Six reasons why today’s inflation figures shouldn’t lead to an interest rate hike

In January CPI inflation was unchanged at 3.0%, in line with the Bank of England forecast issued last week. RPI was 4.0%.

Prices growth continues to outstrip wage growth, last measured at 2½ per cent in November. Over the year as a whole, real wages are likely to have fallen by 0.4% in 2017 (the earnings figures for December are out next week). Real wages have fallen in seven of the nine years since the global recession, and the OBR expected them to fall again in 2018. In terms of GDP, 2017 saw the slowest growth for 5 years.

So why is the Bank of England talking about putting up interest rates? A common-sense understanding suggests that interest rate rises are meant to contain an economy that is growing ‘too fast’, not one where growth is too slow.

But according to the Bank’s analysis, demand in the economy may not be excessive, but the ability of the supply side of the economy to meet it is seriously deficient. The sum of the parts is still a threat of inflation and so the need for a rate rise. “You what?”, might be a fair question. Even more because while demand excess tends to be quite obvious (e.g. ‘conspicuous’ consumption), talking about the supply side is often hypothetical and oblique (e.g. capacity constraints, natural rates and output gaps). The Bank can only point at things that they think will mean higher inflation.

The case for a rise in interest rates is far from proved. Here’s six reasons to think it’s the wrong medicine:

1. Inflation is falling back

Most obviously the Bank of England themselves think inflation is falling back now. They expect inflation to be 2.9% in 2018 Q1 and 2.6% by Q4. They operate under the impression that rate changes affect inflation in more than a year’s time, but, in reality, the immediate outlook is for less rather than more inflation.

This is set to put the UK more in line with the rest of the world, as the effect of the devaluation of the pound falls out of the figures. As the OECD said in November: “inflation is projected to remain moderate in the major economies”.

2. Domestic inflation is benign

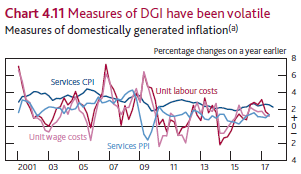

The Bank suggest that measures of domestically generated inflation “while useful can be misleading” – helpfully pointing the interested reader to a box in the May 2017 Inflation Report. On (a slightly small and crowded) chart (below), they show “measures of service sector inflation and those based on the GDP deflator … have fallen back in recent months”, though the title is unhelpful (DGI refers to domestically generated inflation).

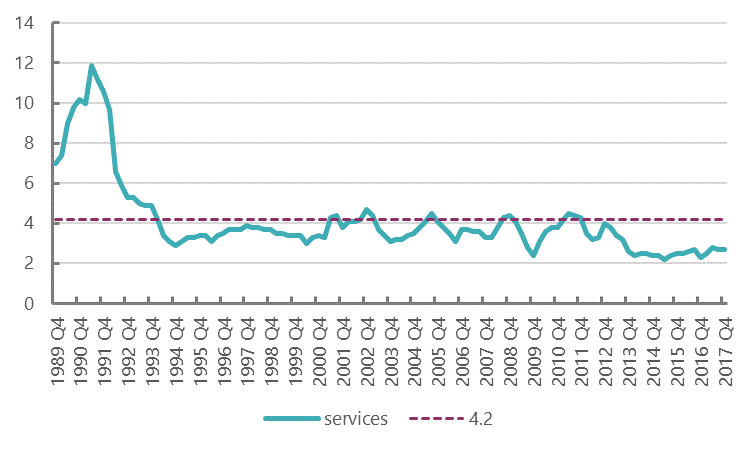

The service measure of the CPI is probably most interesting point here – the chart below shows quarterly figures. Against a long run average of 4.2 per cent, the 2017Q4 reading was 2.6 per cent (January 2018 was 2.8%), and the measure has been pretty much flat for four years.

Services CPI inflation, per cent

3. (Nominal) wage inflation is not taking off

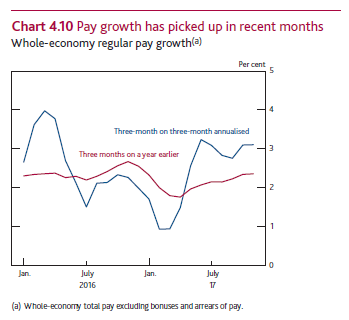

The Bank also show an inventive chart comparing an annual wage growth measure derived from the three-month on previous three-month change with the published headline inflation measure that compares three months with the same period a year ago. Here it is (this time with a rather short x-axis).

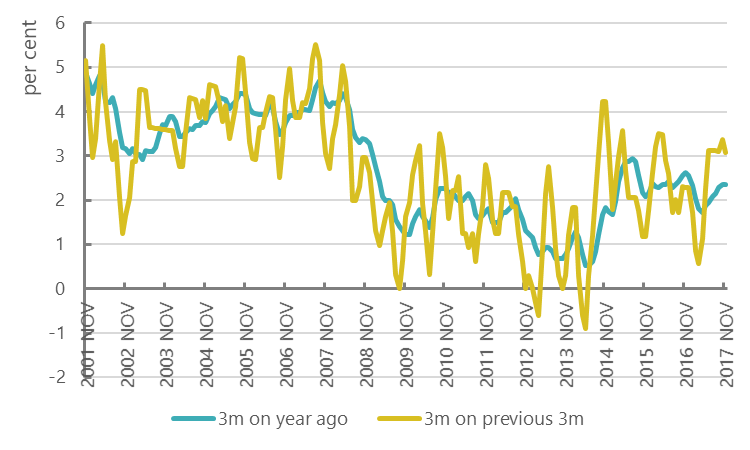

The idea is that the new measure is better at spotting wage growth coming down the line. But the trouble is that higher readings might indicate higher earnings, or could be mainly just noise. Normally we would look at a longer run of data to establish which was likely to be the case. On the below the Bank’s new measure (shown here in yellow) has been above 3% 17 times since the start of 2010; yet the headline measure of inflation has not once risen to 3%.

Average earnings, % age annual growth

So it looks like a measure that isn’t telling us that much. But even if wage inflation is about to hit three per cent, this is very far from cause to apply the brakes. We should remember that pre-financial crisis, nominal wage growth averaged around 4 per cent.

4. Debt distress

The flip side of the living standards crisis has been increased reliance on borrowing and rising household debts. Alarm bells have been ringing for some years – see our Britain in the Red Report. Yesterday the Resolution Foundation showed that almost half of low income households are in some form of “debt distress” (e.g. struggling to pay for accommodation, being very concerned about levels of debt and/or finding unsecured debt repayments a heavy burden). They warn that “the enduring size of our debt burden means that the situation is extremely sensitive to the ultimate scale of rate rises”.

5. Low unemployment does not mean capacity pressures

The more indirect route to inflation pressure is through the labour market. For some decades central bank policymakers have considered that if unemployment falls below a certain point, then wage inflation will begin to rise – and that this point represents a so called ‘natural’ rate of unemployment, or more specifically the ‘NAIRU’ (non-accelerating inflation rate of unemployment). As unemployment and wages have fallen in parallel for the last couple of years, some are increasingly sceptical of this so-called ‘natural rate’ hypothesis. Here’s Matthew Klein in the FT:

“The difference suggests dwindling political support for one of the most bog-standard theories in central banking. Without politicians as adept as Yellen to defend it, the Fed may be forced to abandon the conceit there is always some “natural rate” of unemployment that prevents inflation from slowing down or speeding up. That would be welcome; in addition to being morally odious, the theory is empirically unsupportable and is increasingly questioned by a younger generation of central bankers.”

Given the ‘conceit’ exists at all, then it must be moving downwards. The Bank report how in February 2017 they reduced their estimate of the long-term equilibrium rate from 5 to 4½ %. Last week they further reduced it to 4¼%.

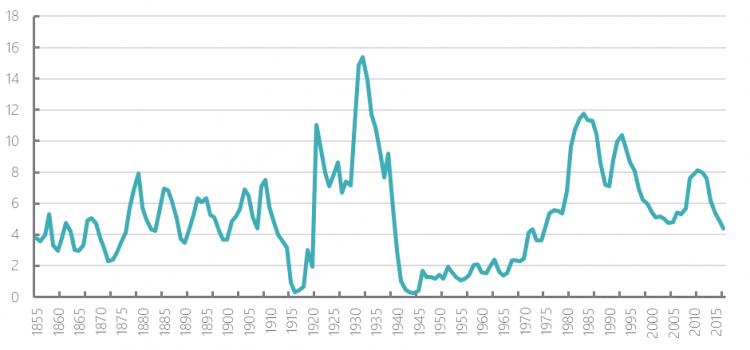

On the ‘natural rate’ view, low unemployment indicates either the economy hitting capacity and therefore imminent inflationary pressure, or misjudgements about the level of the natural rate and so no inflationary pressure. It is hard to argue inflationary pressure when in the process of a series of downward revisions to the natural rate. How far might reductions to the natural rate go? Well, before 1973, the unemployment rate was never above the present estimate of the natural rate.

Unemployment rate, % age

6. Policy is broken

All that said, central bankers’ worries (and it’s not just in the UK, but around the world) are perfectly understandable, given the extreme reliance on monetary expansion to support economic activity.

But to retreat on stimulus (whether increasing rates, as in the UK, or withdrawing QE and increasing rates, as in the US) without something in its place is too dangerous. Financial markets seem to agree. They are most likely not reacting to the threat of inflation, but to the threat of central bankers acting on a perceived threat of inflation.

And they are also likely reacting to the precarious nature of any recovery. Repeatedly recovery is fostered mainly by ever more monetary stimulus, and the threat of withdrawal of stimulus must threaten recovery. In the meantime old fragilities haven’t gone away – not least high and potentially excessive valuations in capital markets (e.g. high-tech shares) and high levels of private indebtedness.

The world economy has been in a bad place ever since the global financial crisis. A new approach is desperately needed. An approach that asks why austerity policies have failed to fix the public debt, and why other financial imbalances (debt, assets prices and the like) remain unresolved. That new approach is likely to involve significant levels of infrastructure investment (not least social housing), reversing public service cuts, increasing public and private sector wages, and a much wider role for collective bargaining and permitting worker voice into the boardroom. But that is a job for the Treasury, not the Bank of England.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox