no justification for this waiting period.

The assessment cycle of universal credit is designed with a monthly payment in arrears with the idea being that it ‘mirrors the world of work’. This is seen as central to universal credit, and it is this which results in the five-week wait for the first payment. However, in the world of work not everyone is paid monthly, previous analysis shows the majority of new claimants starting universal credit who had been employed had been paid either fortnightly or weekly in their last job.[1]

Universal credit also fails to take in to account that most low paid workers do not have savings to get them through this wait. The assumption by government that people should have savings to get them through this five-week wait is not supported by evidence.

Citizen’s Advice highlighted prior to the pandemic that the number of households able to save in the UK is at a near record low, with 6.5 million households having no savings at all.[2]

Government argue an advance payment is a solution to the five-week wait. However this is actually a loan and has to be paid back as a deduction from future universal credit payment. This essentially means you are starting your universal credit claim in debt.

The deduction for the advance is capped at thirty percent of your standard allowance currently paid over 12 months and will reduce to 25 percent from October 2021 – a year away.

On top of this claimants are often paying other deductions, for example council tax arrears, utility payments and tax credit overpayments.

In a written response to a parliamentary question on universal credit deductions, it was revealed that more than 1.6 million families on universal credit in May had an average sum of £60 deducted from their benefits. This was during the height of the lockdown and when working people were experiencing huge financial insecurity. A £100 million was deducted from these families, with the majority (86 percent) of this paying back the advance payment. [3]

The recent report by the National Audit office on universal credit and the first payment, highlights the fact that disabled claimants and people on low incomes are more likely to claim advances and have other debts to repay from their universal credit. Some 80 percent of claims by low-income households, 67 percent of claims including someone who has limited capability for work because of a disability or health condition, and 70% of claims including a disabled child had a deduction applied to their first payment to cover advance repayments or other debts. This compares to 61% of all claims. [4]

The five week wait is a fundamental feature of universal credit; however there has been no assessment by the Department of Work and Pensions on its impact on levels of food insecurity, relative poverty, and destitution in the UK. When asked about this by the Poverty Alliance under a FOI the department replied: ‘having searched all our records, I can confirm that we do not hold the requested information in respect of the five week wait’[5]

The fear of debt also means some claimants do not claim the advance payment despite being short of money. Survey analysis by Citizen’s Advice found, more than half (53%) have faced hardship during the five-week wait for their first payment, during the coronavirus outbreak. And they suggest that some are “scraping by” because they are scared of having to repay an advance.[6]

TUC survey on the five week wait

The TUC ran an online survey on universal credit on the website from 19th May to 12th June 2020 to find out more about the experience of the five week wait by claimants, and thoughts on the five week wait more generally. We had a total of 386 responses in this short time. The responses were split evenly by those who had claimed and not claimed universal credit.

In the survey those who had claimed universal credit were asked – were you able to cope with the five-week wait? The 4 responses they had to choose from were, yes, just about, no, not without borrowing money from elsewhere.

Those who had not claimed universal credit were asked a similar question - if you had to claim universal credit would you be able to cope five weeks without payment? The response options were the same.

Our survey found over two thirds of those claiming universal credit (71 percent) found the five week wait to be a problematic feature of universal credit. One in five said they could just about cope, and only one in ten responded they could cope.

The survey also asked those who obtained an advance payment if this had put pressure on their household budget, 86 percent responded this had

Of those who had not claimed universal credit roughly the same proportion as those who did, said they would find the five week wait problematic if they had to claim.

Personal experiences of universal credit

Claimants were asked to share their personal experiences of the five week wait in universal credit with us. The responses were harrowing, with many being forced into debt, relying on food banks or going without food. Many said it had impacted their mental health through stress and anxiety and feeling degraded by the process.

Our survey found 47 percent of universal credit claimants took the advance payment; and overall 71 percent had to borrow money in some way as a result of the 5 week wait.

The survey also asked those who got an advance payment if this had put pressure on their household budget, 86 percent responded this had.

When I first went on universal it was too long to wait for payment so had an advance - then pay back £70 pound a month which is a lot out of your payment…

We had to take the emergency loan out. Which now has knocked our payments down by £80 and so we are still struggling month to month. After we’ve paid our bills out we’ve got £35 for food, gas and electric. How is that viable for us to live.

Got an advance payment, so in UC debt for 1 year.

….During that time I had to take an advance payment loan as well as borrow money from family and friends and another creditor. The impact of the debt is still felt to this day years later and as a single parent, in work and on benefits, that impact can mean going without the basics and essentials.

One in 5 specifically discussed their struggles to pay rent and other bills, with many going without food and other essentials.

Impossible to pay all bills and live without any money. I lived on about £10 a week for food until I got universal credit payment.

Food for the last two weeks was tight but if you count 500 ish calories on some days I did manage to eat.

Luckily I had saved some money which helped me to get by. But had to walk two miles to and from town for four weeks. Also had to resort to having a meal a day. I'm used to taking a lot of fluid; at home it was okay but when out of the house, couldn't afford a bottle of water. Had to cut down on tea as well - couldn't afford milk. For four weeks, no tea.

I won't receive a payment until June the 8th. I'm a kinship carer for my 12 year old grandaughter. I'm scraping through these next few weeks using the free school meals vouchers, but it's a constant worry that I won't be able to afford gas or electric when it runs out….

Nearly 1 in 10 cited having to use foodbanks to get by at some point while waiting.

Am still paying back the Advance. Had to get meals from family members, visit a food bank and get groceries and basic household bathing and cleaning essentials provided by extended family members, since I had so little to live off after paying back the Advance. It was humiliating.

Put me in debt with bills and behind on my rent which meant I nearly lost my home. Had to go the food bank too.

Left an abusive household where I wasn’t allowed own money. Had nothing at all managed to get something from food bank. 2 weeks after claim had to take advance which I am now paying back monthly.

The stress and worry and degrading nature of the process has clearly impacted many respondents – with 1 in 10 respondents referencing the impact on their mental health.

It was very stressful and mentally exhausting. I had to make a difficult decision whether to take an advance payment/loan and suffer a drop in future payments due to repaying the advance back or make do with what I had till the five week wait was over and then receive my first initial monthly sum. I had not claimed any benefits for the last 12 years and found the whole experience to be unjust, shaming and totally unapologetic throughout.

Horrendous, tried everything to avoid claiming so was already in extreme hardship, the stress effected my health, relationship, and general wellbeing. I was lucky to be able to borrow small amounts from family. Was advised not to claim the advance so not to be indebted to the dwp as it would be worse. I suffered a miscarriage and didn't go to the hospital for 3 days because I could not afford bus fare or parking and was unable to walk.

Respondents also shared stories of having to wait longer than 5 weeks with very little communication about what the hold-up was or because there had been some overlap with their previous months pay, some even finding out eventually that they were not eligible.

It was longer than five weeks. My partner made a tiny error on her form and after almost five weeks we contacted to see why nothing was happening, (they said not to contact as they were so busy), we started the clock from that point. It might be a ten week wait.

Mine was a 10 week wait, absolute hell. I now have a £280 a month to live on.

Made redundant 8/4, received 1 weeks pay 15/4 which meant I didn’t qualify for May UC so my first payment will be 14/6 - 9 weeks after being made redundant. I’ve had to live on £500 for 9 weeks & in that time 2 months worth of direct debits have come out!

What others have been saying

Our survey analysis is line with what others are saying on the suffering caused by the five week wait for the first payment of universal credit.

StepChange, show the five-week wait for the first payment led almost all clients affected (92%) to experience some form of hardship or financial difficulty. And their polling indicates that 25% of those receiving universal credit are in problem debt, three times the rate among the general population (8%), and 11% more than those receiving legacy benefits (14%). [1]

Citizens Advice Scotland say their evidence has consistently shown this lengthy wait for payment to be one of the most problematic features of universal credit for CAB clients. It can cause or exacerbate debt problems, as payment of rent, council tax, utilities and other priority bills may immediately be put at risk, particularly if someone has no savings. ……..Many clients have also reported increased stress and negative impacts on their mental and physical health as a result of the wait. [2]

Trussell Trust end of year data for April 2018 and March 2019 show a record 1.6 million food parcels had been given out by the network, a 19% increase on the year before. And it is waiting for universal credit that is a growing trigger forcing people to food banks.[3]

More recent analysis by Trussell Trust shows during the crisis 73% of those that needed to use a food bank and were receiving universal credit were repaying an advance payment. [4]

The House of Lords – Economics select committee recently reported the five-week wait for the first payment of universal credit is the main cause of insecurity for claimants. Many people have nothing to fall back on during this period when their needs are most acute. The wait entrenches debt, increases extreme poverty and harms vulnerable groups disproportionately.[5] Similarly the Work and Pensions Select Committee reported the five week wait in universal credit leaves people with a difficult choice: five weeks with no income, or the risk of debt and hardship later. [6]

Conclusion

Making our social security system fit for purpose requires fundamental changes, including scrapping universal credit.

The immediate priority, however, is for the government to devise an urgent plan to provide financial support and security to those who need it most. This includes - ending the five-week wait for first payment of universal credit by converting emergency payment loans to grants.

Other immediate steps to fix our social safety net include

- Raising the basic level of universal credit and legacy benefits, including jobs seekers allowance and employment and support allowance, to at least 80 per cent of the national living wage (£260 per week)

- Removing the savings rules in universal credit to allow more people to access it

- Significantly increasing benefit payments to children and removing the two-child limit within universal credit and working tax credit

- Ensuring no-one loses out on any increases in social security by removing the arbitrary benefit cap. In addition, no one on legacy benefits should lose the protection of the managed transition to universal credit as part of this change

- The suspension on conditionality requirements for universal credit needs to remain.

Sick pay must cover the basic costs of living

- Statutory sick pay must be sufficient to cover basic living costs. Weekly payments must rise from £95.85 to the equivalent of a week’s pay at the Real Living Wage – around £320 a week.

- The lower earnings limit for qualification for sick pay must be removed to ensure everyone can access it, no matter how much they earn.

Wider package of financial support for households

- The NPRF restrictions need to be removed permanently. Everyone living in the UK must have access to public funds.

- Introduce a wider package of support for households, by increasing the hardship fund delivered by local authorities. A hardship fund should not just be there for the current crisis; government should put in place a fund that provides a permanent source of grants to support those facing hardship.

[1] DWP – Universal Credit Statistics : 29 April 2013 to 8th October 2020 - https://www.gov.uk/government/publications/universal-credit-statistics-…

[2] NAO – Universal Credit: Getting to the first payment - https://www.nao.org.uk/wp-content/uploads/2020/07/Universal-Credit-gett…

[3] DWP - Universal Credit declarations (claims) and advances: management information - https://www.gov.uk/government/publications/universal-credit-declarations-claims-and-advances-management-information

[4] Resolution Foundation (2017), Universal Remedy - Ensuring Universal Credit is fit for purpose- https://www.resolutionfoundation.org/app/uploads/2017/10/Universal-Credit.pdf

[5] Citizens Advice (2018), Walking on thin ice the cost of financial insecurity - https://www.citizensadvice.org.uk/Global/CitizensAdvice/Debt%20and%20Money%20Publications/Walking%20on%20thin%20ice%20-%20full%20report.pdf

[6] https://questions-statements.parliament.uk/written-questions/detail/202…;

[7] National Audit Office (2020), Universal Credit: getting to first payment -https://www.nao.org.uk/press-release/universal-credit-getting-to-first-payment/

[8] Poverty Alliance (2020) - https://mcusercontent.com/4fae14f57a18ee08253ffc251/files/e5fe874c-5d85-45db-a99d-c222bdccc8fb/FOI2019_44340_Reply.pdf

[9] Citizens Advice (2020), Coronavirus claimants facing further hardship in wait for Universal Credit- https://www.citizensadvice.org.uk/about-us/how-citizens-advice-works/media/press-releases/coronavirus-claimants-facing-further-hardship-in-wait-for-universal-credit/

[10] Stepchange (2020), Problem debt and the social security system - https://www.stepchange.org/Portals/0/assets/pdf/social-security-mini-brief-report.pdf

[11] Citizens Advice Scotland (2019) - Voices from the Frontline: The impact of the five-week wait - https://www.cas.org.uk/news/universal-credit-5-week-wait-leads-people-debt-stress-foodbanks-and-ill-health

[12] Trussell Trust (2019) - Caught between a rock and a hard place: why advance payments are not the solution to the five week wait- https://www.trusselltrust.org/2019/05/01/caught-between-a-rock-and-a-hard-place/

[13] Trussell Trust (2020) - The impact of Covid-19 on food banks in the Trussell Trust network - https://www.trusselltrust.org/wp-content/uploads/sites/2/2020/09/the-im…

[14] House of Lords – Economics Select Committee(2020), Universal Credit isn’t working: proposals for reform - https://committees.parliament.uk/committee/175/economic-affairs-committee/news/147638/substantial-reform-of-universal-credit-needed-to-protect-the-most-vulnerable/

[15] Work and Pensions Select Committee (2020) Universal Credit: the wait for the first payment https://committees.parliament.uk/committee/164/work-and-pensions-commit…

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox