Employer pension contributions plummet by two thirds since 2011

The average employer payment into a typical pension scheme has plunged by two-thirds since 2011, official figures published today have revealed.

The numbers challenge the wisdom of the government’s inaction in the face of mounting evidence that large numbers of employers are paying the lowly legal minimum into workers’ retirement savings.

The Occupational Pensions Scheme Survey confirms that, while rising numbers of workers are being enrolled in pension schemes, the amount contributed falls far short of that needed for a comfortable old age:

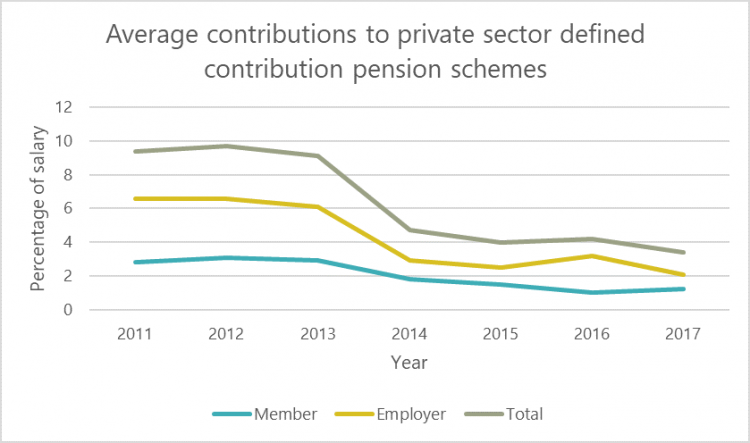

In 2011, the year before workers started being automatically enrolled into workplace pensions, the average employer contribution into a defined contribution (DC) pension scheme was 6.6 per cent of a worker’s salary.

Today’s figures show that this has plunged to 2.1 per cent for 2017, leaving total contributions at just 3.4 per cent.

Why is this important?

This matters because most workers are in DC arrangements where their ultimate pension is already reliant on the vagaries of investment markets. Rock bottom contributions make the task of planning for a secure retirement even more difficult.

This is the result of a swathe of employers contributing the legal minimum to their workers’ savings rather than an amount that would give them a good chance of a decent retirement.

The roll-out of automatic enrolment from 2012 means millions of people now have a workplace pension who wouldn’t otherwise have had one. The number of active members of workplace schemes hit 15.1 million last year, today’s figures show.

But pension rules say that employers initially had to put just 1 per cent of salary into a pension (the same as an enrolled worker). This rose to 2 per cent from the employer and 3 per cent from the member in April. It will increase further to 3 per cent and 5 per cent respectively in 2019.

Ticking time bomb

Even at this level, with workers bearing the bulk of the contribution burden (in contrast to typical past practice where employers stumped up two-thirds), there is a widespread acknowledgement that a total contribution of 8 per cent is utterly inadequate.

By contrast, the average contribution to a private sector defined benefit pension (one where the payout is based on salary and service) last year was 19.2 per cent with 6 per cent coming from the member.

But the government has refused to deal with this problem, the consequences of which will only be exposed in decades to come when savers retire with inadequate pensions. It even decided to ignore the question of contribution rates when it conducted last year’s Automatic enrolment review.

One argument, supported by parts of the pensions establishment, was that it was unknown how savers would respond to rising rates. The evidence thus far is that there has been little impact on opt-out rates.

Long-term thinking

With the final planned increase due to take place in April, it is deeply alarming that there is no sign that the government is preparing to consider how to raise rates from here.

What is clear is that it’s implausible to ask much more of workers themselves with wage growth failing to keep up with household spending due to flatlining pay.

The TUC has long campaigned for a pension split of 10 per cent from the employer of 5 per cent from the worker.

But getting anywhere close to this figure requires decisive, long-term thinking. We could worse than to mirror Australia where the employer contribution has risen over the years, from 3 per cent to 9.5 per cent currently, and will reach 12 per cent by 2025.

The UK needs to start moving in that direction now.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox