Working people are struggling to pay for food

Do you reckon you’d be able to cover the cost?

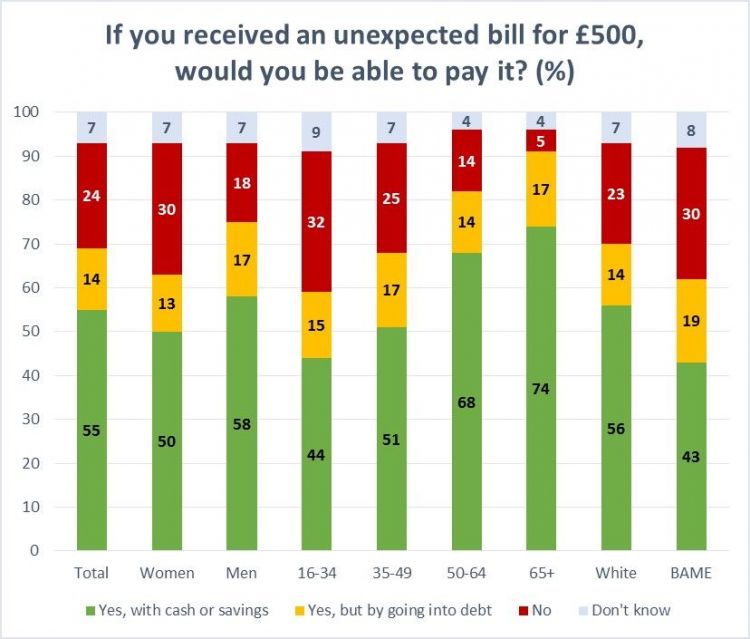

In research carried out for us by the polling company GQR, we asked over 3,000 working adults if they could cope with an unexpected £500 bill. One in four told us they couldn’t. Despite being in work, such a sudden expense would be unaffordable.

This is worse among certain groups. 32 per cent of young workers, for example, would be unable to pay the sudden cost. The situation’s similar for women and for Black, Asian and Minority Ethnic (BAME) workers.

An underlying fear of a sudden big cost is undoubtedly stressful. Working all day, but still constantly worrying about a sudden unexpected bill ruining your budget is frustrating. It’s horrible to be bringing in a wage, but for that wage to insufficient to the point that you panic a bit whenever the washing machine makes a weird noise.

It’s not just unexpected costs causing stress

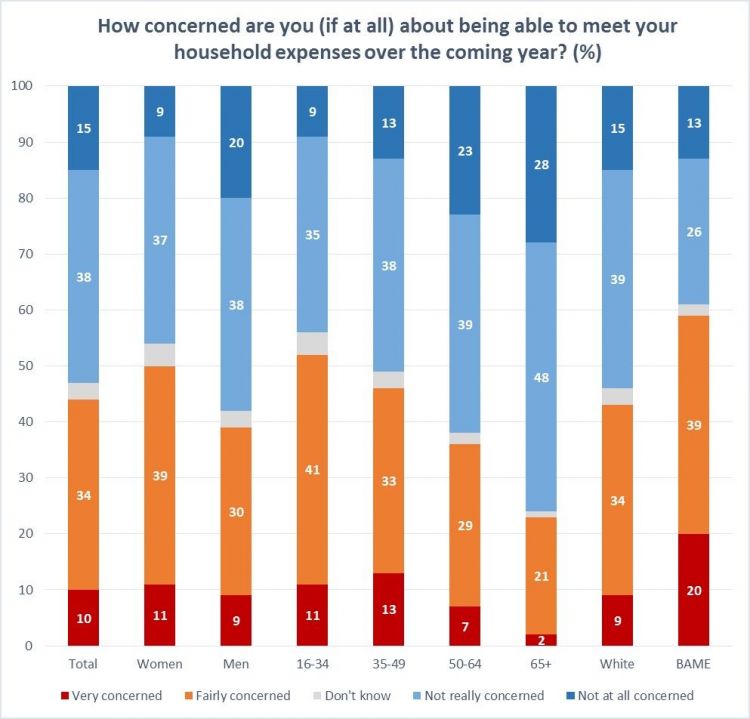

But it’s not just sudden costs, a lot of working people are stressed about just meeting the usual household costs over the coming year.

Just under a half of all workers asked are concerned or very concerned about meeting basic household expenses.

Again, this rises among certain groups. Three in five BAME workers, and a majority of young workers, are worried about paying bills throughout the next year.

This is getting worse. More than a third of workers are finding it harder to pay the bills than they were a year ago – rising to 40% of working women and 39% of BAME workers.

This manifests itself in day-to-day decisions. Two-fifths of workers have changed spending habits to deal with financial difficulty, with many deciding not to go away, or putting off big financial commitments.

17 per cent of workers have left the heating off when it was cold to save on energy bills.

The same number have pawned something in the last year because they were short on money, and the same number again have had to ask a friend or family member for money.

Others are going hungry just to make ends meet. 1 in 8 workers are skipping main meals to save money.

It’s down to wages and the cost of living

The reasons people are struggling are clear – wages are stagnating and the cost of living is increasing.

We asked people for the main reason that household expenses are getting harder to meet.

41 per cent blamed the cost of living – meaning either the general cost of living, increasing prices, or bills going up.

Another 41 per cent told us that the main reason was related to their job in some way. This was due to either:

- Their income not rising to meet rising prices (22 per cent)

- Low pay meaning they simply don’t earn enough (9 per cent)

- Hours being cut, or not getting enough hours (6 per cent)

- Not receiving a pay rise (4 per cent)

No surprises

The core reasons behind concerns about making ends meet come as no surprise.

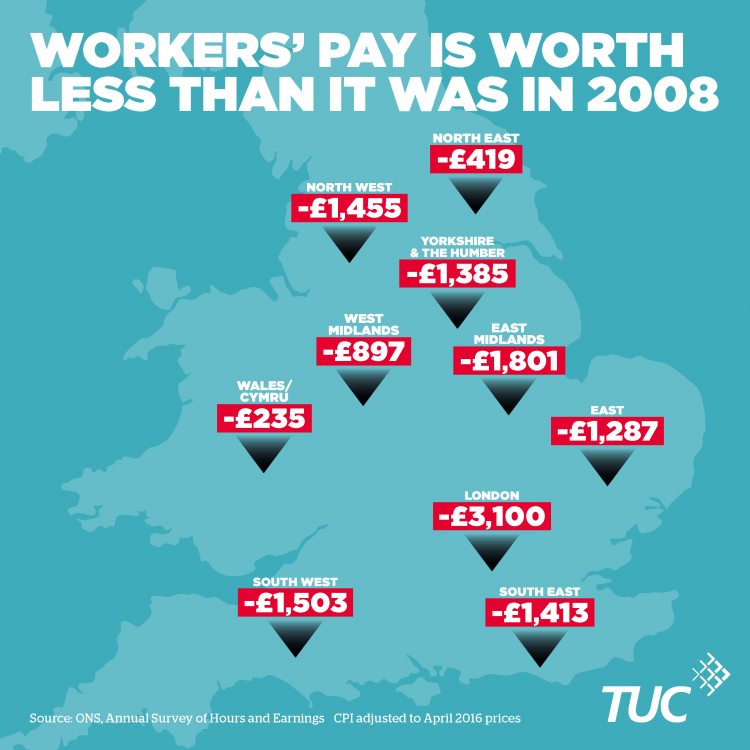

We're experiencing the longest pay squeeze since Victorian times. In 2016, average real weekly pay (that’s pay once inflation has been taken into account) for UK workers was around £1,200 a year less than it was back in 2008.

After the post-2008 crash, real wages did start to recover slightly between 2014 and 2016. However, latest estimates show this trend reversing. Real wages have fallen in each of the past four months.

This isn’t set to get better anytime soon. The OECD forecasts that UK real wages will fall by 1.1% in 2018. This is the joint worst across the OECD countries, and makes the UK one of only four countries that will see a fall in real wages.

Turning to debt

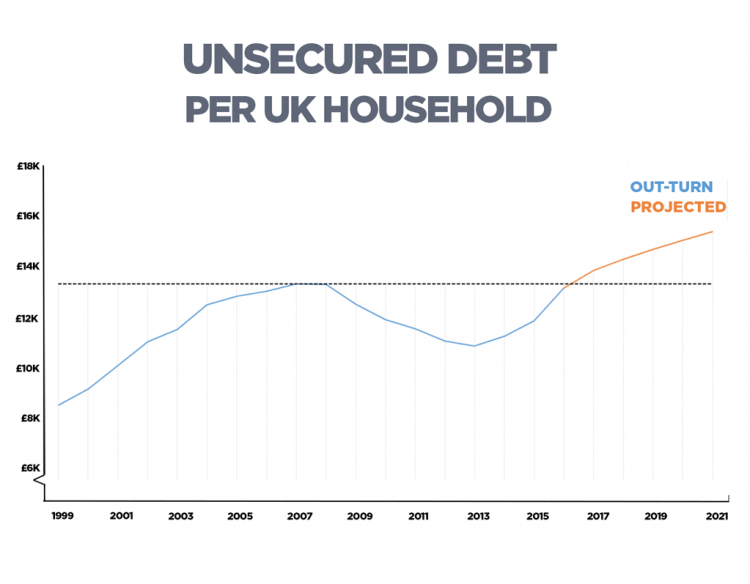

Struggling to make ends meet increases the temptation to take on personal debt. It’s therefore little surprise that we’ve seen a recent rise in unsecured debt.

Back in May, we revealed that shrinking pay packets are forcing workers to take on more personal debt. Unsecured debt per household was £13,200 in 2016 – the highest figure since the crash. And it’s set to reach a record high in 2017, and exceed £15,000 before the end of the next parliament.

Britain needs a pay rise

Something must be done to halt this living standards crisis.

The simplest next step for politicians is to scrap public sector pay restrictions. These artificial restrictions have meant drastic cuts in real pay for those who deliver vital public services.

But this isn’t enough. As the striking McDonald’s have recently shown, those in the private sector clearly need a pay rise too. We want to see the minimum wage rise to £10 per hour as quick as possible.

We also need investment to create great jobs across the country. Too many communities have been left behind and regional inequalities continue to exist. We need a proper industrial strategy with a Great Jobs Agenda at its heart.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox