Jobs and Recovery Monitor - Issue 1

On the precipice of an unemployment crisis

As fears about jobs and the economy grow, this is the first of a series of monthly reports aimed at informing working people about key statistics and policy concerns.

Redundancies doubled to 227,000 over the latest quarter, the steepest rise on record. Unemployment rose by 209,000 over the year. And employment is down half a million since the start of the year. Slow to emerge in headline figures since the start of the pandemic, an unemployment crisis may now be coming into view.

In parallel other measures – like hours and vacancies – that have tracked more closely the output of the economy appear to have bottomed out. But the future for workers and jobs is highly uncertain, with the pace of recovery already known to be moderating, the introduction of new restrictions, and government protections modified and reduced in size. Ministers need to act more decisively to protect and create jobs, and to pay attention to the IMF Managing Director’s call for “stimuli for job creation, especially in green investment, and cushioning the impact on workers”.

Unemployment and employment

The unemployment rate rose to 4.5 per cent in Jun-Aug 2020 from 4.1 per cent over the previous three months (Figure 1) and from a low of 3.8% at the end of 2019. A quarterly rise of this size last happened in the global recession of 2008-09. The employment rate is down 1.0 percentage points since the start of the year (Figure 2). In numbers, unemployment is up 209,000 over the year to 1.5 million, and employment is down almost 500,000 since the start of the year.

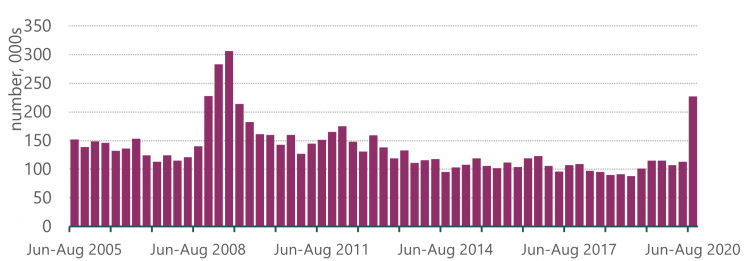

Redundancies

The fall in employment and rise in unemployment are matched by redundancies. Over the latest quarter, redundancies doubled to 227,000 (Jun–Aug) from 113,000 (Mar–May). This is the steepest quarterly increase on record, with the level of redundancies in the latest quarter close to the peak quarters of the global recession.

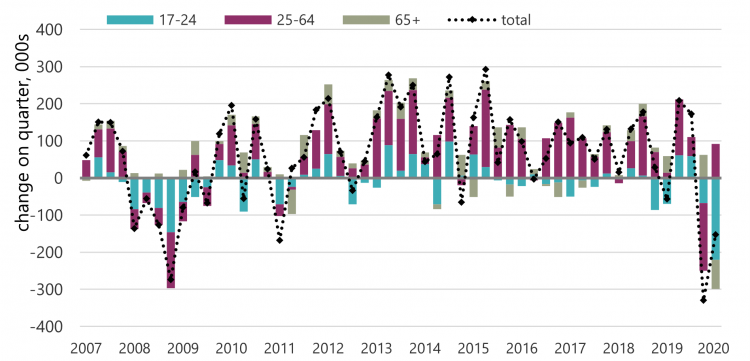

Age impact

While, in the most recent quarter, redundancies were split fairly evenly by gender, men accounted for three quarters of the rise in unemployment over the year. But the most striking feature is age, with young people so far hit hardest. Figure 4 shows the changes: while the data now show the 25-64 group (purple) hit hardest at the start of the pandemic, in the latest quarter there was a record fall in employment for younger workers (blue), while the 25-64 group bounced back a little. Throughout the recession of 2008-09 the employment impact was disproportionately on the young. Later editions of this report will look at how other equalities groups have been impacted.

Of the 480,000 reduction in employment since the start of the year, 470,000 are (full and part-time) self-employed and 240,000 part-time employee posts; conversely there has been a rise of 280,000 in full time employee posts. ONS note there may be some difficulties with this allocation,[i] which likely overlaps with long-standing controversies around the use of the self-employment classification among employers seeking to reduce labour costs.

Industry allocation

A critical feature has been the differing impact according to industry, not least in terms of ‘front line workers’, the extent of use of the furlough scheme, and the ability of workers to work from home. Employment figures (which are based on information provided by firms) now extend into 2020Q2, and show employment falling in a majority of industries (Figure 5). The largest falls are in accommodation and food (though ahead of the impact of ‘eat out to help out’) and administrative and support services, which includes travel and recruitment agencies. The biggest increase was for retail and wholesale, likely reflecting on-line activities.[ii] Some new jobs will likely be insecure. We know that the number of people in employment on ZHCs rose substantially between 2019Q2 and 2020Q2, rising to over 1 million for the first time on record. Across this period, the number of those on ZHCs in wholesale and retail rose by 41 per cent.

Decline arrested

Over recent months the biggest declines have been across total hours, vacancies and a real- time measure of employees. Matching headline figures for monthly GDP, in each of these cases the declines have now bottomed out.

- Hours fell from 1,050 million at the start of the year to 870 million in Mar-May 2020, and rebounded slightly to 890 million in Jun-Aug.

- Vacancies fell from 800,000 at the start of the year to a low point of 340,000 in April-Jun and now back to 490,000 (Figure 6).

- Employee jobs fell from 29,020 thousand in January to a low point of 28,310 thousand in August, and were up marginally to 28,330 in September.

Monthly GDP in fact was at a low point in May, and rebounded vigorously into June (9.1 per cent) and July (6.4 per cent). The August figure was more subdued (2.1 per cent), in spite of a big boost from ‘eat out to help out’.

Regional and national

According to ONS regional figures, employment was still expanding in London into Jun-Aug 2020: by 170,000 on the year (Figure 7) and 70,000 on the quarter (Figure 8). Conversely, employment fell over the year in all other English regions, except the North West. The deterioration in the South West was particularly sharp, with the employment rate down on the year by 4.2 percentage points. Scotland also bucked the trend, with a small rise on the quarter.

Policy

In her reaction to today’s figures TUC General Secretary Frances O Grady warned:

We are on the precipice of an unemployment crisis. Ministers must act now to protect and create jobs. The expansion of the job support scheme is a step in the right direction, but it still falls short.

Wage replacement should be 80% for businesses who have to shut. We need a more generous short-time working scheme for firms which aren’t required to close but will be hit by stricter local restrictions. And self-employed people in local lockdown areas need help too.

Ministers must do more to create good new jobs. TUC research shows that we could create 1.2 million new jobs in the next two years in green transport and infrastructure, and another 600,000 by unlocking public sector vacancies.

These calls resonate with the remarks last week of IMF Director General Kristalina Georgieva.[i] Warning of the danger of premature withdrawal of government and central bank protection for workers and firms, she also addressed the creation of work:

… fiscal policy will be critical for the recovery to take hold. This crisis has triggered profound structural transformations, and governments must play their role in reallocating capital and labor to support the transition. This will require both stimuli for job creation, especially in green investment, and cushioning the impact on workers: from retraining and reskilling, to expanding the scope and duration of unemployment insurance. Safeguarding social spending will be critical for a just transition to new jobs.

The stakes are getting higher and higher. With business and worker confidence in retreat, only the government is in a position to create work. Without decisive action, the threat of mass unemployment will become a reality.

Read all the issues in the Jobs and Recovery Monitor series

Related reports:

-

Jobs and Recovery Monitor - issue 1

-

Jobs and Recovery Monitor - BME workers - issue 3

-

Jobs and Recovery Monitor - Regions - issue 4

-

Jobs and Recovery Monitor - update on young workers - Issue 5

[1] https://twitter.com/jathers_ONS/status/1315923245552500736

[1] See related TUC commentary on Amazon: https://www.tuc.org.uk/blogs/what-can-we-do-about-amazons-treatment-its-workers

[1] https://www.lse.ac.uk/Events/Events-Assets/PDF/2020/03-MT/20201006-The-Long-Ascent.pdf

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox