The government’s benefit uprating policy is hitting the poorest families hard

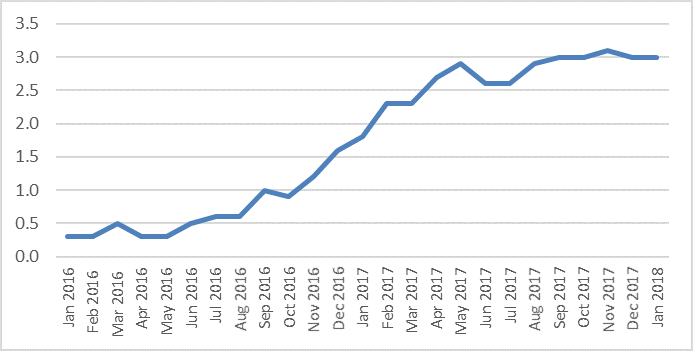

In today’s inflation release, the Consumer Prices Index (CPI) is 2.7 % and Retail Prices Index (RPI) is 3.6%. Inflation measures the rate of increase in prices for goods and services. Traditionally, the government uprated in- and out-of-work benefits in April with the inflation rate from the previous September, this is no longer the case.

Evidence is mounting of the devastating toll that the government’s arbitrary approach to benefit increases is having on Britain’s poorest families.

As in 2010, the Chancellor George Osborne announced that from April 2011, the Government would use CPI to determine benefit uprating. Until then most benefits were raised in line with the RPI; and means-tested benefits were uprated by the “Rossi” index.

The CPI typically produces a lower figure than the RPI and Rossi index, so changing to the CPI has the effect of smaller benefit increases.

This change was expected to reduce the amount spent on benefits by £6 billion a year by the end of the Parliament (2010-15).

Following on from this, the then Chancellor George Osborne made further announcements on benefit uprating in the 2012 Budget. The uprating of most working age benefits was limited to one per cent in 2013/2014, 2014/15 and 2015/16.

And in the Summer Budget of 2015, the Chancellor announced that most working-age benefits would be subject to an uprating freeze over the four-year period 2016/17 to 2019/20.

This means that they will remain the same cash amount as they were in 2015/16 – even while inflation rises. The freeze will affect Jobseeker's Allowance, Employment and Support Allowance, Income Support, Housing Benefit, Universal Credit, Child Tax Credits, Working Tax Credits and Child Benefit.

We are currently in the third year of the four-year freeze. It will bite particularly hard this year as CPI inflation has been as high at 3%. In the past benefits would have increased by 3% this April to cover the rising costs of goods.

Inflation since 2016 (CPI)

The uprating policy affects both working and non- working individuals/families.

The Resolution Foundation and the Institute for Fiscal Studies (IFS) confirm that this year will be the most severe of the four-year benefit freeze. The Resolution Foundation also estimates it will affect almost 11 million families, and the IFS says the saving to the government, and cost to households, of the freeze this year alone is around £2 billion.

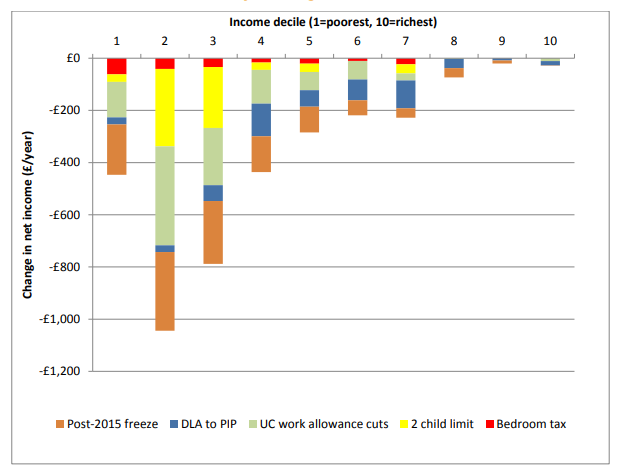

Recent analysis for the Equality and Human Rights Commission (EHRC) also shows the post-2015 freeze in benefits for working-age adults and families with children has a very regressive impact. People in households at the lower levels of the income distribution are far more likely to rely on means-tested transfer payments. As the chart below shows - losses are largest for the bottom three deciles at between £200 and £350 per year in each case.

Cash impact of specific policy reforms by household net income decile, 2021–22 tax year: England

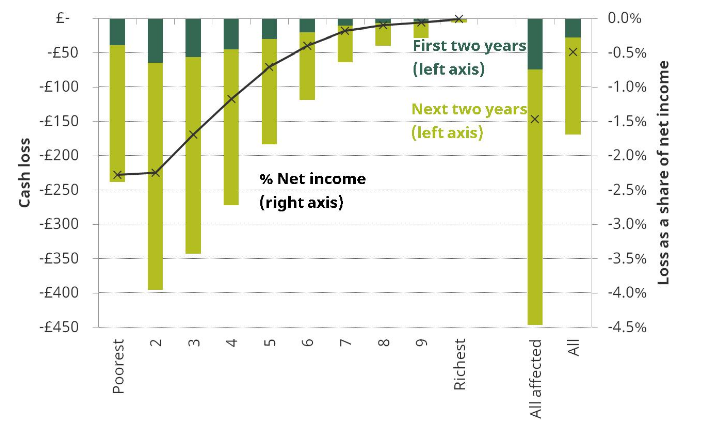

Previous IFS analysis shows (taking in to account the September 2017 rate of inflation) that by the end of the four-year benefits freeze in 2019–20, it will have reduced benefit entitlements by £4.6 billion per year. This results in entitlements being on average £450 lower than they would otherwise have been for around 10.5 million households. The biggest impact is towards the bottom of the distribution, where households are more dependent upon benefits for their income.

Distributional impact of the benefits freeze between 2015-16 and 2019-20

Tampering with uprating mechanisms to reduce the value of benefits was a political decision taken in 2010 to slash the welfare budget. This has created a disconnect between income and living costs.

Analysis by the Joseph Rowntree Foundation (JRF) using its own ‘Minimum Income Standard (MIS ) shows that for a single person out of work, the ‘safety net’ is now providing barely a third of income needs.

To ensure a strong safety net, benefit uprating needs to be based on the essential needs of individuals and families. Benefits should be uprated in line with the cost of living.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox