Beyond Shareholder Value – the reasons and choices for corporate governance reform

There are a wide range of practical ideas for what form it should take, including in the area of stakeholder representation within decision-making within companies and in the wider economy.

This is a three sentence summary of a collection of essays Beyond Shareholder Value: the reasons and choices for corporate governance reform, published today by the TUC. Essay authors drawn from the City, unions, business, academia and politics have set out their views on the problems with our corporate governance system and their ideas for reform. The publication is a collaboration and has been jointly edited by Ciaran Driver from SOAS, Peter Kenway from the New Policy Institute and myself. The full list of contributors is set out below.

The TUC has long argued that the priority given to the rights and interests of shareholders within the UK’s corporate governance system is flawed and in need of reform. Since the financial crisis, this has been a less lonely position to take and an increasingly broad range of voices have questioned the current emphasis on shareholders within our corporate governance system, some of whom are captured within this publication.

One of the most significant areas of consensus from the contributors is that the problems associated with shareholder value are both many and serious. The authors talk about a stifling of innovation and investment; falling labour productivity; the destruction of economic value and indeed of companies themselves when their directors focus on shareholder value at the expense of sustaining their business; an unequal distribution of earnings and increased wealth inequality; and the negative impacts on other company stakeholders, including workers, suppliers, communities and the environment.

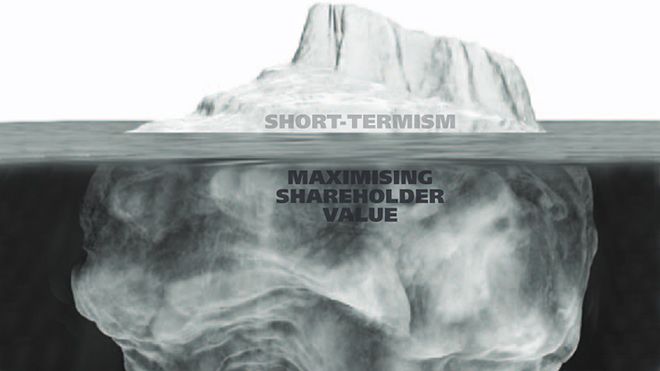

Some authors argue that these problems stem from inherent flaws in shareholder value – arguing, in other words, that shareholder value is flawed in principle. Others argue that it is short-termism, associated with shareholder value, that is the problem. And one argues that it is the practice, rather than the principle, of shareholder value that needs to change.

What is particularly heartening is that between them the authors set out a wide range of practical ideas for corporate governance reform. But despite the range, some key themes emerge. The most significant is that of representation, focusing on who participates in decision-making, both within companies and also within the wider economy. Ideas range from mandatory worker representation on company boards; voluntary stakeholder councils; stakeholder involvement in nomination committees for non-executive directors; wider representation on the regulatory bodies such as the Financial Reporting Council and the Takeover Panel; and more.

There are also some very interesting ideas for institutional reform. These are too varied to do justice to, but include promoting a greater diversity of corporate forms, encouraging reform of share ownership to encourage long-term share ownership, changes to corporate and personal taxation, changing reporting requirements and reforming directors’ legal duties to remove the priority given to shareholder interests.

The key message from the collection is that corporate governance reform is not in the ‘nice to do when we have time’ category. The problems with shareholder value are serious. Reform is urgent and change is possible; and there are a wide range of practical ideas for the path that reform should take.

The publication is being launched tonight at an event in Westminster with Iain Wright MP, Shadow Minister for Industry, and Jesse Norman MP, member of the Treasury Committee and TUC General Secretary Frances O’Grady.

Essay authors: Roger Barker from the Institute of Directors, Bob Hanke from the London School of Economics, Andrew Harrop from the Fabian Society, TUC General Secretary Frances O’Grady, Nita Clarke from the Improvement and Participation Association, Dan Corry from New Philanthropy Capital, Colin Crouch from the University of Warwick, Aeron Davis et al from the Labour Finance & Industry Group, Simon Deakin from the University of Cambridge, Patrick Diamond from Queen Mary University, Michael Gold from Royal Holloway University, economist and author John Kay, William Lazonick from the University of Massachusetts, Jonathan Michie from the University of Oxford, Vicki Pryce from the Centre for Economics and Business Research, Andrew Smithers from Smithers & Co Ltd and Grahame Thompson from the Copenhagen Business School.

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox