Latest growth figures betray dangerous weakness in UK economy

Today the ONS has confirmed that UK GDP grew by a rate of 0.5 per cent in the first quarter of the year.

Along with the increase in quarterly growth, four quarter GDP growth was also up to 1.8 per cent from 1.4 per cent.

Any growth is a good thing, but the 0.5 per cent figure has been widely condemned as erratic.

Instead, attention is already moving to the early signals for the second quarter, with the savage decline in motor vehicle production and fading services output leading the Bank of England to predict zero growth.

And the danger signals are obvious in the expenditure and income detail that the ONS have just released.

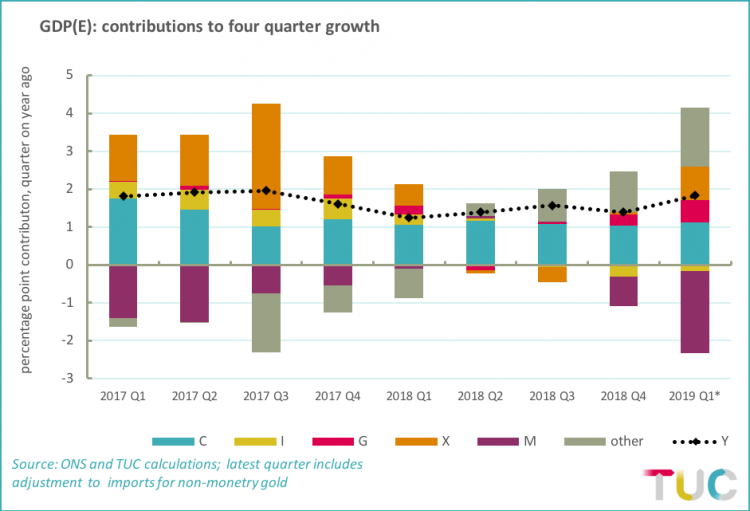

The contributions to growth are shown on the chart below:

The key areas of weakness are plainly apparent:

- Private investment (I – yellow) has been in decline over recent quarters, falling by 1.5 per cent over the year.

- Exports (X – orange) faded to nothing in 2018 as a whole, marginally but better outcomes from the second half of the year mean annual growth of (a still weak) 3.0 per cent. Given global instabilities and trade tensions, this remains a key vulnerability.

- Moreover, in terms of net trade exports are greatly outstripped by a steep rise in imports (M – purple), overall reducing UK GDP (and here the import figures also include a positive adjustment to strip out erratic financial transactions).

The positive factors:

- The biggest gain is in ‘other’, which largely reflects sharp increases in stockbuilding ahead of the original Brexit date (and thus now widely expected to unwind).

- As always, the mainstay is household spending (C – blue), but this amounts only to an unspectacular annual rate of 1.9 per cent.

- Fuller data for the household sector show that even this spending growth is increasingly unaffordable, with the household saving ratio down to 4.1% compared with 4.5% in the previous quarter. The ONS observe that this the “joint fourth-lowest quarterly saving ratio since records began in 1963”.

- Lastly, government (current and capital – crimson) spending is also supporting the economy. OBR figures show a modest rise planned for calendar year 2019-20, but some of this seems to have been brought forward. Spending was up 2.9 per cent on the year, hardly sufficient but still the highest increase for five years (when spending was quietly ramped up ahead of the 2015 general election).

With the Bank of England warning of zero growth but still insisting that interest rate rises are appropriate, this momentum in government spending must be sustained and intensified.

Spending cuts have decimated public services and led to a crisis of pay and work. Financial imbalances, not least private debt but also asset price excesses, have not been resolved. The same is true over the whole world, with the global economy in a phase of serious instability.

It is a small mercy that policymakers finally seem somewhat willing to reverse engines in the face of renewed instability. But the instability is of their making.

We need to put this dismal decade behind us and find a new way forward with the interests of workers rather than wealth prioritised.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox