Headline GDP figures flatter fading recovery

Workers bracing themselves for the predicted wage squeeze, now have to confront the likelihood that the economy was even weaker than expected just a fortnight ago.

GDP growth in Q3 was always going to slow, because the majority of lockdown restrictions were removed in quarter two when growth was 5.5%.

But today’s figure of 1.3% was weaker than the 1.5% expected by the Bank last week and 1.6% by the Office for Budget Responsibility (OBR) the week before. The economy was 2.2% below the pre-crisis level in 2019Q4.

The ONS also give us monthly figures which give a slightly different view across a slightly different time period, with the economy 0.6% down on pre-crisis level in January 2020. But the same monthly figures show growth flagging for some months. The latest release showed monthly growth of 0.6% into September. However, there were also downward revisions to August (monthly growth now 0.2% when previously estimated at 0.4%) and July (now -0.2% when previously -0.1%). Moreover, as the National institute of Economic and Social Research pointed out, the September figure was heavily influenced by a surge in government output on the month, accounting for 0.5 percentage points (ppts) of the growth. If growth continues at the average monthly rate of 0.17% over these three months we are not going anywhere very fast.

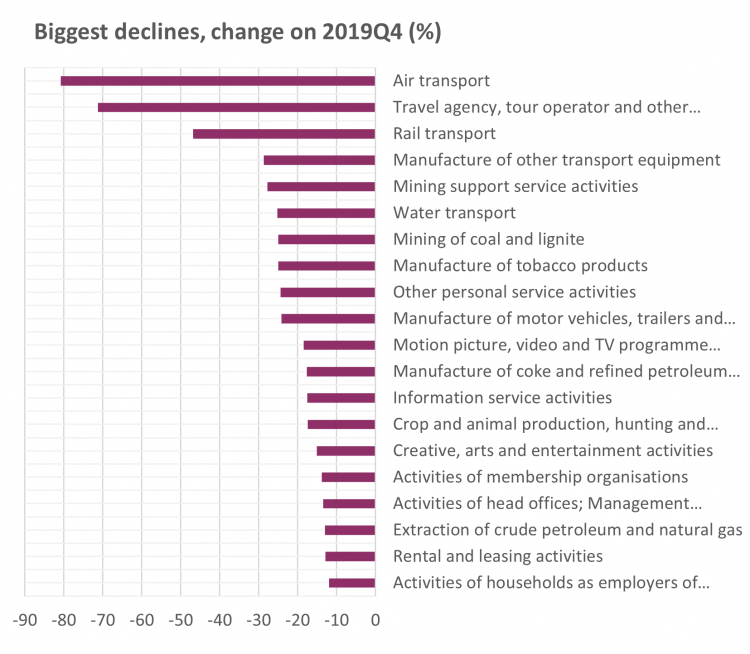

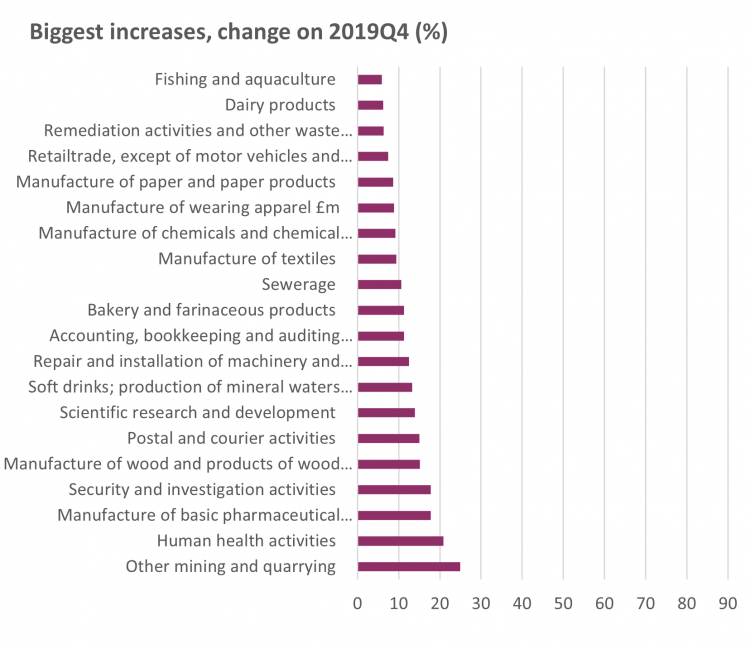

But the bigger concerns are in the underlying data. On the output view, Q3 was driven mainly by the ongoing revival in accommodation and food (0.7 ppts), still strong health output (0.2 ppts) and oil extraction (0.2ppts). However, many industries remain well below pre-crisis levels – the chart below shows the twenty industries in the worse and best positions:

Notably the declines (median = -21%) are larger than the gains (median = +11), and the gains are up to a point concentrated in pandemic related areas – most obviously health, pharma, and postal and courier (and security and investigation?!).

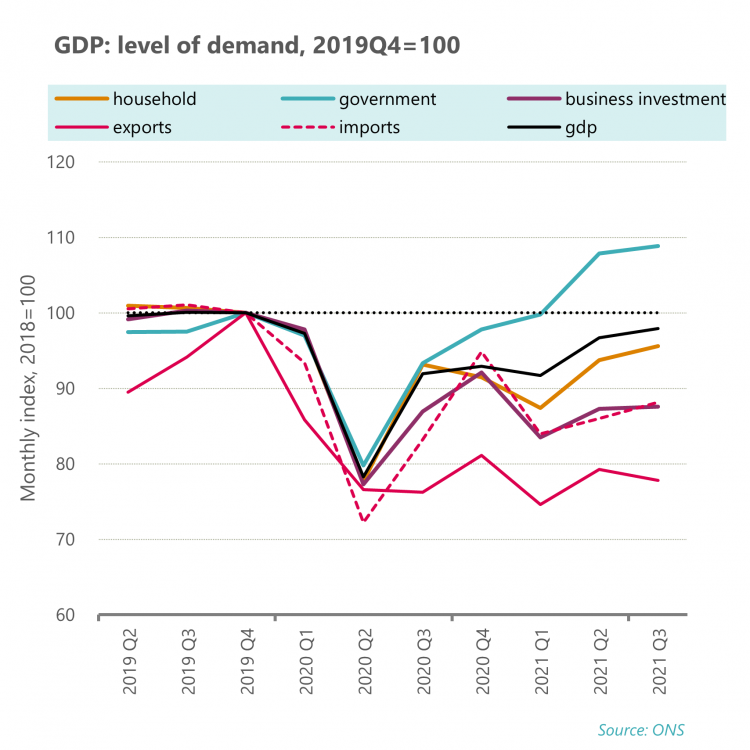

On the demand view, as the chart below shows, everything saw big declines into 2020Q2 at the peak of the pandemic, and then recovered much of the lost ground into 2020Q3. But since then, over the year into 2021Q3:

-

only government demand has seen any material revival, growing by 17%

-

consumer demand grew by only 2.7%, rubbishing expectations that households were bursting to spend savings accumulated in the pandemic

-

business investment grew by only 0.8 per cent

-

exports mustered a feeble 2.1%, leaving the position still 22% below the pre pandemic level

-

the biggest gain was 6% growth in imports, but these count against UK GDP.

Smoke and mirrors on international comparisons

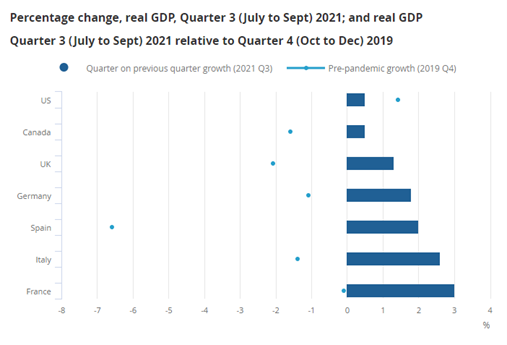

In the Budget the Chancellor boasted that the "UK recovering faster than our major competitors". Many pointed out that he was only able to say this because we had fallen further.

The ONS this month shows an international comparison with the UK among the slowest growing in the third quarter (the bar) and then the worst of all major economies on the pre-crisis level (on the dots). The exception is Spain, who are not usually included in a comparison of like economies.

Today the chancellors new boast was that “we’re forecast to have the fastest growth in the G7 this year”. Again, the same: we have the fastest expectations for growth this year, but this is because we had the biggest decline (bar Spain) last year (see IMF figures below).

A good part of the economy is still operating way below normal levels. On a demand view the economy has gone nearly nowhere over the past year, excepting government action in health and other public spheres. The OBR and the Bank of England have both pointed at real wage declines in 2022. The Chancellor had his opportunity at the Budget, but failed to give the economy the support it needed. We are very far from the high wage economy we were promised.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox