Why we need an increase in statutory sick pay

The current weekly rate of statutory sick pay (SSP) is just £96. This is around one-fifth of average weekly earnings, meaning that if the average worker is off work sick for a week, they lose around 80 per cent of their usual earnings.

Current government guidance requires those with Covid-19 symptoms to self-isolate for ten days. Those who live with someone with symptoms, or have been contacted by the test and trace service, must self-isolate for two weeks. The average worker self-isolating for two weeks on SSP would lose over £800 across this period.

A new TUC/BritainThinks survey shows that 43 per cent of workers would have to go into debt or not pay bills if they were on SSP for two weeks.

Those who have been working outside their home are more likely than those working from home to say they’d fall into debt or not been able to pay bills (47 per cent compared to 37 per cent). And those on low and average incomes are less likely than higher earners to be able to cope on SSP for two weeks.

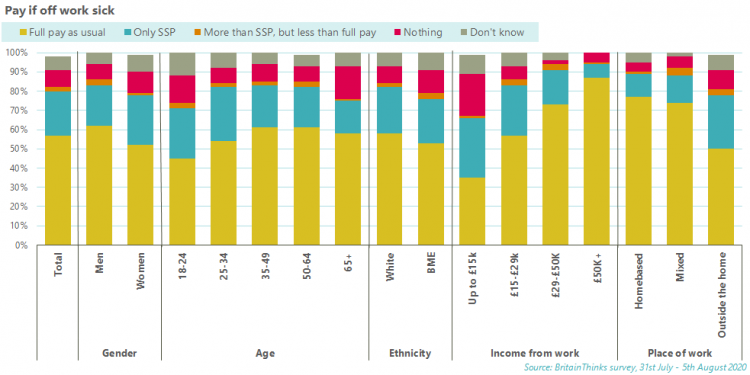

These two groups are also more likely to receive only SSP when they’re ill. While three-quarters (77 per cent) of those working from home receive their usual pay when sick, only half of those who don’t work from home do. 87 per cent of higher earners (£50k+) receive full sick pay, compared to just 35 per cent of those earning less than £15,000 p/a.

Some workers miss out on SSP entirely.

To be eligible, an employee must, on average, earn £120 per week. This excludes 1.8 million employees, 70 per cent of whom are women. This particularly impacts young workers, older workers, those on zero-hours contracts, and low-paid occupations.

The UK’s 5 million self-employed workers are also not eligible for SSP.

The wider problem of household debt

Before the pandemic hit, we warned that the looming household debt crisis should be a key priority for the new government.

This situation has been made worse by the pandemic. Research by Citizens Advice estimates that around 6 million people have fallen behind on bills due to the pandemic.

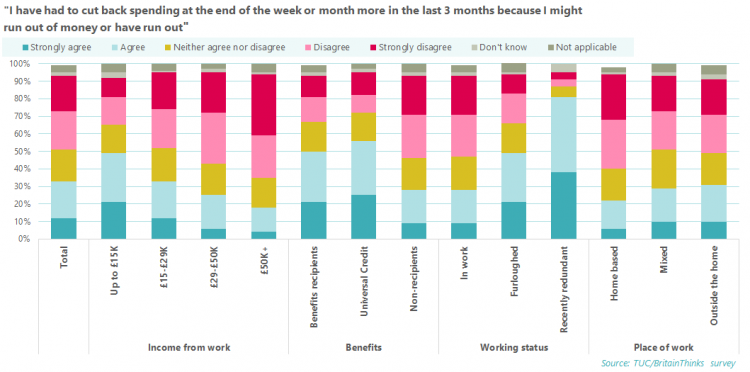

A third of workers told us that they have had to cut back spending at the end of the week or month in the last 3 months, because they have run out, or might run out, of money.

Disabled workers, those on lower incomes, furloughed workers, BME workers and female workers are all more likely to cut back on spending.

Notably, while some agree that they are having to cut back due to the pandemic, there are plenty who disagree, especially among high earners and home-based workers.

These different experiences of the pandemic were also highlighted when we asked people about levels of debt and disposable income since the pandemic began.

While 22 per cent agreed that they’d reduced their debts since the beginning of the pandemic, 42 per cent disagreed. One-fifth of workers (21 per cent) told us their disposable income has increased since the pandemic began, whereas half of workers (52%) disagreed with this.

This reflects a trend that while some are saving money due to the restraints on spending and money saved on commuting, others are struggling due to being on reduced wages or already low incomes.

Many of those struggling are currently being given respite by temporary measures such as payment holidays, the furlough scheme, the ban on evictions and a pause on bailiff action. However, these support measures have ended or are set to end over the next few months. If no action is taken, this is likely to lead to a household debt crisis.

What needs to change

We need to increase SSP to the equivalent of a week’s living wage (£326) and expand it so it’s available to all. Otherwise, those who have to self-isolate will face the tough choice between self-isolating and falling into debt, or going to work with symptoms.

Increasing and expanding SSP will help some to avoid falling into debt, but on its own it won’t solve the looming debt crisis. To do that, we need an extensive support package for households, an emergency overhaul of our broken social security system, and a targeted extension of the furlough scheme.

A support package for households should include:

- A freeze on council tax debt repayment

- Significant increases to the hardship fund delivered by local authorities, as well as establishing this fund as a permanent source of grants

- Support for renters, including an extension of the eviction ban

The government should also explore writing off council tax debt and providing the outstanding money to councils. This would provide support for struggling households and a much-needed cash injection to local councils.

Without proper support, we face a debt crisis that will leave many facing repayments for years to come. On a wider scale, it may also dampen any future economic recovery. Any recovery will depend on people being able and feeling confident to spend. This is unlikely to be the case if people are burdened by debt repayments.

If you think sick pay should be higher, take action today and sign the petition.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox