The economy badly needs a “shot in the arm” through decent job creation

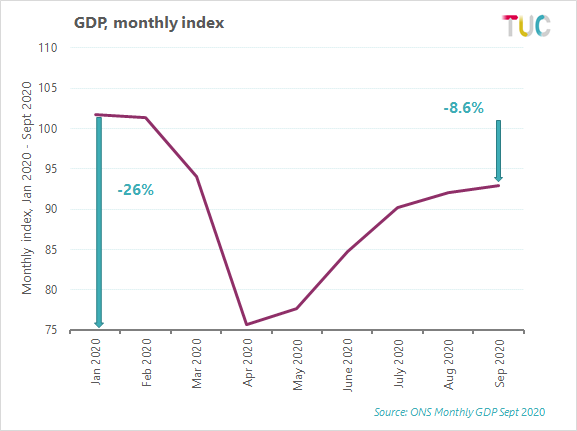

Monthly GDP into September showed growth of just 1.1 per cent. Though this is the fifth consecutive month of growth, the pace continues to slow from 9.1 per cent in June, 6.4 per cent July and 2.1 per cent August.

GDP in September remained at 8.6 per cent below the start of the year, just as we headed into further restrictions across all the UK.

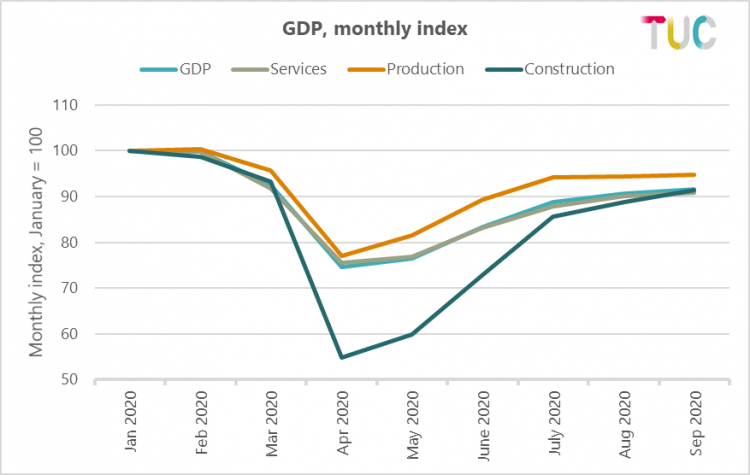

Across all sectors the pace of recovery has been dwindling, with services only growing 1 per cent, production 0.5 per cent and construction 2.9 per cent into September.

Headline GDP, monthly indexes

Services, which account for 80 per cent of UK output, were still 8.8 per cent below February levels, production 5.6 per cent below with manufacturing 8.1 per cent lower and construction 7.3 per cent lower than pre-pandemic levels.

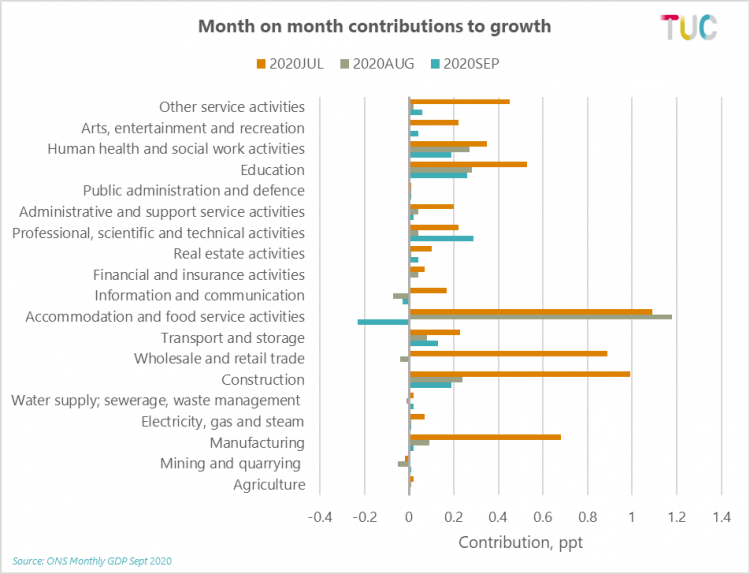

The month-on-month contributions by subsectors below show growth stalling across many parts of the economy, with ‘accommodation and food’ and ‘information and communication’ seeing negative growth in September (blue bar).

The ONS also published for the first time estimates of Q3 which covers July to September.

While the monthly figures lost momentum over the quarter, the actual figure for quarterly growth came in at 15.5 per cent – inevitably the strongest on record, given the previous quarter was the weakest on record.

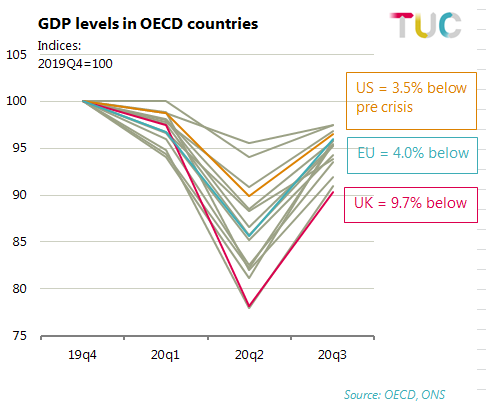

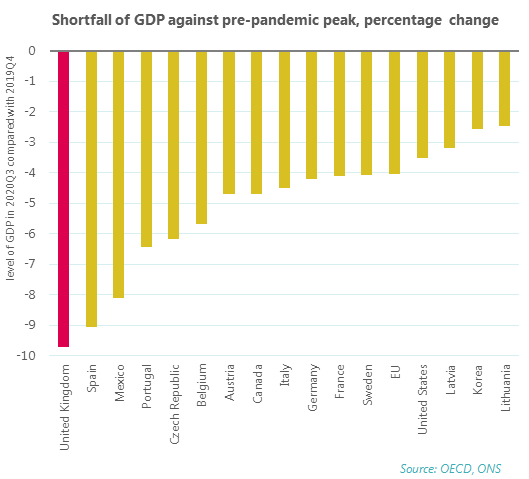

The key point is that according to these quarterly figures the economy remains 9.7 per cent below pre-pandemic levels.

This is the worst position of all OECD countries that have reported Q3 figures so far and, as the chart shows, more than double the decline seen in the EU and the United states.

The next chart shows the shortfalls for individual OECD countries (where data are available) versus pre-pandemic levels.

There is a great deal of variation, as the ONS notes this reflects a variety of factors including the differences in the spread of the virus, timings of lockdowns, voluntary social distancing measures and differences in how countries measure output (especially government output, see here for some discussion).

UK Shortfall in GDP, international comparison

However, the ONS also note that the varied impact of the virus also likely reflects the structural features of different economies. This might leave those with a greater reliance on industries that require in person contact more exposed to the impact of the virus, and measures to control it.

Our ex-colleague Tim Page puts it more bluntly: “This as a result of UK’s excessive reliance on service sector and consumer spending. Suggests that warnings against deindustrialisation over many years were well-founded. Green technology/infrastructure provides great opportunity to reset”.

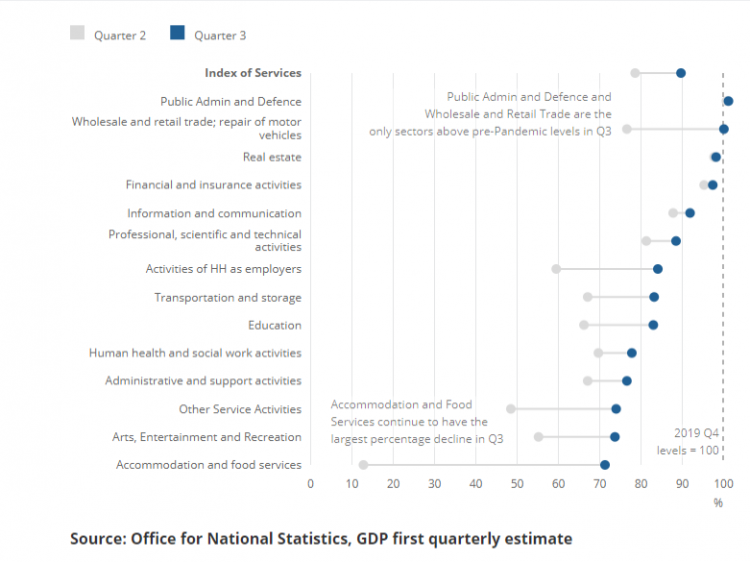

Looking at quarterly figures we can see this play out in services output (see the ONS charts below), where only two sectors recovered to the levels seen in Q4 2019 (public admin and defence and wholesale and retail – driven by the reopening of car show rooms and record levels of online sales).

The rest remain far below especially accommodation and food and the arts, entertainment, and recreation.

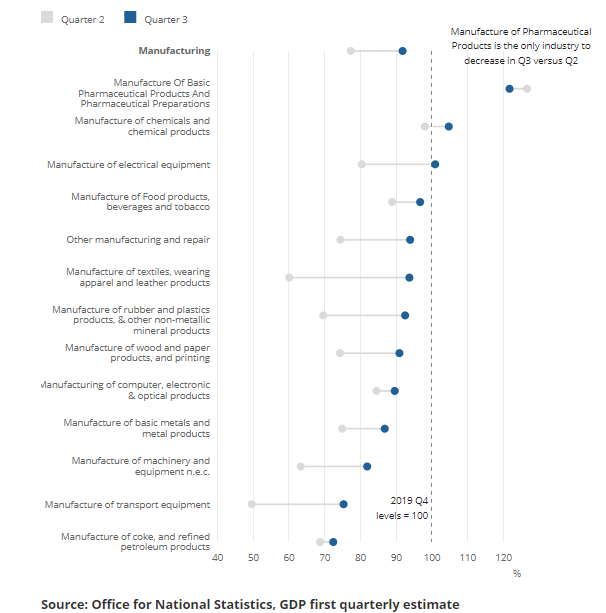

And in manufacturing where only three sectors (manufacture of chemicals, electrical equipment, and pharmaceuticals) saw output in Q3 above pre pandemic levels – though manufacture of pharmaceuticals saw a decline between Q2 and Q3 of this year.

Manufacture of transport equipment, despite growth of 51.8%, is still 22.3% below its pre-pandemic level

UK Services Output, Q4 (Oct-Dec 2019) to Q3 (Jul-Sept 2020)

UK manufacturing output, Q4 (Oct-Dec 2019) to Q3 (Jul Sept 2020)

Weak growth and rapidly rising unemployment mean it is vital that this month’s Comprehensive Spending Review sets out a plan to create decent jobs across the country.

TUC research shows that we could create 1.2 million new jobs in the next two years in green transport and infrastructure, and another 600,000 by unlocking public sector vacancies.

Ministers must also support hard-hit sectors like the arts, hospitality and aviation that are really struggling.

These industries have a long-term future – but ministers must step in and deliver targeted support to help them get through the months ahead.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox