On inflation, it's the government - not RPI - that isn't playing fair

We’ve previously raised the alarm about the inconsistent use of inflation measures by the government and business.

For example, the government use the significantly lower Consumer Prices Index (CPI) measure to calculate costs such as public sector pensions while applying the higher Retail Price Index (RPI) to student loan repayments, beer duty and other duties.

Finally, it seems the tide has started to turn against this practice.

Back in January, the courts rejected an attempt by BT to switch some of its pension payments from RPI to CPI.

Two months later, a government pension paper said it would not let company bosses cut pensions increases from RPI to CPI inflation without their members’ consent.

And just last month the Royal Statistical Society (RSS) held a debate into RPI to which we submitted detailed evidence.

Now a Lords committee that includes two former Chancellors and two former Treasury bosses is investigating whether RPI is an appropriate measure of inflation in the UK, and considering its use by the government.

The House of Lords Economic Affairs Committee has already heard oral evidence from various stakeholders and officials, including the TUC, and is inviting written contributions until 25 July.

You can watch or read the oral evidence we submitted here, but as our written evidence won’t be published in full until the Committee releases its report, below is a summary of what we said.

What we said

In our evidence we categorically rejected the charge that the RPI is fundamentally flawed.

It remains the most widely used measure of inflation for purposes of indexation in private sector contracts and wage negotiation.

And with a history going back more than 100 years, it also benefits from that rare thing: public confidence.

That’s why we’re calling for the constant attacks on the integrity of the RPI to end, and for its restoration to national statistic status.

More broadly, we want to revive the framework which recognises that different measures of inflation are needed for international/macroeconomic and domestic/microeconomic purposes.

In other words, the renewed RPI should be used for indexation, and the CPI reserved for macroeconomic purposes.

Don't shoot the measure

The RPI has also been wrongly blamed for a series of failings of public policy.

For example, long-standing difficulties with measuring clothing prices have wrongly led to an attack on the formula used to average together individual price quotes in the RPI.

The case against the RPI formula is not robust and is far from a fundamental flaw.

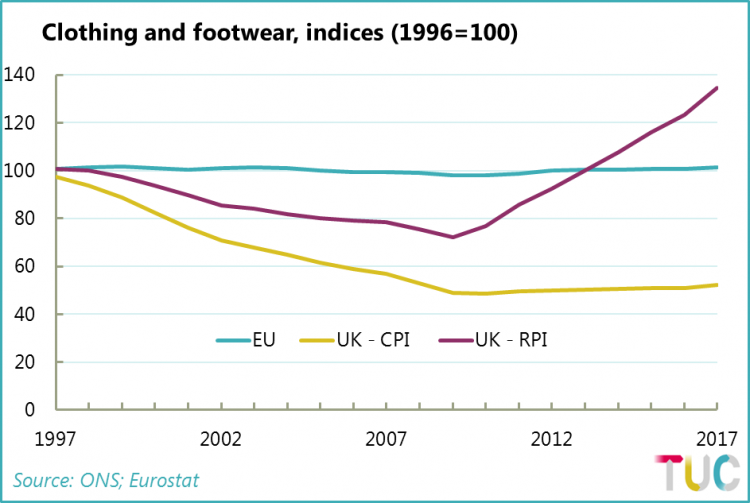

Most obviously while the RPI appears to have exaggerated clothing inflation in recent years, the formula used for the CPI measure meant clothing inflation was understated, as the following chart shows:

(The UK figures are set against the European average as a benchmark, though plainly the lack of movement here is not beyond question.)

The problem with the CPI formula understating inflation has been downplayed throughout the debate.

Yet work carried out for the UNISON union by Dr Mark Courtney shows clearly that the RPI is probably more reliable than the CPI as a guide to the cost increases faced by UK households – as UNISON official Kevin Russell reported in his excellent remarks to the RSS meeting .

And only this week the ONS has published minutes of a discussion on new (electronically collected) clothing data that report how the use of the CPI formula leads to “an implausible decrease” (see section 4).

Time for a new approach

Dr Courtney’s work should be used as a framework for a full assessment of the formula across all inflation measures, perhaps overseen by the Royal Statistical Society, which has played an important and impartial role in the debate so far.

But plainly the statistics are only one half of the problem.

As we and countless others have emphasised, the Treasury policy of paying out using CPI but charging by RPI is grossly unfair.

The Chief Secretary to the Treasury has argued that this follows (perceived) fiscal constraints, but allowing some room to manoeuvre has been found to protect state pension recipients and, more recently, business rates.

And it became clear at the Committee hearings that there was a misapprehension around public opinion.

The public are not outraged that the RPI is too high – in terms of statistics, the outrage is at the denigration of a trusted measure of inflation and its substitution with a measure that is lower.

As stated in the UNISON evidence, this has provided “ammunition for some employers in seeking a considerably lower reference point for pay bargaining – worth about £350 a year to the average full-time UK worker”.

Going forward

Under a renewed overall framework for inflation measurement the aim should be to operate uprating according to the RPI.

And there’s still a sense in some of the Committee’s deliberations that the end goal is only to ‘fix’ the RPI.

To reiterate, the RPI has been made the fall guy for far wider problems in inflation measurement over recent years.

While giving evidence to the Committee earlier this week, the National Statistician even suggested that the ideal might be to turn the RPI into the CPI. On the other hand, he “absolutely agreed” that the issue should be “argued on the statistical merits of each of the measures”.

As it stands, the CPI is inappropriate for uprating given its extensive use of a formula that understates inflation.

Moreover, the CPI is based on a wider methodological approach than can be inappropriate for uprating, not least the (rental equivalence) treatment of housing adopted for CPIH.

So the best way to restore public trust is to renew the RPI.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox